Summary:

- Snowflake’s stock has been under pressure since the exit of its CEO and soft Q4 results.

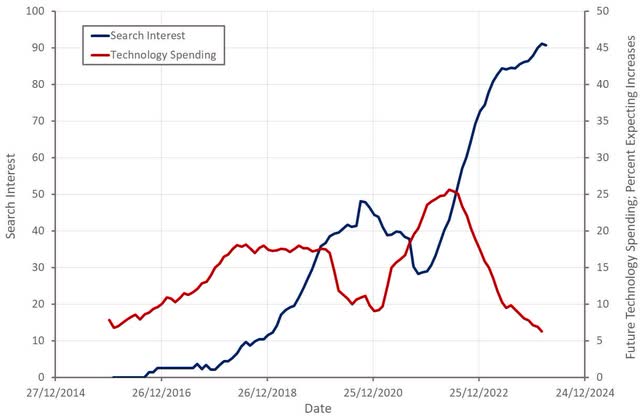

- The demand environment remains soft, which runs counter to investor expectations of a growth surge caused by generative AI.

- As a result, investors are attributing Snowflake’s declining growth rate to company-specific issues rather than the macro environment.

- This could be a favorable setup longer term but SNOW stock can hardly be considered undervalued.

merrymoonmary/E+ via Getty Images

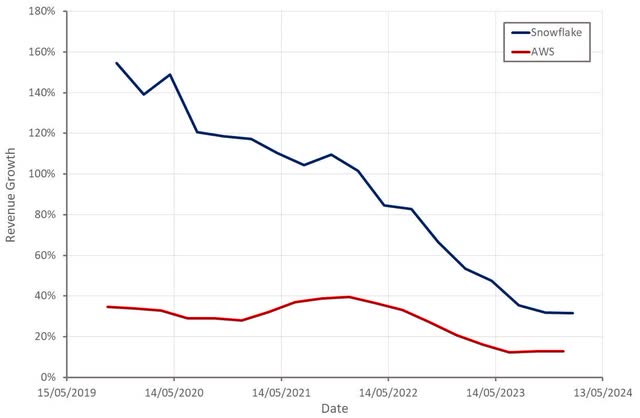

Snowflake’s (NYSE:SNOW) stock has come under significant pressure in recent weeks, with the exit of Frank Slootman and soft fourth quarter results contributing to growing doubt about the company’s competitive positioning. The current situation has probably been blown out of proportion though, as the demand environment remains relatively soft, and Snowflake currently has limited exposure to AI. I suggested in November that while consumption headwinds were easing, it would take time for Snowflake’s business to recover, particularly in regard to AI tailwinds beginning to materialize.

While this is potentially a favorable setup longer term, many investors believe that guidance has been sandbagged to help the new CEO, creating pressure to significantly outperform guidance in the near-term. While guidance is likely conservative, insider sales and ongoing demand weakness suggest that near-term results could be sluggish.

Market Conditions

Consumption was weak in 2023 due in large part to macro uncertainty. Customers also chose to delay longer-term contract expansions, although this is now beginning to reverse. Snowflake has suggested that consumption trends are solid at the moment and that increased bookings are indicative of improved customer sentiment.

Startups remain an area of weakness due to the difficult funding environment. Only around 10% of Snowflake’s revenue is associated with venture backed startups though. Growth is being driven by more mature companies who are ramping consumption in a more disciplined manner and as a result, current growth is more sustainable.

While optimization headwinds have eased, most customers remain cost conscious. This is a problem as Snowflake isn’t really benefitting from the current surge in interest in generative AI. This isn’t necessarily as negative for the company’s long-term outlook as some have suggested, but it does mean growth is likely to remain under pressure in the near-term.

Figure 1: “Snowflake Pricing” Search Interest (source: Created by author using data from Google Trends and The Federal Reserve) Figure 2: Snowflake and AWS Revenue Growth (source: Created by author using data from company reports)

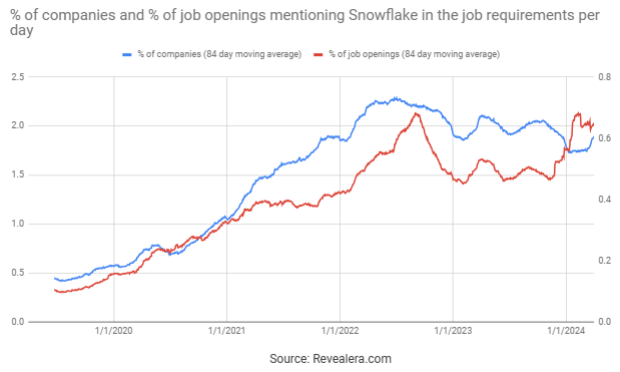

In addition to the macro environment, competition appears to be a growing concern for investors, although it is unclear how warranted this is. When customers are migrating from on-prem, Snowflake is generally competing against Google, Azure, and AWS. Teradata (TDC) is now trying to position itself as a cloud first company, which could help stem market share losses to companies like Snowflake.

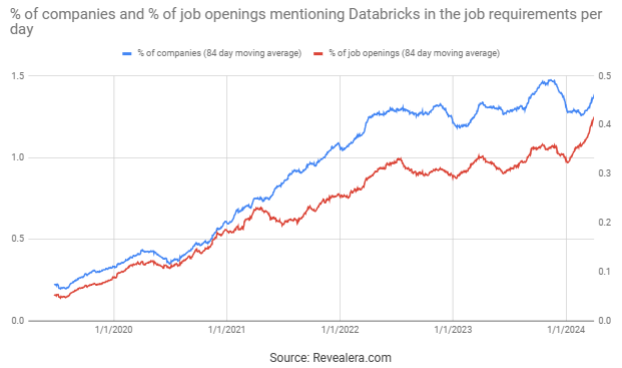

Snowflake continues to downplay direct competition with Databricks, suggesting that it is only broadly competing for workloads. While Snowflake has developed a solution for unstructured data and is trying to address more AI workloads, Databricks likely has a better product for unstructured data. Databricks is also increasing its functionality, bringing it into more direct competition with Snowflake. Databricks generated 1.6 billion USD revenue last year, up more than 50% from the previous year. The company’s Databricks SQL product has a 250 million USD run rate, growing more than 200% YoY.

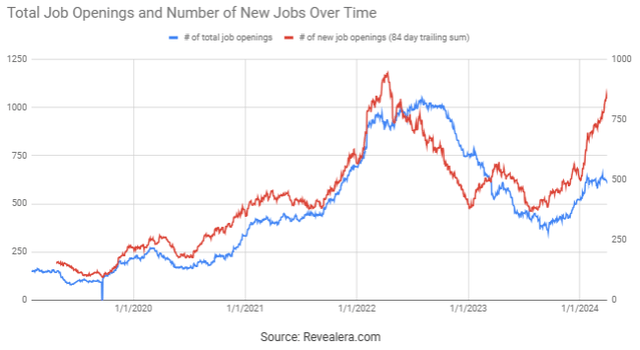

Figure 3: Job Openings Mentioning Snowflake in the Job Requirements (source: Revealera.com) Figure 4: Job Openings Mentioning Databricks in the Job Requirements (source: Revealera.com)

Snowflake Business Updates

While Snowflake isn’t an AI stock and arguably doesn’t have that much exposure to AI related demand at the moment, it is investing to change this, recently introducing products like Streamlit, Snowpark ML Modeling API, and Cortex ML functions.

AI needs suitable data infrastructure, and this is an area where many organizations need to invest. Accenture (ACN) believes that many companies are finding it difficult to scale AI as they lack the data infrastructure and skilled employees.

New CEO

The exit of CEO Frank Slootman likely contributed significantly to the share price decline post Q4 earnings. The long-term importance of this remains to be seen but Slootman earned a lot of investor goodwill from his success with ServiceNow and Snowflake.

Perhaps more important than any actual impact on the business is the signal that this sends. Slootman’s exit seemed fairly abrupt and comes on the back of heavy share sales and a period of weak performance.

The new CEO came to Snowflake through the acquisition of Neeva, potentially indicating an increased focus on AI going forward. Prior to that he managed search ads at Google, successfully scaling that business to over 100 billion USD revenue.

Product Innovation

Over the past few years Snowflake has expanded from a cloud native analytical database for structured data to a more general-purpose data platform. The company is trying to create an application platform and address increasingly complex analytic use cases. This is all based around data gravity and bringing processing to the data rather than the other way around.

Snowflake’s application platform ambitions are supported by Native Apps, Unistore and Streamlit. Snowflake enables app development and distribution, with monetization through Snowflake Marketplace. Native apps run natively within an organization’s data platform, bringing the application code to the data. Unistore unifies analytical and transactional data, negating the need to move data from an operational database to an analytic database. Unistore is expected to become an important contributor to Snowflake’s business long-term, but it will take time to ramp. Streamlit enables developers to build apps using their favorite tools, with simplified data access and governance.

Snowflake is also trying to address more complex analytic use cases with the introduction of Snowpark and Cortex. Snowpark is a set of libraries and runtimes that securely deploy and process a number of programming languages (Python, Java, Scala). Snowpark is the programmability platform for Snowflake and takes the platform more in the direction of Databricks. Snowpark for Python is targeted at a more technical audience, addressing use cases like data engineering and machine learning. Advantages include cost, performance and simplicity. Snowpark ML provides the ability to develop and deploy machine learning models inside Snowflake using a Python API. Snowflake believes it can benefit from AI/ML by allowing workloads to run close to the data in a secure fashion. Customers are reportedly already using Snowflake for training. Unistore enables low latency read and write, which should also some inference use cases. Snowpark generated around 35 million USD revenue in 2023 and is expected to generate around 100 million USD revenue in 2024.

Snowpark Container Services is a managed container solution that enables customers to deploy and manage containerized services, while benefitting from Snowflake’s security and governance capabilities and avoiding data movement. This supports long-running services, like front-end web applications.

Snowflake Cortex is a managed service that offers machine learning and AI solutions to Snowflake users. This includes functions that leverage large language models and functions that perform predictive analysis using machine learning. Cortex also has an LLM powered assistant and brings semantic search capabilities to the Snowflake platform. Snowflake Copilot enables users to explore data using plain English by converting questions into SQL queries, lowering the barriers to implementing analytics. Cortex is currently in public preview and is expected to be generally available around the middle of the year. Cortex could be a growth driver early on as it will generally be compute intensive.

Snowflake is also adding support for Iceberg, with Iceberg Tables expected to be generally available soon. Apache Iceberg is an open table format. It prevents storage lock-in and eliminates the need to move tables between systems. While this has the potential to be a long-term positive by providing Snowflake with access to more data for processing, it will likely be a near-term headwind as Snowflake risks losing storage.

Financial Analysis

Snowflake’s product revenue increased 33% YoY in the fourth quarter to 738 million USD. Less mature customers migrating from legacy vendors and adding workloads drove revenue growth in the quarter. Financial services and retail were the largest revenue contributors, with EMEA and the technology vertical showing strong momentum.

Consumption trends have reportedly improved since early 2023 but are yet to return to more normal levels. Guidance assumes that this continues going forward. Q1 FY2025 product revenue is expected to be 745-750 million USD, representing 26-27% YoY growth. For the full year, product revenue growth is expected to be 22%. Snowpark is expected to contribute 3% of product revenue but no other new products are being included in forecasts at this time. Snowflake has characterized guidance as prudent and there could be substantial upside from new products if they can drive consumption.

Iceberg Tables could weigh on consumption in 2024 but the real impact of this is not expected until next year. Regardless, the impact should be fairly modest as only around 10-11% of Snowflake’s revenue is associated with storage.

Tiered storage pricing is also expected to impact consumption. In addition to software performance enhancements, Snowflake is rolling out the Arm chip in Azure which will impact revenue. This is nothing new for Snowflake though, with the number of jobs running on Snowflake increasing 62% in FY2024 and revenue only increasing 33%.

Snowflake recently removed its long-term target which will hardly be comforting for investors. The company is reportedly still targeting 10 billion USD revenue in FY2029 internally though. The decision to abandon this target was driven by ongoing weak consumption trends.

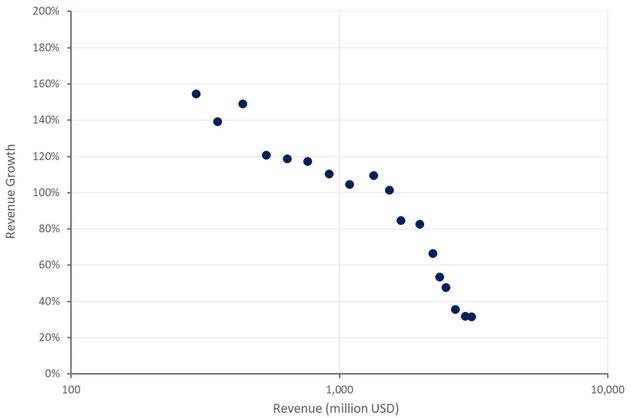

Figure 5: Snowflake Revenue Growth (source: Created by author using data from Snowflake)

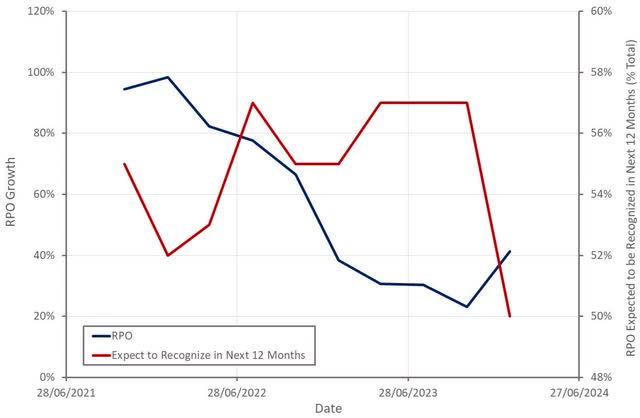

Bookings were strong in the fourth quarter, with remaining performance obligations increasing 41% YoY. This was driven by large multi-year deals though and growth in current RPO was fairly modest.

Snowflake is moving sales incentives towards consumption rather than commitments. Snowflake also now only allows customers to rollover commitments if they renew for an equal or greater amount. These changes make bookings difficult to compare over time.

Figure 6: Snowflake Remaining Performance Obligations (source: Created by author using data from Snowflake)

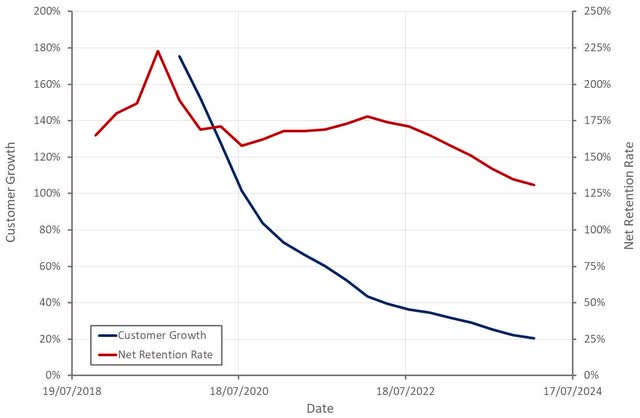

Snowflake’s customer base continues to expand at a reasonably healthy pace, even though growth is moderating.

Customer optimization efforts have normalized, with most of Snowflake’s largest customers growing sequentially. The company’s net retention rate continues to fall though. With a slew of new products coming to market, investors should look for this to rebound or at least stabilize in 2024.

Figure 7: Snowflake Customer Growth (source: Created by author using data from Snowflake)

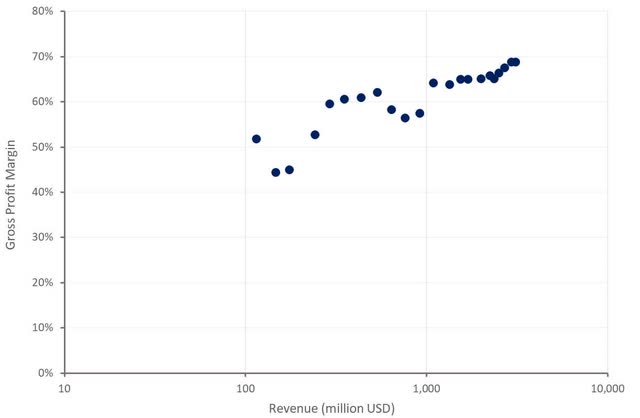

Snowflake’s gross profit margins have edged higher in recent quarters, but further gains could be limited in the near-term. Snowflake renegotiated pricing with the cloud hyperscalers in recent years, creating substantial margins on storage. The company is now introducing tiered storage pricing, which will see larger customers receive discounts. Snowflake also faces losing storage to Iceberg Tables. While storage is a relatively small contributor to revenue, these changes will likely weigh on profits at the margin.

Figure 8: Snowflake Gross Profit Margin (source: Created by author using data from Snowflake)

Snowflake is making significant investments in AI which will drive costs higher in 2024. Approximately 50 million USD of GPU-related costs are expected in FY2025.

Shifting sales compensation towards consumption will also contribute to increased commission expenses as consumption-based commissions are expensed immediately rather than amortized over time.

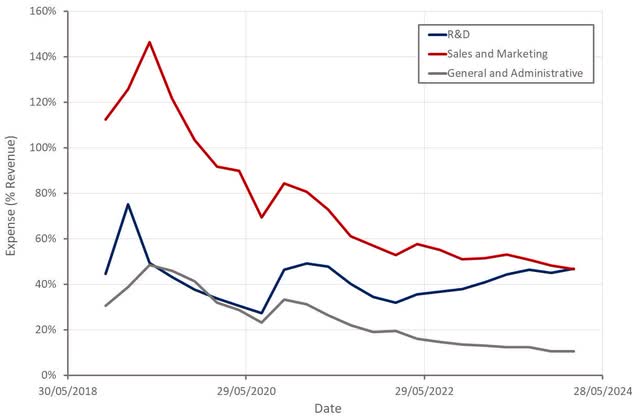

Figure 9: Snowflake Operating Expenses (source: Created by author using data from Snowflake)

Snowflake appears to be ramping hiring at the moment which could indicate a more constructive outlook on the demand environment. It is also possible that Snowflake has under hired in recent quarters to try and reduce losses and is now being forced to make up for this.

Figure 10: Snowflake Job Openings (source: Revealera.com)

Conclusion

There seems to be a broad consensus that recent guidance was deliberately sandbagged to set the new CEO up for success. This is probably true to some extent, but Snowflake is still facing a difficult operating environment.

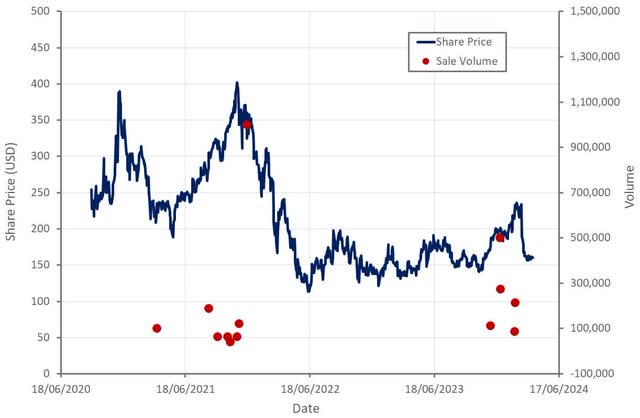

It is worth noting that Snowflake did not repurchase any shares in the fourth quarter, despite having approximately 1.4 billion USD remaining under its share repurchase program. Frank Slootman also executed a series of large share sales in recent months. While this may not end up meaning much, the last time it happened, Snowflake’s share price declined significantly.

Figure 11: Snowflake CEO Stock Sales (source: Created by author using data from Yahoo Finance)

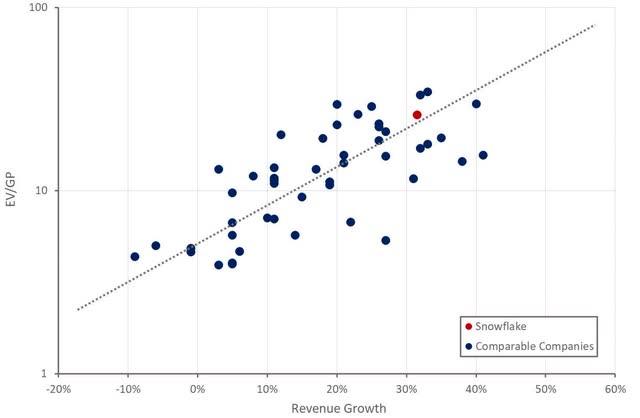

Snowflake’s revenue multiple now appears far more reasonable given the company’s growth and profitability. The Snowflake growth story appears to be at risk of cracking though, with the exit of Frank Slootman and the removal of long-term revenue guidance causing investors to begin questioning the company’s prospects.

While the stock remains at risk in the short-term if growth continues to decelerate, I believe current concerns are overblown. Snowflake is facing a relatively soft demand environment and doesn’t have large exposure to generative AI, causing investors to mistake macro weakness for company specific issues.

Figure 12: Snowflake Relative Valuation (source: Created by author using data from Snowflake)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.