Summary:

- Amazon’s stock price has increased by 37% since my Buy rating in July 2023, driven by strong growth in their AWS business and improved operating margins.

- Third-party seller services accounted for 24.4% of total revenue in FY23, driving growth and margin expansion.

- AWS revenue growth may accelerate again as enterprise cloud optimization nears completion, and the rising demand for AI computing will drive cloud infrastructure growth.

FinkAvenue

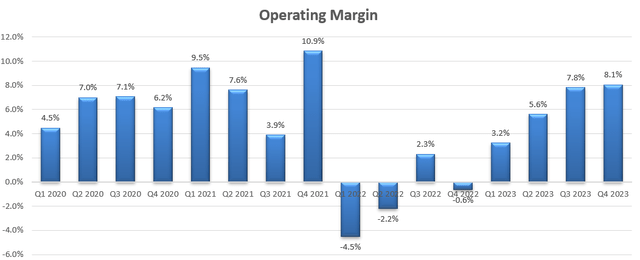

Amazon’s (NASDAQ:AMZN) stock price has surged by 37% since I presented my ‘Strong Buy’ thesis in my initiation article in July 2023. I suggested that their AWS business was underappreciated by investors. They delivered a 6.4% operating margin in FY23, a huge improvement from 2.4% in FY22, primarily driven by their e-commerce growth and cost improvements. I forecast Amazon will continue their double-digit revenue growth momentum with notable margin improvement in the near future. I reiterate my ‘Strong Buy’ rating with a one-year price target of $230 per share.

Third-Party Seller Service Drives Growth and Margin Expansion

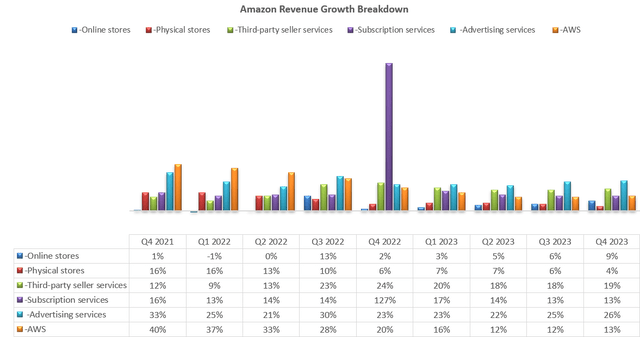

Amazon delivered 12% revenue growth in FY23, driven by strong growth in AWS, 3rd party seller services, subscription and ads. Their third-party seller services grew 19% year-over-year in Q4 FY23, outperforming the sales growth in their online and physical stores, as depicted in the chart below.

Due to the strong growth, their 3rd party seller services accounted for 24.4% of total revenue in FY23, a notable increase from 15% in FY15.

Fulfillment by Amazon (FBA) has been favored by third parties, as merchants only need to select a fulfillment method, selling plan, products, then setup their Amazon seller accounts. Merchants can leverage Amazon’s brand awareness to distribute their products, and Amazon offers comprehensive system to help merchants manage their own inventory and conduct data analytics and performance marketing. Although Amazon doesn’t disclose their FBA margin versus their own online store margin, I estimate FBA carrying much higher margin, as Amazon doesn’t carry inventories, and acts as a platform and service provider. Consequently, the rapid growth in FBA has been accelerated Amazon’s business growth and group margin expansion. As disclosed over the Q4 FY23 earnings call, the worldwide third-party seller unit mix has reached 61% at the end of FY23, the highest level ever. I forecast FBA to continue growth momentum in the near future, driving e-commerce business margin expansion.

Due to the strong margin improvement in their e-commerce, Amazon has been expanding their operating margin on the group level over the past few quarters, as illustrated in the chart below.

AWS: Enterprise Cloud Optimization is Nearing Completion

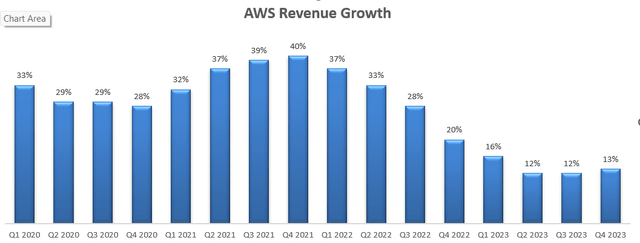

As disclosed by all major hyperscalers including Alphabet (GOOGL), Microsoft (MSFT) and Amazon, enterprises began to optimize their cloud consumptions in early 2023. The chart below presents the deceleration of AWS revenue growth from Q1 FY23. As highlighted in my initiation article, AWS has the long-term growth potential primarily driven by cloud migration, AI and digitalization. In my opinion, the recent revenue deceleration was macro-driven and caused by enterprises tightening budgets. Once Fed begins to cut interest rate, AWS’s revenue growth could accelerate again in my view. In recent quarters, all the three hyperscalers hinted that activities of enterprise cloud optimization are nearing completion and cloud consumption is normalizing.

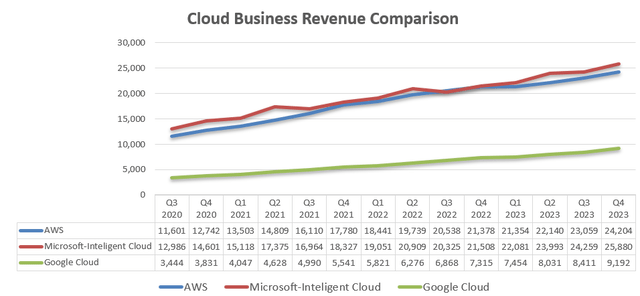

The chart below compares the revenue growth among the three main hyperscalers. AWS and Microsoft Azure are clearly the leaders in the cloud infrastructure market, with Google catching up. With the rising demands for AI computing, all the hyperscalers are likely to experience notable growth in the near future, in my view.

Amazon, Alphabet, Microsoft Quarterly Earnings

On March 18, 2024, Amazon announced that AWS is going to offer NVIDIA Grace Blackwell GPU-based Amazon EC2 instances and NVIDIA DGX Cloud. The partnership could accelerate AI workloads in AWS with running inference on multi-trillion parameter LLMs. As disclosed over the earnings call, AI workloads represent a quite small percentage of total computing in AWS at present; however, their management anticipates AI-related computing would generate tens of billions of revenues for AWS.

AI-related computing requires enterprises to migrate their workloads to cloud infrastructure and integrate data from various sources. Consequently, the rising AI demands would propel the growth of cloud infrastructure demands, in my view.

FY24 Growth Projection

Amazon released their Q4 FY23 result on February 1st, 2024, delivering 13% constant revenue growth and a remarkable 379% operating profit growth. As discussed previously, their cost improvement in e-commerce and fast-growing third-party seller services are primary drivers for margin improvement.

In FY23, Amazon generated $32.2 billion of free cash flow with no dividends and shares repurchase. They have $86 billion in cash and $58 billion in total debts, maintaining a robust balance sheet.

There are several factors for their growth in FY24:

-AWS: I anticipate they will deliver 15% revenue growth, reflecting moderate macro improvement, and less pressure from enterprises budget cut. AWS experienced around 30% revenue growth before FY22 but slowed down to 13.3% in FY23 caused by the weak macro. As such, I think 15% growth projection for FY25 is quite realistic.

-Online store and physical store: I assume they maintain MSD growth momentum. I don’t anticipate there is any structural disruption to Amazon’s online store business in the near future.

-Third-Party Seller Services: I assume the segment will grow at 20%, aligning with their historical average over the past three years.

-Ads: Amazon has been investing heavily in their own machine learning capabilities, making their ads business more relevant to advertisers. In addition, Amazon has been increasing their ads inventories in their streaming properties including Fire TV and Prime Video, as they disclosed over the call. As such, I expect Ads business to maintain 20%+ growth momentum.

Valuation Update

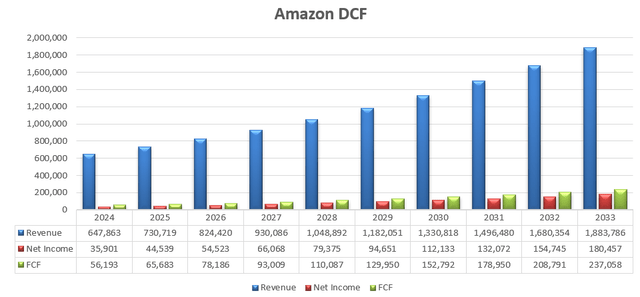

Considering all the revenue growth in each segment as discussed above, Amazon’s total revenue is projected to grow at 12.5% in FY24, primarily driven by AWS, advertisement, and 3rd party seller services.

On the margin side, there are several growth drivers:

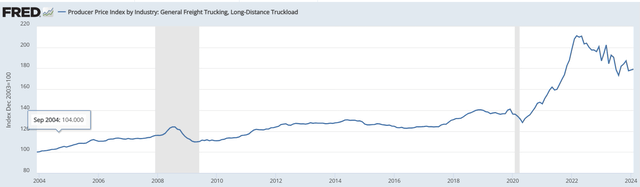

-Fulfillment: due to the reduced logistic costs and less pressure from labour inflation, fulfillment costs as a percentage of e-commerce revenue declined from 25% in FY22 to 24.4% in FY23. As shown in the chart below, the general costs for freight trucking have dropped from the high level during the global pandemic period, and started to normalize.

Federal Reserve Bank of St. Louis

-Cost Improvement: Amazon has been actively managing their marketing costs and G&A expenses. Their management expresses that the company will continue to manage the operating expenses and the margin improvement will not stop at the end of FY23.

In addition, the revenue mix towards more third-party seller services could improve the overall operating margin, as I discussed previously. Net net, I assume a 40bps annual margin expansion, comprising 20bps gross margin improvement, 10bps from fulfillment, 10bps from marketing and G&A leverage.

Amazon DCF – Author’s Calculation

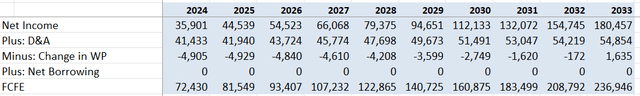

The free cash flow to equity (FCFE) is calculated in the table below:

Amazon DCF – Author’s Calculation

I reached a cost of equity of 14.3% for Amazon with the following assumptions: risk-free rate 4.22% (10-Year U.S. treasury yield); equity market risk premium 7%; beta 1.44 (SA’s 24-month data).

Discounting all the FCFE, I project a one-year price target of Amazon at $230 per share in the model.

I think the market has underestimated the margin expansion potential in Amazon’s e-commerce business. The third party seller services could significantly drive the margin expansion in their e-commerce business, as any incremental FBA revenue growth could be coupled with minimal associated costs, given that Amazon is functioning as a pure platform provider. Additionally, the market remains concerned about AWS’s growth amidst weak macro, as enterprises may reduce overall cloud spending. However, in my view, these concerns are short-term and Amazon’s intrinsic value will be dependent on their future growth potential.

Key Risks

As reported by the media in September 2023, the U.S. government and 17 states sued Amazon in a landmark monopoly, alleging Amazon abused its economic dominance and harmed fair competition. I totally understand these types of complaints, considering Amazon’s dominant position in the e-commerce market. However, I am unsure about the potential outcomes of the lawsuit, other than the possibility of regulators forcing Amazon to change some operational and management procedures or paying a fine.

Amazon hasn’t repurchased any own stocks in FY23, and currently, they haven’t announced any shares repurchase plan. Over the earnings call, their management indicated that they have invested heavily in their distribution centers and AWS infrastructure over the past three years, and they plan to increase capital expenditures in FY24. As such, the company doesn’t appear to have any plans for shares repurchases at this moment.

Conclusion

I favor Amazon’s growth potential in their cloud infrastructure, third-party seller services and ads. Amazon has been one of my core holdings for 12 years now, and I continue to expect their double-digit revenue and profit growth for the next decade. I reiterate my ‘Strong Buy’ rating with a one-year price target of $230 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.