Summary:

- Broadcom has grown through massive acquisitions but lacks a path to long-term shareholder returns.

- The company’s primary source of growth has been mergers, but it has reached a cap on what it can acquire.

- Broadcom’s financial performance shows strong growth, but its gross margin has peaked and it needs acquisitions for further growth.

Sundry Photography

Broadcom (NASDAQ:AVGO) has become famous in both investing and technology circles for its policy of massive acquisitions followed by ruthless cost cutting. The company has become one of the largest tech companies as a result though, with a market capitalization of more than $600 billion, as the company continues its aggressive growth.

As we’ll see throughout this article, despite having strong IP and financials, Broadcom does not have a path to long-term shareholder returns.

Broadcom Overview

Broadcom is one of the largest tech companies in the world, offering both semiconductor solutions and infrastructure software.

Broadcom Investor Presentation

The company has built up a massive IP portfolio, with more than 23k patents. FY23 revenue was $35.8 billion coming from 26 category-leading divisions. The company spent $5.3 billion on R&D, a 14.8% R&D to revenue ratio. While that number might seem high, it’s worth noting the ratio for Intel it’s 29.6%, and for Qualcomm it’s 24.6%.

So the company does spend substantially less than its peers on what’s considered an essential expense for long-term competitiveness.

Broadcom Merger Strategy

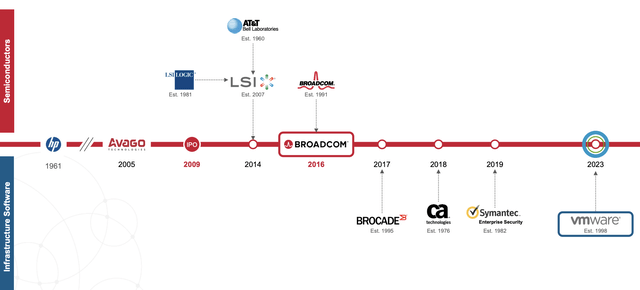

Broadcom’s primary source of growth has been mergers, a strategy that started in 2024.

Broadcom Investor Presentation

The strategy picked up with the acquisition of Broadcom (current brand name) in 2016. That was followed by a spate of major acquisitions. That has closed with the recent acquisition, an almost $70 billion acquisition of VMWare, and the company’s largest ever. The company attempted to acquire Qualcomm for almost $120 billion, but that was rebuffed due to antitrust concerns.

That means that the company has reached an effective cap on what it can acquire. After numerous large acquisitions, there’s not nearly as many options left in today’s expensive tech market as there once was.

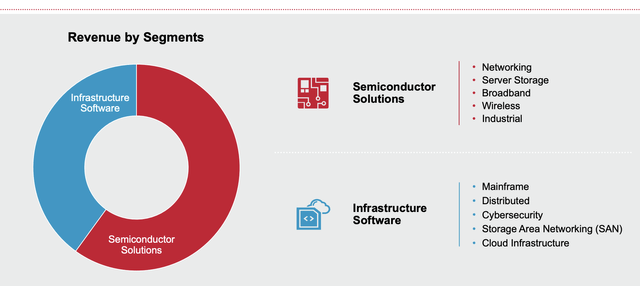

Broadcom Investor Presentation

The above shows the revenue by segment. What was once a semiconductor company has quickly grown to include infrastructure software. That is due to the numerous legacy businesses acquired, and VMWare expands the importance here even further. The one benefit of all of these acquisitions is Broadcom’s diversified portfolio.

Broadcom Financial Performance

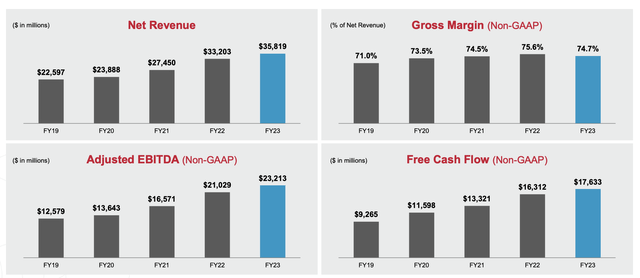

Broadcom’s financial performance show strong growth through continued acquisitions.

Broadcom Investor Presentation

The company has almost $36 billion in revenue and just over $23 billion in adjusted EBITDA. That has almost doubled since FY19. There is a concern here that the company’s gross margin is just under 75%. However, that margin has remained effectively constant since FY20 and it has declined in FY23 versus both FY21 and FY 22. That shows the company has peaked in margins.

The company’s FCF, the number that (for the most part) matters at the end of the day was $18 billion in FY23. That’s a sub 3% FCF yield. Growth also slowed down dramatically from FY22 to FY23 and while artificial intelligence has helped the company, the growth rate hasn’t been staggering. This shows that the company effectively needs acquisitions for growth.

Broadcom Shareholder Returns

The company has provided substantial shareholder returns through its dividend, however, with recent appreciation that has dropped to less than 2%.

Broadcom Investor Presentation

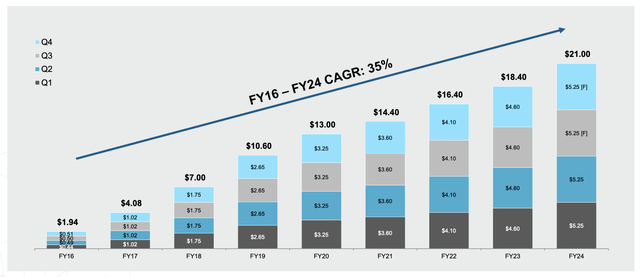

The company has managed to grow its dividend at 35% annually and its dividend is now $21 / share. The company has utilized prior share repurchases in 2021-2022, but since then, they’ve virtually all tapered off. That makes a sub 2% dividend the primary form of shareholder returns. That also shows the impact of share price appreciation, the company had a >3% yield until 2023.

Lower shareholder returns through cash flow means the company will need to reward shareholders with growth. As we’ll see below, we expect that that growth will be hard to continue.

Broadcom Conundrum

In our view, Broadcom has three major conundrums that are facing it as a company. These three issues will work in aggregate to hurt the company’s ability to drive future returns.

The first is the company’s size. The company now has a market capitalization of more than $600 billion. Prior attempted major acquisitions, such as an attempt to buy Qualcomm, were rejected on anti-trust concerns. For the company to double in size, it needs to grow to more than $1 trillion. That’s a tough thing to do, there’s not a lot of needle moving companies.

The second is an internal organization impacted by years of ruthless efficiency. The company is renowned for years of cutting expenses, acquiring, and firing. Broadcom is known for an age distribution that skews higher, with minimal young / new grad employees. That ruthless efficiency means there’s less fat, it’ll be hard for the company to cut costs further going forward.

The third is high interest rates. The company has more than $70 billion in long-term debt. It’s a sizable debt load that could roll off at higher interest rates. New debt will also be expensive, headed towards 6+%. That makes any acquisitions big enough to move the needle likely to involve expensive debt, making it less likely to drive value.

There is a final risk that some of Broadcom’s largest customers are hoping to replace it. Apple and Broadcom have a multi-billion dollar deal, and Apple which is Broadcom’s largest customer at 20% of revenue, is looking to remove Broadcom from the mix. While it’ll take time, that’s clearly a continued risk facing Broadcom.

Thesis Risk

The largest risk to our thesis is Broadcom and Hock Tan’s ruthless efficiency. The company has become adept to operating more efficiently than most of its peers, and it’s continuing to undergo a much larger acquisition strategy than its peers. That combination could result in the company continuing to receive a higher multiple from the market and grow.

Conclusion

Broadcom is a great company with an adept management team. The company has an impressive portfolio of IP that it is continuing to invest heavily in and maintains one of the highest gross margins in the industry. Revenue has continued to grow substantially supporting rapid growth in both the company’s FCF and dividend.

However, the company is expensive. Its market capitalization is more than $600 billion and it’s working to integrate an expensive VMWare acquisition with hefty debt in a high interest rate environment. There’s minimal remaining opportunities to achieve future growth. That combined with a high valuation, could substantially hurt the company’s ability to drive future returns.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.