Summary:

- Increased oil prices have caused a swing in sentiment for most offshore drillers over the past month with market leader Transocean outperforming peers by a wide margin.

- Last week, the company announced a 12-month contract extension for the 7th generation drillship Deepwater Asgard in the U.S. Gulf of Mexico at highly encouraging terms.

- With the recent lull in deepwater contracting activity apparently not impacting dayrates for high-specification assets, I am raising my profitability expectations for 2025.

- However, Transocean remains overvalued relative to peers based on a number of key metrics. Reiterating “Hold” rating with an increased price target of $6.

pabst_ell

Note:

I have covered Transocean Ltd. (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

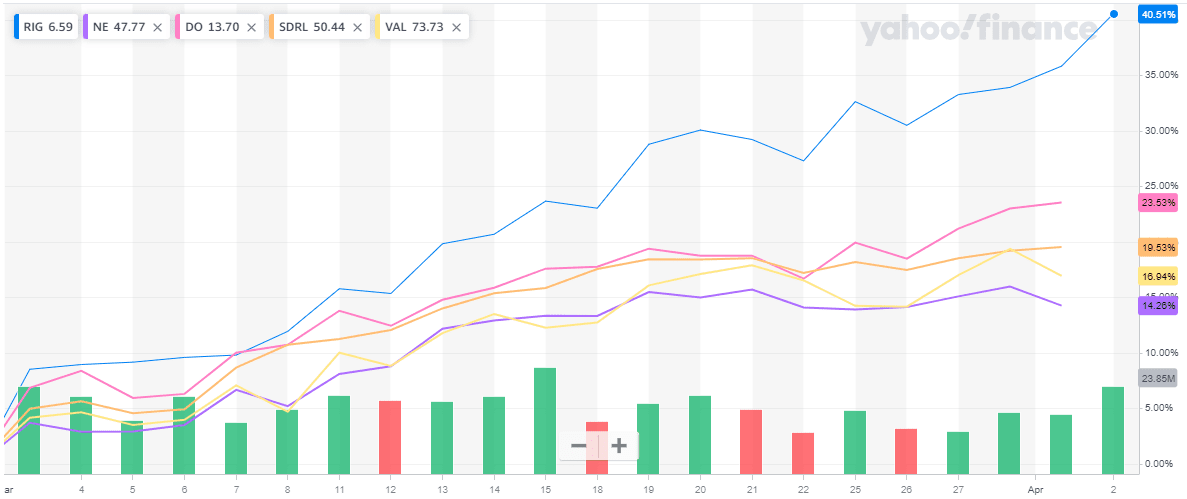

Over the past month, strengthening oil prices have induced a swing in market sentiment thus resulting in strong gains for offshore drillers exposed to the floater markets (drillships and semi-submersible rigs) with market leader Transocean outperforming peers by a wide margin:

Yahoo Finance

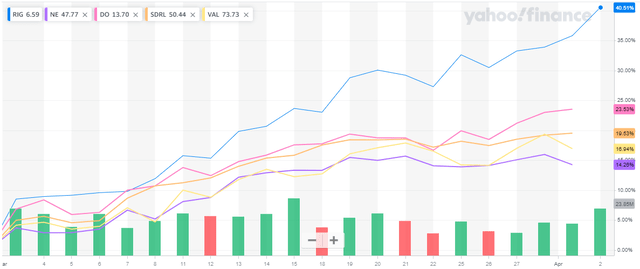

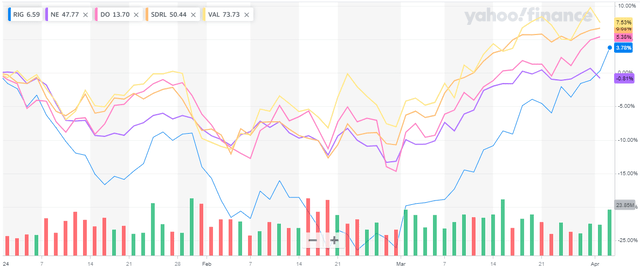

Remember that just six weeks ago, a major earnings warning resulted in shares selling off to new 52-week lows below $4.50 but thanks to the recent rally, the stock price has now turned green for 2024:

Yahoo Finance

As the most leveraged player in the group, shares tend to outperform peers in times of strong market sentiment and underperform once investor enthusiasm starts to vane.

In addition, Saudi Arabia’s recent surprise decision to leave maximum oil production capacity unchanged at 12 million barrels per day and no longer pursue an increase to 13 million barrels has cast a shadow over the near-term prospects of the jackup market thus resulting in some headwinds for peers with material jackup exposure like Valaris Limited (VAL), Noble Corporation (NE) and to a lesser extent Seadrill Limited (SDRL).

Moreover, fellow floater pure play Diamond Offshore Drilling (DO) has been hit by a recent incident on the semi-submersible rig Ocean GreatWhite which resulted in the loss of the rig’s lower marine riser package.

According to the company’s most recent assessment, the incident is expected to result in up to 130 offhire days for the Ocean GreatWhite and up to $45 million in recovery, repair and replacement costs. Adjusted for anticipated insurance proceeds, total financial impact for H1/2024 is expected to be in a range of $33-$35 million.

Furthermore, with just nine active rigs, Diamond Offshore Drilling is lacking scale and the company’s historic focus on the moored semi-sub segment has resulted in a somewhat inferior fleet composition relative to peers.

Given these issues and considering the much higher leverage, Transocean’s recent outperformance is hardly a surprise.

Last week, the company provided tangible evidence that dayrates for high-specification floaters with strong track records are holding up very well despite a recent lull in contracting activity:

(…) Transocean Ltd. (…) today announced a 365-day contract extension for the Deepwater Asgard with an independent operator in the U.S. Gulf of Mexico. The program is expected to commence in June 2024 in direct continuation of the rig’s current program and includes additional services. The total contract value of approximately $195 million includes a $10.9 million lump sum payment, which is not included in the estimated backlog of approximately $184 million.

Assuming the $10.9 million lump sum payment covering the additional services component, the “clean” dayrate would be slightly above $500k, a new recovery high for contracts with longer duration than a few months.

Even better, the contract extension does not require offhire time for upgrades or mobilization of the rig to a new drilling location thus further increasing the margin benefit.

According to Transocean’s most recent fleet status report, the Deepwater Asgard was scheduled to conclude its current contract with Hess Corporation (HES) later this month.

However, reading between the lines of the press release, the existing contract appears to have been extended by approximately two months at an unchanged dayrate of $440,000 with the rig rolling over to the new dayrate in June.

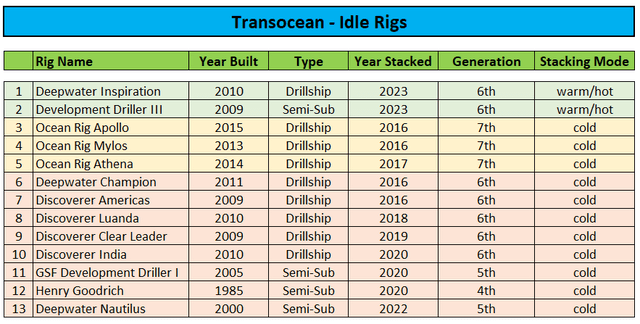

While certainly great news, Transocean, like many of its peers, continues to deal with persistent idle time on a number of rigs like the drillship Deepwater Inspiration (since April 2023) and the semi-submersible rig Development Driller III (since August 2023).

In addition, the company commands an armada of cold-stacked assets but in my opinion, only the highest-specification drillships might make its way back into the market at some point going forward:

Fleet Status Report

Please note that no offshore driller has ever reactivated a rig that has been stacked for as long as the 7th generation drillships Ocean Rig Apollo, Ocean Rig Athena and Ocean Rig Mylos.

While Transocean expects all-in reactivation costs for its cold-stacked rigs to range between $75 million and $125 million, I consider this assessment wildly optimistic. For example, competitor Valaris estimates reactivation costs of approximately $100 million for its remaining cold-stacked drillship Valaris DS-11 but this rig has only been stacked since 2020 and the company has a very successful track record of reactivating drillships in time and on budget.

In contrast, Transocean has never reactivated a modern drillship and wasn’t even involved in the stacking of the above-discussed 7th generation drillships as these rigs were acquired in cold-stacked mode from Ocean Rig back in 2018.

However, last week’s drillship contract extension is highly encouraging as it provides evidence for the recent lull in deepwater contracting activity not having resulted in any sort of dayrate erosion for high-specification assets.

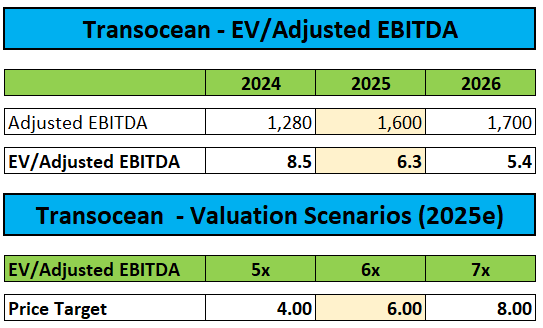

Consequently, I am raising my 2025 profitability expectations while increasing the price target for the shares to $6.00 based on an EV/Adjusted EBITDA multiple of 6x my 2025 Adjusted EBITDA estimate:

Author’s Estimates

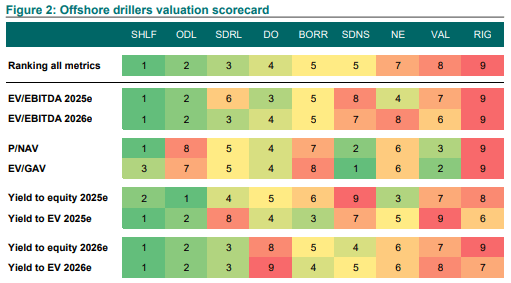

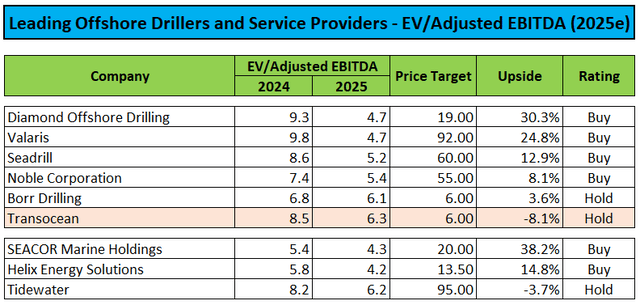

However, Transocean remains expensive relative to peers based on a number of key metrics as very much evidenced by DNB Markets’ most recent offshore driller valuation scorecard:

DNB Markets

Consequently, I am reiterating my “Hold” rating on shares. That said, I would become more constructive on the stock if the company would ultimately succeed in securing long-term contracts with a sufficient return on investment for some of its cold-stacked high-specification drillships.

Author’s Estimates

Bottom Line

Improved investor sentiment resulting from a persistent uptrend in oil prices, has buoyed Transocean’s stock over the past month with shares outperforming peers by a wide margin.

In addition, the company managed to secure a 12-month contract extension for the high-specification drillship Deepwater Asgard in the U.S. Gulf of Mexico at highly encouraging terms.

With the recent lull in deepwater contracting activity apparently not having resulted in pricing erosion, I am raising my profitability expectations for 2025 while reiterating my “Hold” rating on the shares with an increased price target of $6.

However, the company remains overvalued relative to peers based on most key metrics.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.