Summary:

- TSMC’s revenue growth is expected to pick up due to the demand for AI-capable products from prominent players in the industry.

- The company’s financial position is strong, with no risk of insolvency or liquidity issues.

- TSMC’s largest clients, including Apple, Nvidia, Qualcomm, AMD, and Broadcom, are driving the demand for AI innovations, presenting an opportunity for TSMC’s growth.

BING-JHEN HONG/iStock Editorial via Getty Images

Introduction

I wanted to come back to Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) to see how it has progressed through 2023, which was arguably a very tough environment for many semiconductor companies. Unsurprisingly, TSMC’s profitably took a hit, but we are seeing a resurgence in revenue growth. I believe that the future is very bright for TSM, due to the AI hype that other prominent players in the industry are leading the demand for AI-capable products, which should directly influence TSMC’s top line.

Since my last article on the company, the shares have advanced over 60%, outpacing S&P500 (SPY) by a large margin. At that point, I argued that the potential in AI is vast, and the company is trading at a ridiculous valuation, which doesn’t reflect its potential. My stance hasn’t changed.

Briefly on Performance

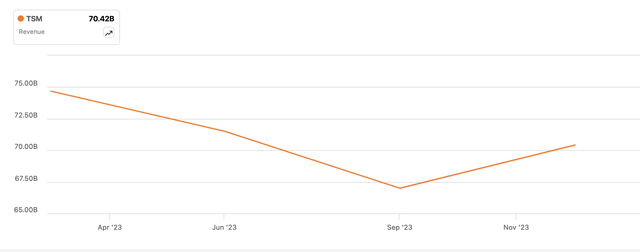

The company has around $55B in cash and equivalents, against around $30B in long-term debt. I don’t think this is particularly a bad position to be in. The company can easily pay it off if it wants to, but there is no need, especially since the company’s interest income easily covers the annual interest expense on debt. Safe to say, the company is at no risk of insolvency and has no liquidity issues. Now, let’s look at how the other important metrics progressed over the last year, which was a tough year, to say the least, so I am not expecting miracles. Starting with revenues.

We can see the company had a tough time at the beginning of the year, due to the negative sentiment of the semiconductor industry, which was plagued with oversupply. It is no surprise that the top line took a hit, however, we can see it has bottomed out in Q3 of the year and is starting to pick back up, showing signs of recovery.

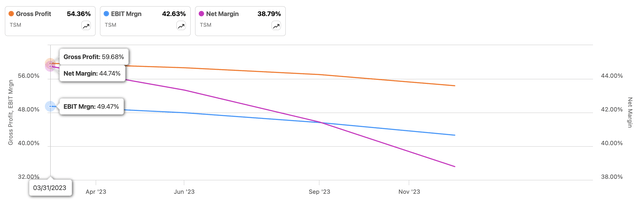

Given the tough environment throughout the year, it is also not surprising to see the company’s profitability taking a slight hit. Nevertheless, these are still very impressive margins, and it seems that the worst is behind for the industry for now, so I would expect to see these pick back up over the next year.

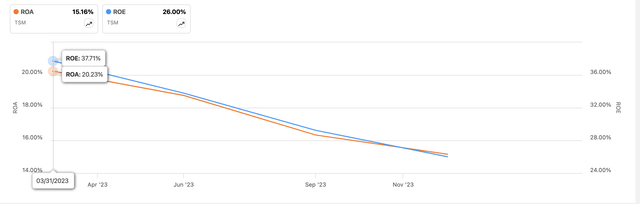

Continuing with efficiency and profitability, the company’s ROA and ROE took a hit since its bottom line deteriorated slightly. The same applies to these as with margins, once the business starts to pick back up, the company’s assets and shareholder capital will be put to better use.

Overall, we can see what I have been saying in the previous articles. A tough year was not unexpected, and the management mentioned this many times in their previous earnings calls. What matters now is the upcoming year, which I think is going to be pivotal, in terms of revenue acceleration, and innovation by the company’s largest clients.

What to expect from upcoming Earnings

Earnings are going to be announced on the 18th of April after the market closes. Analysts are expecting around $18B in revenues and EPS of $1.31. That is around an 8% y/y increase, which is good to see given the last year of negative comparisons. The company slowly returning to growth.

The management is looking at around the same revenue growth of $18.4B at the midpoint. The management expects to see gross margins in the range of 52% to 54% and 40% to 42% for EBIT margins.

I don’t think it would be hard for the company to beat these estimates. But if it does miss, I would expect some profit-taking to take place as it had a nice run-up since the lows.

Comments on the Outlook

Being the pickaxe merchant, TSMC has not been lifted very high in this current gold rush of AI hype, which I think presents an opportunity. The company’s top clients, like Apple Inc. (AAPL), NVIDIA Corporation (NVDA), QUALCOMM Incorporated (QCOM), Advanced Micro Devices, Inc. (AMD), and Broadcom Inc. (AVGO), all are somehow involved in the gold rush craze, and to see that it is not reflected with revenue growth currently at TSM is baffling. The company’s share price did go up from its lows back in October of last year, right about when I wrote my last bullish article on it. This could mean that investors are already pricing in an eventual turnaround in cyclicality, and the return of the positive sentiment in the semiconductor industry, fueled by the aforementioned “gold rush” in AI.

The company’s largest client, Apple, is starting to embrace this trend, and now that the EV project has been scrapped, which I think was a good idea, given the hindsight of EV troubles and slowdown, the company can fully focus on AI innovations. Apple has been quietly acquiring over 30 AI startups in 2023, and I don’t think this trend is going to stop. I guess it is better late than never. With such decisions, the company is looking to improve its upcoming handsets to be more than just a run-of-the-mill slight upgrade as it has been in the recent past. I am excited to see what the AI revolution will bring to the iPhones in the future. I haven’t been impressed by the company since they introduced Apple Silicon with its revolutionary M chip.

Continuing with handsets, QCOM is another exciting company for me, which I covered recently, looks to have a lot to prove but the innovations in handsets, for example, on-device AI should fuel the company’s top line considerably, as AI is simply too hot to ignore and many enterprises and individuals are looking for the next big breakthrough. The company’s upcoming ARM-based processor is specifically designed for Windows laptops and looks to be very power efficient, and a real contender to already established players like Intel Corporation (INTC), and AMD. If I hadn’t just upgraded my Windows laptop of 8 years for an M2 MacBook, I would have most likely bought the one with the next processor of QCOM, unfortunately, it’s not available yet.

Let’s not forget the star of AI, Nvidia. The company saw its revenue transform and turn into a data center powerhouse focused on AI capabilities. In some quarters, the company saw over 200% y/y growth. I don’t think this is going to be sustainable for very long, however, I wouldn’t be surprised if it persists for another year or two, with continual improvements on their data center products like Blackwell and the current top product Hopper H100 and the upcoming H200. With TSMC being the sole maker of Nvidia AI GPUs, there is a lot to be excited about over the next while. The company may not see such growth as NVDA, but if the demand for these new products continues to be strong, revenues at TSMC will certainly pick up.

TSMC is not standing still and is actively looking to increase capacity to meet the demand for innovations regarding semiconductors. The company is looking to spend around $30B on capex “to support customers’ growth”. The company also said that they “have sharply increased our Capex spending in preparation to capture and harvest the growth opportunities from HPC, AI, and 5G megatrends.” Going further to say that the company is well on track to grow between 15% and 20% CAGR over the next several years, which gives me a good starting point for valuation. I believe that this range is still on the more conservative side, given the potential mentioned above. So, it looks like it is great being the merchant of pickaxes in the modern gold rush. The opportunities are there, it’s just a matter of whether TSMC is going to capitalize on it but being one of the most important semiconductor companies in the world, with a highly skilled labor force, the edge is on its side to succeed.

Let’s look at my updated valuation model.

Valuation

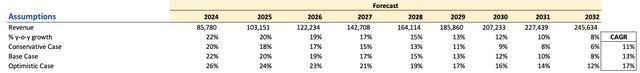

For revenues, I decided to go with around 13% CAGR over the next decade, which I think is more than reasonable, given how hot the industry has become. The semiconductor industry’s sentiment is once again turning positive, the smartphone and PC markets are returning to growth, which will help TSM return to robust growth, on top of AI hype. The management back in 2022 said they were looking for around 15% to 20% CAGR over the next several years, so if we take revenue numbers from FY23 to FY26 assumptions, we get around 14% CAGR, which is on the lower end of their estimates for conservatism sake. After that, we didn’t have any numbers, so what I like to do is linearly grow the growth down over time, ending up with around 13% CAGR over the period. I also went ahead and modeled a more conservative case, and more optimistic one. Below are those estimates.

In terms of margins and EPS, over time, I see capex subsiding, leading to better profitability once investments in capacity upgrades are through. The management has mentioned that they see capex “leveling off” already after an intense few years of ramp-up. The leveling off starts at around $30B a year in capex, so for the next decade, I am modeling around a 10% increase in capex per year, just to be more conservative, as I don’t think $30B per year for the next decade is going to be sufficient. The value of money reduces so the amounts will increase. To keep it even safer, the management also mentioned that they expect to reach over 53% in gross margins over the long term, so I have modeled that the company over the next decade will achieve 55% margins by FY32, which fits well with what the management said. The improvements in gross margins will bring improvements to EBIT and Net margins. Below are those estimates.

Margins and EPS Assumptions (Author)

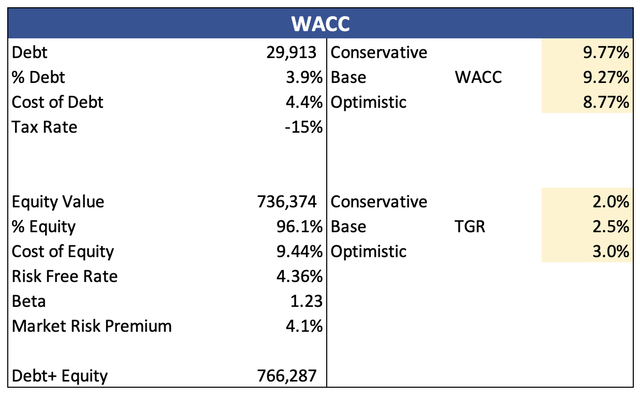

For the DCF model, I went with the company’s WACC of around 9.3% as my discount and 2.5% terminal growth rate for the base case scenario. I didn’t think I needed to add more margin of safety here, as the company’s financial position is very strong.

Furthermore, just to be on a bit more conservative end, I am adding another 10% discount to the final intrinsic value, which should be enough for the same reason as above, its balance sheet. With that said, TSMC’s intrinsic value is $164 a share, meaning the company is still trading at a discount to its fair value.

Risks and Closing Comments

We may see some profit taking if the company misses earnings, which are due in the next couple of weeks. The company has run up over 60% since my last article and October lows, so I wouldn’t be surprised if the company doesn’t deliver great numbers and the shares see a 10% slide. I would say it would be an opportunity to get in at an even better entry point.

If the demand for AI-related products isn’t as robust as I predict, that will affect the company’s top-line, and certainly its fair valuation and share price. Furthermore, there is still a lot of uncertainty in the geopolitical sense. A lot of investors are not keen on investing in a company that is somehow related to China, as it is perceived as very risky. To that I say, it is overblown in my opinion, and I covered that in more detail in one of my earlier articles.

The company’s plans for expansion may come with some unforeseen extra costs, which could bring down its profitability further, but I would say it’s short-term pain for long-term gain.

I believe the company has a lot of room for further growth, well passed my conservative fair value, however, I would be cautious if it climbs over that very quickly, and you miss the entry point. I reiterate my strong buy recommendation, but it wouldn’t be a bad idea to wait for the next quarter’s results before adding to a current position or starting a new one. It is up to you to do further due diligence, and whether you are fine with taking on the risks mentioned.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.