Summary:

- INTC reports underwhelming Foundry prospects after the release of its new segment reporting, as the IDM 2.0 brings forth uncertain cash burn and drag on its overall profitability.

- It remains to be seen when the foundry segment will be able to deliver the critical combination of node advancement, volume manufacturing, and profitability.

- Given the delay in its product launches, we believe that INTC’s “five new nodes in four years” may be loosely termed with volume manufacturing likely to occur later.

- We may see its balance sheet further deteriorate from those reported in FQ4’23, with the management seemingly financing its dividend payouts with debt.

- Combined with the premium FWD P/E valuation and the potential volatility, INTC is not a Buy at this dip.

ajr_images

We previously covered Intel (NASDAQ:NASDAQ:INTC) in January 2024, discussing why the stock’s embedded growth premium offered a minimal margin of safety, with the underwhelming forward guidance bringing forth the sobering correction in its stock prices after the recent earnings call.

While some might opt to view the management’s forward commentary as a kitchen sink guidance, with a subsequent beat in estimates likely to bring forth excellent upside potential, we had preferred to view it conservatively then, triggering our Hold rating.

In this article, we shall discuss INTC’s underwhelming Foundry prospects after the release of its new segment reporting, as the IDM 2.0 naturally brings forth the uncertain cash burn and drag on its overall profitability.

This is on top of its delayed node roadmap compared to its foundry peer, signaling Intel Foundry’s uncertain prospects given its nascency.

While we are optimistic about the stock’s US-made sentiments, it remains to be seen when INTC’s foundry segment will be able to deliver the critical combination of node advancement, volume manufacturing, and profitability, resulting in our reiterated Hold rating.

INTC’s Foundry Investment Thesis Is Speculative At This Point

INTC’s Growing Cash Burn In The Foundry

INTC

INTC has recently reported its new reporting segments by early April 2024, with the Intel Foundry notably being unprofitable at operating losses of -$6.95B (-34.6% YoY) and margins of -36.7% (-18 points YoY) in FY2023.

From these numbers, it is apparent that the cash burn has grown drastically on a YoY basis, with 2024 supposedly being “the trough year for foundry operating losses.“

At the same time, the INTC management has aggressively guided “breakeven operating margin” by approximately 2027 and “60% non-GAAP gross margins and 40% non-GAAP operating margins by 2030.“

It is uncertain how the management aims to achieve this, given that Intel Foundry currently only reports a “lifetime deal value with external customers of more than $15B,” compared to the FY2023 revenues of $18.91B (-31.2% YoY).

When compared to the market leader, Taiwan Semiconductor Manufacturing Company Limited’s (TSM) FY2023 revenues of $69.29B (-8.1% YoY) and operating margins of 42.6% (-6.9 points YoY), INTC’s numbers appear to be very aggressive given its nascency indeed.

As a result of this development, we believe that INTC’s long-term foundry prospects appear to be uncertain, especially since TSM has already diversified its global footprints in Japan and Arizona, partly balancing the latter’s geopolitical headwinds.

INTC’s Node Roadmap

INTC, Tom’s Hardware

INTC’s latest roadmap has also suggested that the 14A node (the equivalent of 1.4nm) is expected to enter production only by 2026 and 10A node (the equivalent of 1nm) to begin development by 2027, with it remaining to be seen when volume manufacturing may occur.

This is compared to TSM’s current roadmap, with 3nm currently in volume production/ 2nm by 2025 and no further detailed offered by the management yet.

If anything, readers must also note that while INTC’s Node Roadmap has highlighted that the 18A node is already in production, the reality is that 18A is only “on-track and manufacturing ready at the end of” 2024, with the future 18A Xeon processor, Clearwater Forest, only slated to be released in 2025.

As a result, we believe that readers need to temper their expectations for INTC’s advanced nodes, since the same may very well occur for the 14A and 10A, with the “five new nodes in four years” seemingly loosely termed and volume manufacturing likely to occur over a longer period of time.

And it is for this reason that we concur with TSM’s commentary in the FQ4’23 earnings call, in that it is more important to “work with the customer to give them the best transistor technology and the best power-efficient technology and at a reasonable cost – the technology maturity that in the high-volume production.“

For now, it may be more prudent to reserve judgment on the foundries’ technological launch timeline, especially since INTC’s foundry segment is expected to remain unprofitable over the next few years, implying its lack of manufacturing scale.

With INTC set to report its FQ1’24 earnings call on April 25, 2024, readers may want to take note of the Intel Foundry’s performance, especially since the segment is expected to hit peak losses in FY2024.

For now, the market has also priced in underwhelming FQ1’24 revenues of $12.78B (-17% QoQ/ +9% YoY) and adj EPS of -$0.14 (-122.2% QoQ/ + 78.7% YoY), worse than the management’s kitchen sink EPS guidance of $0.13 (-79.3% QoQ/ +181.2% YoY).

We believe that the consensus estimates are not overly bearish indeed, with the recent gain in the x86 CPU market share to 62.6% as of Q1’24 (+1.6 points QoQ/ -0.1 YoY) likely attributed to the drastic price cuts and impacted profit margins as discussed in my previous article here.

Combined with the bloated operating expenses and capex, we may see INTC’s balance sheet further deteriorate from the net debts of $21.94B reported in FQ4’23 (+134.6% YoY/ +81.1% from FQ4’19 levels), with the management seemingly financing its dividend payouts with debt.

Readers may want to pay attention to these metrics ahead, since the INTC stock may experience more volatility in the coming weeks.

The Consensus Forward Estimates

Tikr Terminal

Lastly, with INTC racing to expand its global footprint across the US, Israel, Ireland, Germany, and Mexico, amongst others, it goes without saying its Free Cash Flow generation will be impacted, as reflected in the consensus forward estimates, with the company likely to be highly reliant on government subsidies/ local incentives.

With INTC’s Ohio and Arizona plant completions already delayed, the pain may be prolonged indeed, as the market priced in a flattish top/ bottom line performance between FY2019 and FY2026.

INTC Valuations

Seeking Alpha

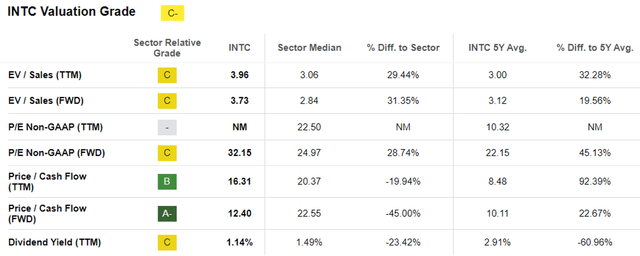

As a result of its minimal growth prospects, we are uncertain about INTC’s premium FWD P/E valuation of 32.15x and FWD Price/ Cash Flow valuation of 12.40x, while moderated from the previous article at 34.65x/ 12.45x still elevated compared to the 5Y mean of 22.15x/ 10.11x and the sector median of 24.97x/ 22.55x, respectively.

So, Is INTC Stock A Buy, Sell, or Hold?

INTC 2Y Stock Price

Trading View

For now, INTC has returned part of its recent gains with the stock appearing to retest its previous support levels of $40s at the time of writing.

Based on the annualized FQ4’23 adj EPS of $1.36 (after adjusting for the $1.2B litigation benefit for improved accuracy, as opposed to the reported sum of $2.52) and the 5Y P/E mean valuations of 22.15x, it appears that the stock is trading way above our fair value estimate of $30.10.

We believe that it is more prudent to refer to INTC’s 5Y P/E mean here, given its projected lack of growth and impacted profitability between FY2019 and FY2026 as the company undergoes an uncertain transition to IDM 2.0.

At the same time, its dividends seem to be shaky based on the Seeking Alpha Quant Rating, with impacted TTM Interest Coverage ratio of 0.04x and TTM Dividend Coverage ratio of 0.55%, compared to the sector median of 10.97x and 2.82%, respectively.

Combined with the numerous factors discussed above, we believe that there remains great uncertainty in INTC’s execution moving forward.

As a result of the mixed signals, we prefer to continue rating the INTC stock as a Hold here. It may be more prudent to observe the management’s intermediate-term execution before adding at this perceived dip.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.