Summary:

- Today, we will start with a brief contemplation of the Palantir business and its experience over the last 20 years.

- We will then parse the growth rates of the various segments of the business.

- Then, we will conclude with a consideration of Palantir’s valuation and its expected future returns.

- While I am totally content with the performance of the business, I do not find Palantir’s valuation particularly attractive at these levels. That said, I do believe the market’s treatment of its stock and corresponding valuation expansion has been justified.

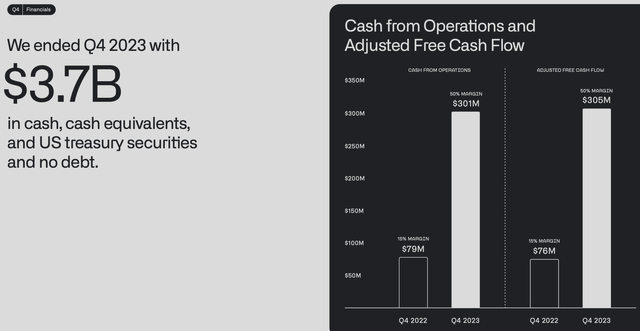

- The business is doing incredibly well atop solid free cash flow, GAAP net income, and a massive $3.7B cash hoard and no long-term debt.

Michael Vi

Enjoy This Little Ride

Our expansion and growth, as both a company and as an organization, have never been greater.

Alex Karp, CEO, Q4 2023 Palantir Shareholder Letter

Throughout my coverage and ownership of Palantir (NYSE:PLTR), I’ve always viewed the business through the philosophy of its founding, its core ideology underpinning its creation. When I introduced the business to my readers, I focused on the core, underlying principles with which the founding team, including Peter Thiel and Alex Karp, both of whom still lead the business today, created the company.

While reviewing Palantir’s most recent quarterly report, I was struck by this vantage point seeming more evident than ever before.

When we think of the company’s name: Palantir, given to it on the day it was founded 20 years ago, we are reminded of the core, underlying philosophy that was imbued into it during those early years.

As you may be aware, a “Palantir” is an object from the Lord of the Rings trilogy, which allowed its users to see into the future, as if they possessed a divine omniscience.

Palantir intentionally selected its brand name to represent the idea that the company existed to aggregate data and fashion the data in such a way that some level of “omniscience” regarding the future could be attained.

To this end, and coming back to the title of this section, I found it noteworthy that the company’s founding ideology required twenty years for the technological landscape to catch up with it and allow the business to fully materialize in the way in which it was envisioned when it was founded.

I found it noteworthy that it required essentially the peak productivity lifetimes of its founders, Messrs. Karp and Thiel, for the business to materialize in the way in which it was envisioned when it was founded.

These are momentous events built on the back of a 20-year assumption that software would define our reality. The winners would be those that understood software, rejecting linear, narrow, sales-driven software, Frankenstein monster infrastructures that have been so historically popular for investment in Silicon Valley, rejecting sophism, as not only an approach to business, meaning I only say what I believe if it doesn’t matter or I never say what I believe. Those assumptions have seeped into our products, whether they’re a military product, whether they’re foundry, or ontology, or AIP.

Alex Karp, CEO, Q4 2023 Palantir Earnings Call

Coincidentally, the same could be said for the technology company that has acted as the foundational hardware infrastructure supporting Palantir’s newfound relevance: Nvidia (NVDA). Founded in 1993, Nvidia required nearly 30 years for its technology to find what would ultimately be its defining application: acting as the hardware layer for the creation of software-defined AI like that which Palantir supplies to enterprises and like that which the Palantir in the video above illustrates.

In our US commercial business, the expanding addressable market, driven by AIP, is propelling growth both through new customer acquisitions and expansions with existing customers. I’ve never before seen the level of customer enthusiasm and demand that we are currently seeing from AIP in US commercial.

With regard to new customer acquisition, the expanding addressable market is reflected in the greater scale of the top of our sales funnel. And now we’re doubling down on how we’re converting bootcamps to enterprise deals. We’re already seeing evidence of bootcamps helping to significantly compress sales cycles and accelerate the rate of new customer acquisition, which rose to 22% sequentially for US commercial in Q4 versus 12% and 4% in Q3 and Q2, respectively. And we more than doubled the number of US commercial deals with TCV of $1 million or more from the fourth quarter in 2022 to 2023. We’re also seeing a meaningful increase in our US commercial TCV on a dollar-weighted duration basis, which is up 107% year-over-year and 42% sequentially.

Alex Karp, CEO, Q4 2023 Palantir Earnings Call

Upon reaching this appreciation for the time it has taken for Palantir and Nvidia to mature into the versions of themselves in which they were ultimately destined to find themselves, I was reminded of what a little ride life is, and I was reminded that it should be an objective for us all to enjoy it as we experience the highs, lows, and everything in between, on our journey to who we will ultimately become, at whatever stage of life we find ourselves.

Our results reflect both the strength of our software and the surging demand that we are seeing across industries and sectors for artificial intelligence platforms, including large language models, that are capable of integrating with the tangle of existing technical infrastructure that organizations have been constructing for years.

Alex Karp, CEO, Q4 2023 Palantir Shareholder Letter

In our US commercial business, the expanding addressable market, driven by AIP, is propelling growth both through new customer acquisitions and expansions with existing customers. I’ve never before seen the level of customer enthusiasm and demand that we are currently seeing from AIP in US commercial.

Ryan Taylor, CRO, Q4 2023 Palantir Earnings Call

With these ideas as our platform, let’s now review Palantir’s Q4 2023 quantitatively.

More Accelerating

Of course, my musings on Palantir may sound nice, and some may take issue with their more ethereal nature, e.g.,

Many far-reaching claims in this almost-romantic analysis of PLTR but I think the author overreaches with his rainforest analogy and invocation of God. Alex Karp is not God. He is a megalomaniac smitten with his own intelligence – that’s it. A more humble sort will apply fluid dynamics to battlefield software. So be careful: hype is a mark-up to a stock price.

They may evoke a sense of untethered romance for the business of Palantir; however, the concrete, indisputable reality is that Palantir’s business has been accelerating, as I will detail for you today.

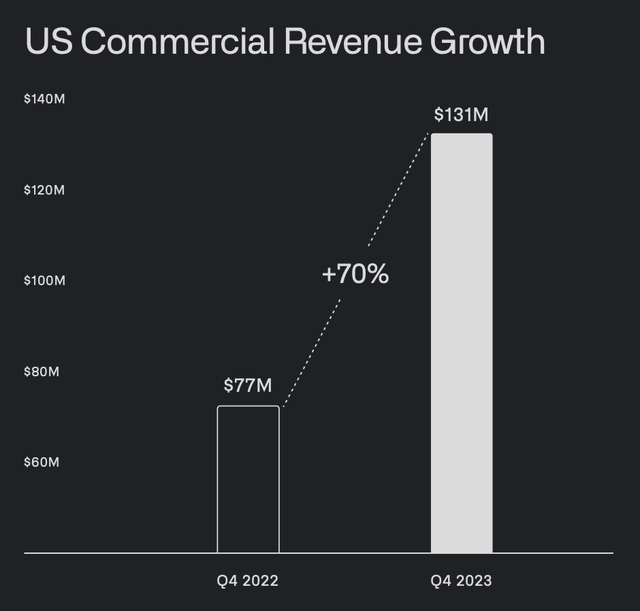

The numbers that just fly off the screen are the 70% year-on-year growth in Q4.

[This refers to the growth of Palantir’s Q4 2023 U.S. commercial business.]

The numbers were so good that I almost had to turn the page when I saw them were the over 100 contracts, over $1 million, 37 over $5 million, and 21, roughly, over $10 million. It’s almost inconceivable to do that many contracts given the way our product used to be.

And so, what you see is a convergence of our product being easier to use, an augmentation of its charisma, both driven by developments in AI, large language models, which make the product approachable foundry to the broader market.

You also see just this enormous demand and our ability to meet that demand with a pilot — new piloting approach that we call bootcamp. So, we went, like — two years ago, we did 92 pilots. And last year, really mostly the second half of the year, we did over 500 bootcamps.

Alex Karp, CEO, Q4 2023 Palantir Earnings Call

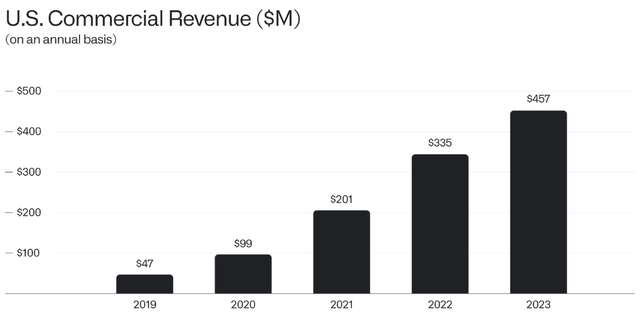

And we can see this growth in the charts below.

Palantir’s U.S. Commercial Business Grew At 70% In Q4 2023, Representing True Hypergrowth At Significant Scale

Q4 2023 Palantir Earnings Presentation

Looking at the growth of the business in years below, we can see the growth of this business that was virtually non-existent just 6 years ago.

Revenue Growth Of Palantir’s Commercial Business Since 2019

Q4 2023 Palantir Shareholder Letter

And Palantir expects this growth momentum to persist into 2024:

We now anticipate that our U.S. commercial revenue will exceed $640 million in 2024, which would represent a growth rate of at least 40% from last year.

Alex Karp, CEO, Q4 2023 Palantir Shareholder Letter

As I often noted when Palantir was in the single digits, its commercial business has grown rapidly, and, were it to be valued on a standalone basis, it would likely fetch a price tag of roughly $20B as of today.

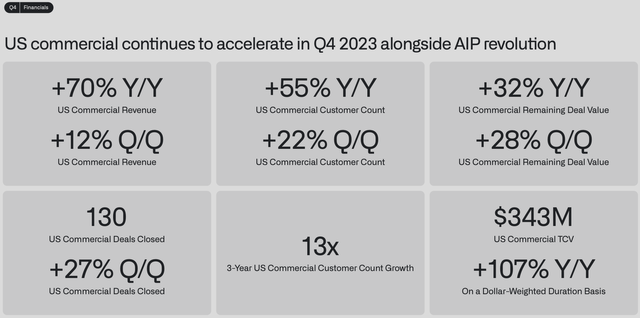

To further parse this growth for you; thereby convey the momentum Palantir’s U.S. commercial business has experienced recently, below, we can see the sequential (i.e., Q3->Q4 2023) growth rates the line of business experienced in Q4 2023.

Note The Sequential Growth Rates (Q/Q) For Palantir’s U.S. Commercial Revenue Growth And U.S. Customer Count Growth

Q4 2023 Palantir Earnings Presentation

If we were to extrapolate the sequential growth illustrated above over the next four quarters, Palantir’s U.S. commercial business would grow at ~60% in 2024, which aligns with the guidance CEO Alex Karp provided to us, which I quoted just a moment ago.

We now anticipate that our U.S. commercial revenue will exceed $640 million in 2024, which would represent a growth rate of at least 40% from last year.

Alex Karp, CEO, Q4 2023 Palantir Shareholder Letter

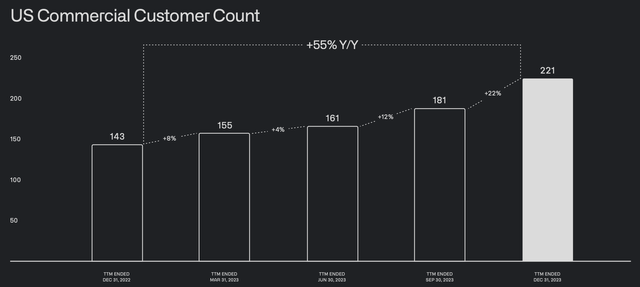

If we extrapolate customer growth over the next year based on growth trends from Q3 to Q4, Palantir will more than double its U.S. customers in 2024, which bolsters the idea that Palantir’s U.S. commercial business will grow at, at least, 40% in 2024 and possibly closer to 60-70%.

U.S. Commercial Customer Count Growth Accelerated Materially In Q4 2023

Q4 2023 Palantir Earnings Presentation

With the introductory commentary that I shared with you in mind, this represents a business hitting hockey stick growth at giant scale, and, as we discussed, it required 20 years for this day to come, in the same way it required about 30 years for Nvidia to experience hockey stick growth for its data center, AI-chip business.

A Representation Of Hockey Stick Growth

Forbes

While this is something of a random aside, I believe it’s important to note as we make investments with a long term time horizon: We can be very right directionally, though timing can be challenging, and it may require more time than we originally anticipate.

My best stocks have been the stocks I owned in my fifth, sixth, and seventh years.

Peter Lynch

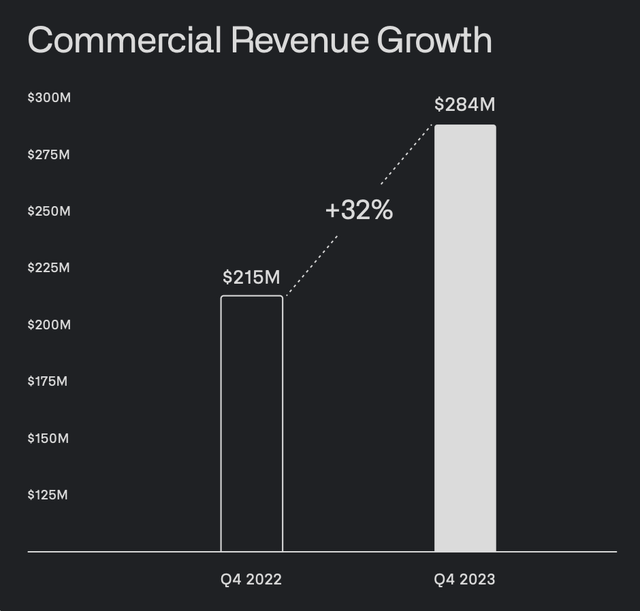

Turning to overall commercial revenue growth, below, we can see that Palantir’s overall commercial business, including international sales, now operates at an annualized run rate of ~$1.2B.

Q4 2023 Palantir Earnings Presentation

We closed out the year with $608 million in fourth quarter revenue, representing 20% year-over-year and 9% sequential growth. Our commercial business surpassed $1 billion in revenue over the last 12 months, a noteworthy milestone. And our fourth quarter commercial revenue grew 32% year-over-year.

Ryan Taylor, CRO, Q4 2023 Palantir Earnings Call

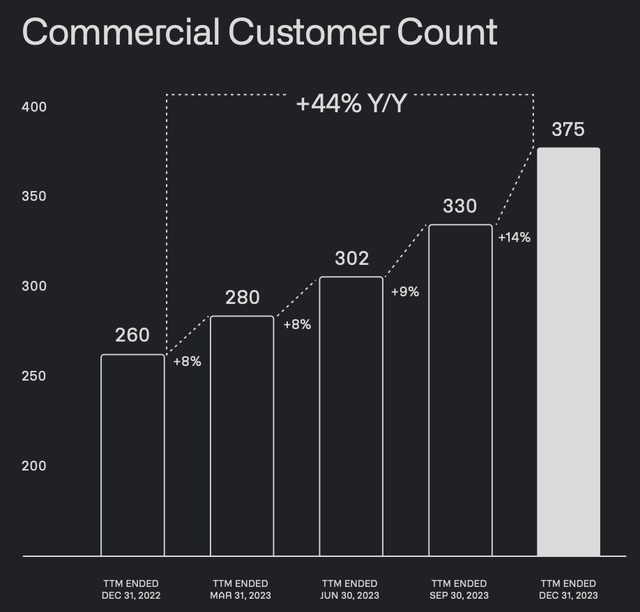

Palantir Commercial Customer Count Growth, Which Also Accelerated Due In Part To The Success Of Its U.S. Commercial Business

Q4 2023 Palantir Earnings Presentation

Such scale gives Palantir further resources to accelerate the momentum of its U.S. and overall commercial business, allowing it to grow rapidly and, notably, profitably.

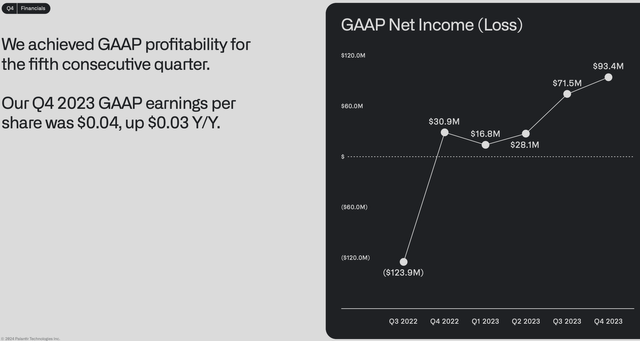

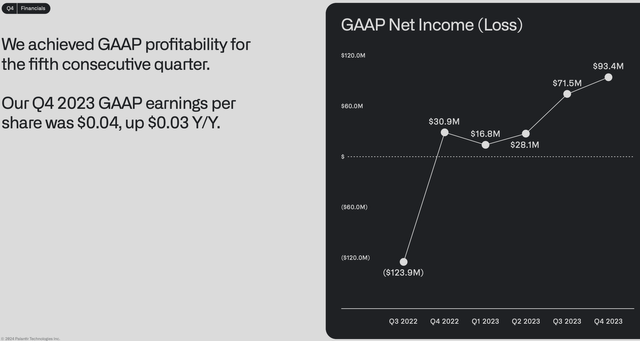

Palantir Generated A 15% GAAP Net Income Margin In Q4 2023, Demonstrating Its Ability To Accelerate Growth While Generating Profits

Q4 2023 Palantir Earnings Presentation

To close this section, Palantir’s commercial business is growing gangbusters. It represents the consistent execution of a business philosophy conceived 20 years ago that is today finding its place in the world in a material way.

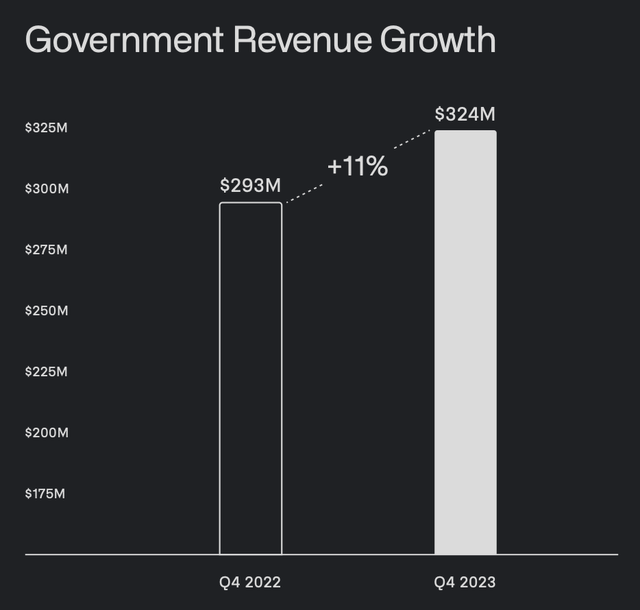

The Lagging Government Business

As you likely know, Palantir has been historically, in essence, a defense contractor first and foremost. While this narrative has begun to take a backseat as a result of its commercial business’ success, it is worth reminding ourselves that Palantir sells into the nearly $1T U.S. defense budget, illustrating the long runway for growth that this segment of Palantir’s business has.

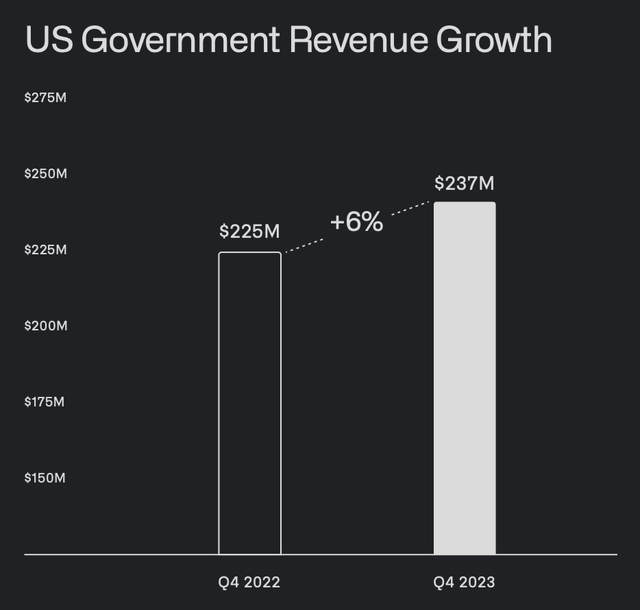

Government Revenue Only Grew At 11% In Q4 2023

Q4 2023 Palantir Earnings Presentation

And U.S. Government Revenue Grew Even Slower

Q4 2023 Palantir Earnings Presentation

About two years ago, Palantir’s government revenue growth began slowing meaningfully, the growth rate of which slid from ~35% CAGR over the preceding decade to the 11% rate we’re witnessing today.

One of my central contentions through this entire slowing process has been that business is non-linear, and it is natural for the growth rates of our companies to ebb and flow over time.

I maintain this perspective today, especially for Palantir’s government business, which is objectively lagging as of my typing this.

That said, I do believe we will witness acceleration: the demand for AI-centric software that serves to defend the western nation-state, as well as portions of eastern nation-states, such as Japan and Korea, in the 21st century is as big as ever, and it’s likely set only to increase as technological progress continues apace.

In our government business, we are actively engaged across all theaters of crisis and conflict. The strength of our US government business is not reflected in the fourth quarter results, which remain muted.

Some of this is due to the continuing resolution and timing of large potential contract awards. But it’s also a function of the department’s pace of scaling their AI and software efforts to match the realities of modern combat, particularly with JADC2.

Ryan Taylor, CRO, Q4 2023 Palantir Earnings Call

As Ryan mentioned, while our fourth quarter US government results are muted due to the timing of larger contract awards, we expect our US government business to reaccelerate in 2024.

Dave Blazer, CFO, Q4 2023 Palantir Earnings Call

While the government business continues to lag, Palantir does believe that growth will accelerate in 2024, but, frankly, if it didn’t, I would not be concerned.

Eventually, I very much believe Palantir’s government revenue will accelerate, though the timing of this acceleration cannot be identified with any true certainty. Software spend will likely continue to grow as western nation-states and their allies look for reliable vendors to assist in these governments’ primary service to their citizenry: defense, and, once the government revenue accelerates, the revenue growth rate of the Palantir conglomerate will accelerate, and there’s a solid chance we see ~30% revenue growth in the years ahead, up from 20% today.

Valuation Exercise

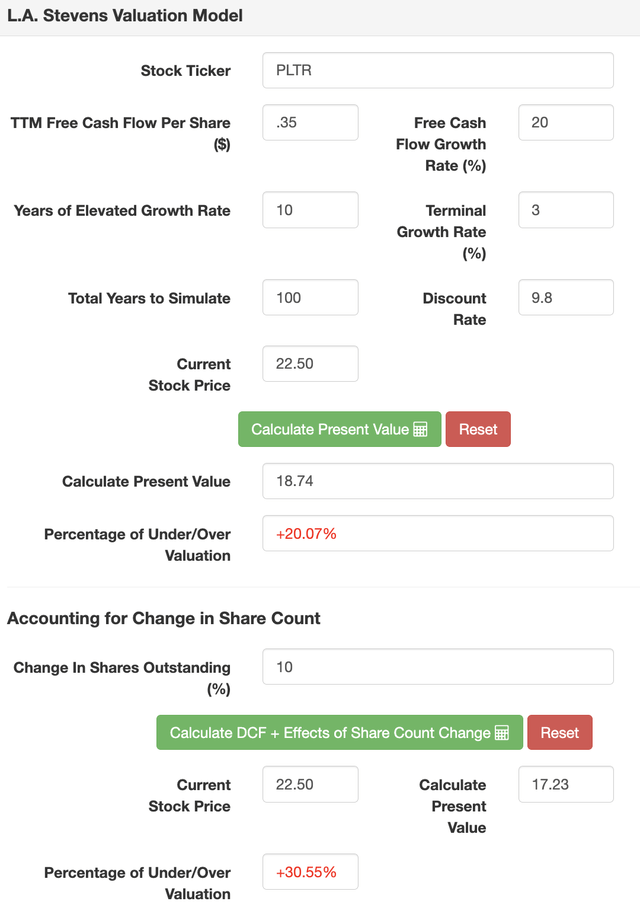

With the review of Palantir’s growth as our platform, let’s conduct a brief valuation exercise for the business. Without having done such an exercise since about Q3 2023, my inkling is that Palantir is not very quantitatively attractive, but I will allow the data in this section to objectively determine the reality of the company’s valuation. Let’s begin.

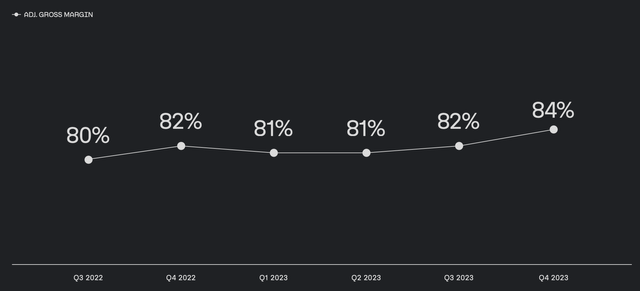

Starting with a few key pieces of data that will inform our valuation assumptions, we can see below that Palantir’s gross margin has expanded to 84% as of today.

Q4 2023 Palantir Earnings Presentation

Considering the nature of Palantir as an asset-light vendor of software, I believe this provides a solid foundation to assume a long run free cash flow margin of 35%, which aligns with such a high gross margin and is in line with Palantir’s software peers.

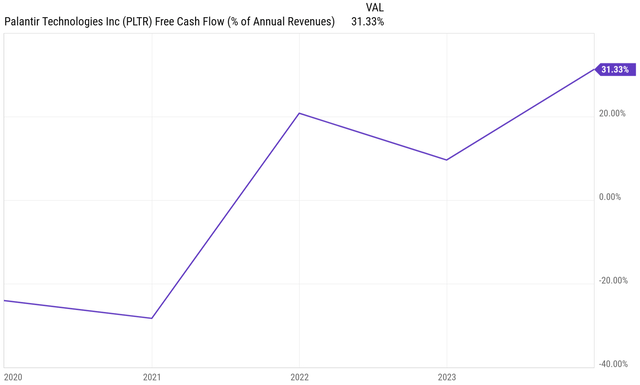

Furthermore, the business generated a 31% free cash flow margin in 2023, and this margin has expanded almost linearly since the company direct listed in 2020.

For 2024, Palantir guided to a free cash flow margin of ~$900M/$2.65B, or 34%, representing further margin expansion like that which we’ve seen in the above chart.

Let’s now turn to our key assumptions and valuation exercise.

Assumptions:

|

TTM revenue annualized [A] |

$2.4 billion |

|

Potential Free Cash Flow Margin [B] |

35% |

|

Average diluted shares outstanding [C] |

~2.4 billion |

|

Free cash flow per share [ D = (A * B) / C ] |

$.35 |

|

Free cash flow per share growth rate (reasonable) |

20% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

And here are the results:

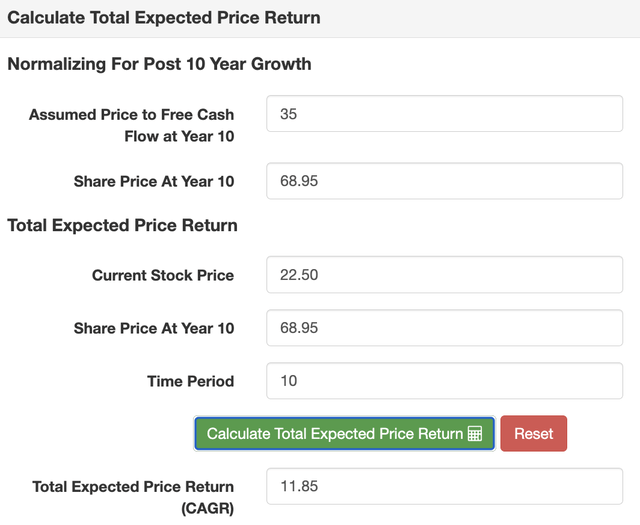

And below, we can see Palantir’s projected return profile using the assumptions above.

I would say that 20% annualized growth is fair or reasonable. I do not believe it’s conservative, nor do I believe it’s overly aggressive.

With that in mind, we can see that we’re not even generating 10% annualized returns, while also not factoring in a margin of safety.

As a result, I do not like Palantir at these levels, and this has been reflected in its omission from the Weekly Top Ideas in recent months.

Very notably, I did the valuation exercise in one go: I did not manage the assumptions in any way to create a desired outcome. After exhaustively reviewing the business as of Q4 2023 and its margins, I simply inserted reasonable assumptions and the result was less than exciting returns, if we’re to invest with some iota of a margin of safety, i.e., conservatism.

So, again, I don’t love Palantir at these levels, and, with Snowflake collapsing recently, I’d prefer to buy Snowflake (SNOW) over Palantir as of today, as something of a random aside.

Concluding Thoughts: Cash Hoard And Profitability

As I noted earlier, Palantir now generates GAAP profits and huge free cash flow.

Q4 2023 Palantir Earnings Presentation

This has contributed to Palantir’s hulking $3.7B cash hoard, alongside $0 in long term debt.

Q4 2023 Palantir Earnings Presentation

While I will not be adding to Palantir at these levels, I could not be happier with the business’ execution, and I am pleased to see our thesis for the business materialize.

Next stop on the journey of being pleased with the business will be the re-acceleration of its government business!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.