Summary:

- Acuity Brands, Inc. announced financial results for Q2 of fiscal year 2024, with revenue declining but profitability improving.

- Revenue fell by 4% due to weakness in the Acuity Brands Lighting and Lighting Controls segment, but the Intelligent Spaces Group segment saw a 17% increase in sales.

- Earnings per share exceeded expectations, with improvements in cost of products sold and selling, distribution, and administrative costs contributing to higher profitability.

- Even so, Acuity Brands shares look more or less fairly valued, especially after how much they have risen since I last wrote about them.

Larysa Pashkevich/iStock via Getty Images

On April 3rd, the management team at Acuity Brands, Inc. (NYSE:AYI), a company that focuses on producing and selling lighting solutions like commercial and architectural lighting, as well as a variety of other offerings such as building management systems and location-aware applications, announced financial results covering the second quarter of its 2024 fiscal year. Those who follow my work closely might know that I’m not the most enthusiastic person about the enterprise. But if you look at my past regarding the business, you would know that my calls have also been wrong. In March of 2022, I wrote an article about Acuity Brands wherein I rated it a “hold.” This was based on some growth-related struggles the company saw, even prior to the pandemic. Its balance sheet and cash flows were impressive, but the stock looked more or less fairly valued.

Unfortunately, that call ended up being overly pessimistic. While growth continues to be a problem, with revenue actually declining year over year, management has improved profitability rather significantly. This has led to shares roaring higher, with the stock generating a return for investors since my last article about the business totaling 40.6%. That dwarfs the 19.6% rise seen by the S&P 500 (SP500) over the same window of time. The performance that has pushed the stock up so much more than what the market has seen has mostly continued through the second quarter of the 2024 fiscal year. While the business did fall short of expectations when it came to revenue, it exceeded forecasts when it came to profits per share. Even so, given how the stock is still priced, I cannot imagine this outperformance continuing. Because of that, and in spite of being off on my call so far, I’ve decided to keep the business rated a ‘hold’ for now.

A mixed quarter

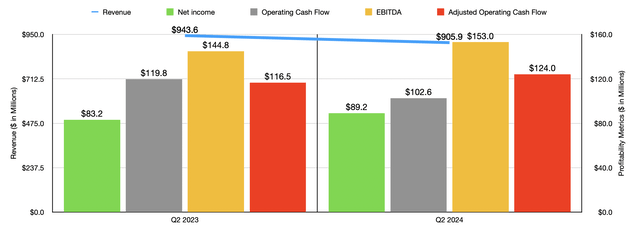

As I mentioned already, April 3rd was met with some interesting news from the management team at Acuity Brands. Management reported mixed financial results that were largely greeted warmly. Take revenue as an example. Sales during the second quarter of the 2024 fiscal year totaled $905.9 million. That represents a decline of 4% compared to the $943.6 million generated one year earlier. It’s also $2.1 million short of what analysts were anticipating.

According to management, this was driven by weakness in the ABL (Acuity Brands Lighting and Lighting Controls) segment. Revenue for that unit dropped 5.3%, plunging from $890.8 million to $843.5 million. Management claimed that all sales channels were negatively impacted for this unit. But it appears to be because the second quarter of the 2023 fiscal year resulted in higher-than-expected revenue because the company was working through backlog. Fortunately for investors, not every segment for the company was negatively impacted. The smaller segment, known as the ISG (Intelligent Spaces Group) segment, reported a 17% increase in revenue, with sales shooting up from $58.2 million to $68.1 million. An acquisition, combined with higher volume that was driven by demand, was responsible for this increase in sales.

With revenue falling, you might think that profits would have taken a beating. But the opposite is true. Earnings per share for the quarter came in at $2.84. This was $0.14 per share higher than what analysts had forecasted. It comfortably exceeded the $2.57 per share reported the same time one year earlier. There were multiple contributors behind this improvement that took net profits from $83.2 million to $89.2 million. But the most significant, by far, ended up being two particular metrics. The firm’s cost of products sold declined from $536.9 million last year to $493.5 million this year. And the companies selling, distribution, and administrative costs dipped from $295.2 million to $294.3 million. Improvements when it came to material and import costs were largely responsible for the decline in the company’s cost of goods sold. Other profitability metrics followed a similar trajectory.

The one exception to this was operating cash flow. It dropped from $118.8 million in the second quarter of 2023 to $102.6 million the same time this year. But if we adjust for changes in working capital, we get an increase from $116.5 million to $124 million. Meanwhile, EBITDA for the business managed to grow from $144.8 million to $153 million.

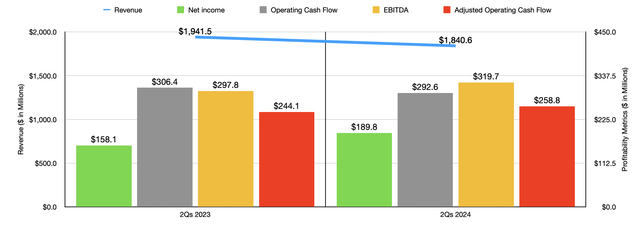

As you can see in the chart above, the result seen during the second quarter of 2024 ended up being very similar, relative to the second quarter one year earlier, as what we saw for the first half of the 2024 fiscal year relative to the first half of 2023. Revenue fell, as did operating cash flow. However, net income, adjusted operating cash flow, and EBITDA all improved on a year over year basis. Unfortunately, we don’t really know what to expect when it comes to the 2024 fiscal year in its entirety.

But if we assume that the first half of the year is indicative of how the second-half will perform, we can get some reasonable estimates. Net profits, for instance, should come in at around $415.4 million. That would be up nicely from the $346 million reported for 2023. Adjusted operating cash flow of $493.4 million would beat out the $465.4 million generated in 2023. And EBITDA totaling around $696.2 million would exceed the $648.5 million the company generated last year.

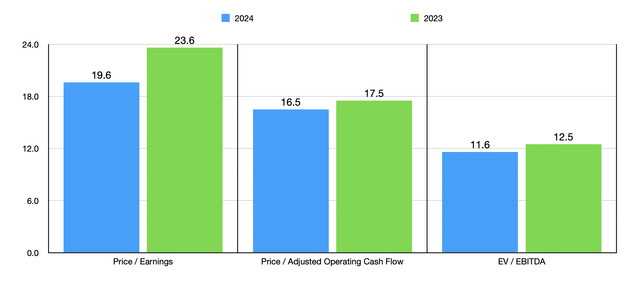

Taking these numbers, it becomes simple to value the firm. In the chart above, I did just that, using both historical results for 2023 and estimates for 2024. The stock does look a bit cheaper on a forward basis. This is especially true when it comes to the EV to EBITDA approach. But that’s because the firm has negative net debt in the amount of $83 million.

I wouldn’t exactly call this a value prospect. But it’s certainly not overpriced either. Relative to similar firms, I would actually argue that the stock is more or less fairly valued.

This can be seen in the table below. In that table, I compared Acuity Brands to five similar firms. When it came to both the price to earnings approach and the price to operating cash flow approach, I found that three of the five were cheaper than our candidate. This number drops to two of the five when using the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Acuity Brands | 19.6 | 16.5 | 11.6 |

| Encore Wire Corporation (WIRE) | 12.5 | 10.1 | 7.4 |

| Emerson Electric (EMR) | 5.9 | 102.8 | 20.2 |

| Nextracker (NXT) | 31.2 | 18.0 | 29.9 |

| Regal Rexnord (RRX) | 38.4 | 16.2 | 18.9 |

| Atkore (ATKR) | 11.3 | 9.5 | 7.4 |

Takeaway

Fundamentally speaking, I’m not the biggest fan of Acuity Brands, Inc. I don’t like seeing revenue drop year after year. Although I didn’t show it, revenue did decline from 2022 to 2023 as well.

It is nice to see profits and cash flows rise. However, Acuity Brands, Inc. stock is not cheap enough to warrant any meaningful degree of optimism. Instead, I think that keeping the business rated a “hold” would still be logical at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!