Summary:

- Energy Transfer is a leading North American midstream operator, moving ~35% of all US produced crude and ~30% of all US produced natural gas along ~125k miles of pipeline.

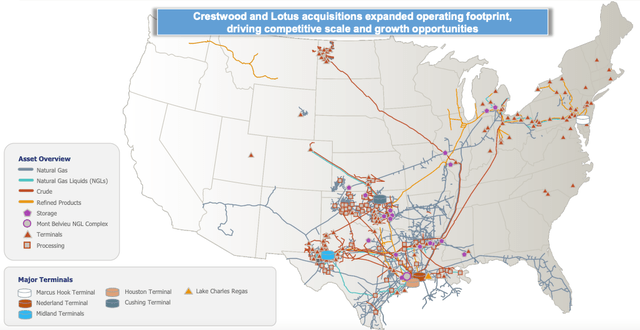

- ET recently closed its highly complementary $7.1B acquisition of Crestwood Equity Partners with synergies ~15% of deal value after doubling initial estimates to now expect $80MM run-rate from 26E.

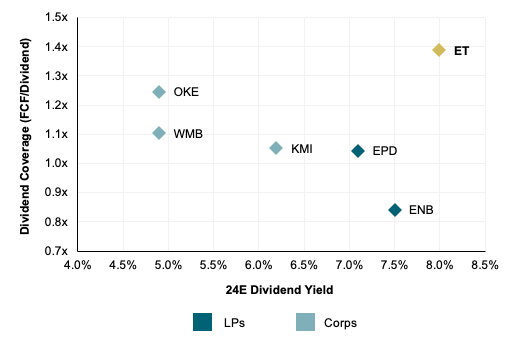

- Forward dividend yield of ~8% screens as highest in its peer group and is well protected at 1.4x FCF coverage based on 24E consensus.

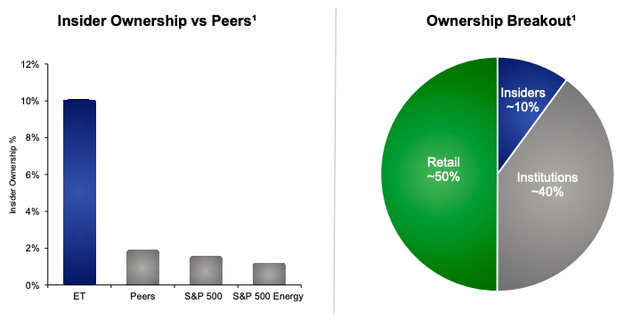

- Significant insider ownership at currently ~10-11% is unique among peers and a key competitive advantage in aligning management execution with long-term shareholder interests.

- Trading at up to 40% discount to peers, I see highly favorable risk reward and initiate shares at Overweight with a total 2024 TSR potential of ~34%. (PT $19.8).

spooh

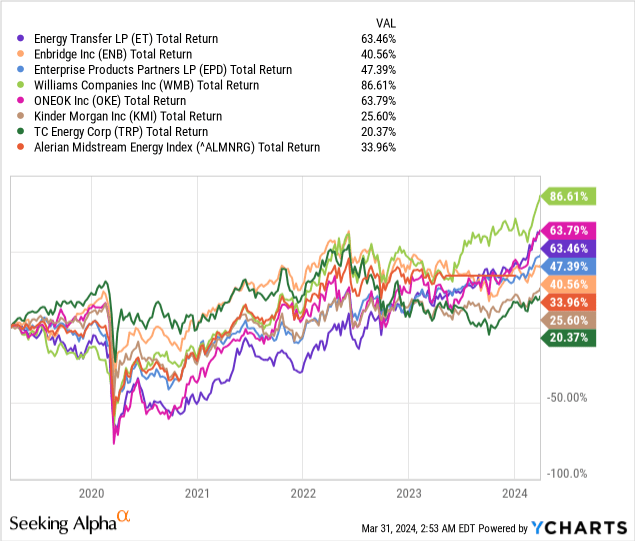

With ongoing above-target inflation and a solid outlook for energy demand, the utility-like character of the midstream segment has become more and more a focus of income-oriented investors. Energy Transfer (NYSE:ET) has been one of the top performers in the sector, delivering a 63.5% total shareholder return (“TSR”) over the last 5 years (~13% annualized), significantly ahead of its large-cap LP peers Enbridge (ENB) and Enterprise Products Partners (EPD) and the broader sector at 34%.

Offering the highest forward dividend yield among North American large-cap midstream peers and a heavily discounted valuation, I believe ET can continue to outperform and initiate at Overweight with a YE24 price target of $19.8 per common unit based on 50/50 DDM and multiples approach. At ~26% price upside and an 8% forward dividend yield, I see potential for ET shares to deliver up to 34% of TSR through 2024.

[Note: All company projections from ET’s latest Investor Presentation and Factbook. Peers refer to Enbridge (ENB), Enterprise Products Partners (EPD), Williams Companies (WMB), ONEOK (OKE), Kinder Morgan (KMI) and TC Energy (TRP)]

Company Overview

Founded in 1996 as a small Texan intrastate gas pipeline operator, ET has successfully grown through organic expansion and M&A to be the largest midstream company by FY23 sales of $80B+.

ET operates in the midstream segment of the broader US energy complex, offering transportation and storage for natural gas, crude oil, NGLs and refined products such as diesel and gasoline. It also owns terminals and NGL fractionation assets along major basins and the US Gulf coast making it the currently single-largest exporter of NGLs at ~20% of global demand.

Following the close of its 2023 acquisition of Crestwood Equity Partners, the company now owns and operates ~125k miles of pipelines and has operations and assets spread over 41 states, focused on the mid continental oil province from North Dakota to the Gulf Coast. ET also has a significant footprint around the Great Lakes and the MidAtlantic where it supplies natural gas and refined products to the region’s major economic hubs.

As of 2023, around 90% of ET’s total revenues came from fee-based contracts where the company is paid by volume, giving it only a 10% exposure to commodity and spread pricing

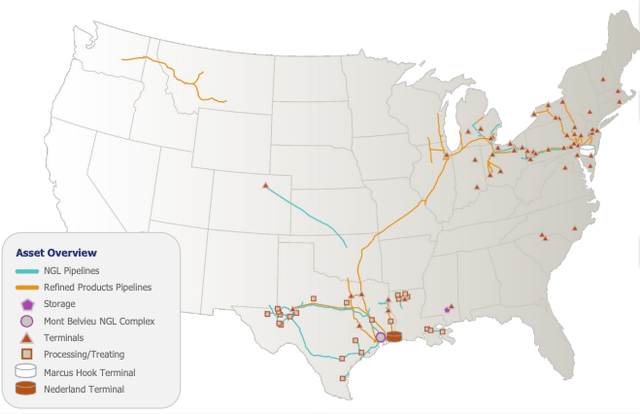

ET Asset Overview (Energy Transfer IR)

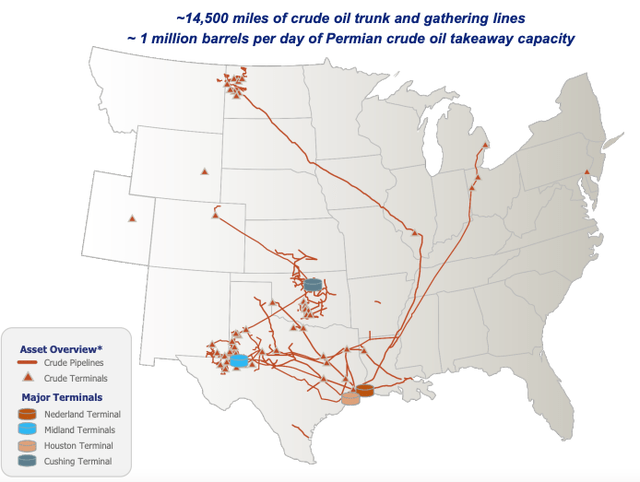

Crude Oil – ET’s crude oil operations have a highly advantaged geography, being directly connected to ~37% (6.8Mboed) of the US’ total refining capacity through among others its interest in the Bakken (36%), Permian Express (88%) and Bayou Bridge (60%) pipelines. As of 2023 ET’s crude oil pipelines moved ~35% of all US produced crude oil. The segment has major gathering and processing capabilities in three of the US’ most prolific liquids plays: the Permian basin, the Bakken and the STACK & SCOOP in Oklahoma’s Anadarko basin.

Key terminals include the export hubs of Houston and Nederland as well as the Permian Midland Terminal and the WTI delivery point in Cushing, OK. Across all terminals ET currently holds ~65Mboe of storage capacity with around three quarters of that located on the Gulf Coast. On the Gulf Coast the company also owns about 1.9Mboed of direct export capacity at its Nederland and Houston terminals.

Crude Oil Segment Assets (Energy Transfer IR)

NGLs and Refined Products – ET operates ~3.8k miles of pipelines to transport refined product from the refining hubs on the Gulf Coast to the urban centers of the Great Lakes and the MidAtlantic states where the company’s only major non-GoM export terminal Marcus Hook is located. Across 37 smaller terminals in total the segment further holds ~8Mboe of storage capacity for refined products including diesel, gasoline and fuel oil.

The ~5.7k miles of NGL pipelines are largely focused on Texas and the Gulf Coast with ET further owning ~95Mboe of NGL storage capacity and over 1Mboe of daily fractionating capacity along its Geismar and Mont Belvieu facilities. NGL fractionation has been a key driver of ET’s capital spending in recent quarters with the latest upgrade to its Mont Belvieu plant adding ~150Kboed capacity in Q3 23.

NGLs and Refined Assets (Energy Transfer IR)

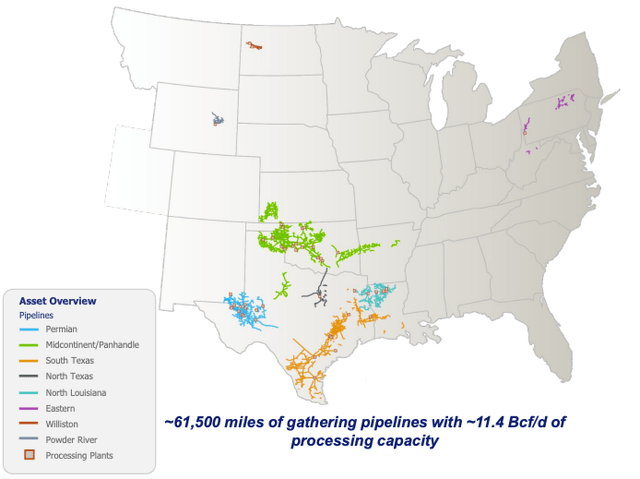

Midstream G&P – The midstream G&P (Gathering and Processing) segment operates ~62k miles of pipeline and has capacity to process ~11.4Bcf of natural gas per day. The segment holds asset in most major US producing basins focusing on the Permian (3.4Bcfd) and Eagle Ford (2.4Bcfd) basins in Texas and the SCOOP & STACK plays in Oklahoma (2.9Bcfd). Smaller footprints also exist in the Haynesville and Bakken shales as well as the Appalachian Marcellus. Driven by an ongoing growth in Permian produced gas volumes, ET has recently expanded its local processing capacity, having completed two greenfield processing plants and being in the process of upgrading several existing ~200Mcfd facilities to continue meeting customer demand.

G&P Assets (Energy Transfer IR)

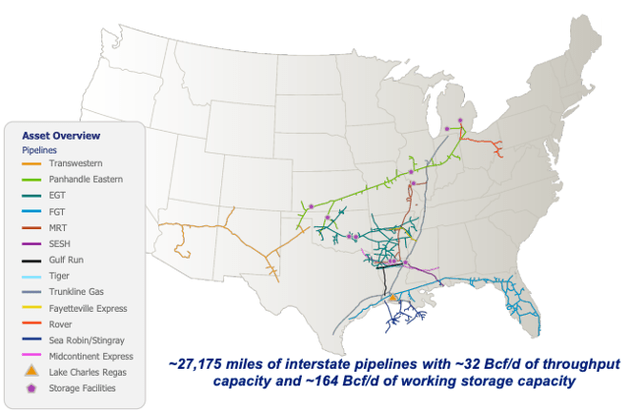

Intra- and Interstate Natural Gas – ET is also a major player in both intrastate (Texas) and interstate natural gas transportation, owning and operating ~27k miles of interstate pipeline with capacity to transport around 32Bcf in gas per day. It further holds storage facilities across the country with a combined capacity of 164Bcf. Geographically the segment is concentrated in the southern US with the Texan intrastate network adding a further 12k miles of pipeline and 88Bcf in storage capacity. Key pipelines include the Panhandle Eastern, supplying Ohio and Illinois from Oklahoma and the Florida Gas Transmission (“FGT”) system, supplying gas from the Texan Gulf Coast to Florida. Such long-distance natural gas transportation pipeline represent a highly stable source of revenue with ET noting ~95% of revenue from fixed-fee contracts.

Long-Distance Natural Gas Assets (Energy Transfer IR)

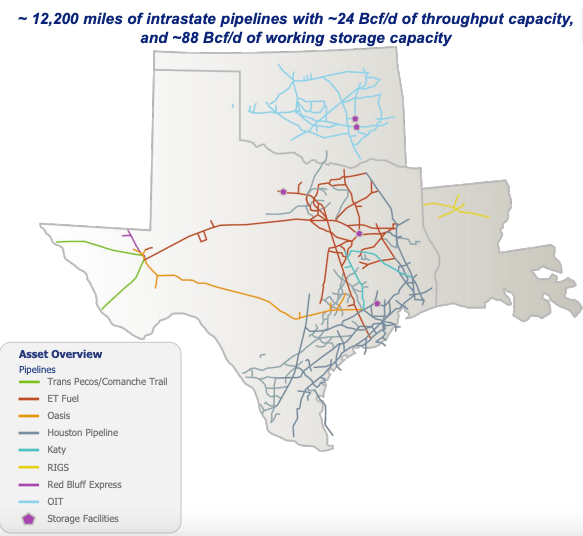

Across Texas, key assets are the Houston Pipeline System (5.3Bcfd capacity) and the ET Fuel pipeline originating in the Permian basin (5.2Bcfd). Recent expansions and projects include an upgrade of the Oasis pipeline, adding 60Mcf of daily capacity to debottleneck the Permian basin which came online in Q1 23.

Texas Gas Assets (Energy Transfer IR)

SUN, USAC & Other – ET also owns the general partner interest and ~34% of the outstanding common units of Sunoco LP (SUN), and the general partner interests with ~47% of the outstanding common units of USA Compression Partners (USAC).

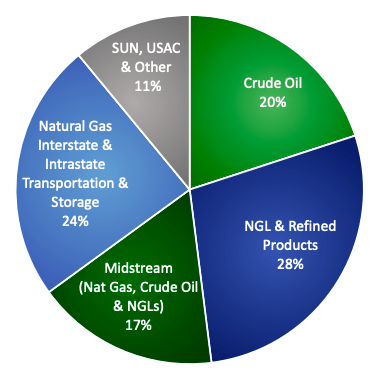

FY23 EBITDA Split (Company Filings)

For FY23, ET’s EBITDA was split roughly even between the segments with no single division making up more than a third of group EBITDA allowing for a very balanced commodity exposure.

Key Investment Thesis

Crestwood Acquisition immediately accretive to DCF/sh with synergies comprising ~15% of deal value. As part of its longstanding inorganic expansion and consolidation strategy, ET announced it would acquire 100% of publicly-listed Crestwood Equity Partners in August 2023. Total consideration was $7.1B, paid 100% in equity. As part of the deal ET would gain major footholds in the Williston, Permian and Powder River basins, adding ~2Bcf of gas gathering and ~1.4Bcf of gas processing capacity per day. The deal further increased daily crude oil gathering and storage capacity by 340Kboe and 2.1Mboe respectively as well as adding 10Mboe of additional NGL storage in the Marcellus/Utica play. Acquired customer relationships range from global Supermajor ExxonMobil to regional and private E&Ps such as Continental Resources.

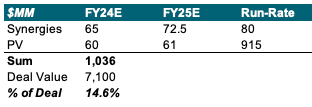

The acquisition was driven by significant observed synergy potential with ET initially aiming to realize a stable annual run-rate of $40MM in cost savings by 2025, ~13% of Crestwood’s total operating & corporate expense basis of $300MM. With further thorough due diligence conducted post the offer, by transaction close in November 2023 and ET’s Q4 earnings call, management had doubled its expected synergy to potential to now reach an annual run-rate of $80MM in 26E with $65MM realized by YE24.

Assuming a linear rise in synergies over 25E and a CAPM-derived ET WACC of ~8.75%, I estimate total present value of synergies at ~$1B or roughly 15% of the $7.1B deal value. With management also citing potential for further synergies from customer overlap and other efficiency gains, I see the transaction as highly promising for ET, reportedly being immediately accretive to DCF/share.

Crestwood Synergy Estimates (Company Filings, WSR Estimates)

Unique insider ownership ratio at ~10-11% of outstanding units. I see a unique competitive advantage in ET’s unique degree of insider ownership with management and other company staff holding approximately 10-11% of outstanding shares. Since January 2021, insiders and board members have purchased ~41MM shares for a total consideration of $411MM or ~2.3% of January 31 2021 market cap. Executive chairman Kelcy Warren alone has purchased a total amount of $621MM in ET stock (51MM units) over the last 5 years with the company’s co-CEOs’ holding 6 or more times their annual base salary in shares.

And while insider ownership per se is nothing special, it does present an attractive framework for investors as management execution and strategy is highly aligned to their goals for long term, sustainable capital appreciation. A key problem that many companies face is the inherent dilemma between the usually very short term view that Wall Street analysts and funds hold, often punishing stock prices for (necessary) capital investments to provide long term growth and the very long term time horizon that most individual and retail investors have. As such I see ET’s high degree of insider ownership as providing additional trust in management’s long term vision and a highly attractive and unique differentiator versus peers and the broader market.

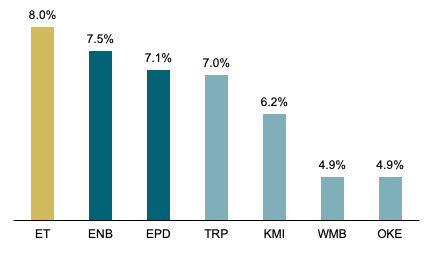

Strong and durable shareholder return framework offering highest 24E dividend yield at strongest FCF coverage. Based on its announced 2024 dividend of $1.26/unit and current share price, I see ET offering an 8% forward yield, above both its LP peers at ~7.3% and C-Corp midstream peers at ~5.8%. Compared to the entire peer group, ET offers a 23% higher dividend yield with average across the group at ~6.5%.

24E Dividend Yield (Seeking Alpha)

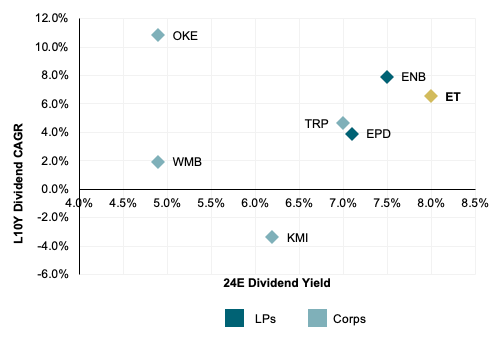

Plotting current forward dividend yields against annualized growth rates over the past 10 years, ET stands out in a highly favorable position at an attractive blend of growth and yield. Having grown its dividend at ~6.5% since 2014, ET is only behind ENB (7.9%) and OKE (10.8%) while offering a more attractive yield. Notably, KMI is the only company in the group to have actually decreased its payouts, mainly a result of the 2015 dividend fiasco which saw Kinder Morgan cut its dividend by 75% as a result of low oil prices.

Seeking Alpha

Further plotting expected yield against coverage (defined as 24E total dividends paid over 24E FCF), ET stands out at the highest coverage with projected dividends covered by FCF more than 1.4 times versus most peers at around 1x.

Seeking Alpha

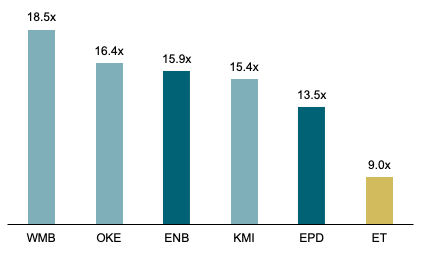

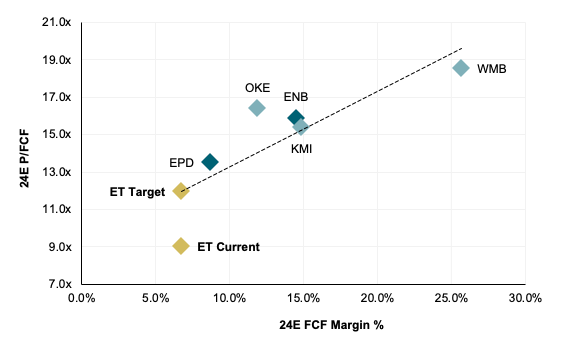

Up to ~40% valuation discount vs key midstream peers on 24E financials. Despite its status as the US’ leading pipeline operator and its strong operational and financial track record, I find ET trading at a significant discount versus the broader industry on almost all relevant financial metrics. Based on 24E FCF of ~$5.9B, ET currently trades at just a 9x equity multiple, significantly below both LP and Corp peers at 14.7x and 16.8x respectively. I note that TC Energy is excluded since the company is expected to deliver negative FCF for 24E. Compared to the entire group, I see ET at a 39% discount vs peers.

24E P/FCF (Seeking Alpha)

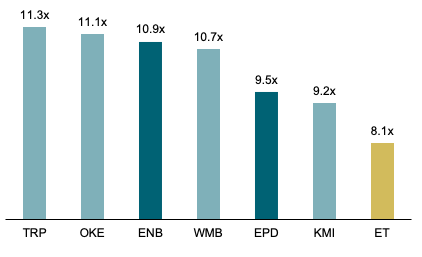

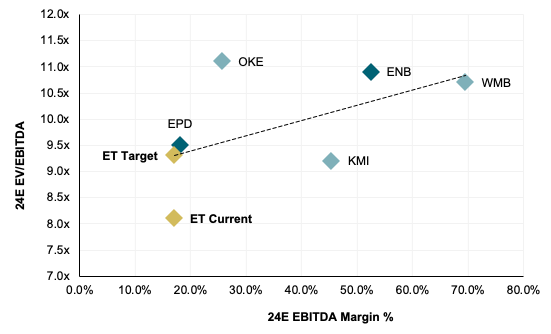

Plotting peer multiples on a forward 24E EV/EBITDA basis reveals a similar discount with ET trading at 8.1x its 24E EBITDA of ~$14.8B, a ~20% discount to peers.

24E EV/EBITDA (Seeking Alpha)

And while I do believe that some discount is warranted for ET given its significantly lower margins on both EBITDA and FCF (17% and 7% vs group averages of 42% and 11%), I feel current discounts to be too stretched and pessimistic in the light of ET’s continued strong execution in M&A and its favorable ownership structure.

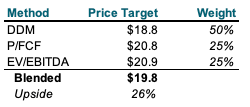

Valuation

I value ET based on a blend between an intrinsic Dividend Discount Model (“DDM”) and relative valuation on both 24E P/FCF and EV/EBITDA with intrinsic valuation having a 50% weight and multiples at 25% each. Across all three methodologies I calculate a fair price target of $19.8 per common unit, implying ~26% price upside from current levels.

Company Filings, WSR Estimates

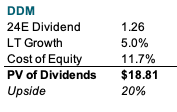

DDM

ET has declared a $1.26 dividend per unit to be paid during 2024. I assume an infinite growth rate of 5%, at the higher end of 3-5% management guidance but below L10Y CAGR of 6.5%, implying the potential for guidance adjustments which should serve as an important catalyst to rerate the stock from current valuation levels. Further using a CAPM-derived cost of equity of 11.7%, I find ET’s future dividend stream to be worth $18.81 today, or ~20% above current unit price. Notably, backsolving for implied LT growth rate I find that the market currently prices in ~3.7% infinite growth rate for ET’s dividends which I find significantly too low given a) official company guidance of between 3-5% with a likely skew towards the higher end and b) ET’s dividend history with ~6.5% annual growth over the last 10 years which had not been easy environment for energy companies.

Company Filings, WSR Estimates

Multiples

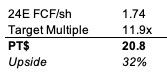

Plotting peer multiples on 24E FCF/sh against consensus estimated realized FCF margins, I find ET trading significantly below what it should be valued at. At currently 9.0x expected 24E FCF/sh, ET stock trades ~25% below a regression-estimated multiple at 11.9x.

Seeking Alpha, Bloomberg

Applying this fair 11.9x multiple to 24E FCF/sh which street consensus currently estimates at $1.74, I calculate a price target of $20.8 per common unit, ~32% upside.

Company Filings, WSR Estimates

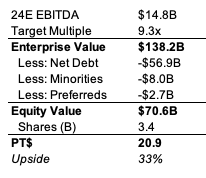

I also find ET shares significantly below regression-estimated value on the basis of 24E EV/EBITDA. With an expected EBITDA margin at ~17%, ET should theoretically trade at a 9.3x multiple, ~13% above its current 8.1x valuation.

Seeking Alpha, Bloomberg

Applying a 9.3x multiple to consensus 24E EBITDA of ~$14.8B implies an enterprise value of $138B. Adjusting for net debt, minority interest and preferred stock (ET recently bought back $3.8B of preferred stock through new debt issuance), I calculate a fair equity value of $70.6B or $20.9 per common unit for ~33% upside.

Company Filings, WSR Estimates

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.