Summary:

- AT&T has transformed itself by shedding non-core assets and cutting costs, making it a more focused and streamlined wireless provider.

- The stock has rebounded from its low levels and is poised to break out to new 52-week highs.

- Earnings estimates imply a low price to earnings ratio and the company’s dividend yield is attractive, especially as interest rates decline.

Joe Hendrickson

I last wrote about AT&T (NYSE:T) back in 2014, and I suggested buying a pullback in the stock when it was trading for about $24. The stock ended up going to around $33 in 2016, and I sold my shares. Now I see another opportunity to buy this stock. This company has been dealing with many challenges over the past few years and until fairly recently, the stock has been in a major downtrend. However, I now believe it is once again an ideal time to be accumulating this stock on pullbacks.

One major reason for taking a fresh look at AT&T right now, is because the company has transformed itself over the past few years. It has been shedding non-core assets, it has been cutting costs, and it is a more focused and streamlined wireless provider. Investors seem to be finally appreciating these changes, but there still appears to be plenty of upside left. AT&T recently announced it would increase prices on its unlimited plans by 99 cents per month, starting on March 5, 2024. This is the first increase in the unlimited plan since 2020. While a 99 cent increase is not a lot, when it is multiplied by the millions of users this company has, it will add up and benefit AT&T’s bottom line in the coming quarters. Let’s take a closer look at some additional positive trends that appear to be emerging:

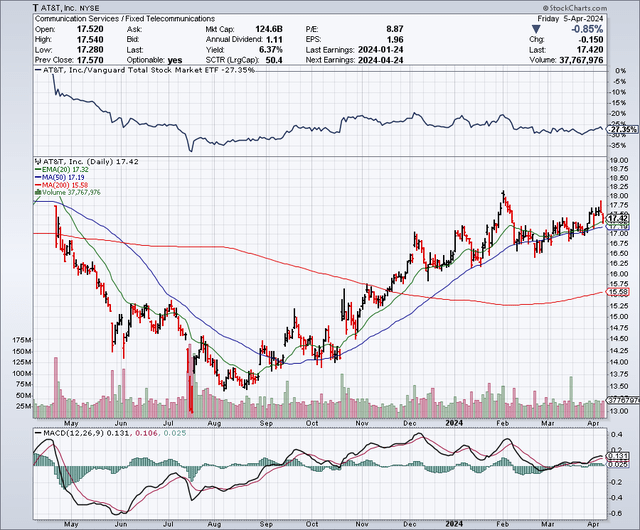

The Chart

As the chart below shows, this stock bottomed out in the $13 range in the third quarter of last year. It was surprising to see such an iconic company trading at these low levels, but since then, this stock has been rebounding. In December, a bullish “Golden Cross” was formed on the chart with the 50-day moving average (which is currently $17.19), having risen above the 200-day moving average which is currently $15.58.

As this chart shows, it has been paying off to buy any dips in this stock for the past several months, and I expect this trend to continue. I also think this stock is poised to break out to new 52-week highs. With the stock now trading at about $17.50 and the 52-week high being around $19.99, it won’t take too much of a move higher before that level is taken out. I believe a strong quarterly report or the Fed cutting rates sometime this year will be all it takes for AT&T shares to start making new 52-week highs. My expectation of this is another reason why I believe it makes sense to buy any pullback in this stock now.

Earnings Estimates And The Balance Sheet

Analysts expect AT&T to earn $2.20 per share in 2024, with revenues coming in at $123.71 billion. For 2025, earnings estimates are at $2.30 per share, on revenues of $124.68 billion. In 2026, the company is expected to earn $2.35 per share, with $125.89 billion in revenues. These earnings estimates imply a price to earnings ratio of just 8, and this is way below the current price to earnings multiple for the S&P 500 Index (SPY) which is currently trading for about 28 times earnings. Many tobacco stocks are trading for about 8 times earnings, and those businesses are seeing volume declines, so to me, it makes no sense for telecom companies to also trade at this level. I believe multiple expansion can occur as interest rates decline in the coming years and as AT&T pays down debt, and grows earnings.

As for the balance sheet, AT&T has $161.26 billion in debt and nearly $7 billion in cash. This is a very large amount of debt, and it is something to consider when investing in this stock. I believe the company should work hard to pay down debt over the coming years. This could increase its ratings with credit agencies.

The Dividend

AT&T pays a quarterly dividend of $0.2775 per share, which totals $1.11 per share on an annual basis. This provides a yield of nearly 6.4%. That is already more than the roughly 5.2% yield that many money market funds currently offer. However, the Federal Reserve recently released projections that suggest a 2.25 point drop in the Fed Funds rate by the end of 2026. This indicates the Fed funds target rate would drop from the current range of 5.25% to 5.5%, to a range of 3% to 3.25%, by the end of 2026. If these Federal Reserve projections are accurate, it means money market funds could see yields drop down to about 3% or so. This would likely make many investors hungry for yield again. These rate cuts are what could make AT&T’s dividend yield very attractive and send the shares higher in the future.

The Lead Cable Issue

In 2023, a number of phone companies such as AT&T and Verizon (VZ) were hit by investigation and lawsuits over the health concerns that might come from lead-sheathed cables. Analysts at Goldman Sachs (GS) suggest this liability could cost AT&T about $4 billion. While this is a large amount of money, it is not so much for AT&T. As we saw above, this company has about $161 billion in debt, so let’s just say AT&T had to pay the $4 billion by issuing more debt right away. All it would need to potentially do to put this issue behind it, is add another $4 billion to the debt of $161+m in debt. I bring up the debt load because it just shows that AT&T is a huge company and the lead cable issue is a drop in the bucket. So, while the lead cable issue can grab headlines, I would ignore this noise and buy dips if any headlines from this issue take the stock lower.

The Data Breach Issue

On March 30, 2024, AT&T announced that about 73 million current and former customers had their data stolen. It did not take long for multiple class action lawsuits to be filed and this is another liability AT&T will have to deal with. This data breach news was released over a weekend, and on the following Monday, AT&T shares were trading down slightly in the low $17 range, but later that day and for the rest of the trading week, this news seems to have been shrugged off by the market. So many companies have had data breaches and it seems to be something consumers and investors accept as a part of modern life.

Potential Upside Catalysts

AT&T’s price increases will add significant incremental revenue in the coming quarters and this could create a positive tailwind on financial results going forward. Management recently announced a goal for $2 billion (or more) in additional cost cuts to be implemented between now and mid-2026. This could be another beneficial tailwind for financial results and an upside catalyst for the stock. While the Fed might try to delay rate cuts for as long as possible, sooner or later cuts are likely to happen and lower rates could create renewed demand for higher yielding stocks like AT&T. I am expecting this to result in capital gains for AT&T shareholders, which combined with the 6.4% yield will amount to a generous total return. As the chart shows, the technical outlook for this stock is very positive and bullish technicals (combined with bullish fundamentals) could lead to a breakout and new 52-week highs. My target price for the next few months is $20 per share with more upside potential into 2025 and 2026.

Potential Downside Risks

The wireless phone business is extremely competitive and will likely continue to be that way. AT&T’s debt load is a potential downside risk, and I believe this sizable amount of debt is impacting the valuation of this stock and could become a bigger issue if revenues and profits were to decline. AT&T debt outlook is rated as stable by most credit agencies and it has a BBB rating by S&P. It is important that ratings do not get downgraded to lower levels.

In Summary

A mobile phone and the service to operate it are one of the most essential needs for almost anyone to function these days. I feel like telecom stocks should be valued like the consumer staples sector, which is valued at a much higher multiple, but for now telecom stocks are valued more like tobacco companies. I see that the debt level is a concern but at just around 8 times earnings, this stock appears deeply undervalued.

The yield is extremely attractive now, and will probably become even more attractive as interest rates decline. The decline in interest rates helps AT&T shareholders in two ways: Lower interest rates could push the valuations of dividend stocks significantly higher, and at the same time, lower rates help reduce interest expenses for companies that have significant debt loads like AT&T. This stock is in an uptrend now and I expect it to continue. It won’t take too much more in the way of gains for this stock to break out and trade at a new 52-week high. I plan to accumulate AT&T shares on pullbacks and another attractive way to get involved with this uptrending stock is to sell put options. Selling the $17 strike price for AT&T put options is an ideal strategy to me, because it gives investors a chance to either collect some option premium or to possibly buy the shares somewhere in the $16 range after factoring in the option premium.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.