Summary:

- Exxon Mobil is the largest company in the American Energy sector and has a good chance to dominate the twilight phase of carbon-intensive Energy while also helping reduce emissions.

- Investing in Exxon stock through dividend reinvestment can be a great way to achieve compounding long-term.

- Exxon Mobil will likely play a vital role in solving climate change through natural gas and cost-cutting measures.

- The firm is undervalued by both discounted cashflow and dividend discount models despite a very strong YTD rally that beat its large-cap peers.

Michael H

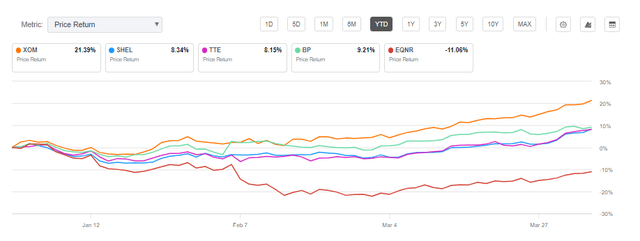

Exxon Mobil Corporation is the titan of the oil industry. I wrote an article a couple of months ago explaining why I thought that the American Energy Titan was slated to dominate the last chapter of the Energy industry. Furthermore, that chapter is likely to be longer than a lot of folks appear to think. The American Energy sector has been showing strength lately, and there are few better companies to own for the long term. Exxon has been up significantly on a YTD basis and has outpaced its large Energy industry peers in the period.

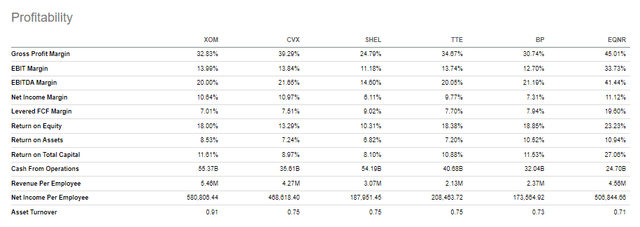

The stock’s performance has been stellar lately, which leads many investors to have an urge to “take the money and run.” However, an analysis of Exxon’s valuation based on both dividends and free cash flow suggests that considerable upside remains in the dominant US Oil Major. When you compare Exxon to its peers, I think its superior Asset Turnover Ratio (a particularly important metric for an oil major) will continue resulting in greater capital efficiency and ROE compared to peers and the continued ability to maintain its stellar capital return record.

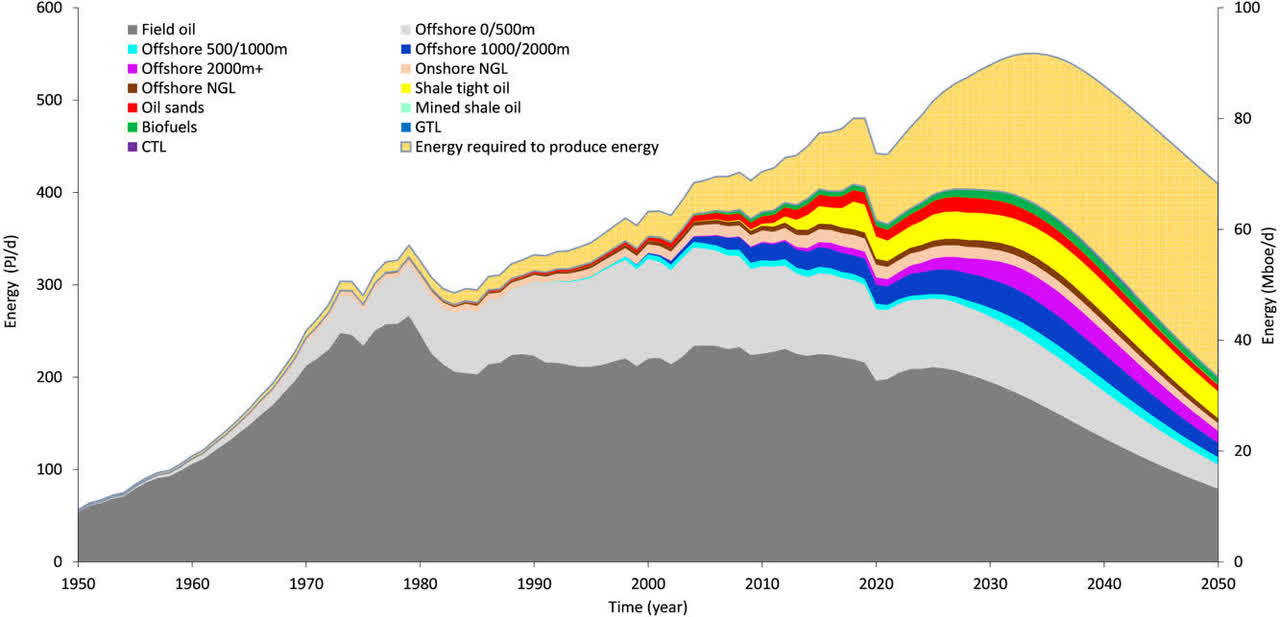

I agree with Exxon’s management that peak oil is likely further in the future than many more optimistic peers kowtowing to public officials would care to admit. And this means the company is better prepared than a lot of peers because of its significant advantage in upstream, which should help the stalwart firm compete on a bare knuckles level in the final chapter of a maturing industry. The stock has done very well since I last recommended and I anticipate further strength over the next three months.

Peak oil and the low-carbon energy transition: A net-energy perspective Louis Delannoy a b, Pierre-Yves Longaretti a c, David J. Murphy d, Emmanuel Prados a

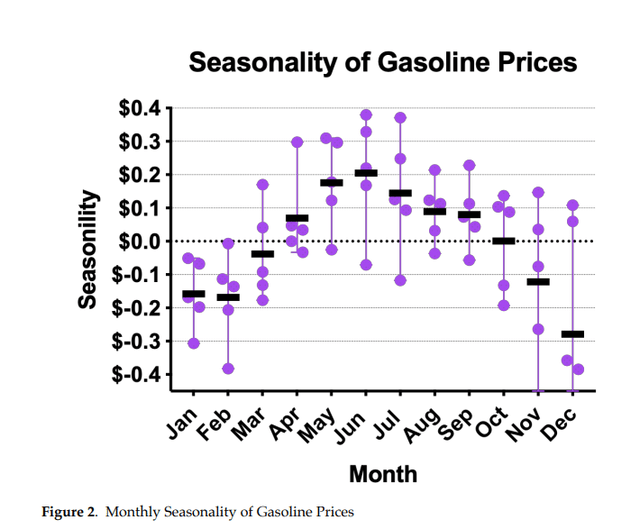

Despite a few months of solid gains, I still think this is the case for Exxon. The seasonal tailwinds for Energy should help Exxon even though it can lag its peers during periods of strength in oil prices, which was pointed out in a great short article on the firm. This Seeking Alpha author’s article is a great argument for those seeking quicker alpha in the Energy market.

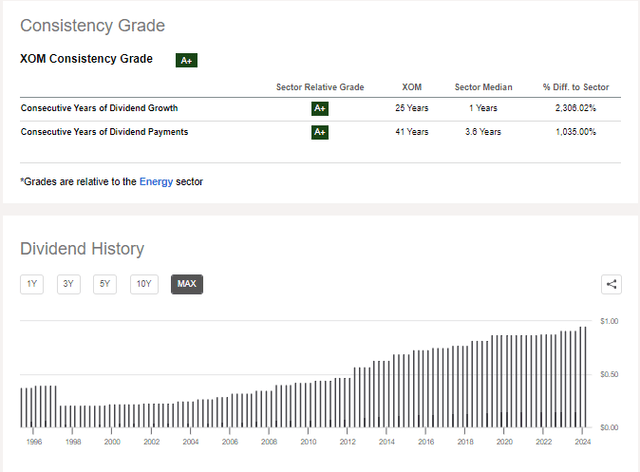

I agree that there are probably better opportunities in this developing bull market that might benefit more directly from seasonal oil price rises, but I’m a long-term investor in Exxon and the firm’s heft and prestigious status as a dividend aristocrat help mitigate the normal cyclicality and high risk of bankruptcy in the US Energy complex.

The author argues there could be better opportunities in the Energy sector, and he may be right, but I am a long-term investor in Exxon. I agree, but I’ll sacrifice some potential for upside in exchange for stability and near surety of long-term gains through consistent compounding. If you haven’t bought Exxon yet I suggest you enroll in the dividend reinvestment program and don’t even look at your money for five years. It would be even more optimal if you set up automatic buying in addition to your dividend reinvestment.

I always suggest enrolling in the Computer Shares automatic buying and dividend reinvestment program for a stock like Exxon. It is also a great gift for expecting parents. Putting $1,000 into Exxon stock in a dividend reinvestment program has the potential to put a major dent, or even cover, some major educational expenses for new babies. I know for people with shorter time horizons, you can really cash in when smaller Energy players start rising with prices. But Exxon has several strengths that smaller Energy companies don’t have:

- The company is a massive integrated oil major which gives it natural diversification and the ability to access levels of capital, and scopes of projects that are simply not available to most peers.

- The firm was recently the subject of aggressive board action from environmentalists. While the firm benefits from an improved environmental image and a credible carbon-friendly strategy, it also benefits from the aggressive actions of more truculent management teams in the past.

- The firm has some of the most viable alternative energy projects, a massive refining capacity with improving economics, and a stellar management team with a proven capacity to reward shareholders through some of the toughest cycles in Energy’s history.

- Massive growth opportunities through M&A and upstream strategy. The augmentation of reserves in the Permian and in Guyana gives the firm a key competitive advantage over more passive rivals.

One of the things I like about Exxon is that it is far less sensitive to oil prices, and it has a highly prestigious and lucrative history of capital return that won’t be interrupted anytime soon in my estimation. Sacrificing short-term fireworks for long-term reliability is a choice that I think will prove much more profitable over time.

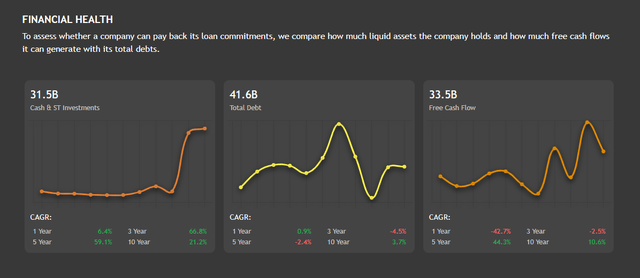

The reason I am confident in Exxon as a long-term play is very simple, it is not exposed to the risk of its smaller peers who may achieve more alpha, but may also achieve bankruptcy. Exxon isn’t achieving bankruptcy anytime soon. The firm’s cash flow and financial health have been improving across multiple metrics. And for a firm with the maturity and size of Exxon, its share price gains and levels of growth and investment have been quite impressive. Some might even say very spry for a firm that’s over a century old.

Exxon is in pristine financial condition relative to many smaller firms in this sometimes financially precarious industry, and while it is overvalued, if you have a long time horizon any subsequent price retreat is merely an opportunity for your automatic buys and dividend reinvestment to lower your cost basis. Let Exxon work for you like it has worked for countless other investors over its many decades of delivering to shareholders.

One of the amazing things about Exxon Mobil that a lot of people miss is that it is one of the most vital pieces to solving climate change, whether or not people acknowledge it. Firstly, natural gas is an essential stepping stone to a less carbon-intensive future and Exxon has a primary role in this step no matter who you talk to. Secondly, Exxon Mobil’s culture of ruthless cost-cutting and efficiency is actually quite congruent with the nitty gritty necessary to reduce human emissions on a meaningful scale.

Valuation

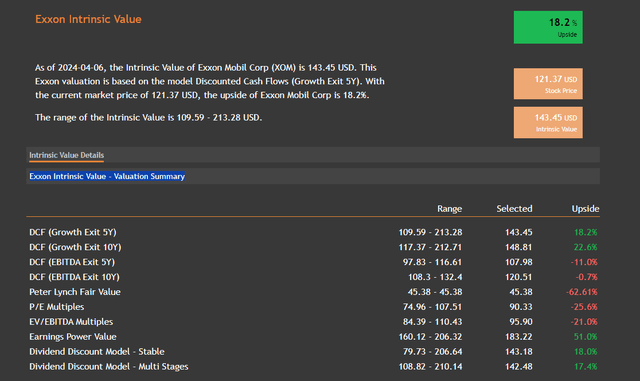

Exxon has enjoyed a quarter of significant outperformance. However, based on some of the most credible valuation methodologies, the stock still has a significant implied upside. Both the 5-year and 10-year Growth Exit discounted cashflow models suggest significant upside is present in the stalwart stock.

One of the things I like to see in a mature stock like Exxon is that both the 5-year and 10-year models suggest upside is still available for investors. There are some other attractive features of Exxon in addition to its attractive valuation. It is a very fundamentally strong stock that is asset-heavy. One advantage of this is that the stock will act as a natural inflation hedge. Of course, the firm also has a generous dividend with a pristine track record. I’ll discuss that more later in the article.

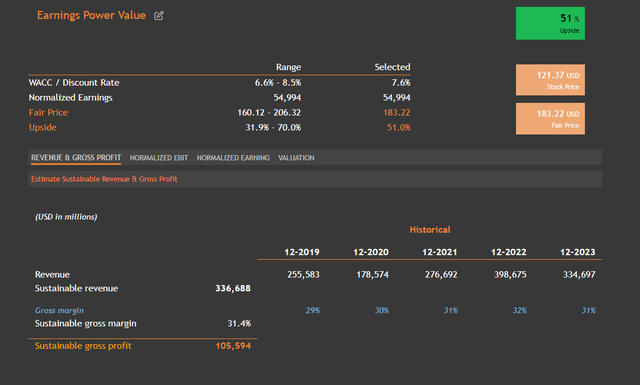

The other thing about Exxon is that it is one of the largest companies in the world by many measures. Of course, by market cap, it has floundered relative to some of its big technology peers, but in terms of actual size, global reach, and volume of assets, Exxon is still one of the biggest companies in the world. It has what is increasingly looking like an indomitable position in the global Energy complex. The upside implied by the Earnings Power Value is very encouraging and reflects the high staying power of Exxon’s earnings, and the relatively high quality of revenue compared to peers.

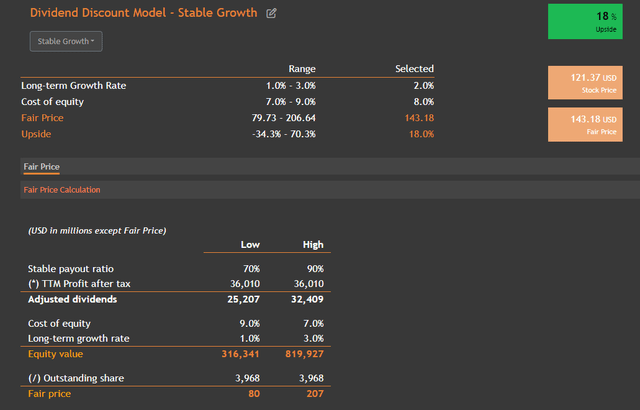

In addition to the earnings-based intrinsic value measures, Exxon is also shown to be undervalued using a dividend discount model. The convergence of the free cash flow and dividend-based intrinsic value measures both suggest comparable upside. This is a significantly positive sign me that gives me the confidence to advise my readers to continue accumulating this stock even though it has enjoyed a significant run-up lately.

Risks and Where I Could Be Wrong

I would say the biggest risk to my bullish disposition on America’s largest Energy company is certainly a recession, which could be caused by any number of things from an unanticipated escalation of multiple geopolitical conflagrations. However, it should also be noted that Exxon may be able to perform quite well compared to international peers, given that its means of production and refinery capacity primarily lie in America, away from the direct physical influences of conflict. This would potentially not be the case for Saudi Aramco in the case of conflict erupting in the Middle East.

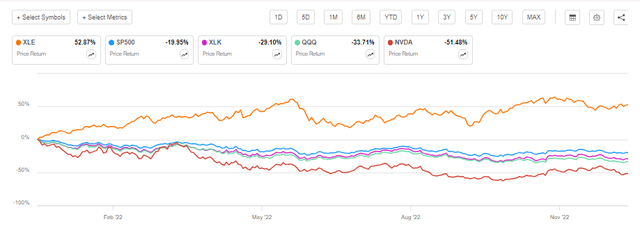

Seeking Alpha (Price Performance in 2022)

The year 2022 showed what an effective hedge the Energy Industry can be against weakness in key areas of the market. As you can see above, in 2022 Energy provided a very effective hedge and was really the only thing that did well at a sector level in a year where the rest of the market languished. Those who didn’t have a significant Energy allocation in 2022 would have had a very hard time outperforming the benchmark. Exxon also reported diminished expectations for upstream performance in Q1, although I expect this to reverse in short order.

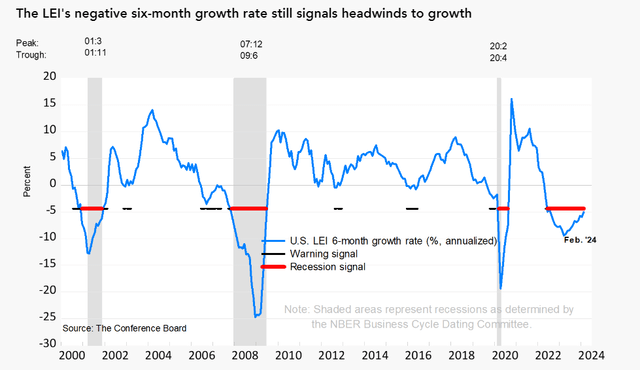

Of course, Energy is very cyclical and economically sensitive. The recession predictions have been thick while also elusive. Nonetheless, several key indicators are suggesting that a recession could be imminent. And if this is the case, it’s very likely that Exxon Mobil and the Energy sector in general will experience their typical cyclical price weakness. Of course, the Energy sector’s performance depends on more than just the price of oil, but it is highly correlated to its performance. Of course, any of these following risks could cause problems for Exxon as well.

- Escalation of geopolitical risks in China, Ukraine, or the Middle East.

- Fed policy error.

- The banking crisis worsens.

- Return of inflation.

- CRE meltdown.

- Write-downs of private assets.

However, I think Exxon has emerged from the pandemic and period of negative oil that immediately followed it as a much stronger company. It has gotten some needed ESG credentials and has both the most growth-oriented upstream projects along with very credible efforts to reduce carbon emissions. I think the new Exxon is well slated to dominate the Energy industry’s long and important last chapter and will be continuing to add to my position and reinvest my dividends.

Conclusion

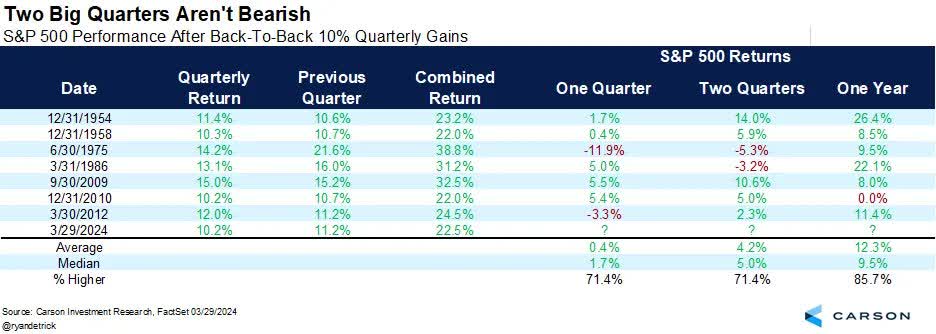

Human beings are simply more sensitive and averse to loss aversion than we are attracted to and motivated by achieving superior financial gains. Experiencing financial loss is an emotionally loaded experience that can even produce trauma that discourages rational action. One great example is that we had two back-to-back quarters of gains over 10%. Now this is an incredibly rare event that might make you feel like you should sell immediately because an impending crash must be just around the corner.

Carson Investment Research

However, the historical data, although limited, implies you have about the same chances of having gained a year from now in spite of the strong performance as you would winning a hand of Texas Hold Em’ with pocket aces (85%). So it’s important to check the conclusions we intuitively arrive at with the data. When you look at seasonal data for the Energy industry and the significant upstream initiatives that should be coming online in the next few years, it’s easy to see why there’s both tactical and strategic upside in the name.

Similarly, despite a big run-up for Exxon when you look at the data from a valuation perspective, it suggests a current upside. Furthermore, we are entering a period that is typically seasonally strong for gasoline prices. The refining economics for Exxon are very advantageous, and any geopolitical conflagration may be able to be spun into a benefit for the company with a relatively safe geographic footprint compared to many peers.

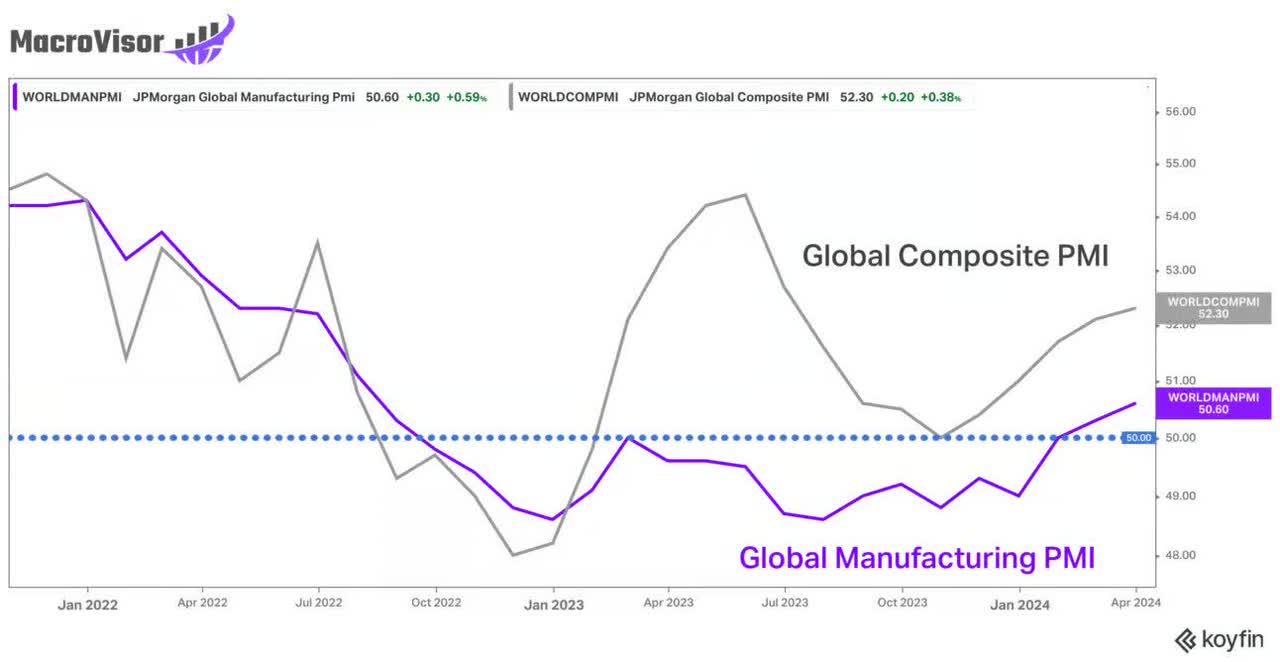

However, what gives me the greatest confidence in Exxon’s ability to continue delivering is economic strength that continues exceeding expectations. The recent jobs report is more evidence that a soft landing is occurring. Not only is a soft landing occurring and a post-pandemic economic boom seeming very resilient, but it has also been occurring while companies de-leverage. The recent turnaround in PMIs suggests Exxon’s gains are going to continue, and even if there is a price retreat, it’s merely an opportunity to compound for long-term shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.