Summary:

- Microsoft Corporation stock’s buying momentum has waned as investors reassess the company’s AI exuberance.

- Microsoft’s ability to monetize AI effectively positions it well for growth opportunities.

- Microsoft’s expansion into the consumer AI space and partnership with OpenAI strengthens its AI roadmap and potential for further monetization.

- However, Microsoft Corporation’s highly expensive valuation demands robust execution with sky-high expectations.

- The rapidly evolving AI landscape is intensely competitive. Even slight disappointments could hurt its buying sentiments. Be patient and wait for the right opportunity.

lcva2

Microsoft Corporation (NASDAQ:MSFT) investors hoping for another dramatic run in 2024 have likely been disappointed with its recent performance. On the bright side, MSFT has outperformed the S&P 500 Index (SP500, SPX) YTD with a total return of more than 11%. However, MSFT’s buying momentum has slowed, as I cautioned in my previous article in January 2024. While the leading Software as a Service, or SaaS, company posted a solid fiscal second-quarter earnings release, it hasn’t been sufficient to lift buying sentiments much higher.

SaaS investors will closely watch MSFT’s performance as they assess the AI growth inflection as these companies embed generative AI into their products. Microsoft’s market leadership and astute partnership with OpenAI have bolstered the market’s confidence in Microsoft’s ability to capture near term and medium-term monetization opportunities as the AI landscape continues to expand.

Microsoft’s ability to embed AI monetization within its enterprise suites has placed CEO Satya Nadella and his team in pole position to benefit from the growth inflection. As a result, Nadella telegraphed in Microsoft’s FQ2 earnings conference on the “continued strength of Microsoft Cloud, which surpassed $33B in revenue, up 24%.” Notably, the momentum was boosted markedly by Microsoft’s robust and rapid AI execution, “applying AI at scale by infusing AI across every layer of [Microsoft’s] tech stack.” Consequently, it has underpinned Microsoft’s endeavors to “win new customers and help drive new benefits and productivity gains.”

Not one to rest on its laurels, I was pleasantly surprised with Nadella’s recent “licensing” deal with Inflection AI. Keen Microsoft investors should be aware that Mustafa Suleyman (ex-CEO of Inflection AI) has joined Microsoft to lead its consumer AI efforts. He also displaced Mikhail Parakhin, who previously led Microsoft Bing and associated advertising businesses. Microsoft executed the deal within a “licensing” framework, avoiding potential anti-trust scrutiny in the case of an outright acquisition. While regulatory scrutiny will likely remain, I believe it was an astute move to expand Microsoft’s capabilities and influence in the consumer space. Microsoft has appreciated the opportunities within the consumer AI space as it looks toward the AI PC refresh cycle. Despite that, with Google (GOOGL, GOOG) and Apple (AAPL) as gatekeepers of two highly dominant consumer ecosystems in Android and iOS, Microsoft remains well below the leadership it has established in the enterprise space.

With consumer AI startups reportedly struggling to generate sustainable revenue amid intense competition and saddled with AI chips, I believe Microsoft has flexed its muscles again at the right time, as it did with OpenAI. In addition, The Information recently reported that OpenAI and Microsoft are working on a partnership to build a $100B Stargate AI supercomputer by 2028, entrenching their dominance. As a result, it does suggest that Microsoft’s AI leadership is likely still in the early innings and could be further extended if it can expand toward the consumer space effectively.

With OpenAI likely dependent on Microsoft’s extensive resources to build critical AI infrastructure to maintain its competitive edge, it should strengthen the partnership between OpenAI and Microsoft. In other words, Microsoft’s AI roadmap looks secure, with growth optionalities for further expanding its monetization to the consumer AI space.

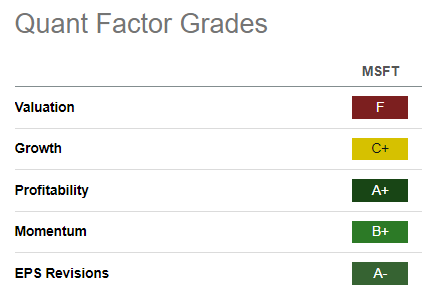

MSFT Quant Grades (Seeking Alpha)

As a result, I’m not surprised that the market has remained confident in its fundamentally strong business model (“A+” profitability grade). As seen with its “B+” momentum, buying sentiments have remained constructive. Moreover, MSFT’s solid “A-” earnings revisions grade corroborates its execution ability.

Despite that, we still need a leap of faith when considering MSFT’s forward EBITDA multiple of 23x, which is well above its 10Y average of 15.8x. In addition, it’s also well above its sector peers, as MSFT is assigned an “F” valuation grade.

Therefore, I believe it suggests that expecting outperformance from MSFT moving ahead demands robust execution over the next few years. However, investors must account for execution risks in a rapidly evolving AI landscape, with enterprise SaaS players vying to take Microsoft’s lunch.

Moreover, with Apple (AAPL) and Google ramping up their AI efforts to safeguard their turf, it could intensify competition against Microsoft’s efforts to penetrate the consumer space. Hence, the Microsoft Corporation risk/reward profile seems balanced at best for now unless we get a much steeper pullback moving ahead.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!