Summary:

- iQIYI is trading at depressed levels compared to historically.

- Q4 results showed flat quarterly revenue but impressive annual growth, with membership services and advertising revenue contributing to overall growth.

- iQIYI is leveraging AI technology to improve efficiency and content production, and its strong library of original content is driving viewer engagement and market share.

Giuliano Benzin

Spun-off by Baidu (BIDU) in 2018, iQIYI (NASDAQ:IQ) has faced a precipitous decline in share price from an over $40 peak in 2018 to around $4 as of late. iQIYI stands out amongst competitors/peers as having achieved so far sustained profitability, but this does not seem to be reflected in current prices with the stock plummeting by similar percentages. In relation to these competitors iQIYI stacks up favourably, and although there are some risks to consider as well as questionable Q4 results, these are outweighed by the inherent strength of the company’s library and potential catalysts including effective deployment of AI to increase efficiency.

Q4 And Annual Results

In Q4, relatively flat quarterly results were contrasted with impressive annual ones. Annually for 2023, revenue grew 10%, operating profit grew 68% and net profit grew 121%. Q4 revenue meanwhile only increased by 1% YoY, while average daily total subscriber count actually fell to 100.3 million from 107.5 million the previous quarter. Offsetting this appears to be Average Revenue per Member which grew 13% annually, with the subscriber mix improving and more annual plans. These numbers are a bit worrying if they extrapolate further, it could be an indication membership will plateau and iQIYI are currently compensating with gains in ARM.

Membership services for 2023, which make up the majority of revenue, grew 15% annually to over RMB 20 billion, while advertising grew by 17%. Advertising revenue grew 6% in Q4 YoY which management attributed to a recovery in the health, communications and food and beverage sectors, as well as generative AI.

AI Developments and Efficiency Gains

There is a vast array of potential applications for AI in the entertainment industry and currently iQIYI is wasting no time in deploying them. Generative AI is being used to improve ad creation, mass production of marketing materials and generation of plot summaries. The efficiency of content production is also being improved by the “iQIYI Content Production Management System” which records the production process, this is backed up by results, with content cost having fallen by 5% annually for Q4 and the content related cost ratio having declined by 12% annually. Further integration of and investment into AI to speed up production seems like a good catalyst for the stock. However, the longer term impact of AI on this stock and many others is more ambiguous, video generating models now exist and plausibly will grow more sophisticated in the future, so it is a matter of monitoring the technology and how the company adapts.

Strong Content Library

Producing original content is critical to retain subscriptions and market share, and iQIYI has been producing an increasing percentage of originals, which now account for 65% of drama releases. Tim Gong comments on original content below.

Tim Gong, Q4 earnings:

Original programming remains the cornerstone of our content strategy and a key revenue driver. We have made remarkable advancements in the quality of our original productions. In 2023, original content contributed 80% of the total revenue from key new dramas during the new-release period. And that’s not all. For 7 straight quarters, over half of our revenue for new key dramas has come from original titles.

Using the company’s popularity index, a proxy for viewership and engagement, the figures for content are improving with 71% more titles exceeding a score of 9,000 on the index as compared to 2021. Viewership figures also support this, with a 47% share in the Chinese online movie streaming market and the company broadcasting 7 of the top 10 most viewed new dramas.

Additionally, animation is a growth area both now and potentially for the future. 2023 saw a 90% increase for revenue from animation, while iQIYI also focused on expanding their original animation content by doubling the number of original titles.

International Market

Expansion into the international market, likely specifically the South East Asian and other Asian markets will be a key area to target for more growth. While there is no revenue breakdown by region released by iQIYI, growth for Q4 in many countries exceeded domestic figures as addressed below.

Tim Gong:

In Q4, membership revenue and ad revenue both recorded double-digit annual growth, driven by the growing popularity of premium content among users and advertisers. Membership revenue increased by over 80% in Japan, Hong Kong and the UK, and over 50% in Mexico and South Korea. Ad revenue grew 20% annually and 49% sequentially.

Southeast Asia is also a key overseas market the company is expanding into. In an announcement in December iQIYI announced 280 more Chinese language dramas, films and variety shows and over 35 original productions from Southeast Asia. A bit more transparency into the relative size of these markets and revenue figures would be desirable, to properly assess the opportunities internationally.

Valuation

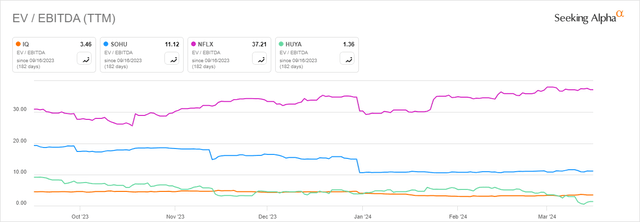

Charting the trailing EV/EBITDA alongside some similar companies, the company is well below Netflix’s (NFLX) comparatively lofty multiple but above Huya (HUYA). The forward EV/EBITDA is even lower at 2.35, over 70% below the sector median. Perfect comparisons here are difficult to find because some of the competition are segments of much larger companies like Youku, part of Baba (BABA) or Tencent Video, part of Tencent (OTCPK:TCEHY). IQIYI’s forward P/E ratio is 9.89, which is over 40% below the sector median of 16.97, a significant difference.

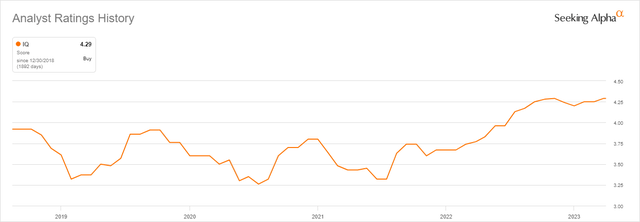

Wall Street analysts have a Buy rating for the company and are as positive as they have been in the last five years, a positive trend despite the general position of the market being pessimistic on Chinese stocks recently.

Risks

General China related risk is of course present, however it seems likely that at this point many investors who find the risk too high have already closed their positions. For this particular stock it does not seem particularly at risk from international geopolitics, as the company is broadly serving a domestic market, and does seemingly should not have any relevance to defence or related concerns. The Chinese regulatory landscape is perhaps more concerning. In 2021 the country passed data security and personal information laws governing how companies manage data. While there does not appear to be any recent news that directly affects IQ, the entire framework is quite murky regarding what standards will be applied to who and how rigid enforcement will be.

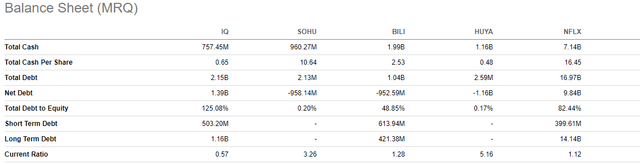

Another problem is the company’s debt. The company has a current ratio of 0.57, which is low even taking into account some peers have relatively low ratios near one. Interest coverage ratio is at 2.64 which is fine but borderline. Given profitability being a relatively recent development for the company there is an argument to be made this may be a problem if it proves hard to sustain.

Conclusion

iQIYI is a compelling prospect when considering various strengths that make it standout against other beaten down Chinese stocks, including a recent history of profitability, a strong originals library of content and catalysts such as AI tools which are helping drive efficiency. There are however some drawbacks, specifically China related factors, the current ratio and potentially AI disruption down the road, something that is hard to forecast. Despite these, at this price there is room for upside here which is why I have a position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IQ, BABA, BIDU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser and this is not financial advice. This article is intended for informational purposes only and reflects my personal opinions only. You should always make investment decisions based upon your individual financial situation and personal research. Please consult a licensed investment adviser before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.