Summary:

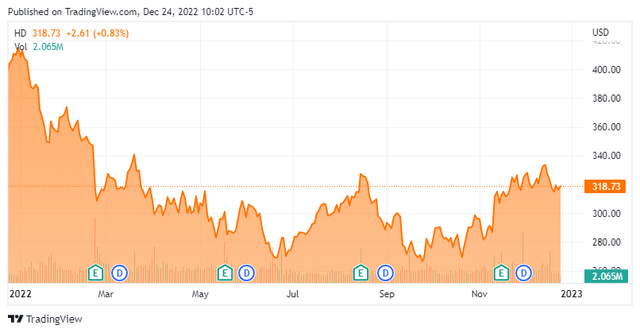

- Today, we take a deeper look at Home Depot whose stock is down nearly 20% so far in 2022.

- The company is facing mounting headwinds from a fast-slowing housing sector and had some notable insider selling in its stock in 2022.

- Time to start accumulate shares in this retail giant or more pain ahead? An investment analysis follows in the paragraphs below.

Justin Sullivan

As a man is said to have a right to his property, he may be equally said to have a property in his rights. ― James Madison

Today, we take a look at a look at Home Depot (NYSE:HD). The stock of this retailing giant has held up relatively well given the weakness in the overall market and with housing being impacted severely thanks to mortgage rates being over six percent.

Can the company continue to navigate through considerable headwinds or is there additional pain ahead for shareholders? An analysis follows below.

Company Overview:

Home Depot is the largest home improvement retailer in the world and is headquartered in Atlanta. The company owns and manages just over 2,300 big box stores in the United States that sell various building materials, home improvement products, lawn and garden products, and décor products, as well as facilities maintenance, repair, and operations products. The company also offers installation services for flooring, cabinets and cabinet makeovers, countertops, furnaces and central air systems, and windows.

February Company Presentation

The company serves both the DIY community as well as contractors. The stock currently trades just under $320.00 a share and sports a market capitalization just north of $320 billion.

February Company Presentation

Third Quarter Results:

The company posted third quarter numbers on November 15th. Home Depot delivered GAAP earnings of $4.24 a share, more than a dime a share above expectations. Revenues rose 5.6% on a year-over-year basis to $38.9 billion, approximately $900 million above the consensus.

Comparable same store sales rose 4.3% from the same period a year ago, besting expectations of three percent growth. In addition, merchandise inventories fell sequentially to $25.7 billion from $26.1 billion at the close of July. However, analysts had anticipated a far lower $23 billion level to be reported.

Analyst Commentary & Balance Sheet:

The analyst community is mixed in their views on Home Depot at the moment. Since third quarter results posted, ten analyst firms including Morgan Stanley and Goldman Sachs have reiterated or assigned Buy/Outperform ratings on the stock. Price targets proffered range from $328 to $400 a share. In addition, five analyst firms including Wedbush and Piper Sandler have maintained Hold/Neutral ratings on Home Depot with price targets ranging from $280 to $335 a share.

Only approximately one percent of the outstanding float is currently held short. However, on November 16th and 17th, several company insiders sold just over $20 million worth of stock. Notably, booth the CIO and CEO sold a substantial chunk of their overall holdings in the equity. Home Depot had nearly $2.5 billion of cash and marketable securities on its balance sheet at the end of the third quarter against nearly $39 billion of long-term debt.

Verdict:

The current analyst firm consensus has the company earning just over $16.65 a share in FY2022 as revenues rise four percent to $157.5 billion. Home Depot made $15.53 a share of profits in FY2021. Only one percent sales growth is projected in FY2023 as profits are expected to rise slightly to $16.94 a share. That leaves the stock trading at around 19 times this year’s earnings, just over two times sales with a 2.4% dividend yield. Shares in competitor Lowe’s Companies (LOW) trade for 14.5 times earnings, 1.3 times sales with a 2.1% dividend yield in way of comparison.

November marked the tenth straight month of U.S. home sales declines on a year-over-year basis, which is unprecedented. The previous worse level was the 8-month string of slippage in 2007 as the country was careening towards the financial crisis. In addition, housing market activity tends to decelerate in the fourth quarter, a period that usually proves to be the slowest three-month stretch of the year. It will be interesting to see what, if any, impact that might have with Home Depot’s Q4 numbers

With just over flat earnings and sales growth projected in the coming year along with a collapsing housing market and an economy that seems likely to enter recession sometime in 2023, it is hard to justify an investment in Home Depot at these valuation levels. The company is very well run, but it will likely face significant economic headwinds in the coming years. It is easy to see why some of the management team has taken significant chips off the table in the fourth quarter. If I were in their position, I would be doing the same.

No man’s life, liberty or property are safe while the legislature is in session. ― Gideon Tucker

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author’s note: I present an update my best small and mid-cap stock ideas that insiders are buying only to subscribers of my exclusive marketplace, The Insiders Forum. Our model portfolio has more than doubled the return of its benchmark, the Russell 2000, since its launch. To join our community and gain access to our market beating returns, just click on our logo below.