Summary:

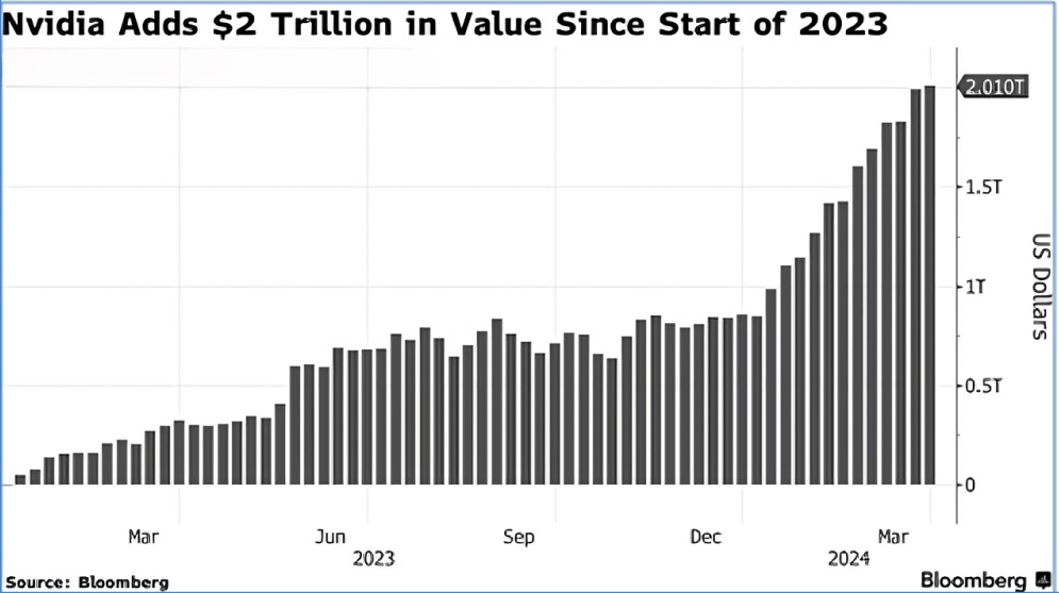

- Nvidia has ascended to a $2.2 trillion market cap, becoming a key player in AI chip design and dominating 90% of the AI data center market.

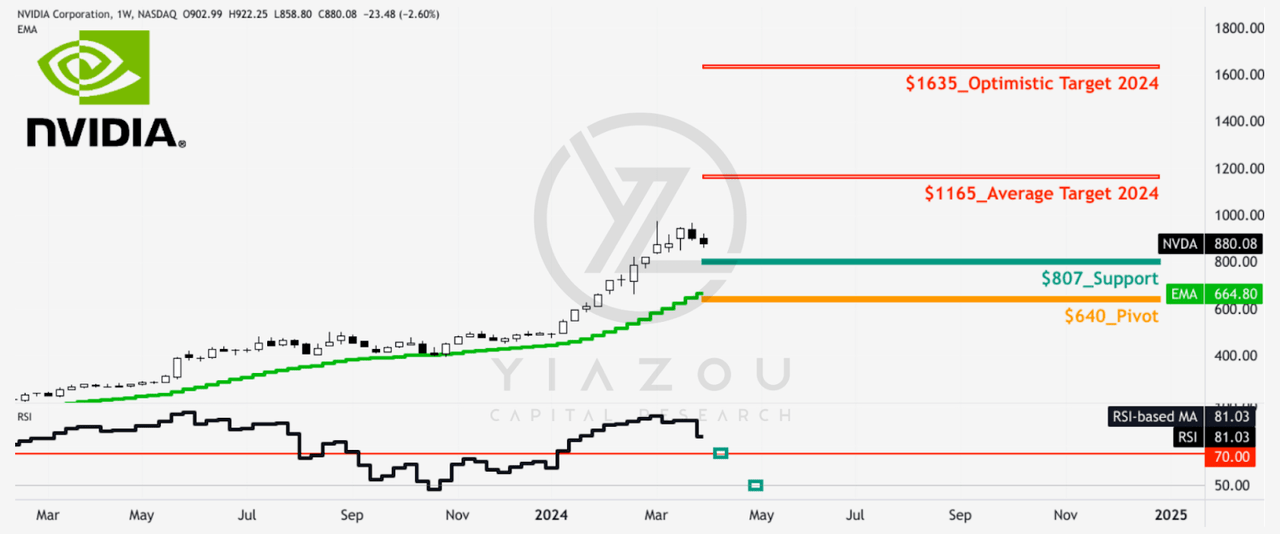

- NVDA has exceeded our ambitious $905 target, affirming its robust position and growth in the AI and gaming sectors. It is now setting sights on reaching between $1,165 and $1,635.

- Nvidia diversifies by investing in AI ventures like SoundHound AI and advancing its CUDA interface, navigating challenges from client dependency and competitors like AMD and Intel.

- Nvidia’s record-breaking revenue and earnings growth, driven by its dominance in AI chip design, position it for continued success in the market.

MF3d

Investment Thesis

NVIDIA Corporation (NASDAQ:NVDA) has been the wonder of the past 12 months, becoming a household name amid the artificial intelligence (“AI”) revolution. Over a short period, it has become a trillion-dollar empire designing and developing chips that make AI work. Following the rally, Nvidia has become the third largest company behind Apple (AAPL) and Microsoft (MSFT), reaching a market cap of over $2.2 trillion.

Our investment thesis and target price on NVDA have proven successful, surpassing our $905 target from $616. This performance validates NVDA’s strong position and growth in AI and gaming, reaffirming our confidence in its upward trajectory.

Bloomberg

Nvidia’s Bullish Horizon: Aiming for $1,165 to $1,635 Amidst Short-Term Volatility

NVDA has shown a downward move in the recent two weeks, showing a decline in market valuation of nearly 10% from the high of $974. However, the stock price momentum is highly bullish. Following the ongoing trend, the stock may reach $1,165 based on the average momentum delivered over the mid-term. Optimistically, based on the bullish momentum prevailing in 2024, the price may reach a maximum of $1,635. These projections are based on Fibonacci levels expended over the recent price swings.

On the downside, the price may hit $807 under the ongoing correction. $807 emerged as a resistance during February 2024. After the price closed above this level, $807 became a vital support and may be retested. From a long-term perspective, in the case of a considerable correction, $640 (pivot) is another critical support level, which is in line with the current level of the short-term exponential moving average (EMA).

Assessing the relative strength index (RSI), which is 81, indicates an overbought state of the stock price. A correction may push the RSI down to hit 70 again, or in the case of a major correction towards the pivot, the indicator may hit the level of 50. In short, $807 and $640 are ideal levels to establish long positions, while $1,165 and $1,635 may serve as primary levels to book partial profits.

Nvidia Dominates AI Chip Market: Record Earnings as Demand for GPUs Soars

Even as valuation concerns become louder, Nvidia strengthens, becoming the number one AI chip designer. With the company controlling 90% of the market share in the AI data center market, its fortunes have improved significantly, as evidenced by skyrocketing earnings and revenues in recent quarters.

As accelerated computing and generative AI hit a tipping point, Nvidia has come out on top of providing some of the most sought-after GPUs for powering various AI models. Likewise, the company benefits from the growing demand for data processing, training, and interference from large cloud service providers. Its AI-powered solutions increasingly attract interest and use from various vertical industries led by auto, financial services, and healthcare, presenting a multibillion-dollar opportunity.

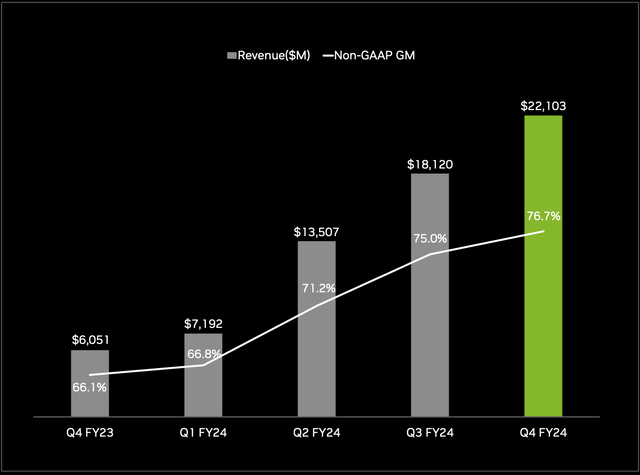

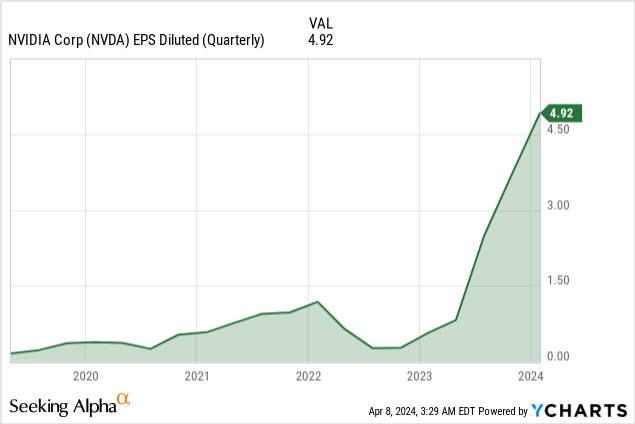

Likewise, the company delivered a record year-end quarter driven by data center growth. Revenue in the Fiscal 2024 fourth quarter was up by 265% to $22.10 billion, beating the company’s guidance of $20 billion, while full-year revenue was up 217% to $47.5 billion.

The robust revenue growth over the past year can be attributed to Nvidia emerging as the primary beneficiary of the technology industry’s obsession with AI models developed on its graphics processors for servers. While there have been fears that the company may be unable to keep up the growth, CEO Jensen Huang insists conditions are excellent for continued growth as demand for GPUs remains high due to generative AI and a shift away from central processors.

The Santa Clara-based chip giant delivered a 409% increase in data center revenue, which came in at $18.40 billion. The company benefited from compute revenue growing more than five times and networking revenue growing three times. Nvidia expects the growth to continue in 2024 as demand for next-generation products for data centers continues to outpace supply.

The data center business now accounts for most of Nvidia’s business as it benefits from the growing use of enterprise software and consumer internet applications. Nevertheless, the segment could have delivered better results had it not felt the impact of U.S. restrictions on exporting advanced semiconductors to China.

Meanwhile, gaming revenue is also rising, driven by strong consumer demand for the GeForce RTX GPUs. Revenues were up 56% to $2.87 billion as GeForce RTX 40 Super Series GPU sales continued to soar. The gaming division benefits from the Nvidia RTX platform, which is increasingly used in mainstream gaming PCs. It has also emerged as a preferred computing platform used in workstations for designing complex, large-scale models.

Finally, robust revenue growth across various segments propelled Nvidia to a record net income of $12.29 billion for the fourth quarter, or $4.93 a share, up 769% year-over-year.

Nvidia Robust AI Products Pipeline

The primary catalyst behind Nvidia’s record earnings and revenues over the past year is its broad pipeline of chips at the heart of generative AI. Its products accelerate the processing of AI workloads in data centers.

The H100 is one of the company’s primary AI GPUs and is in high demand even though it costs $40,000 a chip. Consisting of 80 billion transistors, the H100 is a workhorse designed to enhance the training of large language models that underpin apps like ChatGPT.

The chip has proved highly effective in handling various workloads and AI models, helping strengthen the company’s edge in the field. Likewise, it has allowed the company to sign big deals with the likes of Microsoft (MSFT), Oracle (ORCL), and Meta Platforms (META), which are increasingly using the chip in their data centers.

Given the strong demand, Nvidia currently controls nearly 90% of the market share in the data center AI GPU chip market and about 80% in the entire market. The company wants to extend its lead in AI by unveiling a new superchip for quantum computing services.

Blackwell is the new AI chip Nvidia has designed to be used in powerful, expensive data centers that train frontier AI models. For starters, the Blackwell B200 is an upgrade of the popular H100 AI chip that can reduce the amount of electricity used by the AI industry.

Additionally, Nvidia has unveiled a GB200 super chip that squeezes two B200 chips into a single board to offer 30X the performance of server farms that run rather than train chatbots. The new chip also promises to reduce energy consumption by up to 25 times. In addition to developing chips, Nvidia is also branching into the world of humanoids with the launch of the GROOT project to control humanoid robots.

Nvidia Amplifies AI Edge with SoundHound Investment

To strengthen its prospects for AI, Nvidia has been expanding its footprint with investments in other AI companies. SoundHound AI (SOUN) is one of the companies that has caught its attention. The semiconductor giant has already acquired 1.7 million shares in the company as it looks to gain access to and exposure to its voice AI solutions focused on restaurants and automobiles.

SoundHound AI has developed AI solutions that allow businesses to offer customers incredible conversational experiences. The company has already unveiled a voice assistant integrated with ChatGPT functionality for automobiles as it strengthens its prospects in the hyper-growth niche machine learning market. The voice assistant has already been incorporated into Stellantis (STLA) DS Vehicles to give drivers a much more robust digital assistant experience.

While the focus among many semiconductor companies has been developing hardware or chips, Nvidia has also sought to strengthen its prospects in the multibillion-dollar sectors on the software front. The company has been pushing its CUDA programming interface, which runs on AI chips. The interface is designed to allow software to use certain types of graphics processing units for accelerated general-purpose computing. Some top companies using the interface include Oski Technology, Sinopec Technology, and even Advanced Micro Devices (AMD).

Navigating Big Tech Dependencies and Rising Competition

Nvidia has benefited from the AI arms race among companies looking to boost their computing power on AI workloads. Nevertheless, the semiconductor industry is best known for boom and bust cycles, as it has always struggled with long-term introductions of production capacity and short-term swings. At the end of last year, the company generated a good chunk of its revenues from four firms: Microsoft, Meta, and Amazon (AMZN).

A slowdown in the rate at which the four companies purchase chips from Nvidia could be detrimental, raising the concern that the company needs to rely more on a specific customer clique. Competition is another significant headwind that threatens Nvidia’s long-term prospects. Lastly, AMD has already unveiled the MXI300 chip, a cheaper alternative to the more expensive H100 chip. Intel (INTC) is also launching its range of AI chips to eat into Nvidia’s market share.

Takeaway

The future is all about AI, and Nvidia is one of the companies playing the long game. It has invested in technology for years and is developing a robust competitive moat.

Its chip designs and capabilities are far ahead of the competition, which has been the catalyst behind the company’s posting record revenue and earnings. While the technology is still in the early stages of development and use, the chip giant remains well positioned to generate significant value as more companies turn to its products to develop various AI models.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.