Summary:

- Amazon stock has continued outperforming the S&P 500 as AI hype finally catches up.

- Amazon is investing aggressively to maintain its cloud computing leadership.

- Microsoft may be perceived as the current AI leader. However, Amazon has the scale to catch up.

- When it comes to winners like AMZN, let them run and don’t let go.

FinkAvenue

Amazon (NASDAQ:AMZN) stock has outperformed the S&P 500 (SPX) (SPY) since my January 2024 AMZN update, as I urged investors to remain focused on the long-term prize. Notwithstanding its “expensive” valuation, AMZN has inched closer to re-testing its all-time highs as AI euphoria finally reached the Seattle-based company. Amazon’s undisputed e-commerce leadership and its massive scale in cloud computing have underpinned AMZN’s ability to maintain robust buying sentiments. Even though the retail space has continued to face economic headwinds, Amazon’s fourth-quarter earnings release in February 2024 demonstrated its resilience, as North American sales increased 13%.

Amazon has continued to revise its e-commerce business to cope with intensified threats from Shein and Pinduoduo-backed (PDD) Temu. The Chinese-based fast fashion companies have taken the US e-commerce market by storm, making inroads with their highly affordable merchandise from Chinese merchants. Amazon management was reportedly increasingly concerned about the challenges, although their scale was still well below Amazon in GMV terms in 2023. As a result, I don’t envision imminent threats against Amazon’s e-commerce leadership as the Andy Jassy-led company navigates its return to growth and sustainable profitability. Amazon has also revised its brick-and-mortar approach, focusing on its burgeoning grocery business to challenge Walmart’s (WMT) leadership position. In addition, Amazon has also discontinued its “cashierless Just Walk Out system from grocery stores, marking a significant shift in its retail strategy.” It culminated with recent job cuts as Amazon restructured its focus on its retail segment. Given the intensely competitive generative AI landscape, I believe these changes shouldn’t surprise investors.

Amazon didn’t allude to its capital allocation priorities as it revamps its brick-and-mortar strategy. However, Amazon could invest $150B in data centers over the next 15 years. The aggressive roadmap is intended to help AWS maintain its market leadership ahead of Microsoft (MSFT) and Google (GOOGL) (GOOG) as the hyperscaler battle intensifies. Therefore, Amazon needs to channel its resources to businesses where it could generate the highest potential upside. Amazon’s decision to increase its investment in Anthropic by another $2.75B underscored the criticality of achieving AI leadership. In other words, the rapidly evolving AI space likely requires intense focus and resource allocation by Jassy and his team, given Microsoft’s broadening leadership. Even Google CEO Sundar Pichai has reportedly taken on Google’s “Chief Product Officer” role for AI-related initiatives. The Mountain View-headquartered company looks to make up much-needed ground for its Gemini faux pas.

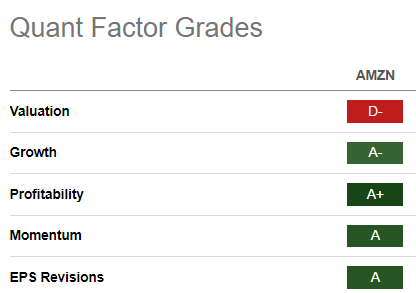

AMZN Quant Grades (Seeking Alpha)

I assessed AMZN to be solidly positioned to compete effectively with Microsoft and Google. Microsoft has accelerated its progress toward the consumer AI space with its “licensing” deal with Inflection AI. Moreover, Apple (AAPL) is expected to make AI a focal point for this year’s WWDC, heralding the Cupertino company’s formal entry into the AI hype.

I believe the risks of AI overhype cannot be discounted, as near-term revenue inflection potentially peaks after the initial adoption phase. However, the medium- and long-term opportunities are likely sustainable after we move past the initial hype phase. As a result, fundamentally strong companies like Amazon (“A+” profitability grade) have the wherewithal to outcompete their smaller AI peers, as seen with the “licensing” deal arranged by Microsoft with Inflection AI. Amazon could also look toward similar opportunities following its increased investment in Anthropic to ensure it covers its bases. AWS’s IaaS leadership should also provide Amazon with plenty of much-needed scale to leverage efficiencies in AI infrastructure investments, leading to an earlier profitability inflection.

While AMZN’s “D” valuation grade has likely bewildered bearish AMZN investors, the market isn’t foolish, as seen with its “A” momentum grade. The market understands that its cloud computing leadership proffers Amazon with a high potential to benefit from improved scale efficiencies, even as near-term revenue generation could face challenges.

Therefore, a shakeout in the AI space that hampers smaller AI startups could allow Amazon to invest more aggressively to catch up with Microsoft’s partnership with OpenAI. I believe it’s reasonable to assess that the rapidly evolving AI market is far from settled, with open-source models (led by Meta (META)) looking to challenge proprietary AI companies. Hence, if one company has the scale, profitability, and market confidence to execute, I would continue to bet on AMZN.

With AMZN increasingly likely to achieve a decisive breakthrough above its all-time highs, it’s still too early for investors to cash in on their gains or turn neutral.

Rating: Maintain Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!