Summary:

- The Walt Disney Company embarks on recovery with strategic initiatives under CEO Bob Iger, aiming for streaming profitability.

- Despite competition, Disney moves toward profitability in streaming, offsetting subscriber plateau with cost-saving measures.

- Disney affirms its ability to return shareholder value by reinstating dividends and announcing a $3 billion buyback program.

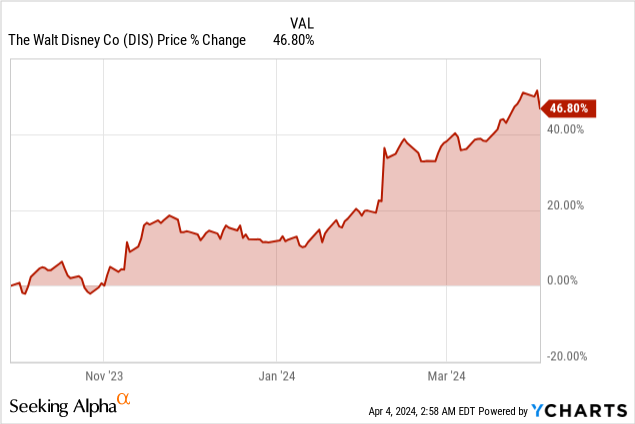

- Disney’s stock rallies to 52-week highs amid economic uncertainties, signaling investor confidence in its turnaround plan.

RinoCdZ

Investment Thesis

With economic uncertainty and challenges slashing across industries, The Walt Disney Company (NYSE:DIS) has embarked on a daring path to recovery under CEO Bob Iger, including a couple of game-changing moves.

Against that economic backdrop, Disney stock was moving to 52-week highs, reflecting the company’s resilience and potential. The resurgence has been buoyed by strategic initiatives that include a wide range of cost-saving measures and an aggressive push for streaming profitability, even if it means a plateau in subscriber growth.

Breaking new ground in its empire-building ambitions, Disney announced the deal with Epic Games and planned to re-energize its gaming division with the new ESPN streaming service. These strategic initiatives are the bare minimum that represents Disney’s innovation and growth, having thrown away the shackles of old with the new and improved content and viewer experiences.

Lastly, Disney’s financial strength is highlighted by its huge cash balance and proactive approach to shareholder value by repurchasing shares and reinstating dividends. Therefore, these strategic and financial maneuvers position the firm toward a promising turnaround with courage, innovation, and value creation for long-term investors, supporting the buy rating for the stock.

Disney on Recovery Mode

While the company has faced stiff competition in its streaming business, given the threat posed by Netflix (NFLX), it continues to make strides thanks to years of investments. Likewise, investors are impressed that the entertainment giant is on track to report a profit in its direct-to-consumer segment this year; losses in its streaming business have shrunk from $984 million to $138 million.

The company is also tapping new revenue streams thanks to joint ventures with Warner Bros. Discovery and Fox (FOX) and plans for a new ESPN streaming service. Iger’s solid steps in unlocking value from Disney’s legacy assets, including merging Indian TV and streaming assets in an $8.5 billion deal, have only strengthened the company’s prospects and sentiments in the content streaming business.

Disney’s core business, which depends on consumer spending, came under pressure in 2022 and 2023 amid growing concerns that the U.S. economy was headed for a recession. Given that it is one of the biggest consumer discretionary businesses, the company is always susceptible to deteriorating economic conditions. Such conditions affect consumers’ ability to visit its theme parks, buy tickets, and subscribe to streaming services.

With forecasts of a recession dissipating fast, Disney stock is on the move, powering to 52-week highs amid renewed investor interest. The rally has resulted in a massive turnover of traded shares, signaling to investors that the stock is highly undervalued despite its unending challenges, from proxy fights to competition on the streaming front.

After two years of underperformance, Disney turned bullish in September last year as Iger got into action with an aggressive turnaround push. Ever since, the stock has been making higher highs, rallying in a tight rising channel that signals upward momentum.

The stock’s rise and finding support above the 200-day moving average in November reiterated the bullish momentum, signaling buyers are in complete control. The Moving Average Convergence and Divergence Indicator has also risen and found support above the zero line, further affirming the upward momentum.

Disney Triumphs in High-Profile Proxy Battle Against Nelson Peltz

Disney stock has been rising despite the company having been through a high-profile proxy fight with activist investors. Nelson Peltz’s Trian Capital has engineered a proxy fight as it pushes to be given two seats on the board. In addition, the activist hedge fund is pushing for the sale of Disney’s traditional TV channels amid claims they have been shrinking the business of the more expansive Disney empire.

Ahead of the election for board members, Peltz insists they are not in any way trying to replace Iger but to support him. It is still unclear if that is the case, especially with Trian’s Capital withholding its vote for the CEO to be on board. While Disney has nominated 12 directors to be board members, Trian is opposed to two, insisting they should be replaced with Peltz and former Disney CFO Jay Rasulo. Trian was pushing to have two directors on the board to influence policy and push for strategic changes that it believed could unlock any hidden value in Disney stock.

Nevertheless, Bob Iger won the proxy battle, and Walt Disney Company successfully re-elected its board of directors, outpacing rival nominees from Nelson Peltz’s Trian Group and Blackwells Capital in a costly proxy contest. Shareholders backed all 12 Disney nominees, reflecting support for the company’s current leadership amid critiques of past stock performance.

Iger’s Disney: Resilient Returns Outshine Rivals Amid Challenges

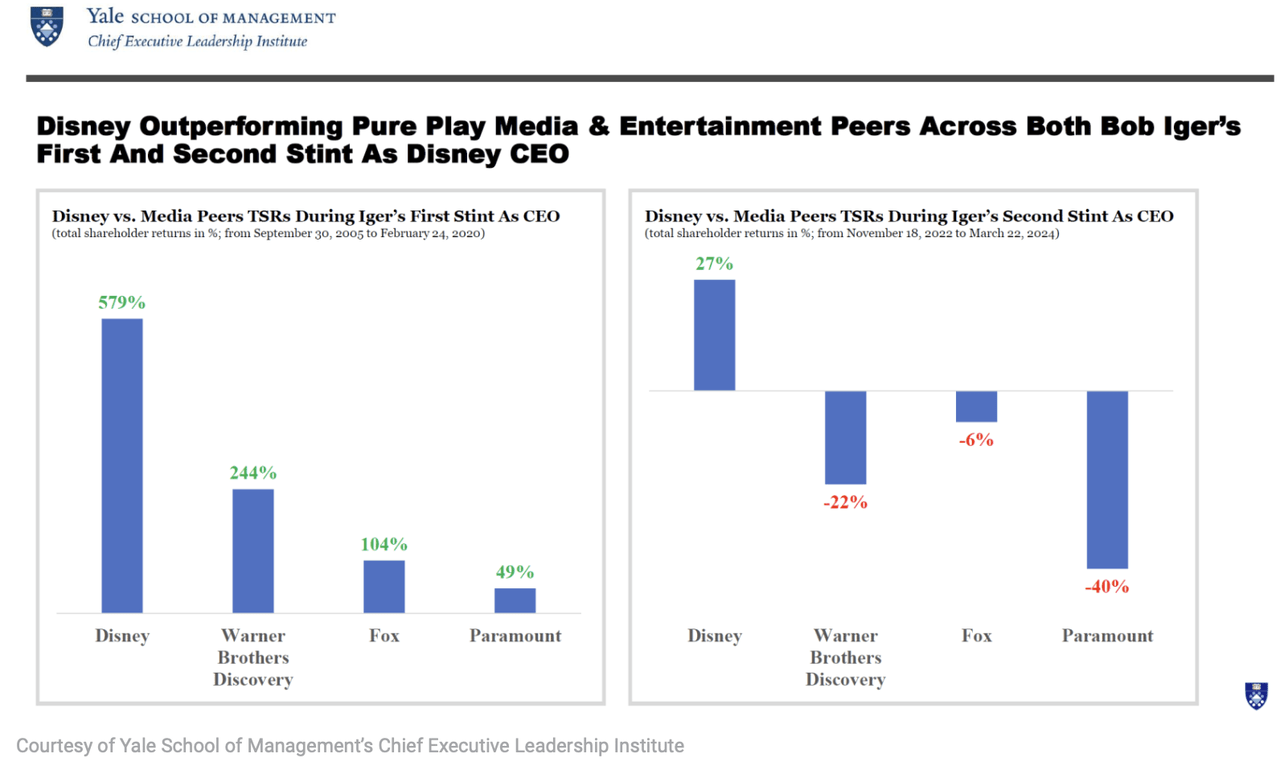

Additionally, the claims that the company has consistently underperformed under Iger’s leadership appear to have fuelled the proxy battle into a forced standoff. Nothing could be further from the truth, as Disney generated 579% shareholder returns during Iger’s first tenure at the company between 2005 and 2020. The returns far outpaced the 244% returns for Warner Bros. Discovery (WBD), 104% for Fox, and 49% for Paramount’s Global (PARA) over the same period.

Since Iger returned to the company in November of 2022, Disney has generated 27% total shareholder returns compared to negative returns for Warner Bros. Discovery, Fox, and Paramount over the same period. While it’s true Disney has shed nearly 40% in market value from its peak of about $200 a share recorded in 2021, it all happened when Iger was not at the helm. At the time, Bob Chapek was the CEO, a period in which the stock imploded to about $85 a share.

On the other hand, Disney has indeed underperformed big tech giants like Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), and Meta Platforms (META). However, unlike Disney, tech giants generate a good chunk of their earnings from non-media businesses.5693

Disney’s Strategic Moves Set the Stage for Turnaround and Streaming Profitability

Embattled CEO Bob Iger has made impressive strides in revitalizing Disney’s prospects and fortunes ahead of the proxy vote on April 3. Even though the company is still in the early stages of its turnaround, several analysts believe it has what it takes to generate solid numbers in 2024.

Specifically, analysts at UBS believe the company can drive free cash flow generation higher over the next few years. The firm expects the entertainment giant to report $8 billion in free cash flow this year and $14 billion in 2026, as it also targets $7.5 billion in cost savings. The free cash flow estimates align with Disney boosting profitability in its streaming business amid significant subscriber growth.

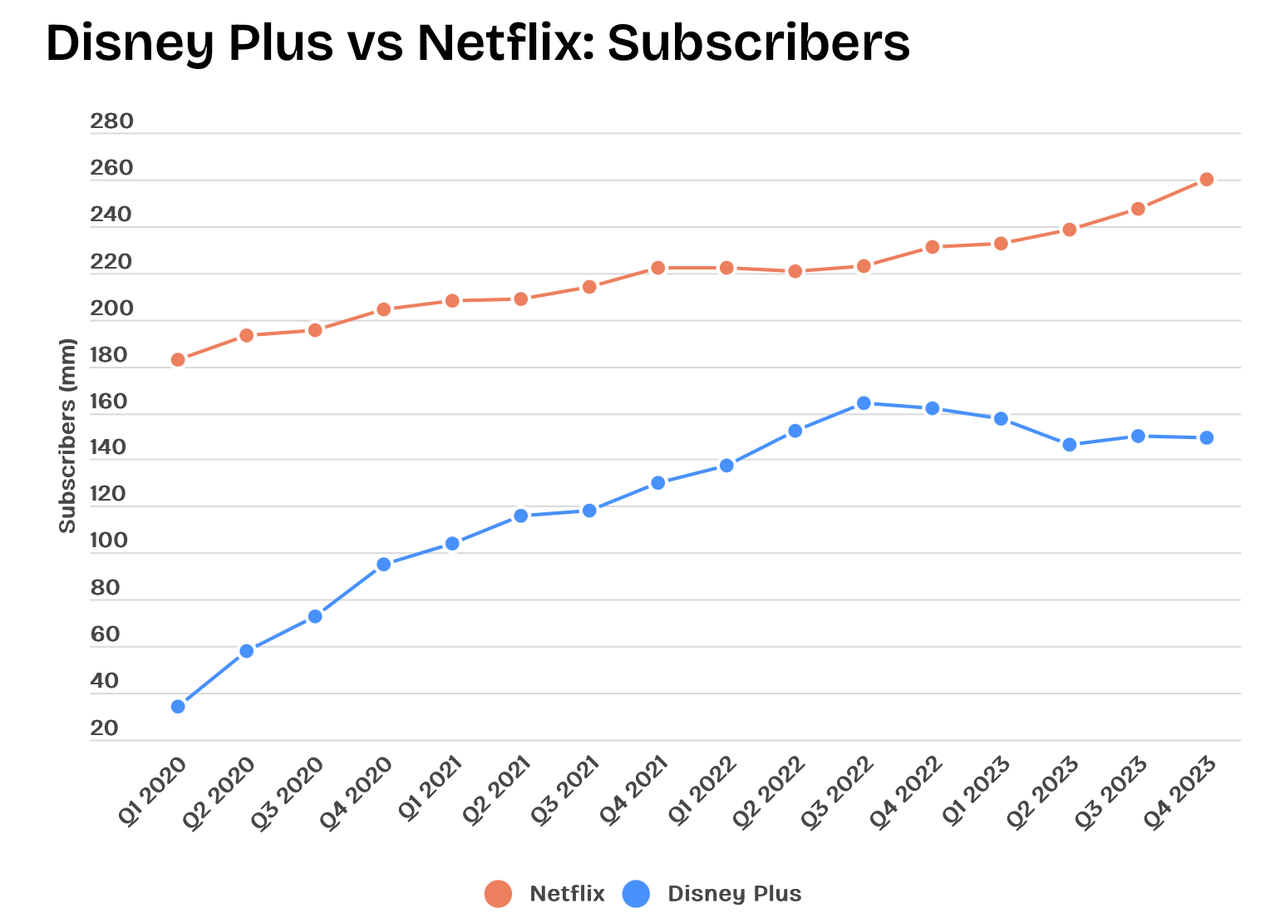

As of the end of last year, Disney had about 149.6 million subscribers across its two services, a 600,000 decrease from the fourth quarter of 2022. Disney’s subscription growth has stagnated recently, and Netflix continues to make significant gains.

In the last quarter, Disney’s streaming business generated $6.1 billion in revenue but plunged to an operating loss of $216 million. Nevertheless, the company insists it is on track to reach profitability in its streaming business by the end of the year on losses narrowing in the first quarter.

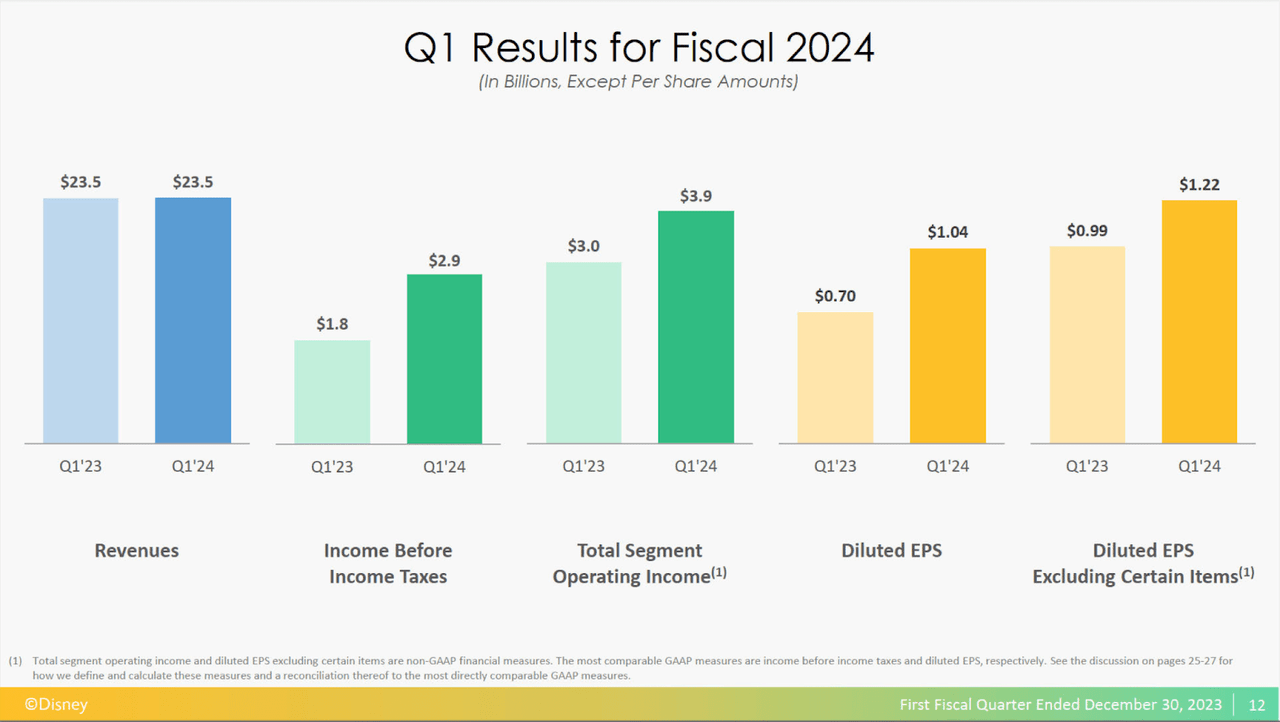

The path to profitability comes from Disney delivering stellar first-quarter results boosted by cost cuts and growing revenue in its theme park businesses. The company earned $1.91 billion or $1.04 a share in the quarter, representing a 49% year-over-year increase. The significant earnings increase came from Disney making substantial progress on cost reductions, reducing its selling, general, and other expenses by $500 million. Additionally, the company benefited from cutting close to 7,000 jobs as part of a broader plan to achieve $5.5 billion in cost savings.

Finally, revenue in the quarter totaled $23.55 billion, compared to $23.51 billion generated in the same period last year. The slight revenue increase came despite Disney losing 1.3 million subscribers to its Disney+ Streaming service in the quarter due to the price hikes in Hulu’s monthly cost by 20% to $17.99, aiming to channel more viewers towards ad-supported subscription models. However, the company continues to generate more money from each subscriber, thanks to price hikes. Similarly, the entertainment giant expects revenue to increase significantly in the current quarter with the addition of 6 million subscribers.

Disney’s Game-Changing Moves: Epic Games Acquisition and New ESPN Streaming Venture

Disney has announced plans to acquire Fortnite maker Epic Games for $1.5 billion to strengthen its empire. The acquisition should allow the company to improve its gaming unit as it looks to create more games and an entertainment universe. According to Iger, the acquisitions mark the company’s most extensive entry into gaming and are expected to offer significant opportunities for growth and expansion.

Additionally, Disney has moved to strengthen its streaming empire with plans to launch an ESPN streaming service in 2025. The service, which will include ESPN programming, will feature new personalization and integration with ESPN Bet and ESPN fantasy platforms.

The launch of the ESPN streaming service is part of Disney’s push to capture TV viewers who have abandoned cable but still want access to premium sports offerings. While Disney still operates as a sports streaming service under the ESPN+ banner, the service does not include the most popular live sports offering, which is seen as one of the reasons its subscription base tanked from 26 million to 25.2 million in the recent quarter.

Therefore, with the launch of the new ESPN streaming service, ESPN plans to offer more features and provide a much more immersive experience for sports fans.

Classic Content and Price Hikes Fail to Match Netflix’s Rise

Competition remains the biggest threat to Walt Disney in the streaming business. The company has struggled over the years to take on Netflix despite enjoying solid growth in the initial years of the Disney+ launch. Subscriber growth has plateaued in recent years, signaling the company needs to do more to fend off competition and attract new subscribers.

The biggest downside to Disney’s streaming ambition has always been its content library. While the company spent close to $27 billion on content, much more than $17 billion for Netflix, its library still consists of classic shows that are viewed as content that cannot attract new subscribers, as is the case in the other networks

Even with new content, the latest releases have struggled to perform as expected, affecting Disney’s streaming service attractiveness. In 2023, out of the eight blockbuster shows that Disney released, seven were underperforming in the US and overseas, resulting in the network losing close to 1.3 million subscribers. A move to increase the subscription price did not aid either, making it difficult for Disney to attract more subscribers.

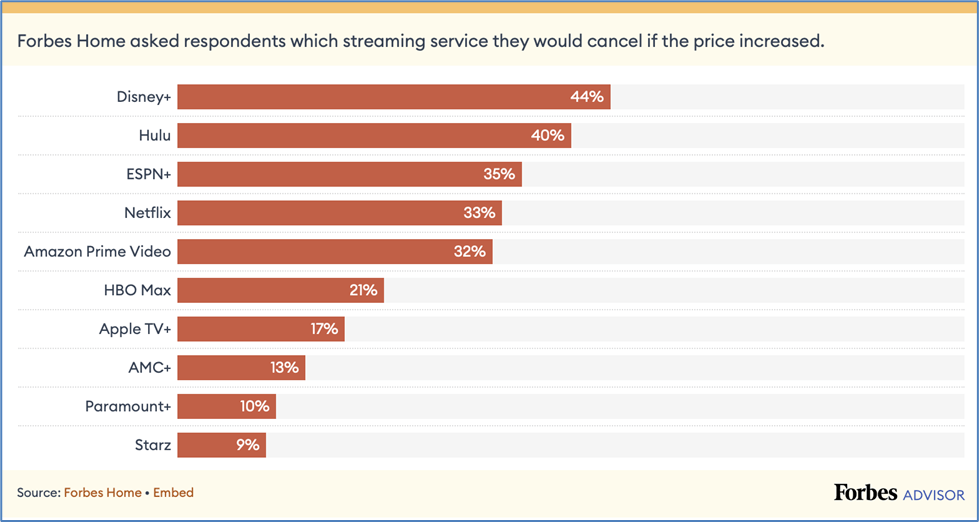

A Forbes survey on which streaming service subscribers would unsubscribe should prices increase significantly saw Disney come out on top, further signaling that a push for price hikes might not be suitable for business. Netflix has always had an edge due to its aggressiveness in bolstering its content library to attract new subscribers. Hence, the lack of substantial new content could negatively affect Disney’s long-term prospects in the lucrative streaming business, where it is pushing for profitability.

Forbes

Surging Stock, Solid Finances, and Boosted Shareholder Value

While Disney has risen by about 31% year to date, the stock is still trading at discounted levels, having underperformed in previous years. The stock trades at a forward price-to-earnings multiple of 26.0x, while the S&P 500 Communication Services index trades at a P/E of 28, further affirming Disney’s undervaluation.

The company is far from any financial troubles, with a round of $7.2 billion in cash and equivalents and $41 billion in long-term debt. Having exited the first quarter with EBIT of around $2.9 billion and net interest expense of about $246 million, Disney’s interest coverage ratio was about 11.0x, significantly higher than the 2.0x often deemed healthy.

Nevertheless, Disney remains in a solid financial standing, as depicted by its free cash flow growth. The authorization of $3 billion worth of share repurchases for the first time since 2018 underlines the company’s commitment to returning value to shareholders.

Finally, the company has reinstated its dividend offering and announced a 50% increase in the July payout. This move continues to strengthen its sentiments and valuation in the market.

Bottom Line

Disney is trending in the right direction as it invests in its streaming business and investment parks. Revenue and earnings growth in the recent quarter affirms a company firing from all angles as Iger’s turnaround plan continues to bear fruits. While the company faces stiff competition on the streaming front, it is working round the clock to strengthen its competitive edge with new offerings. It shows as it eyes profitability before the end of the year.

Finally, Disney is still in turnaround mode, yet it generates shareholder value through share price increases, dividends, and share buybacks. Therefore, despite the company’s challenges and streaming competition, it remains a solid long-term investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS, NFLX, WBD, PARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.