Summary:

- Disney CEO Bob Iger leads the company to a successful proxy battle win, with all directors elected or re-elected to the board.

- Shareholders demand a long-term vision and a “pot of gold” in the future from management.

- Activist investor Nelson Peltz (and his group) and others attempting to gain control of Disney’s board did not succeed due to a lack of a comprehensive future vision.

- Clearly, the coronavirus challenges, the company shut down, and the company restart overwhelmed Bob Chapek.

- The proxy battle illustrates the need to communicate to shareholders concrete accomplishments of a future vision that will be very profitable.

RomoloTavani

The Walt Disney Company (NYSE:DIS) reported that Bob Iger, CEO, has led the company to a successful proxy battle win. All the company-backed directors were elected or re-elected back to the board. Most press releases noted that the margin of the win was substantial. That means that both Iger and the board have a decisive mandate to continue along the pathway that they have mapped out. The win also points out that management needs to give shareholders a vision of a “pot of gold at the end of the rainbow” or else shareholders will look for someone outside the company to present that picture. This is business. Therefore, making a lot of money in the future as a vision appears to be every bit as important as running the company competently.

When Iger retired the first time and Bob Chapek took over as CEO, the one thing lacking was a long-term vision as to where the company should go. That more than anything else likely caused the proxy battle in the first place.

However, the coronavirus challenges shut down the entire company and really was unprecedented. Anyone could easily have stumbled given the unique situation that the coronavirus challenges presented. Even when the company began to ramp back up, there were isolated shutdowns of parks again. It’s not like anyone has practiced recovering from the coronavirus.

The company was so occupied with that recovery that there was really no time to focus on shareholder communications and long-term goals (even though that was probably more important during that period of uncertainty).

In addition to the coronavirus challenges, movies began not meeting the typical Disney standard and streaming ran up far more losses than probably anticipated. While the entrance to streaming followed standard strategy (see Michael Porter’s book “Competitive Strategies“), the actual results probably needed a little more control than was actually apparent in the execution.

Everything that was happening could be fixed. But without a vision about the direction of the company, shareholders began to wonder “who had the wheel.” At that point, it was only a matter of time before someone stepped up to say “I can do better.”

Fortunately, Iger understood the situation and entered the campaign for the proxy battle with a complete program complete with that “pot of gold at the end of the rainbow” for shareholders in the future. The stock price has clearly responded to that vision more so than the actual results at this time. But then again, this market clearly cares about the stock price action far more than actual results. All anyone has to do is look at companies like Spotify Technology S.A. (SPOT) that really do not make money or make nominal profits at best to understand how the market responds to a bright future vision.

Had An Activist Won

The biggest thing to understand about activists (that I covered before) is that many times they’re going for immediate gratification.

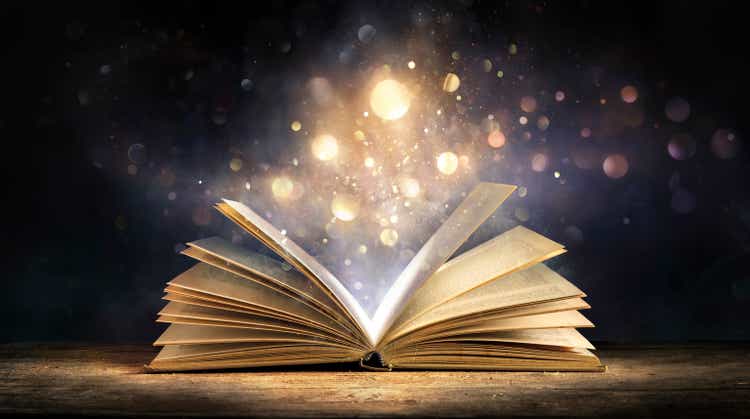

Disney’s Depiction Of Peltz’s Record While On The Board Of Other Companies (Disney Corporate Presentation Of Shareholder Value Creation)

With a company as large as Disney, these activist investors first need to understand the business. That could easily take years for a company that was the size of Disney.

Compare this to the initial proxy fight (and the broader fight for company control) years ago that brought in Michael Eisner as CEO. The big difference was that Eisner had a known record in the industry as someone to pay attention to.

This time around Nelson Peltz and his affiliated people (aka Peltz) are talking about doing it as a board member. That rarely works. Disney actually hit back at this idea:

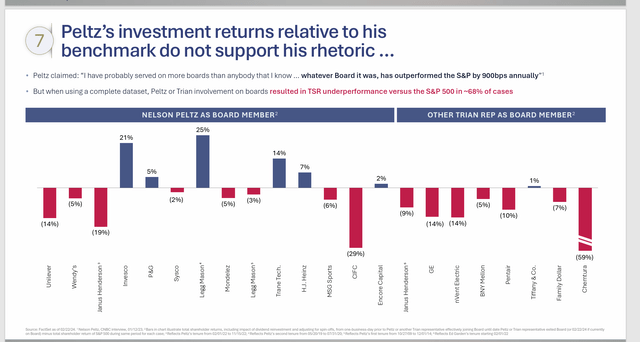

Disney Response To Peltz Ideas During Proxy Battle (Disney Corporate Presentation Of Shareholder Value Creation)

At the very least, a Peltz Group win would have led to a divided board and inefficiencies. Having someone with no experience at a higher level than someone with experience bringing up “new” ideas and not listening to those with industry experience generally leads to a lot of mistakes.

A simple example is I often headed projects with programmers and engineers. But I never told a programmer (for example) how to program. My boss would have told me to start coding if I knew so much.

But that Peltz Group claimed to know as much or more than Iger. You can almost tell from the company responses that this was not going to work without a lot of senior executive turnover if it would work at all. Just about any headhunter will tell you that understanding company history and culture is a key to success. Yet the dispute demonstrates that key tribute was lacking on the activist side.

Stock Price

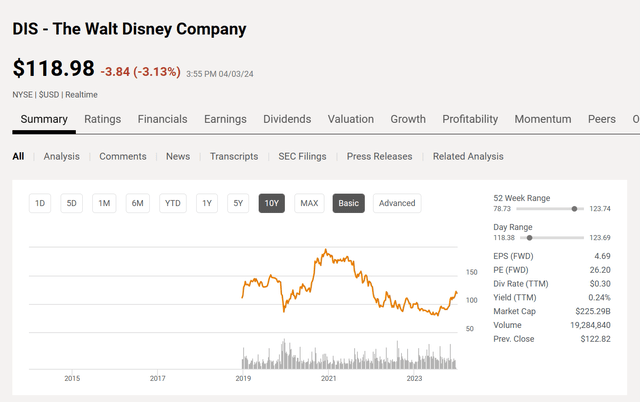

The Peltz Group blamed the company for the stock price history:

Disney Stock Price History And Key Valuation Measures (Seeking Alpha Website April 3, 2024)

The problem with blaming management for the stock price performance is that the activists end up blaming Disney for the coronavirus effects and continuing challenges. No one saw coronavirus coming and no one knew what the ensuing ramp-up would be like. What Disney really needed was coronavirus practice and a really good crystal ball.

The activists really sidestepped the issue of the one-time situation by claiming they would do better in the future. For that matter, I do not know Disney as well as Iger, but I bet I could do better without the coronavirus challenges and there is nothing special about me. What happened during the coronavirus with the stock and the company was likely the best management could do in an unprecedented situation. The chances of it happening again are highly unlikely.

More to the point, the company had a fine record until that happened. Likewise, the criticism of Chapek is likely unfounded. Just about anyone would have stumbled (probably quite a bit) in that unprecedented situation. For a new CEO, that was probably the most overwhelming situation he could have imagined. That future was certainly not on the agenda when Chapek took over and he certainly had no idea what was in store for him.

It certainly is not fair to say that the stock price action was solely management’s fault and therefore “we” can do better in the future.

Management Value Creation

The first thing to consider is that the board brought Iger back to run the company when it became apparent to the board that needed to happen. Therefore, this is not a passive board that allowed the company “to go down the drain.” Anytime I have followed a failure, the key trait was inaction. There’s absolutely nothing here to indicate that there’s inaction.

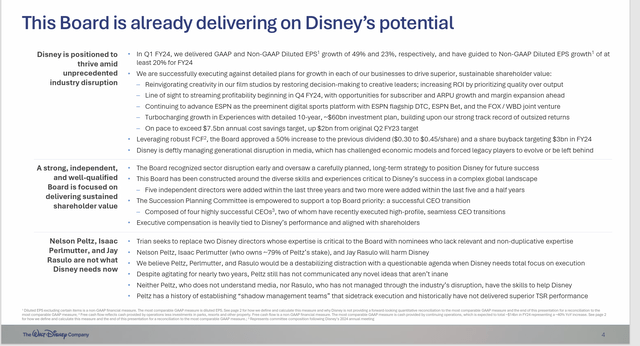

Disney Management’s Summary Of the Board’s Action To Add Future Value (Disney Corporate Presentation Of Shareholder Value Creation)

The key here is that the board is acting in a way that fits Iger’s vision of making a lot of money in the future. You have a united team that has already produced some preliminary results.

I have long reported that large companies often take years of working on a strategy before shareholders see the results. In this case, management had to work on the company goals while restarting the company after the coronavirus demand destruction. It’s also apparent that the company markets changed during the coronavirus shutdown and the restart.

It’s no surprise that the company is still course-correcting from all of that. But the key to the company presentation is that the company will attempt to keep correcting as needed in the future to keep the company healthy.

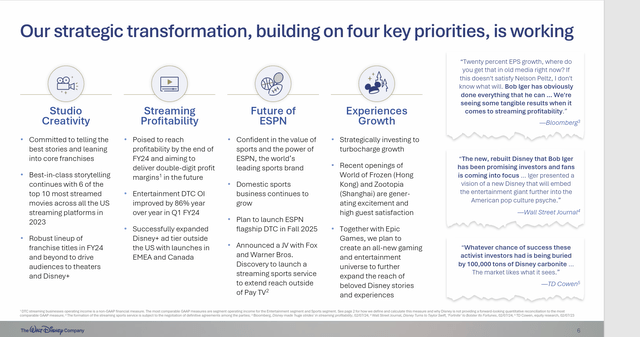

Disney Management’s Summary Of Strategic Transformation Process Within Four Key Goals (Disney Corporate Presentation Of Shareholder Value Creation)

As the company ramp-up to regular activity levels comes to an end, there’s a change back to emphasizing corporate strategy while responding to changing market conditions. Shareholders look at finances. But many times, it takes time, sometimes years, for the appropriate action to show up in finances. If the market changes too fast, it may never show up when investors can tell the right strategy is happening. That was probably the case in the recovery period from the coronavirus challenges.

Disney Management Details Shareholder Verifiable Accomplishments That Fit Long-Term Strategy (Disney Corporate Presentation Of Shareholder Value Creation)

The likely reason that management had an advantage in the proxy battle was that management could point to concrete accomplishments that shareholders could verify or already knew about. This builds a credibility issue that puts activists on the defensive. Management inaction is the key to activists winning.

Disney was another company that made a major acquisition before the coronavirus challenges hit. This kept the company from taking full advantage of that acquisition. Part of the strategic goals is making up for that situation.

A lot of activists have complained that the acquisition was a waste of money and added debt. That’s easy to say when the acquisition gets made and then the company gets shut down. A lot of good acquisitions sat there throughout a lot of industries during the coronavirus shutdown because there was no progress to be made until after the recovery was done.

Investors just had to hope that these acquisitions were made in a way that the company would survive the shutdown followed by the recovery period. Clearly, Disney survived. Now it’s time to make up for time lost. There really is no better way to do things.

Summary

Activist investors often appeal to shareholders by stating they can increase value. Many times that increased value is a short-term gain with a long-term cost after the activist is gone. Like anything else, sometimes an activist shareholder is needed.

But in the case of a large company like Disney, an involved board with some industry experience is likely the answer. The Disney board showed that it was involved by bringing back Iger.

This still leaves the succession issue as a central issue. However, that succession has to be done with the company culture and board in mind. An outside activist trying to force a solution is likely to cost everyone money and time instead.

Iger met the proxy battle challenge with a vision for the future (for the first time really since the coronavirus challenges) combined with actual results demonstrating that the board was working on the current challenges and so was management.

But this whole episode demonstrates the importance of communicating a future vision to shareholders along with measurable progress toward that vision. Also needed is a blunt assessment of things not accomplished and what needs to be done about it. Managements that admit to failures and talk about course corrections needed will often solve problems to keep the company moving in the right direction. Iger seems to be that person.

Disney remains a strong buy with the caveat that both the board and management probably need to do a better job on the CEO succession issue. I honestly think they will. I think that Chapek as CEO had way too many challenges that would have sunk a more experienced CEO.

I still remember Paul Volker (when he was chairman at the Federal Reserve) stating that raising interest rates past 20% was the easiest thing he ever did because everything else had been tried and it did not work. That did not make all those other Chairman failures. It just meant that under Ronald Reagan as president, there was only one thing left and he did it.

Chapek was the CEO that tried things in a unique situation. He eliminated a fair number of ways that did not work. Anyone can have the stance that Iger would have skipped steps had he remained CEO to get to the correct solution faster. That’s all well and good but that was not the resource available at the time.

Now we have Iger back as CEO. For the time being, the future looks good. Let’s see how that CEO succession works out though because that could materially change the outlook a few years from now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.