Summary:

- Intel Corporation stated they lost $7B on their foundries in 2023, and 2024 will be worse.

- This was not unexpected, as entering the external foundry business is very expensive, and takes time to generate profits. It was also necessary.

- Although things will improve after 2024, it will be several years before the foundry is a strong contributor to earnings.

- The potential benefit to Intel is enormous, and justifies the cost, long term.

maybefalse

I have been long Intel Corporation (NASDAQ:INTC) stock for a few years, and was a bit surprised by the reaction of the stock price on the recent news where Intel broke down the losses on their foundry business. Intel announced their foundry lost $7 Billion dollars last year, and will lose more this year. While it certainly has some meaning, some of it is also how Intel uses their accounting, and it just means their other divisions are much more profitable. It is not damning for the company; we already knew the company isn’t where it needs to be in manufacturing maturity, technology and efficiency. The enormous investments in new sites and process R & D were always going to be a huge drag on the company until they could translate into benefits. Those benefits are, and were always intended to be, in the future.

I want to start with a lot of this article is not based on cold facts, because we are looking forward to nodes that we don’t have full information for, and the future is also never certain. Stock prices look forward, so do I, and so we have to make the best of what we have now to try to best estimate the future.

Some Basics

So, let’s start with some basics. Intel not only designs their chips, but they also manufacture (most of) them. They will use outside companies, namely TSMC (TSM), when it makes sense. Many consider TSMC to be ahead technologically, and although that’s not completely true, it is close. Intel’s 7 is better than anything TSMC has in terms of raw performance at fairly absurd power scenarios (which Intel does use), but in almost every other way, Intel 7 is behind. And this is important, because it’s an indication of what Intel values, or at least did, and what TSMC does.

Intel 4 is hard to categorize, but it doesn’t seem any more efficient than Intel 7 in power use, as Meteor Lake uses essentially the same architecture as Raptor Lake, and doesn’t demonstrate clear clock speed improvements in laptop chips. It also doesn’t seem to have the raw performance of Intel 7, based on the maximum clock speeds we see. It is far more dense though.

I should point out, names like 3nm, or 10nm, are not meaningful. As Intel said, they could just as easily call their node “George,” as it’s not an actual measurement anymore, but just a name. So, for example, it’s doubtful anything in Intel 7, or TSMC 3nm, is actually 7nm, or 3nm, and if there is, it’s purely coincidental. Companies will try to make the name meaningful, so, you would expect Intel 4 to be more dense than Intel 7 (which it is), but at the end of the day, it’s just a name. And processes with the same number are not equal; Intel 3 and TSMC’s 3nm will be significantly different, as each company places a different emphasis on their design goals.

Even now, no one makes processors that clock as high as those based on Intel’s 7 process. It’s likely TSMCs processes are not as well suited for this, although clock speed is also based on architecture, so it’s not a certainty. But this is a clear indicator of what Intel has historically considered the most important, and which TSMC does not prioritize to the same extent. I mention this because this pattern will extend into the future, although I suspect to a lesser extent.

Intel’s Current and Future Nodes

Intel has proudly talked about the 5N4Y plan, which means five nodes in four years. While it nice Intel has released two real nodes in those four years, it’s far less impressive than they would have you believe. Intel 7 is a (spectacular in some ways) derivation of 10nm, so isn’t a new node. It’s an improved node. Intel 4 and Intel 3 are essentially the same, or if you prefer, two half nodes, but either way count as one real node. Intel 20a and 18a are similar. It’s still an impressive achievement, considering their issues with 14nm and 10nm nodes, but it’s really nonsense in how it’s presented, and to dilute the accomplishment by being misleading.

Right now, Intel 7 is the dominant node used by Intel, with Intel 4 now ramping up with Intel’s Meteor Lake processors (but only for the CPU part of the chiplet; a lot is made by TSMC). Intel 4 is essentially an internal node, although it does have at least one external customer. Intel 3 is very closely related to Intel 4, and will be the node Intel offers to external customers, and will also be Intel’s last FinFET node. Intel 7 uses what is called DUV (Deep Ultraviolet Lithography), which is a relatively approach on leading edge processes, and requires additional steps (multi-patterning) to create the tiny transistors in modern nodes. This adds cost, and can lower yields, making Intel 7 a very expensive node.

Did Intel care? Not that much, since they were selling expensive processors, and that largely masked (forgive the pun) the expense of the node. Intel 4 partially uses EUV, which is an abbreviation of Extreme Ultraviolet Lithography, to a limited extent, which simplifies the process compared to a pure DUV approach. A very crude way of thinking about it is, is cutting with a sharper knife. Intel 3 will increase the use of EUV, which lowers the amount of steps needed even further, and thus lower cost.

Wafer cost is very important outside of the context of Intel selling its own processors. It’s been estimated the expense of an Intel 7 wafer is roughly the same as what TSMC charges for theirs, even with their profits, so it’s very inefficient. Intel 3 should be better, but according to Intel, still more expensive than TSMC’s 3nm nodes (of which there are several).

What to Expect

Does this really matter? Not that much, because the battle of Intel 3 and TSMC’s 3nm is essentially over before Intel even released their node. Companies have to start designs well in advance, so we know TSMC has largely won this round. The “2” (meaning Intel 18A vis-a-vis TSMC/Samsung 2nm) is where there will be some sort of battle, and clearly where Intel will do better. For that reason, I’m not going to waste too much time on Intel 3, it’s not going to generate a lot of money or interest, although it could generate interest as Intel improves the process with new derivations, and for those who wish to stick to FinFETs. But, it will never be a big node.

Intel 18a, however, looks promising in some ways. CEO Pat Gelsinger has indicated he is betting the company on it, although with his penchant for needless drama, it’s not that important a statement. A lot has to be determined in terms of how it will match up against TSMC 2nm. Intel will be ahead by using PowerVia, which should improve efficiency and performance. But, that’s not a clear indicator of superiority, as there are other characteristics that are probably more salient.

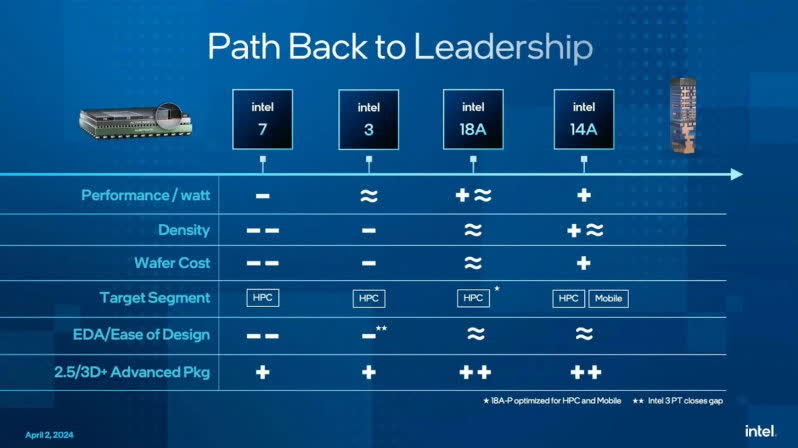

Below is Intel’s image describing how they view the competitive landscape going forward.

Intel

For one, Intel is in some ways a prisoner of its own success. TSMC has never had super high performing nodes, since it’s a relatively small market compared to the phone market, for example. Intel wants really good clock speeds, because they sell products which benefit from them. Outside of Advanced Micro Devices (AMD), which is lucky to have 20% market share in the PC segment, they don’t have many customers that require this. Efficiency? Yes. Density? Yes. This is not to say TSMC cares nothing about performance, and it’s dreadful. It’s not. It’s just not as good as Intel’s, and likely won’t be. And they are fine with that.

Intel has historically cared about performance first. And probably second as well. Of course, the others matter, even to Intel, but when it comes down to it, they’ll take clock speed. Even now, Intel’s CCG group dominates their revenue, so it’s not a misplaced priority. But, for external customers? It’s not as widely useful as other factors.

My guess, based on information and estimates by people who know more than I do, and information given by Intel, is 18A will lead in performance, be roughly equivalent in power efficiency, at least as cost-efficient, but significantly less dense (which is why I think cost efficiency will be good; they are related).

I think it fairly obvious that density will be more important than absolute performance in more scenarios that external customers are involved in, but certainly 18A will have advantages, and will be competitive. It’s not even that important in the greater scheme of things though. Intel has a big advantage over TSMC in that almost everyone outside of TSMC wants another leading edge fab to choose from, as competition can only help them. That’s where it ends though. TSMC has the advantage of being a known partner, and one that has many successful partnerships. No major company will risk their major line on Intel yet, and even Intel has indicated this. On top of this, TSMC is not a competitor in any market their customers are in. And of course, their PDAs are more mature, and Intel is still learning things TSMC has known for years.

With this reality, Intel can’t possibly even come close to TSMC in attracting as many external customers in the 18A era. I think a realistic way to look at it is, Intel 3 is going to be quite unsuccessful in attracting external customers, and that battle has pretty much been fought, and lost. If it’s even been fought. This is not to say it won’t help Intel sell their own products, at least servers, but for external customers, it’s already been decided.

18A is really the first step. It’s probably more attractive from a technical perspective vis-a-vis TSMC 2nm, than Intel 3 is when compared to TSMC’s multiple 3nm nodes. But, more than that, companies have had more time to evaluate it, and Intel has had more time to pursue them. It’s almost a pipe-cleaner node (not technically, 20A actually is) for new customers in the sense that companies will likely commit relatively lower volume parts to it, but not their most important products; the risk is too high. But, if these relationships work out and have success, it could start a pattern where Intel can gain momentum as their relationships mature, as well as their experience in operating as a foundry.

I think it’s premature to talk about 14A outside of this context. I haven’t really seen much on its technological merits, so won’t comment much about it. Intel will likely be using High-NA EUV, but not much beyond that is known about it yet. I think they have a greater opportunity with it than 18A, if for no other reason than those stated above; more mature relationships, and greater experience. But, if they screw up, that could easily work against them as well.

Is Intel’s Strategy Sensible?

Many people consider this whole thing as too risky, either in investing too much in new fabs and such, or in even keeping the fabs as part of the company. I would say these are exactly why it’s such a winning formula; it’s extremely difficult for anyone else to enter this industry, although Rapidus seems to be trying. It’s extremely capital intensive, it takes a very long time to build the fabs and fill them, and it’s also difficult to develop the experience and supporting technology that allows external customers to efficiently make processors.

Then, you have to build trust. Compare that with processor designs, where we see cloud providers coming out with new internal only designs all the time. There’s also a synergy with having your own fabs and designs, one that benefits Intel processors, even with their current fab technology being largely behind.

It’s going to take time, and money. If you’re a patient investor, the payoff can be huge. If you’re not, it probably seems like Intel is killing itself. Even Intel is giving indications they are not meeting expectations (which they will not come out and say directly), by first saying they won’t have any major product line on 18A, the 18A ramp being in 2026, and in their foundry news indicating the company does not have to increase external revenue to make their manufacturing profitable.

No doubt there is some truth to this, as they can certainly improve their efficiency and technological position. The company also indicated they expect to move from outsourcing 30% of their manufacturing to 20%, which is related to the previous remark. We also see delays in construction of Intel’s new fabs. Put together, it’s difficult for me to not see this as Intel thinking they would get much more business by this time, or at least much stronger interest, than they have. And now they have to put together a business plan that more realistically assesses the slower external revenue growth than was expected.

One company I have left out is Samsung (OTCPK:SSNLF). Yes, they kind of, sort of, well, make advanced transistors. In theory. At least according to their published papers. And numbers they come up with. Except, they have no enjoyed success, regardless of their rhetoric. Whereas history records Intel as often having the best processes, with TSMC currently having extremely strong product lines. Even so, we can’t say for sure Samsung will continue to be non-competitive, but Intel has to aim higher than this flightless bird, so I focused primarily on TSMC. Intel may not have to pass TSMC in every metric, but they have to be competitive, and have advantages in some scenarios. I think they will (and do), particularly in performance. But they also better not be so severely disadvantaged in everything else.

However you look at it, the foundry business is going to be a painful grind. It’s super expensive, it’s time consuming, and it’s going to take a long time before it’s very profitable. Companies are not going to jump ship en masse to the great Intel foundries. They aren’t great anymore; it’s not 2010. They not only have to improve capacity and technology, but also have all the tools in place for their customers. They need experience, which only happens slowly. After that, they need trust, and that is even a slower process. Intel has a lot of smart people, and I think they are better understanding this market now, and are being more realistic about it. But even if they execute very well, it’s still a very long process to become very profitable. It is realistic to expect improvement in the losses with the new nodes and better focus, nearer term, however.

Of course, this article is largely about their foundry, and does not reflect the overall opportunities of the company. Of course, nodes like Intel 3 will impact their server line, for example, and presumably very favorably, but I wanted to focus more on the external foundry business. I am still very optimistic on Intel as a whole, and even on the foundry business. I think it’s a very difficult business to get into, but it also allows Intel to profit in far more scenarios than selling their own processors directly. It also will generate income that will allow further development costs possible, as each node is enormously expensive. It will also allow Intel to use equipment much longer for trailing nodes that external customers will still need long after Intel’s products would not find them meaningful.

Conclusion

All of this convinces me this is the right strategy for Intel Corporation. I never expected the foundry business to be a quick payoff, and always just wanted to see iterative improvement. We’re still really early in the game, and while we see the technology becoming more competitive, we don’t see significant design wins yet, or major customers producing important product lines at IFS. Nor would we expect to yet, so that part is inconclusive. We should see some uptake on 18A, and hopefully continued momentum going forward. But however you look at it, it’s going to be slow, and will take time for Intel Corporation to fully develop it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.