Summary:

- Shares of iQIYI have experienced a significant decline since the publishing of my bearish articles in 2020 and 2021.

- However, the company has recently achieved four consecutive quarters of positive free cash flow and has turned profitable due to revenue growth and expense control.

- In the meantime, the stock appears attractively priced.

- Thus, my view on the stock has turned from bearish to bullish.

Robert Way

The first time I shared an article on iQIYI (NASDAQ:IQ) was all the way back in April 2020, supporting the view that the company’s unattainable profitability was poised to deteriorate shareholder value.

This was followed by two more bearish articles in August and December of the same year and one more in April 2021, each reiterating my view and building on my bearish stance on the stock.

I am listing them below, just for the record, in case anyone wants to go back and read my thoughts.

- April 2020: iQIYI: Unattainable Profitability Deteriorates Shareholder Value

- August 2020: iQIYI: Consistent Shareholder-Value Crumbling Is Set To Continue

- December 2020: iQIYI: Shareholder Value Going Straight Down The Drain

- April 2021: iQIYI: The Shareholder Value Deterioration Story Continues

Since each article was published, the stock has declined by 71.7%, 74.7%, 71.5%, and 71.7%, respectively.

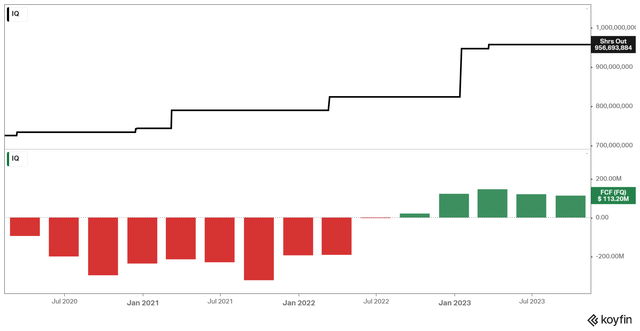

As you can see in the graph, iQIYI proceeded to post massive negative free cash flows in the quarters following my articles. In turn, management kept diluting shareholders as its money-losing operations meant it constantly needed more cash.

IQ’s Free Cash Flow & Shares Outstanding (Koyfin)

However, this trend has reversed lately. As the same graph above illustrates, iQIYI has now posted four consecutive quarters of positive free cash flow. In fact, free cash flow in each of the past four quarters has exceeded $100 million.

Although iQIYI has begun to generate positive cash flow, the stock’s sentiment has not yet reflected this positive shift. The investment landscape has transformed from that of an unprofitable company with an expensive stock – which prompted my previous bearish stance – to that of a profitable company with an attractively priced stock, thereby driving my current bullish stance.

But let’s take a step back to review how the company turned profitable and why its bottom line is likely to remain green moving forward.

How Did IQ Turn Profitable? – And Why It’s Going To Last

iQIYI’s leap into profitability can be credited to an impressive resurgence in revenue growth and meaningful expense control. Let’s take a look at both factors.

Revenue Growth Resumes

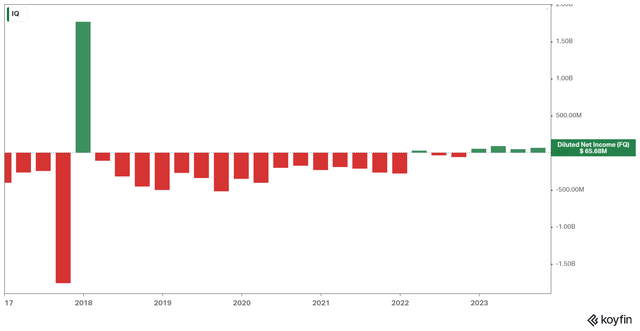

To contextualize this turnaround, iQIYI grappled with losses in nearly every quarter from the fourth quarter of 2016 through the third quarter of 2022, with only two notable exceptions—one being a unique, non-recurring gain in the fourth quarter of 2017 tied to IPO-related gains.

IQ’s Historical Net Income (Losses) (Koyfin)

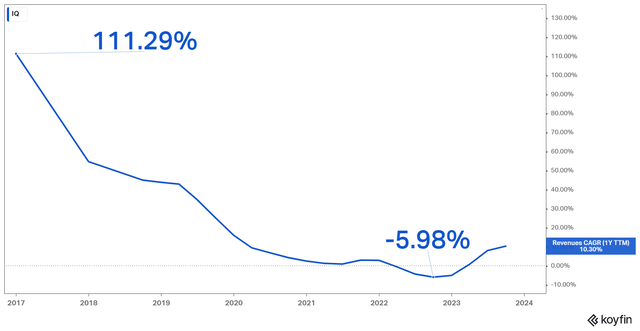

In the face of these hardships, iQIYI experienced a deceleration in revenue growth, witnessing a dip in its last-12-month (LTM) revenue growth from a mighty 111% in the fourth quarter of 2016 to a worrisome -6% in the third quarter of 2022. During this period, the company was witnessing a gradual erosion in its performance quarter after quarter.

However, in recent quarters, iQIYI orchestrated a notable reversal, achieving four consecutive quarters of revenue growth. As the graph above illustrates, the company’s LTM revenue growth as of its most recent quarterly report (Q3) stood at an impressive 10.3%. This marks a notable upswing from the preceding year’s -6%.

The company’s third-quarter results highlighted that the resurgence in top-line growth is being propelled by an expanding membership base, complemented by an encouraging uptrend in revenues per membership.

In particular, iQIYI posted a 7% uptick in revenue for the quarter, reaching $1.1 billion. This surge was fueled by a 6.4% surge in average daily subscribers to 107.5 million and an 11.8% increase in the monthly average revenue per membership to RMB15.54 ($2.19).

iQIYI’s third quarter performance received an added boost from Online Advertising Services revenues, totaling an impressive $229.5 million—a 34% year-over-year surge attributed to performance-based and brand advertising growth.

However, the upward momentum in Online Advertising growth was somewhat counterbalanced by a 28% decrease in content distribution revenue, which landed at $72.1 million. This dip was primarily driven by a reduction in the average unit price of barter transactions, offering insight into why iQIYI’s revenue growth remained within the single digits.

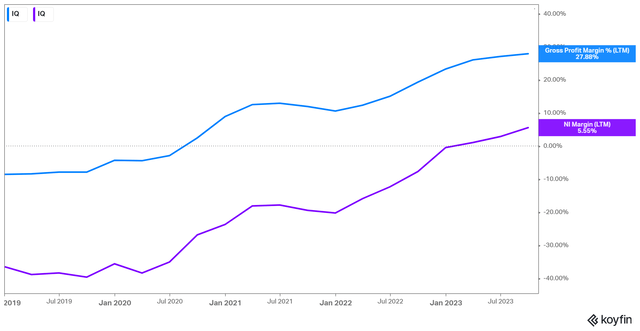

Cost Expenses Drive Improving Margin

In tandem with this robust revenue growth, iQIYI prudently controlled its total expenses, which grew by a mere 5% year-over-year in its most recent results.

The combination of economies of scale kicking in due to improving unit economics amongst subscribers and handling expenses prudently paved the way for net income margins to shift out of the red zone.

The LTM net margin has now reached 5.6%, while net income reached $65.2 million in Q3. It marked the fourth consecutive quarter of positive earnings.

IQ’s Gross & Net Income Margins (Koyfin)

Given the seemingly sustained trend of positive net income, iQIYI appears to be charting a promising course toward enduring profitability.

Why Is iQIYI’s Profitable Growth Likely Going To Last?

I am optimistic about iQIYI’s enduring positive net income trajectory, which stands out for its ability to effectively manage expenses while expanding its subscriber base—an achievement that distinguishes it from its Western counterparts.

In contrast to these rivals grappling with an oversaturated streaming industry, where numerous giants vie for market dominance, iQIYI navigates growth with remarkable resilience.

While Western streaming behemoths face challenges such as stagnant subscriber growth due to intense market competition, they also contend with substantial expenditures on content and advertising, impeding significant profit growth.

A notable case in point is Disney+, which has witnessed declining subscriber numbers in recent quarters, contributing to persistent operating losses in Disney’s DTC segment.

In sharp contrast, iQIYI operates in a market with limited direct competition from multiple streaming giants. Its market-leading position in China, without a close counterpart enjoying a similar scale, suggests iQIYI’s ongoing scaling of unit economics over time.

The Valuation – iQIYI Is Likely Cheap

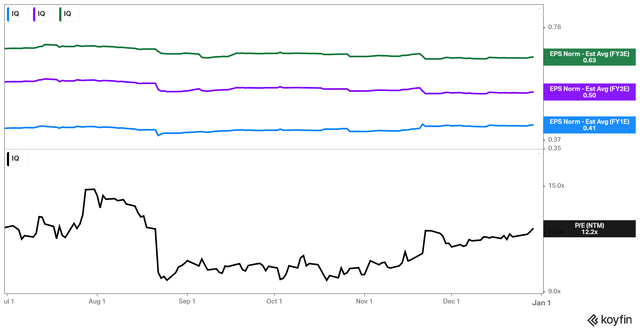

Shares of iQIYI have appreciated in recent weeks, in line with most equities. Yet, I believe the stock remains cheap. Its forward P/E currently stands at just 12.2X, while based on Wall Street’s estimates, the stock is trading at 9.8X and 7.7X expected EPS for fiscal 2024 and fiscal 2025, respectively.

IQ’s EPS Estimates & Forward P/E (Koyfin)

Being a Chinese company, I doubt investors will ever be willing to trade the stock at the premium multiples its Western counterparts may attract. Still, iQIYI’s forward multiples appear low enough to allow for the possibility of a notable P/E expansion.

With management ceasing diluting shareholders, rising net income, and iQIYI not facing as significant competition risks as its Western counterparts, I believe that investors’ confidence in the stock is likely to pick up.

Takeaway

In hindsight, my bearish outlook on iQIYI in 2020 and 2021 accurately reflected the company’s challenges, with its stock declining substantially. However, recent quarters have seen a remarkable turnaround, marked by consecutive positive free cash flows and a shift to profitability.

The resurgence in revenue growth, driven by an expanding membership base and encouraging trends in revenues per membership, has been a key factor. The company’s adept management of expenses has further contributed to improving net income margins.

Simultaneously, in a streaming landscape saturated with Western competitors, iQIYI’s distinct market position in China and its ability to navigate growth with resilience set it apart.

Finally, despite recent stock appreciation, iQIYI’s forward valuation metrics suggest it remains attractively priced. As the company continues its trajectory toward enduring profitability, investor confidence will likely grow – hence the shift from my earlier bearish stance to a more optimistic outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Wheel of FORTUNE is a most comprehensive service, covering all asset-classes: common stocks, preferred shares, bonds, options, currencies, commodities, ETFs, and CEFs.

- WoF is 1 out-of-only 3 services with 50+ reviews that have a 5* rating.

- WoF is 1 out-of-only 7 services with 25+ reviews that have a 5* rating.

- Single, uncorrelated, trading ideas [ >250/year, on average].

- Managed portfolios, aim at outperforming SPY on a risk-adjusted basis.