Summary:

- Higher interest rates were supposed to kill BNPL companies. Affirm has passed the test.

- Affirm has seen GMV growth accelerate sequentially for 3 consecutive quarters, and unit-level margins have stabilized.

- Management is back to “beat and raise” quarters, with its beats being of surprising amounts.

- I am upgrading AFRM stock to buy.

Cn0ra/iStock via Getty Images

Affirm (NASDAQ:AFRM) has shown great resilience amidst the higher interest rate environment. It was just one year ago when the company had seen its unit-level margins contract below its target range, and Wall Street responded with extreme bearishness. In the many quarters since then, management re-calibrated their credit management policies, which has brought their unit-level margins back within their targeted range without impacting their ability to grow GMV at incredible rates. I mustn’t ignore the surprising impact that the Affirm card has had on GMV growth rates and there are reasons to believe that competitive fears are overblown. While the stock may have some meme-reputation to some investors, I am of the view that the current valuation looks more than reasonable if management can come anywhere close to their medium term targets. I am upgrading the stock to buy but caution that volatility almost guaranteed.

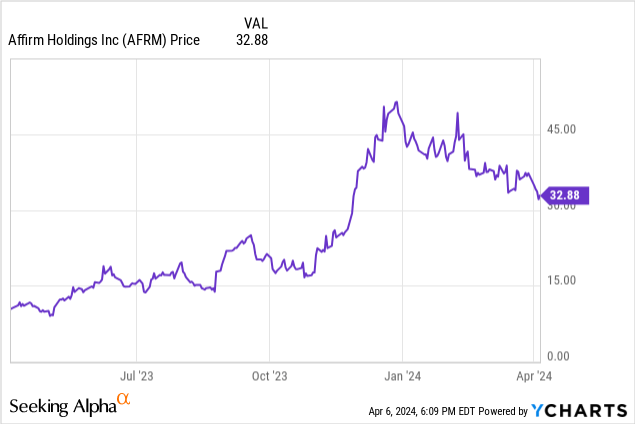

AFRM Stock Price

As I wrote in my January report, I have regretted selling my AFRM stake back in October, as the company appeared to be dismantling the bear thesis. I nonetheless still recommended avoiding the stock, as I felt that the valuation had gotten too far ahead of itself. The stock has since underperformed the broader market index by around 30%. While the stock has not fully retraced to where I sold my shares (the stock is still up 77% from October levels), it is still offering a great discount since the last time I covered the name.

That underperformance has created a buying opportunity as management continues to execute at a high level.

AFRM Stock Key Metrics

AFRM is the largest pure-play Buy Now, Pay Later (‘BNPL’) company in the public markets, and Wall Street has been wary of the BNPL space ever since interest rates ticked up. The fear was that rising cost of capital would crush unit-level margins and lead to steep operating losses. AFRM, however, appears to be back to operating like it was during the pandemic, highlighted by management’s reputation to “under promise and over deliver.”

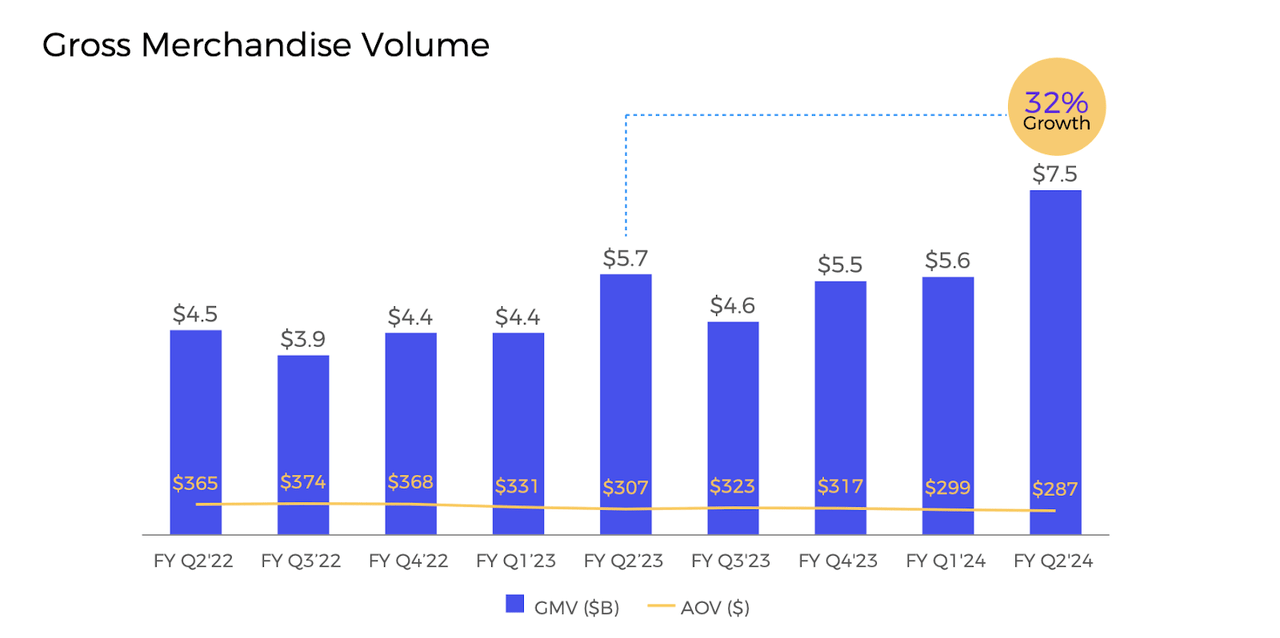

In the most recent quarter, AFRM generated 32% YoY growth in gross merchandise volume (‘GMV’) to $7.5 billion, crushing guidance for $6.9 billion.

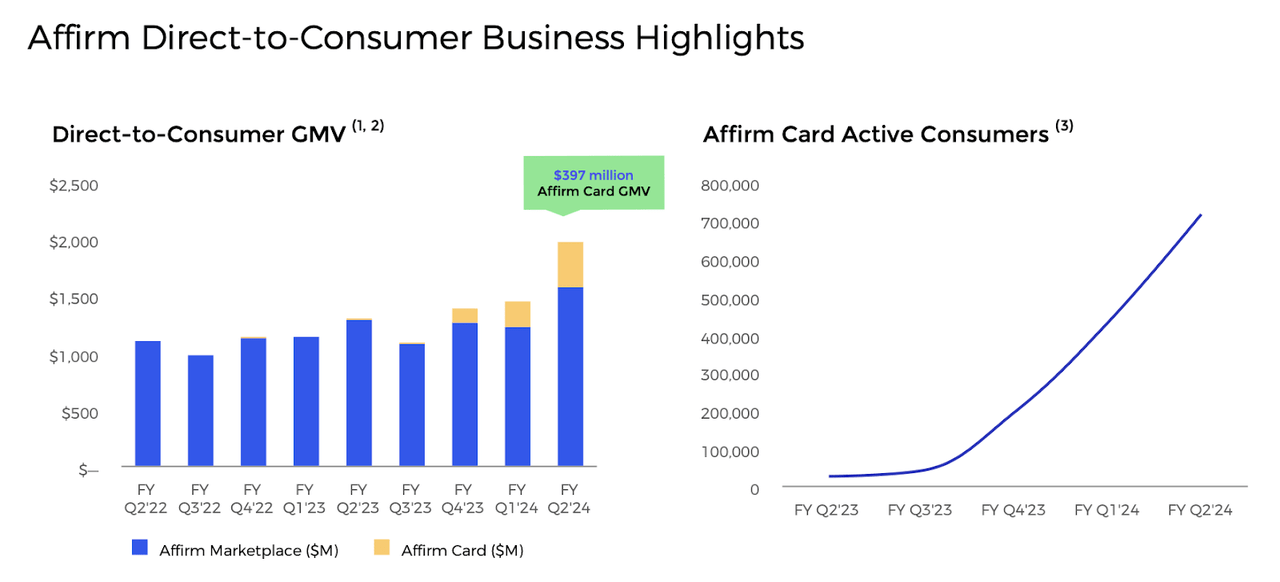

$397 million of that GMV was driven from the Affirm Card, which showed exponential growth on a QoQ basis. It is worth noting that e-commerce operator Shopify (SHOP) showed 23% YoY GMV growth and Amazon (AMZN) showed 13% YoY GMV growth in their most recent quarters, indicating that AFRM appears to be growing faster than e-commerce overall. This is the third consecutive quarter of sequential acceleration in GMV growth, and it has all occurred without an interest rate cut from the Federal Reserve during that time period.

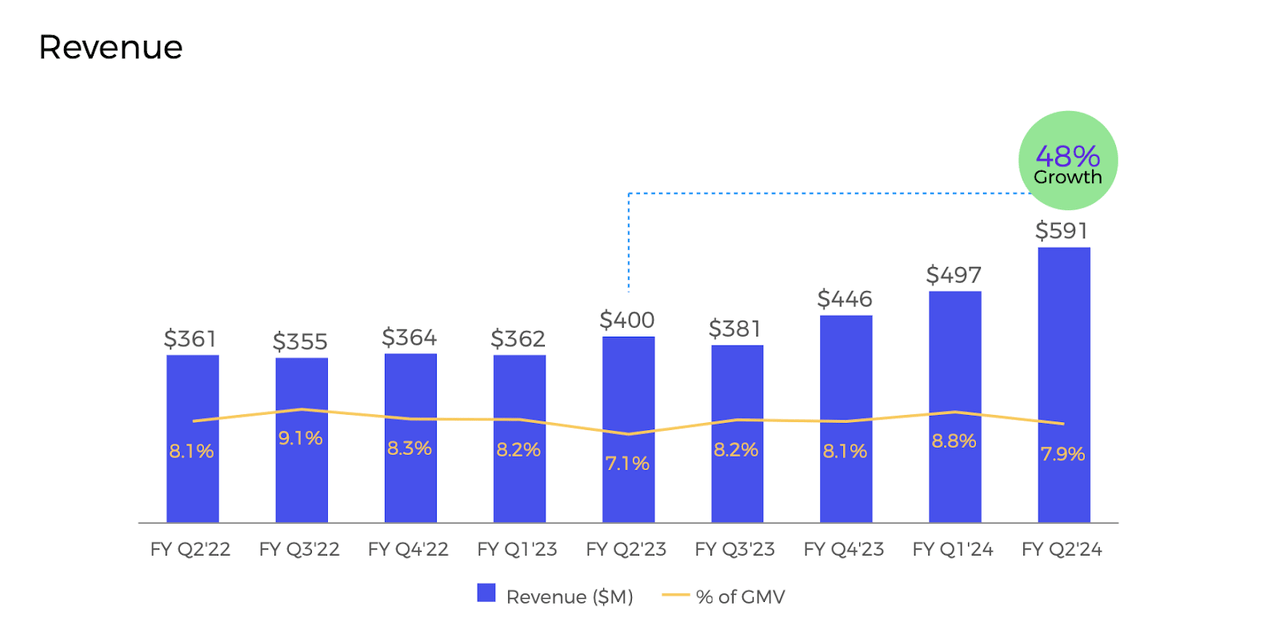

AFRM saw revenue grow even faster at 48% YoY to $591 million, crushing guidance for $495 million to $520 million. This was faster than GMV growth due to revenue as a percentage of GMV increasing 800 bps to 7.9%, driven by both the Affirm Card carrying “substantially higher” GMV rates as well as the company continuing to benefit from pricing initiatives.

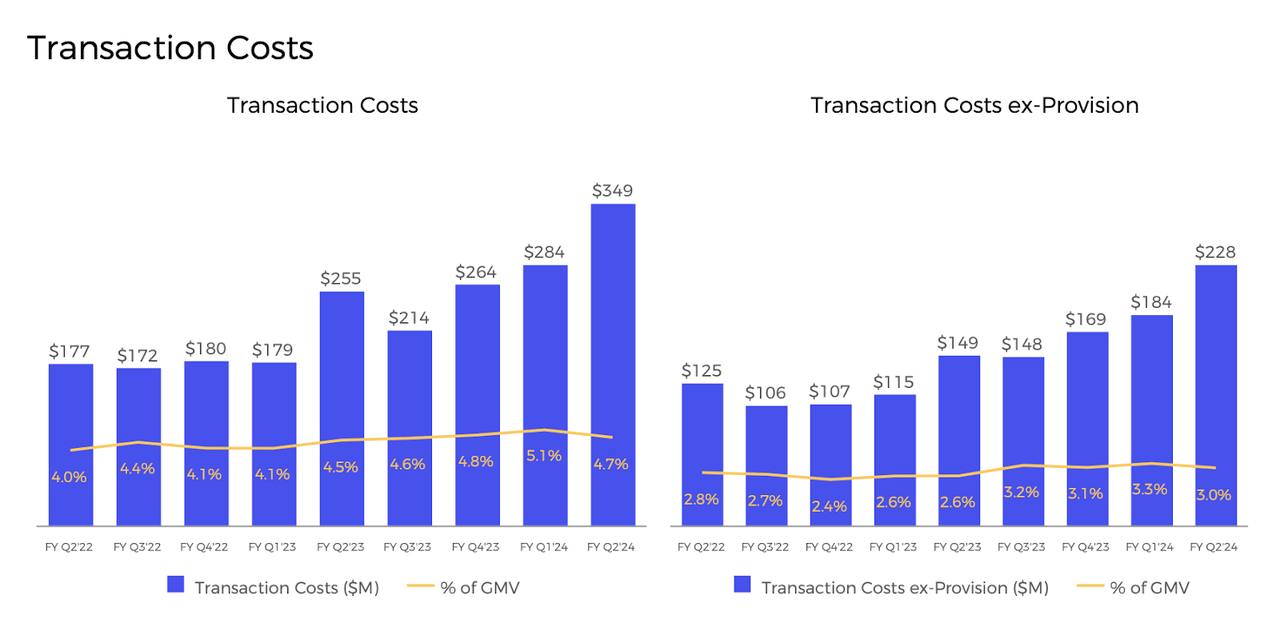

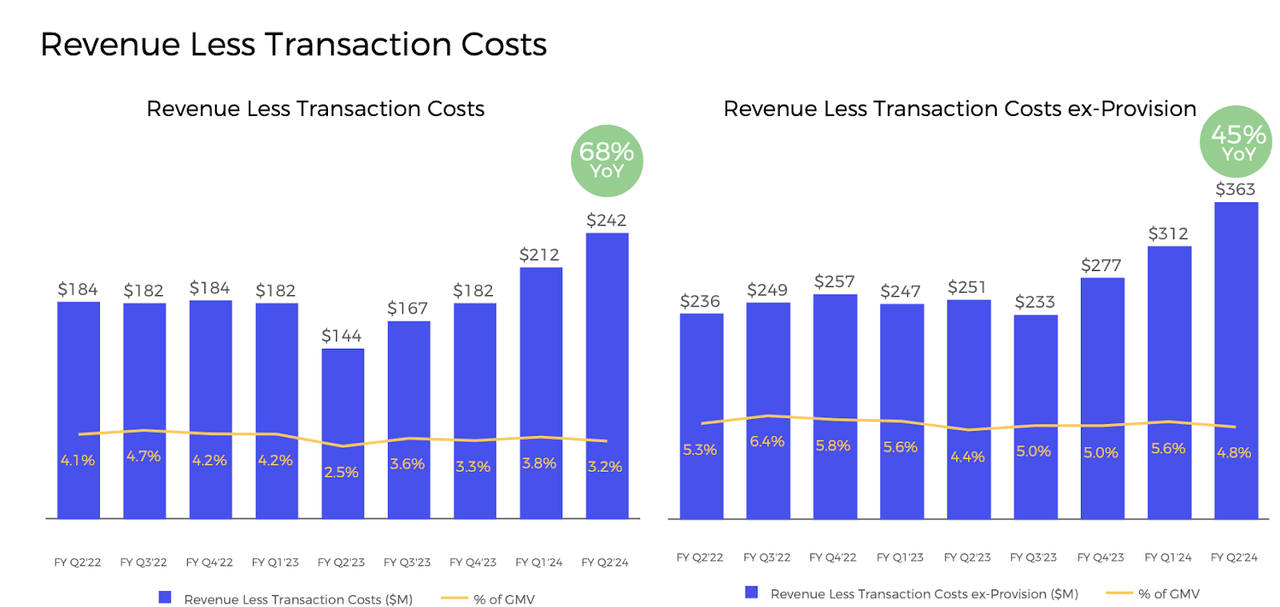

After 4 straight quarters of sequential increases in transaction costs as a percentage of GMV (due to the higher interest rate environment), AFRM finally saw that number decline 400 bps QoQ to 4.7%. This was driven by again ongoing growth in the Affirm Card as well as sequentially more modest provision for credit losses.

That led to revenue less transaction costs (‘RLTC,’ what I view to be gross margins for the business) to grow 68% YoY to $242 million, crushing guidance for $185 million to $200 million. RLTC made up 3.2% of GMV and was once again within management’s targeted range of 3% to 4%. I note that while investors should not expect the vast outperformance relative to GMV (36% in this quarter) to continue indefinitely, I still expect RLTC to grow in-line with GMV moving forward due to the company not appearing to be “over-earning” relative to their guidance. In contrast, notice how the company was earning in excess of 4% two years ago, which led to the disappointing RLTC growth in recent quarters (RLTC growth had been much lower than GMV growth for many quarters).

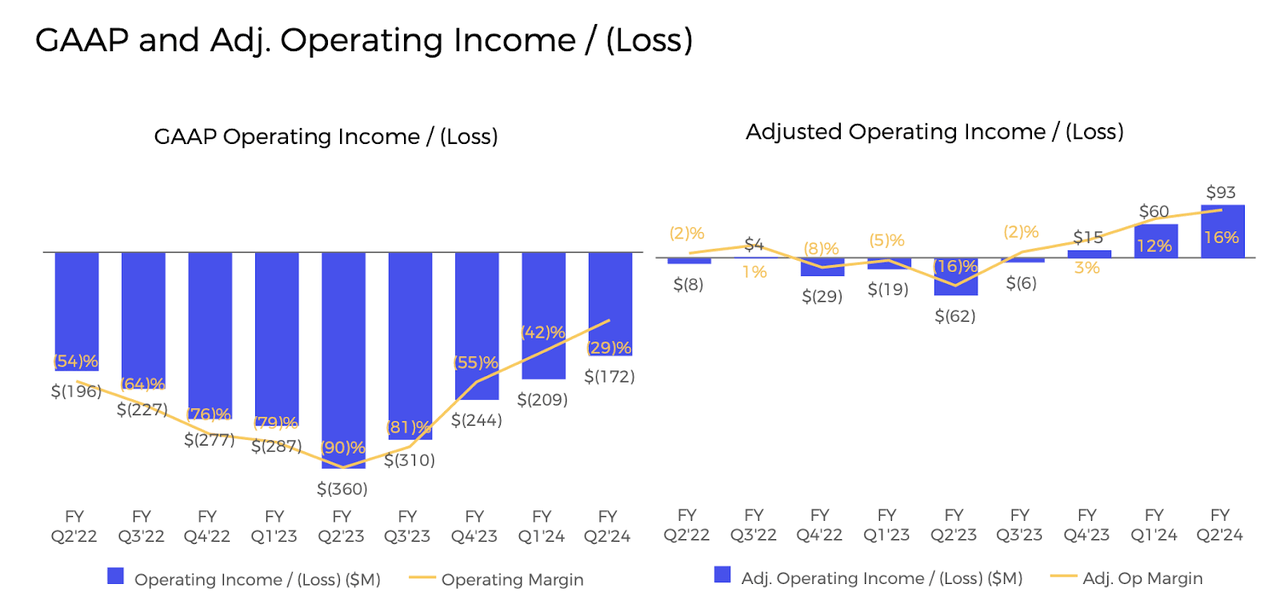

While AFRM remains unprofitable on a GAAP basis, the company continues to make progress in reducing its GAAP losses and increasing non-GAAP margins. The company generated a 16% adjusted operating margin in the quarter – management had guided for 2% to 4%. Management had gained a reputation for giving conservative guidance during the pandemic, a reputation which they had lost for many quarters. It looks like management once again is in control and has a better ability to forecast future results.

AFRM ended the quarter with $2 billion of cash and investments versus $1.4 billion in convertible notes, representing a strong balance sheet.

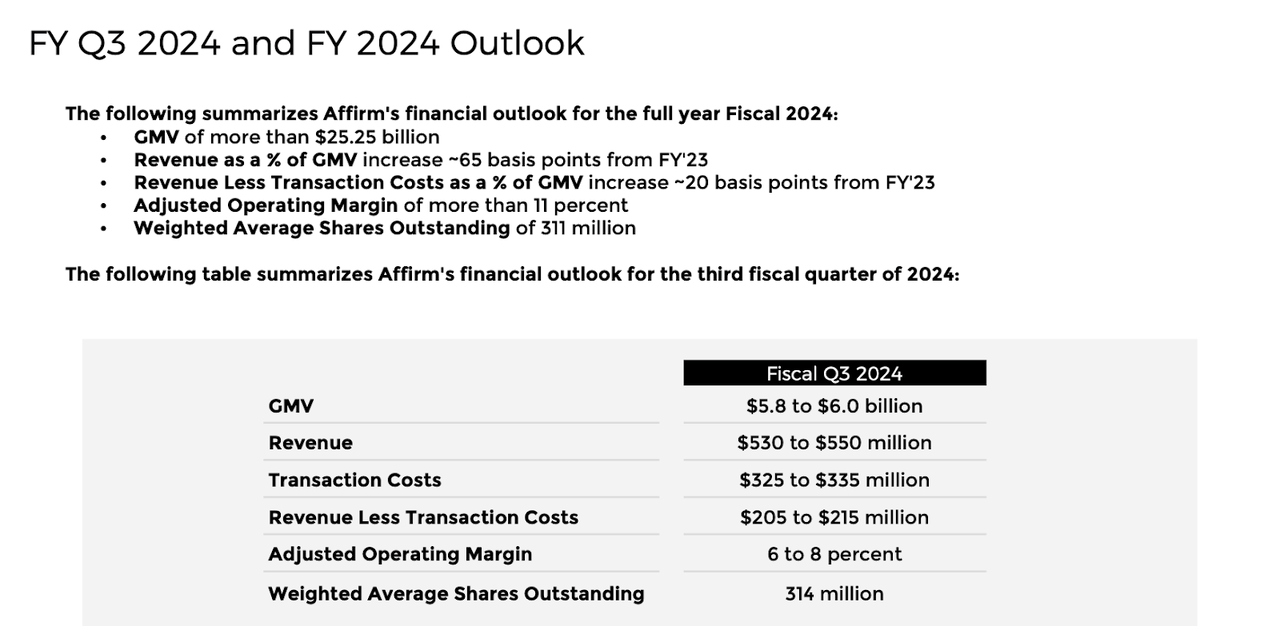

Looking ahead, management has guided for the third quarter to see GMV growth of up to 30%, revenue growth of up to 44%, RLTC growth of up to 28.7%, and adjusted operating margin of 6% to 8%.

On the conference call, management noted that they “really like the environment” and also emphasized that they view guidance as “just a floor.” Management believes that their strong performance is evidence of the company’s ability to underwrite credit more efficiently and accurately than peers. It is difficult to verify these claims given that other BNPL operations are either nonpublic or housed within larger corporations, but AFRM’s results do indicate great outperformance. Management did note that investors should not expect their 36% APR cap to lead to additional volume growth, as they are “completely done” in rolling that out. Management emphasized that they intend to stay within their 3% to 4% RLTC as a % of GMV target, calling that a “real constraint” for the business that helps to guide how aggressive they can be in acquiring new business.

Is AFRM Stock A Buy, Sell, or Hold?

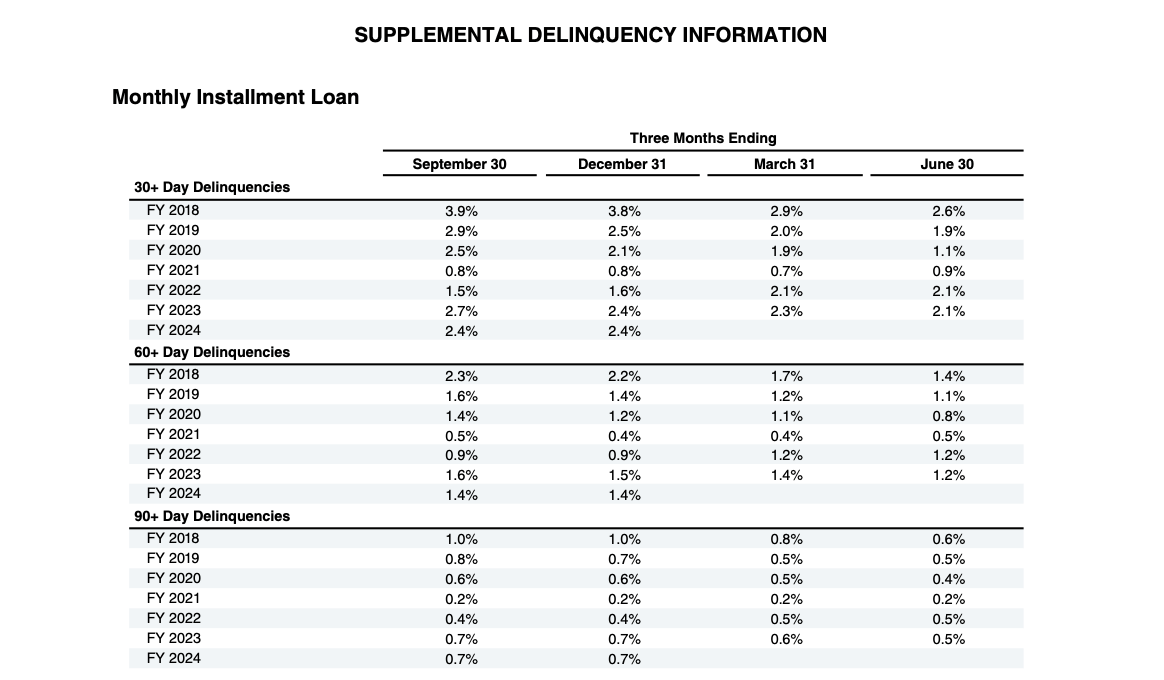

Entering the rising interest rate backdrop, many investors may have expected AFRM to experience great financial difficulties highlighted by increased delinquencies. However, the rise in delinquency rates have proven to be very gradual, basically returning to pre-pandemic levels but not more than that.

FY24 Q2 Presentation

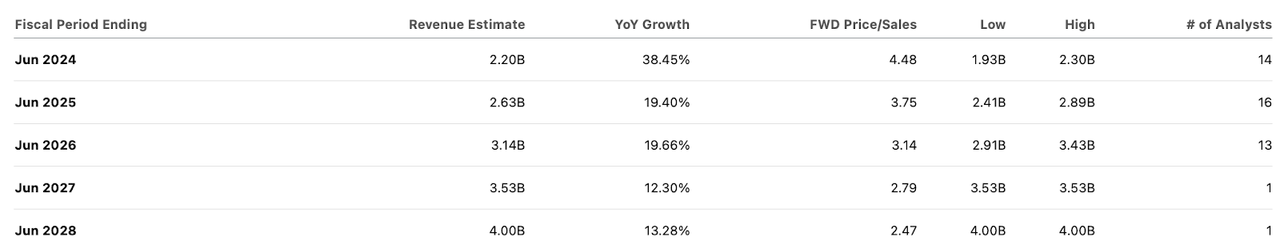

AFRM’s strong results have proven the skeptics wrong. Consensus estimates call for the company to generate around 19% top-line growth in the next fiscal year.

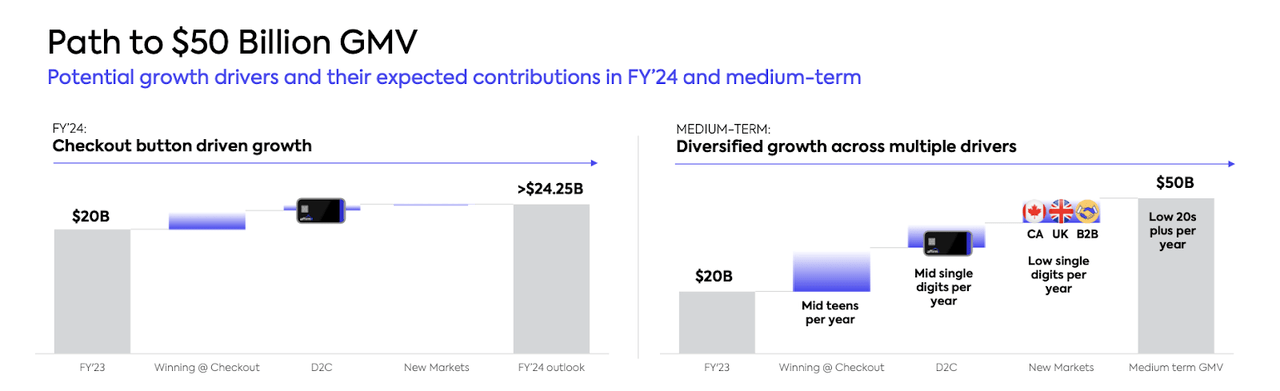

There may be upside to consensus estimates. In addition to the company already showing acceleration in top-line growth including a 32% GMV growth rate in this past quarter, management has also outlined the path for at least 20% GMV growth over the medium term.

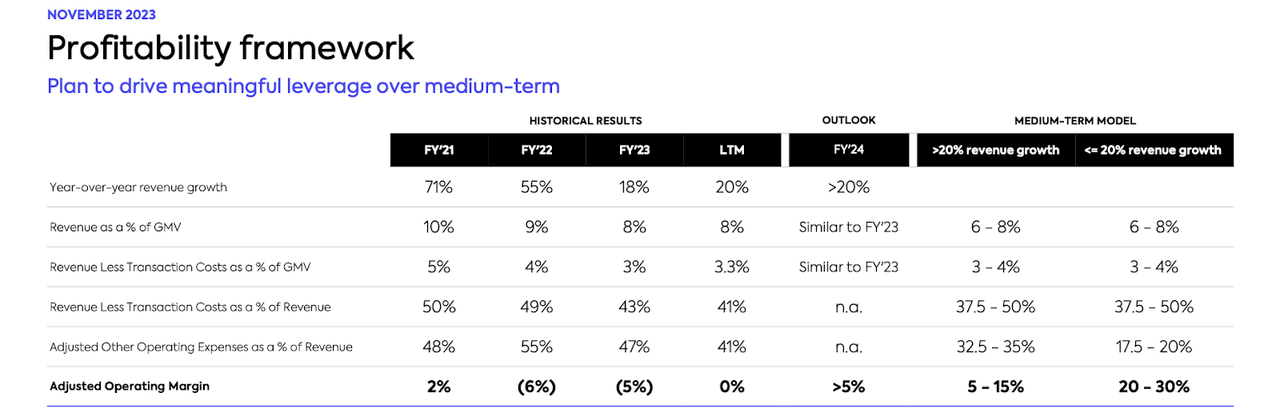

As stated earlier, the company is operating within its 3% to 4% RLTC as a percentage of GMV framework, making it plausible to expect revenue and RLTC to grow at rates close to GMV. AFRM has targeted a 20% to 30% adjusted operating margin over the long term.

If we assume that the company can generate a 20% long term net margin, and that the company can sustain 20% top-line growth, then the stock is trading at around 19x forward earnings and at around a 1x price to earnings growth ratio (‘PEG ratio’). Investors who have not examined AFRM’s strong results might come to the conclusion that the stock has reached “meme status,” but I have reached different conclusions as the company has performed extraordinarily in spite of interest rate headwinds.

It is difficult to calculate a fair value estimate for the stock. On the one hand, it is tempting to assign AFRM a low mature earnings multiple estimate due to its exposure to economic conditions. On the other hand, AFRM does not have the same deposit risk as traditional banks, its loans are inherently low duration in nature, and the company maintains a net cash balance sheet. I think that as long as the company is growing its top-line at a 20% clip, a 15x to 18x earnings multiple looks appropriate, and this allows for solid returns over the next 5-7 years as the company continues to execute against its growth opportunities. I can see the stock delivering returns almost in-line with top-line growth moving forward, implying a 12-month stock price of around $40 per share.

What are the key risks? It is possible that I am premature in assuming that management is back to issuing conservative guidance. It is possible that top-line growth proves to be much slower than expected. I am skeptical of this risk, at least in the medium term, given that macro conditions appear to be improving rapidly for e-commerce operators and (as stated repeatedly), AFRM is unlikely to face the same headwinds posed from a compression of RLTC as a percentage of GMV. Competition remains an important risk. Larger names like PayPal (PYPL) and Apple Pay (AAPL) may prove to be formidable competitors, as it is not immediately clear how loyal consumers will prove at the time of checkout. Investors should be mindful of volatility, as AFRM continues to trade as if it has great exposure to interest rates (which it does), and it is not clear if consensus on Wall Street is viewing AFRM as a high quality stock as of yet.

Conclusion

Against all odds, AFRM has emerged from the higher interest rate environment on solid footing, and is now benefiting from accelerating GMV growth, normalizing revenue growth, and rapidly improving profit margins. The company maintains a net cash balance sheet and the stock trades at GARP-like valuations. I am upgrading the stock to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!