Summary:

- Intense competition will likely continue to erode Tesla, Inc.’s market position and already mediocre margins.

- It does not have a core competency in battery production and it relies on third parties for this crucial component of an EV.

- Its charging network is not a moat, and it can’t be a source of excess profits. It will likely only deliver a fair rate of return.

- Even if the FSD Supervised updated software allows for faster AI Training and a robotaxi in August, Tesla is still 7-years behind the market leader, and it has nothing special to bring to the table. It likely won’t be a home run.

- Despite the recent selloff, Tesla stock is still overpriced.

Justin Paget/DigitalVision via Getty Images

Tesla, Inc. (NASDAQ:TSLA) recently reported disappointing vehicle delivery figures for Q1 2024. Not only did it badly miss the consensus of analyst estimates (449,000), but deliveries were also lower than the previous quarter. Some of this drop might be explainable by seasonality, as the first quarter is always the weakest quarter for sales in China due to the Chinese New Year holiday. Crucially however, sales were also lower by 36,000 vehicles compared to the same quarter in 2023, which also included that holiday, and which occurred when China still had Covid lockdowns in many cities.

Table 1: Tesla – Number of Vehicles Delivered

|

Q1 2023 |

Q4 2023 |

Q1 2024 |

|

422,875 |

484,507 |

386,810 |

There have been disappointments such as this before that have caused temporary drops in the stock price, and maybe these weak numbers are partially explainable by short term factors such as the discontinuation of consumer subsidies in key European markets. That said, there clearly is a lot of anxiety surrounding the stock. On April 5, a Reuters story stated that Tesla was halting the development of its $25,000 Model 2 car, and its stock dropped 4%. A few hours later, CEO Elon Musk tweeted that Reuters was lying, and Tesla subsequently announced that it would have a robotaxi rolled out by August 2024. This was met with skepticism, because Elon Musk has previously stated on several occasions that such a step was imminent, only for these promises to not be kept.

It is time, therefore, to step back and ask if this really is only a blip, in which case Tesla is still a growth stock, or is it something more fundamental, in which case Tesla should now be valued like a traditional non-growth company. To answer this question, we need to look first at what Tesla is as a company today, second, what are the sources of any potential future growth, and third, if Tesla can still execute on these opportunities the way it has in the past.

I. What is Tesla today?

Tesla has always been considered to be a growth stock, where traditional metrics like P/E ratios and valuation methods like Discounted Cash Flows (“DCF”) have not been appropriate to value it. Investors have rightly focused not on what Tesla was, but rather, on what it had to the potential to become. From time to time, there have been missteps which have given investors cause to question Tesla’s ability to execute on the opportunity in front of it, but in general, the market consensus regarding the opportunity itself has never wavered.

In part, this was due to faith in Elon Musk, who cut his teeth in Silicon Valley, where he learned about showmanship, first mover advantage, how Apple was able to create an ecosystem to build a moat, and later, about the importance of big data. So, although Tesla’s Market Cap is one of the worst performers recently in the S&P 500 (SP500), down substantially from its $1 Trillion peak market cap, its shares still have risen by 800% over the past five years, and it is now the largest carmaker in the world when measured by market cap.

Table 2: Leading Car Companies Market Cap USD Billions – April 5, 2024

|

Tesla, Inc |

Toyota Motor Corp (TM) |

Stellantis N.V. (STLA) |

Porsche A.G. (OTCPK:DRPRY) |

Mercedes-Benz A.G. (OTCPK:MBGAF) |

BMW (OTCPK:BMWYY) |

|

|

Market Cap |

$525.17 |

$321.55 |

$103.19 |

$93.91 |

$83.83 |

$76.66 |

1) Is Tesla really the biggest car company in the world?

Per Table 2, Tesla is the largest car maker in the world when measured by market cap, with a valuation that is 63% higher than Toyota’s. However, when measured by Enterprise Value, the gap is much narrower. Enterprise Value is calculated by adding a company’s market cap to the market value of its debt. As banks are reluctant to lend to unprofitable companies, and Tesla has only recently become profitable, Tesla has very little debt. Therefore, when measured by Enterprise Value, Tesla is only 7.5% larger than Toyota. If one uses the number of employees companies have, then Toyota is the largest car company in the world. Toyota needs this large work force because it sells more vehicles than any other company in the world. In 2023, it sold 10.8 million vehicles followed by Volkswagen (8.8 million), Hyundai-Kia (7.1 million) and Renault-Nissan (6.9 million). Tesla by contrast, did not make the Top 10, selling only 1.84 million vehicles.

Table 3: Leading Car Companies

|

Tesla, Inc |

Toyota Motor Corp |

Stellantis N.V. |

Porsche A.G. |

Mercedes-Benz A.G. |

BMW |

|

|

Enterprise Value USD Billions1 |

$506.63 |

$471.16 |

$84.49 |

$93.35 |

$182.04 |

$167.80 |

|

Number of Employees1 |

140,473 |

375,235 |

258,275 |

40,694 |

166,056 |

154,950 |

|

Revenue per Employee1 |

688.91K |

– |

810.21K |

1.10M |

1.02M |

1.11M |

2) Does Tesla squeeze more juice from the lemon?

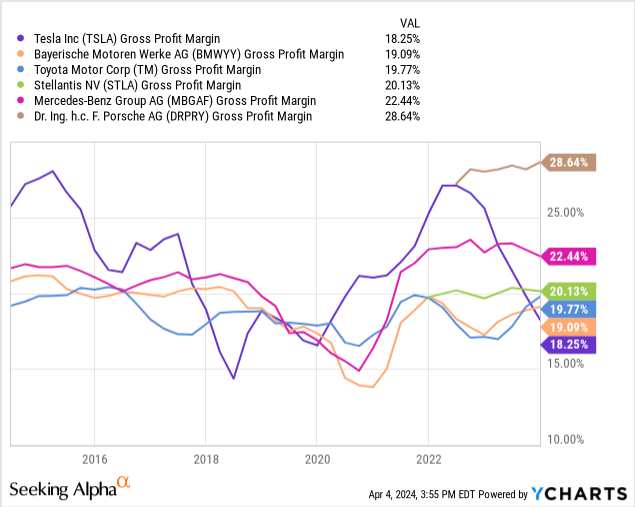

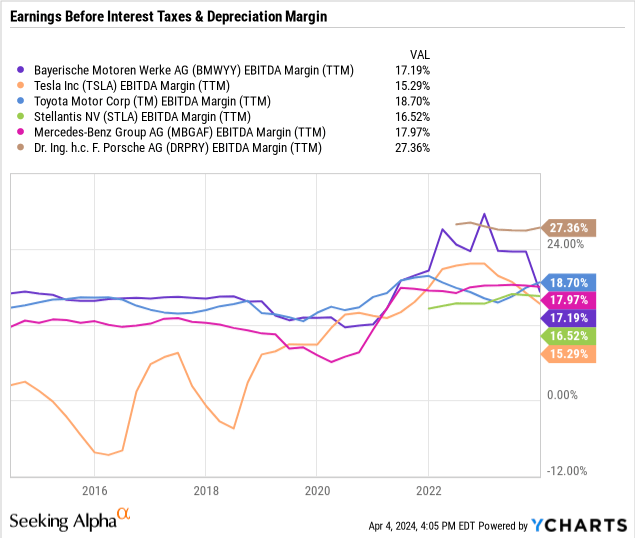

It depends on how you look at it, but no, not really, is the answer. As per Table 3, in terms of Revenue per employee, Tesla ranks fifth out of five peer companies. And in terms of costs? Gross Profit Margin is what is left over after the Cost of Goods Sold is deducted from Revenue. Using this metric, Tesla ranks fifth out of six peers, well below manufacturers like Porsche, Mercedes Benz and Toyota. This means it has higher manufacturing costs than those peers.

If you look at Net Income Margin however, Tesla ranks first in its peer group with a NIM of 15.5%. The next closest competitor is Porsche (12.72%), and the worst company is BMW at 7.26%. Obviously the legacy companies have a lot of overhead and fat to trim, whereas Tesla is a lean mean fighting machine. Right? … Right? … Well, not really – there is an explanation.

First, the legacy companies use a lot of debt in their capital structure, and Toyota, Mercedes Benz and BMW all have Debt / Equity Ratios in excess of 100%. The interest payments on this debt are a deduction that reduces Net Income.

Second, it appears that the legacy manufacturers use less labor and more capital goods in their manufacturing processes. For example, Toyota produces 10.8 million vehicles with 375,235 employees, or 28.8 vehicles per employee. Tesla’s output, by contrast, is only 13 vehicles per employee. As a result, the legacy companies all have large depreciation and amortization expenses. EBITDA, (Earnings Before Interest Tax and Depreciation) is similar to cash flow, and Tesla has a similar EBITDA Margin as most legacy car manufacturers, with only Porsche sticking out as a positive outlier.

3) What is Tesla’s Market position?

Once upon a time, Tesla dominated the battery electric vehicle, or BEV, market, but that is no longer the case. Similar to a Tech company introducing a new smartphone, piece of Virtual Realty Bio Wear, or some other new gadget, Tesla initially targeted early adapters. These tend to be people with money to burn who buy a new type of product at an inflated price, not only for its perceived benefits, but also because they view it as a status symbol, and / or because they’re bored with what they currently have. Over time as the market broadens larger production runs are possible. This allows for economies of scale which lead to lower costs and prices, and a virtual cycle ensues.

Unquestionably Tesla made the right choice in pursuing the high end market. However, subsequent decisions and low cost producers from China mean that Tesla is now in danger of not realizing the benefits that usually accrue to a first mover from wide spread adaption.

Tesla lost its crown as the world’s largest manufacturer of BEVs in Q4 2023 to BYD Company (OTCPK:BYDDF). Although seasonal weakness in China related to the Chinese new year have allowed Tesla to reclaim the Number 1 ranking for Q1 2024, most analysts believe that BYD will ultimately overtake Tesla again. In large part, this is because China is the world’s largest and fastest-growing BEV market.

China is important to Tesla, as it gets 22% of its revenue from there, but increasingly, Tesla is not important to China. In 2023, its share of the Chinese market fell to 6.7% from 10.5% the year before. This is despite it cutting prices a number of times due to the fact that BYD and other Chinese companies are able to manufacture and offer BEVs at a fraction of the price that Tesla can. In fact, some analysts estimate that as much as 33% of Tesla’s Chinese sales are at a price below its average cost.

Worryingly, this isn’t due to cheap labor or unfair government subsidies. Tesla has a Shanghai factory, and another facility in Beijing, so it has the same labour costs as its Chinese competitors, and historically it has been the largest recipient of subsidies from the Chinese government. The fact of the matter is that BYD has built a better mousetrap.

4) Tesla seems to have forgotten that Batteries are a core competency for BEV Manufacturers

At the heart of every BEV is a battery; Tesla seems to have forgotten this, because it is reliant upon third parties and competitors for its batteries. Its existing technology leaves it poorly positioned to address the segments of the market that will experience the most growth in the next decade. Competitors are able to build similar quality cars at a much lower price, because their batteries cost 30% less to make.

Tesla uses three cylindrical Lithium Ion batteries. Initially, Tesla purchased existing general purpose 18650 batteries from Panasonic, the third largest battery producer in the world. Later, the two entered into a partnership, and since 2014, Panasonic has been manufacturing 2170s at Tesla’s Gigafactory in Nevada.

Although many believe that Tesla makes its own batteries in Nevada, this isn’t true. Panasonic owns the IP, and Panasonic leases space in Tesla’s Factory to produce the batteries. It then passes the finished product over to Tesla, who then assembles them into battery packs. Tesla also purchases batteries from LG Energy Solution, a Korean company that produces 2170s for Tesla in China, for use in its Shanghai factory. Tesla is only now starting to vertically integrate, and it has invested heavily into the 4680, which it produces in Austin Texas – it has encouraged its suppliers to do the same.

Traditional Lithium Ion Batteries are expensive because they use metals like cobalt and manganese. They are also controversial due to reports of child labor being used in mines in the Democratic Republic of Congo, the only source of Cobalt. As a result, Tesla has been trying to scale back the use of these metals and replace them with nickel, which is more readily sourced and cheaper.

As well as cylindrical batteries, Tesla also buys Prismatic Lithium Iron Phosphate (LFP) batteries from the world’s largest battery manufacturer, which is Contemporary Amperex Technology Co., Limited ((CATL)). These are used in the Model 3 and the Model Y, and I was extremely surprised to learn that more than 50% of Teslas that are now sold contain LFP battery packs from CATL. My surprise isn’t because there is an issue with LFPs, but because Tesla doesn’t control of this crucial part of the production process. As mentioned above, Tesla is trying to correct this by making its own 4680s.

Unlike Tesla, whose DNA can be traced back to Silicon Valley, BYD started life making batteries for cell phones. When it decided to make BEVs, it received an infusion of capital from Berkshire Hathaway (BRK.A), and Charlie Munger reportedly called it his best ever investment.

BYD is now neck-and-neck with Tesla in terms of vehicles sold, and its entry level vehicle costs circa $10,000. Compare this to an entry level Model 3, which costs $40,000, or to the Model 2, which Tesla plans on selling for “somewhere around $25,000.” Since 2020, all BYD cars come with its Blade Battery, an LFP that many industry sources rate as the best in class.

Surprisingly, Tesla has been using BYD blades in its Berlin Gigafactory. I find this astounding. It would be much like Apple using Microsoft’s Windows NT, or Ferrari using a Ford engine. It’s a safe bet that BYD sells its batteries to Tesla at a higher price than their own internal cost. Clearly relying on third parties like Panasonic, LG Energy Solutions and CATL, as well as sourcing batteries from competitors isn’t a long-term recipe for success. More worryingly, though, is that not having a core competency in batteries means that Tesla will struggle to innovate, and it will always be behind the curve.

Tesla is betting on Lithium in a big way, and it is investing over $1 billion to build a Lithium refinery in Texas that is scheduled to start production in 2025. It is quite possible that this is the wrong bet, and that Tesla is in danger of making the same mistake Toyota did in 2010. Much like Tesla’s BEV position today, in 2010, Toyota had a market-leading position in Hybrids, as it had invented this category with the Toyota Prius. It was considering partnering up with Tesla to take the next step into BEVs, so it sold its shuttered NUMI plant in California to Tesla for $42 million, after first buying 3% of Tesla’s equity for $50 million.

The two companies collaborated to produce a few hundred electric RAV4s, but ultimately Toyota turned away from BEVs to focus on Hydrogen fuel cells. Toyota did so because it determined that it was not possible to profitably produce the small sub compact cars it sold in Japan if they were BEVs.

It was a spectacularly bad decision. Today, Toyota’s BEV hopes rest on the possibility of developing a solid state battery that will allow it to leapfrog the rest of the market in 5 to 10 years time.

Sodium is one of the most common elements in the world, think of salt. It is also right next to lithium on the periodic table of elements. By contrast, the vast majority of the world’s supply of lithium is controlled by China. It is also environmentally unfriendly and expensive to process. In July 2021 CATL announced its first Generation Sodium Ion battery, or Na-Ion battery. The main benefits of an Na-Ion battery are cost, fast charging times, performance at low temperatures, and safety, as it is less likely to catch fire.

However, due to its low energy density, it was forecast that it would only be practical to use these batteries for energy storage, and small vehicles such as two-wheel EVs, forklifts, and golf carts. CATL subsequently proposed a battery pack that was a mixture of Na-Ion and Lithium Ion batteries, that would have a range of up to 400 km. In April 2023, Chinese car company Cherry announced that it would use CATL’s sodium-ion batteries. However, both have been beaten to the punch, as JAC, a Chinese company partially owned by Volkswagen, produced the Yiwei, the world’s first Na-Ion car in December 2023. It has been selling in China since January 2024, and in February, 5,000 were exported to Central America.

Not to be outdone, BYD broke ground on a new 30 GWh factory which will produce Sodium Ion batteries for its scooters and micro vehicles such as the Seagull. A Lithium Ion Seagull is forecast to cost $11,600 and it is anticipated that a Seagull with an Na-Ion battery will cost $8,500. Tesla bulls who are anticipating a future where the market doubles every 7 or 8 years, with Tesla capturing most of this growth, leading to fat profits and add on revenue from more visits to Tesla charging stations and $200 a month full self-driving (“FSD”) subscriptions, may have to revisit their assumptions.

5) Does the market still value Tesla as a growth stock?

Soon after Tesla became profitable, its shares started to drastically underperform both the overall market, and the shares of its competitors. Despite this, it appears as if the market still treats Tesla as a growth stock. Using the average forecast earnings for next year of the 47 Wall Street Analysts who cover it, Tesla trades at a forward P/E ratio of 62. The next highest ratio is Porsche’s at 17.2, and then Toyota’s at 10.4. Clearly the market has priced in a higher rate of growth for Tesla than it has for its competitors.

Table 4: Total Return as of April 5, 2024

|

Tesla, Inc |

Toyota Motor Corp |

Stellantis N.V. |

Porsche A.G. |

Mercedes-Benz A.G. |

BMW |

|

|

Return on Shares YTD |

-33.64% |

31.28% |

14.24% |

15.45% |

17.12% |

9.35% |

|

Return on Shares One Year |

-11.11% |

73.45% |

65.25% |

-20.07% |

16.74% |

22.54% |

|

Return on Shares Three Years |

-28.41% |

65.41% |

75.09% |

– |

25.80% |

34.99% |

|

Return on Shares Five Years |

799.59% |

123.12% |

190.68% |

– |

107.17% |

99.96% |

II. Where might Tesla’s future growth come from?

Tesla bulls’ hopes fall into in three categories: 1) Continued growth of the market; 2) Tesla’s network of chargers; and 3) Tesla’s self-driving ambitions.

1) A rising tide lifts all boats

To some extent, whether you believe that the Battery Electric Vehicle market will grow by 21% in 2024, or if you believe that the market will grow by 9.8% annually for the next 5 years is immaterial in the long term. There will be ups and down, but the market will expand. The real questions are: “How much of this growth will Tesla be able to profitably capture“?; and, “Are there other players that will capture more of it“?

The world is different than it was 10-years ago. According to a separate analysis by Bloomberg Green about the U.S. market

“… the era of scarcity is coming to an end. The number of vehicles that can go 300 miles or more on a charge, which many consider the bar for US range convenience, jumped to 30 models at the beginning of 2024, a 500% increase in three years. A dozen more are set to go on sale later in the year.”

So, while the market as a whole is forecast to grow substantially, it seems unlikely that Tesla will capture the lion’s share of that growth, and it also likely that Tesla’s U.S. margins will come under further pressure, much as they have in China.

2) There is an opportunity in Superchargers, but a charging network isn’t a moat

As the first mover, Tesla took the lead in building the network of charging stations in both the U.S. and the EU. Forecasts made at the time that Tesla would be able to use this “ecosystem” as a moat to protect market share in much the same way that Apple was initially able to use i-Tunes to dominate the smartphone market were misguided. No government would ever allow Boeing or Pan Am to build a common resource like an airport so that they could restrict usage to their ‘planes, or, allow someone like Mark Zuckerberg to buy the Golden Gate bridge for the exclusive use of Meta Employees.

It was no surprise, therefore, that the EU forced Tesla to use the same plug as other manufacturers, and to allow access for non-Tesla EVs to its European network of charging stations. Seeing the writing on the wall, Elon Musk wisely did the same thing voluntarily in the U.S., thereby locking in Tesla’s standard as the market standard in the U.S.

As the BEV market continues to grow, the need for more charging stations to be built is clear, and Governments all over the world (including the USA through the Inflation Reduction Act) are legislating as well as subsidizing this buildout. There is money to be made, but I don’t think it will become the home run Tesla bulls hope for. There are four reasons I hold this opinion.

- First, Gas Stations aren’t core business for existing internal combustion engine, or ICE, automobile manufacturers. Ford, GM, VW, etc. have determined that they can make a higher return on capital by building cars than they can by competing with oil refiners like Exxon. Without a strategic reason such as building a moat, I suspect that the same will be true for Tesla in the charging market.

- The second reason is competitive pressure; Tesla will one of many. Other EV manufacturers are building their own networks and it isn’t only car companies entering this business. Enel, an Italian energy giant, wants to deploy 2 million chargers in the U.S. by 2030. One would expect that it will be able to produce and deploy chargers cheaper than Tesla will be able buy chargers from them, and then deploy them at its own charging sites.

- The third reason is governments. Even if Tesla were able to achieve a monopoly position and the relevant governments were to allow this to continue, it would be forced to charge a lower price than what the market will bear. Similarly, governments only give out subsidies if they get something in return, and this usually has nothing to do with profit maximization. The IRA for example, offers a 30% subsidy for charging equipment for residential users, and a maximum of $100,000 for equipment used in commercial sites that is installed before 2032, so long as the properties in question are in low income or non-urban communities. There aren’t a lot of Teslas in low income communities, but perhaps Tesla’s the Cyber Truck will do better than Ford’s F150 Lightening did in non-urban communities.

- According to NACS, there are more than 145,000 fueling stations in the USA. They occupy prime positions accessible to transportation links and 64% of these are independently operated. Many will be converted to charging stations, or dual fossil fuel / charging stations.

3) Tesla’s Self Driving Ambitions

Tesla offers three self-driving options. Autopilot was introduced in 2014, and it is provided free of charge. Enhanced Autopilot has more features and costs $6,000. The third option also allows a car to stop and go at stop lights. This option costs $200 per month, or $12,000 upfront.

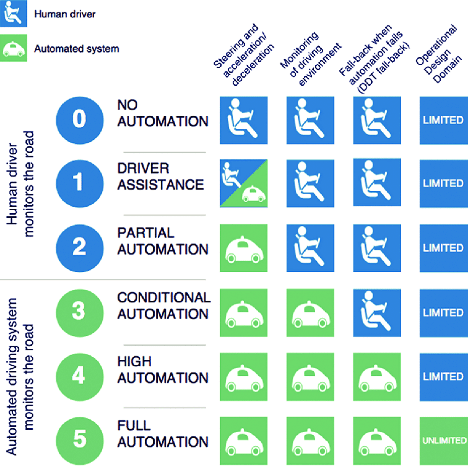

It has somewhat controversially been named Full Self-Driving Beta, or FSD Beta, indicating that it is in the Beta testing phase. The reason for the controversy is because as is the case with both versions of Autopilot, driver supervision is required for FSD.

It is not possible to build an FSD equipped Tesla without a steering wheel, or for drivers to sit in the back seat while the vehicle drives them. So, as with Autopilot, FSD is only rated at Level 2 Automation on the industry standard SAE Scale, and not at Level 4, which is what Full Self-Driving would imply, and what Tesla has promised to deliver to customers who have paid $12,000 upfront. It should be noted that on April 1, 2024 a new version came out which was called FSD Supervised, but it is still a Level 2 system.

Society of Automotive Engineers J193 Rating Scale For Vehicle Ride And Handling

Society of Automotive Engineers

Three thousand new lines of C++ Code was the biggest improvement mentioned in Tesla’s press release concerning FSD Supervised, not some new functionality that will provide value to consumers. This hints at the hurdles Tesla faces. Apparently this new code will speed up the machine learning of the AI that operates Tesla’s cars.

In order for an AI to replicate, and then improve on the actions of a human, it has to interact hundreds of thousands of times or more with human beings. It is probably for this reason, more than marketing purposes, that Tesla has offered Tesla owners a month’s free access to FSD Supervised until April 30. Tesla badly lags behind not only other car makers such as Volvo, Mercedes and Cruise, but especially industry leaders Waymo and Baidu in writing appropriate code and in training its AI.

It isn’t clear that Tesla has a competitive advantage over other car manufacturers in this area, and indeed it lags behind many of them. Volvo, which is owned by Geely Automotive (OTCPK:GELYF), a large Chinese car company, has been testing self-driving cars in Sweden since 2014. Cruise, a company affiliated with GM and Honda, received regulatory approval for its Level 4 self-driving system in October 2020, and it has been trialing a robotaxi in San Francisco since then, although it has recently been forced to pull back from this market by regulators after a crash in October 2023. Meanwhile, Mercedes has operated its SAE Level 3 Drive System in Europe since 2022, and it has announced that it will offer this package in the USA in 2024. In Europe, consumers pay less less than Tesla customers pay for Enhanced Autopilot, a level 2 system, and approximately half of what Tesla charges for FSD Self Drive, which is also only rated Level 2.

Waymo is a software company that started as a division of Alphabet (GOOG) before being spun out as an employee-owned company, with Alphabet retaining a large stake, and deep pocketed institutional investors also contributing capital. It has been operating SAE Level 4 robotaxis in Phoenix since 2017, San Francisco since 2022, and it recently received regulatory approval for Los Angeles, where it will start operating later this year. Waymo does not build its own cars, instead it installs its software in the cars of other manufacturers. In that sense, its strategy is to license its software, much as Microsoft licenses its software to various PC and Laptop manufacturers. So, it doesn’t matter if the car in question is a BEV, ICE, or Hybrid vehicle, and for the last six months Uber and Uber Eat has been using their software in Phoenix, after abandoning its own project to develop a self-driving car.

Baidu, Inc. (BIDU) is the Alphabet of China, with expertise in search, coding, and an AI search engine capability that went live at approximately the same time as Chat GP. It has been operating robotaxis in Beijing for several years, and it has recently expanded to other cities like Wuhan and Chongqing. Unlike Waymo, Baidu is building its own cars that use its software. If Waymo wants to be a Microsoft, only licensing its software, Baidu appears to want be be an Apple, building its own hardware and software. This Youtube Video gives an idea of the functionality of its cars.

End users are also making strides. Human capital is expensive and it will only get more expensive as the work force ages This in my opinion, is what most justifies the hype around self-driving cars. Amazon, which has expertise in sensors and LIDAR technology through automating its warehouses, has invested billions into self-driving software, with a view to using this technology in the trucks that deliver goods to and from its logistic centers. It also has a robototaxi initiative, called Zoox, but it isn’t clear if Amazon is pursuing this as a commercial opportunity, or as a means to the end of training its AI.

In any case, competition is fierce, as can seen by Apple discontinuing its activities in this area in March after investing billions of dollars over a 10 year period. It isn’t clear that Tesla brings anything special to the table, or that if they are successful, that it will be a massive home run. It may be that in the consumer market, self-driving will just be an optional feature car companies offer like leather seats and premium speakers.

III. Conclusion

Tesla has a loyal customer base due to the high quality of its cars and its position as first mover in the BEV market. However, this customer base is limited, and as shown by its experience in China, its products do not suit the mass market. It is now facing the threat of increased competition in the USA.

Tesla is trying to develop the ability to produce its own batteries, so that it does not have to rely on third parties, but compared to competitors like BYD, it is a novice in this space. It is betting on the existing Lithium Ion battery technology, in the hopes that it can lower their costs and improve their performance. This leaves it vulnerable to innovations such as Na-Ion and solid state batteries. It risks losing its status as a leader, and becoming a follower.

Hoped for home-runs like self-driving and fat profits from its charging network are somewhat like the V2 rocket in 1944. Ultimately it didn’t change the course of WWII.

Despite all this, as well as mediocre margins, Tesla, Inc. shares trade at a hefty premium to its peers. Any rebound from recent weakness should be used as an opportunity to reduce or exit the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.