Summary:

- I am recommending a sell rating for ACN.

- Accenture’s performance outlook is bleak due to tightening client budgets, slower decision-making, and declining VC investments.

- Valuation should see compression when ACN prints slow growth rates in the next few quarters.

HJBC/iStock Editorial via Getty Images

Investment summary

My recommendation for Accenture plc (NYSE:ACN) is a sell rating. I am negative about ACN’s performance over the next few quarters, as the outlook is bleak. Multiple leading indicators, like tightening of client budgets, a longer decision-making process, low VC investments, and management-cutting guidance, all point to a poor outlook ahead. Multiples should see mean reversion as the market realizes that ACN growth is going to stay weak for the near term.

Business Overview

ACN is a big name in the consulting world that most people should be aware of. The main business of ACN is to offer management consulting services to businesses, like strategic review, how to reduce cost structure, etc. They also help companies in their digital transformation journey, which is a major growth trend as more businesses realize they need to rely on digital tools to stay competitive. Major companies include Bain Consulting, Boston Consulting Group, McKinsey, and the big four accounting firms. Reputation and access to top-level management are two competitive advantages that I think ACN has built through its long operating history and track record of delivering key transformation projects. A strong reputation also attracts more talent. Smaller consulting firms lose out on being less reputable and lack access to large ticket-size deals, which reduces their financial capacity to hire talents.

ACN generates revenue from across the globe: 47% from North America, 33% from Europe, and the remainder from the rest of the world. The ACN fiscal year ends in August, and its latest results announced on March 21st (2Q24) reported revenue of $15.8 billion, representing flattish revenue growth on a constant currency basis. Breaking down the revenue drivers, managed services grew by 3% while consulting fell by 3%, and growth trends deteriorated across both consulting and managed services in EMEA. For bookings, 2Q24 saw bookings of $21.58 billion, translating to a 1.37x book-to-bill ratio. Adj EPS came in at $2.77.

Demand outlook is bleak

I think ACN is going to experience poor performance in the coming quarter. While bulls are focusing on the strong deal bookings of $21.6 billion (I note this is the second-highest bookings ever), I am staying conservative on extrapolating this strength forward because it could be driven by large-sized transformation deals that are lumpy. To support this view, I point readers to the record-high bookings in 2Q23. When compared against last year’s performance, 2Q24 bookings of $21.6 billion were actually down 2% on a constant currency basis.

Another reason for my negative view is that there is an increased tightening of client budgets. During the call, management noted that client budgets show that tech budgets have been even tighter in the past quarter, especially on smaller deals. What stands out is that discretionary spending (tech spending) is still being re-prioritized. The slowdown in tech spending is huge because it gives a good sense of what businesses are expecting. In good times, businesses are willing to invest heavily in tech as they are confident of positive performance ahead to make back the cost of investment. The reduction in tech spending suggests to me that businesses are still holding on to a conservative mindset, and I believe that implies keeping cash in the balance sheet to ensure they can survive another weak macro environment. A good piece of evidence that supports my view is that even Gen AI bookings (which is a very hot topic and area of investment today) saw growth decelerate from 100% to just 30% sequential growth. Furthermore, decision-making remains slow, and the pace of spending slowed down in 2Q24.

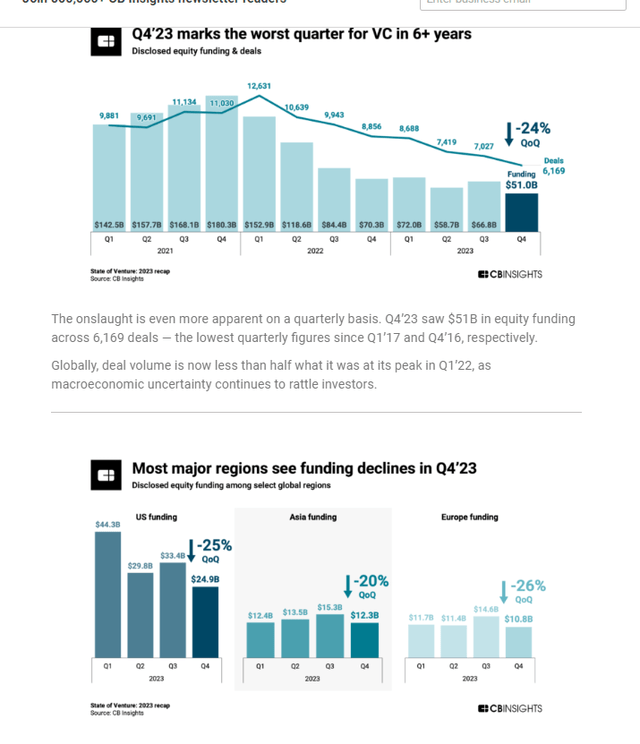

Soft pace of VC investments

The lack of VC investments also suggests that demand for ACN services is going to get hit. The first effect of reduced VC investment is a general slowing of technological development, which in turn reduces the incentive for established businesses to upgrade (since there are fewer new entrants to the market). There are several articles/research papers (below I highlight 2 links) on this that readers can check out.

Most entrepreneurs and startups recognize that venture capital is a crucial funding source for them, particularly in industries driven by innovation and technology. By actively seeking out and investing in promising startups, VCs act as catalysts for innovation, attracting talented entrepreneurs and fostering a culture of risk-taking and experimentation. A look at what happens when Washington seeks to regulate Silicon Valley by enforcement. By Louis Lehot & Patrick Daugherty, Foley & Lardner.

All our four main explanatory variables have a positive impact on innovation. Our results support previous literature that VC investment promotes and spurs innovation. Does Venture Capital Investment Spur Innovation? A Cross-Countries Analysis.

Secondly, it also means that there will be less hiring competition for talented tech experts. Incumbent companies will have access to these talents, giving them more capacity and the necessary talents to insource digital development projects. On the VC investment outlook, I don’t expect to see a recovery in VC investments as we saw a few years ago because interest rates are likely to remain high in the near term.

Guidance cut further points to a weak outlook

Finally, I think management-cutting guidance is a strong sign of weakness. Management has cut their FY24 constant currency growth guidance by 100-200 bps to 1-3%. However, if we dig deeper into the finer details, it implies a bigger cut from an organic basis because inorganic growth is expected to drive 3% growth from the guide of more than 2% earlier. I think the biggest sign that management is preparing for a slowdown is that net hiring turned negative again in 2Q24. The nature of ACN’s business is heavily dependent on the number of consultants it has, and unit economics can be viewed on a per-consultant basis. The more consultants ACN has, the more capacity it has to take on more projects, and the opposite is true when it has fewer consultants. Hence, lower net hiring suggests that management is not seeing a lot of opportunities.

Valuation

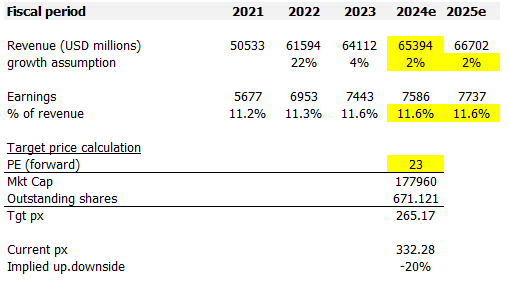

Redfox Capital Ideas

I model ACN using a forward PE approach and using my assumptions, I believe ACN is worth $265.

For revenue, I am expecting the business to see weak growth ahead, with FY24 coming at the midpoint (2%) of the revised downward guide (range is 1 to 3%). Based on my outlook for CY24, I believe ACN is unlikely to see any positive recovery in growth; hence, I model a similar growth rate of 2% in FY25. I have also assumed a flat earnings margin for FY24 and FY25. In FY24, margins are likely to stay at least flat vs. FY23 because 1H24 saw very strong margins (12.8% for 1Q and 11.15% for 2Q). Note that ACN saw reduced net hiring and has driven high utilization for each hire; hence, that should manage the cost structure (positive margin support). Once the market sees that growth is not showing any form of recovery in the near term, I expect the valuation to see a mean reversion back to 23x forward P/E (ACN 10-year historical average).

Risk

As noted in the guide, inorganic growth is going to contribute more than expected, and if ACN uses its balance (net cash position of ~$2 billion) to acquire businesses to drive growth, it could outperform my assumptions. Just a few days ago, ACN acquired Intellera Consulting, which posted 14% constant currency growth for FY23 (much higher than ACN’s total growth).

Conclusion

My view for ACN is a sell rating. Multiple indicators point to weak demand, including tightening client budgets, slower decision-making, and declining VC investment. Management’s downward guidance revision and reduced net hiring further support this view. While strong deal bookings may appear positive, they could be driven by large, lumpy deals. With limited growth prospects, I believe the stock’s valuation will regress to the mean. The main risk to my bearish thesis is if ACN leverages its cash position to acquire high-growth businesses.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.