Summary:

- Rocket Lab continues to demonstrate strong execution capabilities through successful missions and contract wins.

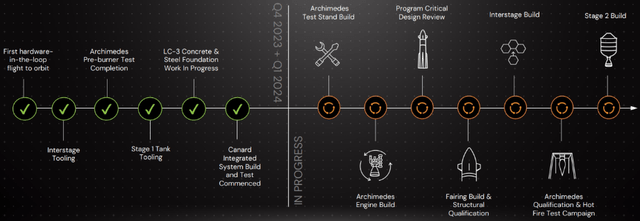

- The launch of the Neutron rocket in FY24 is expected to be a pivotal moment for the company’s future growth.

- Despite a slump in share price, the potential upside for Rocket Lab remains attractive, even when considering a delay in hitting management’s UFCF target and applying a discount rate.

Pixelimage

Investment action

I recommended a buy rating for Rocket Lab (NASDAQ:RKLB) when I wrote about it the last time, as I believed execution was still on track. There was strong evidence of this, for instance, the sold-out planned launches for FY24, HASTE contract progress, and the achievement of several milestones. Based on my current outlook and analysis of RKLB, I continue to recommend a buy rating.

FY24 is going to be an important year for RKLB, and I expect good results given the continuous execution track record that is supported by customer adoption. All eyes are on how RKLB’s Neutron performs this year, and if it executes as expected, I expect the share prices to see a surge as consensus has more confidence in pricing the potential earnings upside.

Review

Despite the continuous fall in share price from my previous updates, I think the moment of positive inflection is near-in FY24-and the focus will be on RKLB’s new rocket, Neutron. The result will have a massive impact on the stock’s sentiment, as Neutron is important for RKLB to not only service lucrative government missions, but eventually launch its own constellation.

Although the initial set of Neutron customers has not been disclosed, management has hinted at significant interest from both the public and private sectors. Hence, my view is that the market will have more confidence in pricing the future earnings power of the business if Neutron can work without issues.

Importantly, RKLB continues to show that it is able to execute. On February 21, RKLB announced that it had successfully returned Varda’s space capsule to Earth. In case any readers were wondering, the capsule contained pharmaceutical crystals that are used in antiviral medication, and the purpose of the approximately 8-month mission was to investigate how pharmaceutical product development can be enhanced in microgravity. The role of RKLB in this case is to have constructed a unique spacecraft for Varda and then performed in-space operations, deorbit maneuvers, and reentry positioning maneuvers so that Varda’s capsule could return to Earth through hypersonic reentry.

I don’t know how you feel about it, but this demonstrates RKLB’s execution skills, and customers have faith in RKLB to invest in the space. Another piece of evidence that RKLB’s value proposition and products are effective is the fact that they were awarded contracts for three more Varda missions. The more significant point, in my view, is that RKLB’s efforts to create a reentry capsule for Neutron could be influenced by Varda’s capsule reentry, which could be utilized in theory to assist with future crewed missions.

Also, it’s great that RKLB can keep winning contracts and fund the business without having to raise a ton of money. For example, RKLB was awarded a contract by the Space Development Agency [SDA] to supply 18 satellites for their proliferated constellation in Low Earth Orbit, which will help with missile tracking capabilities.

The award is based on a fixed-price contract structure and has a value of $525 million. Crucially, RKLB has been chosen as the prime contractor for this SDA contract. If RKLB does a good job, it could lead to more deals and add another success to its portfolio.

While I am not an exact fan of capital raises, in the case of RKLB, I believe the $355 million capital raise in convertible debt ($300 million net after cost) done in February 2024 was a strategic one. The notes mature in 2029 and carry a 4.25% interest rate. This brings RKLB’s total cash position to nearly $550 million (FY23 ended with $244.8 million). Given that this and the next few years are going to be pivotal for RKLB, having more cash makes it easier for them to step up on investment if necessary, in particular for M&A, for which RKLB has done a pretty good job so far. Within 6 months of going public, RKLB acquired 3 targets (SolAero, Advanced Solutions, and Planetary Systems Corporations), which I believe has helped RKLB deliver on company plans to provide end-to-end space services. From a cash burn perspective, this additional capital also pretty much removes the bear case that RKLB would run out of cash before it turns EBITDA positive (expected in FY25 by consensus).

Valuation

Author’s work

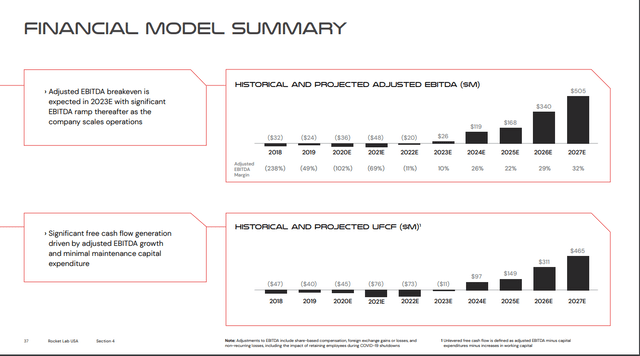

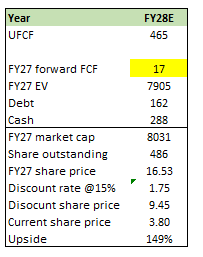

My previous model was to focus on the FY27 UFCF that management has provided in their long-term guidance. However, looking at how RKLB has performed as per FY23, I think it makes more sense to take a conservative approach in the timing of realizing this $465 million of UFCF. The reason I say this is because RKLB was supposed to achieve $119 million in adj EBITDA in FY24, but to date, adj EBITDA is still -$146.2 million, and consensus expectation is for -$96.5 million in FY24.

To ensure that I am not too aggressive in my estimates, I assume RKLB will achieve its FY27 target by FY29, a 2-year delay. This is in line with market expectations for RKLB to achieve its management FY25 adj EBITDA target of $168 million in FY26 (cons estimates: $189 million). In terms of valuation, looking at the same peer set that I have used previously (i.e., Textron, Barnes, and Howmet Aerospace), valuations have trended upwards since December by ~10%. This is definitely positive for RKLB as it operates in a similar space, but I remain conservative here as RKLB is still a fairly new player that has not turned profitable yet.

Hence, I continue to value the business at a discount to peers at 17x forward FCF. In addition, I believe a more accurate way to show the upside is via a discounted share price basis. Regardless of my belief in the execution and fundamentals of the business, this is without a doubt a high-risk investment that warrants a high discount rate. In my model, I expect a 15% return a year to justify investing in RKLB, and with that assumption, I got to a discount share price target of $9.45, still implying an attractive upside even if RKLB achieves its UFCF target 1 year later than expected.

Risk

The major risk is in how Neutron performs. If it works out well, that would be great as the market starts to price on the upside. However, if it fails for whatever reason, or even if it shows signs that it might not work within the expected timeline, the market is likely going to take a more conservative approach to the near-term outlook, putting more pressure on the share price and sentiment.

Final thoughts

My recommendation is a buy rating for RKLB despite a slump in share price. The company continues to demonstrate its execution capabilities through successful missions and contract wins. FY24 is expected to be a pivotal year with the launch of Neutron, a new rocket crucial for future growth. Even if adjusted for the delay in hitting management UFCF target and attaching a 15% discount rate, I still think the potential upside is attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.