Summary:

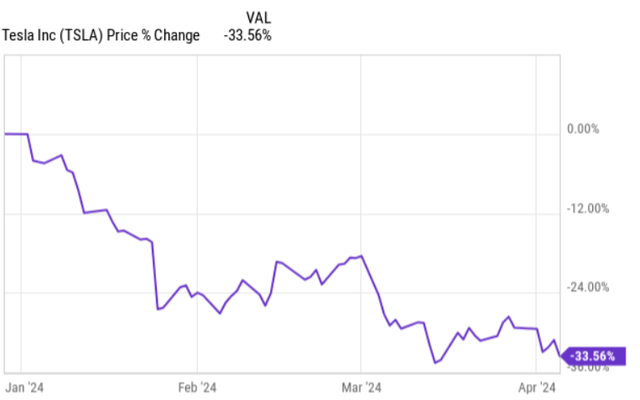

- Tesla’s stock has dropped by 33% on a YTD basis due to challenges in production and delivery, signaling pressure on the company’s returns.

- Meanwhile, part of the Buy-side analysts have maintained their positive outlook on Tesla despite the recent setbacks.

- Investors expect significant EPS growth in 2025 and beyond, even though the market factors in EPS contraction in the near term.

- Given the dynamics in China market, the increased competition in the overall EV space, and Tesla’s challenges to keep the margins intact, it just seems that there is too much baked into the cake.

georgeclerk/E+ via Getty Images

End of January this year, I published an article on Tesla, Inc. (NASDAQ:TSLA) outlining a rather bearish case, where it boiled down to just too rich valuations for the situation in the underlying fundamentals.

Already back then, the Q4, 2023 results indicated several signs of a more challenging road ahead with increasingly depressed margins and a notable slowdown in deliveries across the board.

Also, at that time, the Stock was down ~ 29% on a YTD basis which warranted speculations around “once in a lifetime” opportunity to buy the dip before the market recognized the long-term growth potential that could be supported by incremental improvements in the financials.

Well, the recently circulated production and delivery statistics clearly paint a continued pressure within TSLA business to register returns that would satisfy the market. For example, given the fairly rich valuations, one would expect a strong double-digit growth in the deliveries, yet the Q1, 2024 data reveal a negative rate of change dynamic, where the total number of cars delivered has decreased by ~9% compared to Q1, 2023. Even compared to the prior quarter, the numbers are down by a stunning ~20% (albeit in this comp we have to take into account the seasonality effect). As it will be described below in the article, it has been the combination of several notable factors imposing these headwinds for Tesla’s deliveries such as tighter competition in China and globally, technical struggles, and general slowdown in EV growth.

As a result, the Stock dropped even further, reaching ~ 33% negative return territory on a YTD basis.

Yet, if we look at how some of the buy side analysts have reacted to this, we will not notice any material changes in how they view the Company.

For example, Morgan Stanley has decided to keep the overweight rating in place. Cathie Wood from ARK Invest considered this an opportunity to capitalize on the overreaction and bought the dip by adding over 240 thousand shares of TSLA.

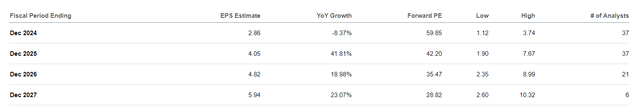

It is also interesting to take a look at the consensus EPS trajectory in terms of how the analysts have priced the earnings growth over the foreseeable future.

Despite the recent challenges in Q4, 2023 financials and Q1, 2024 deliveries together with the worsening industry (EV market) dynamics, investors expect ~40% EPS growth in 2025 that would be followed by a continued EPS expansion of ~20% in 2026 and 2027.

Interestingly, that some dose of reality has kicked in as it can be implied by the consensus expectation of experiencing some EPS contraction this year. However, there is still an assumption baked into the cake that suddenly starting from 2025, the story will take the complete opposite direction and that Tesla will manage to come back with a vengeance.

Where is the issue?

The overarching issue with all of this lies in the very rich valuation multiples at which Tesla is currently trading. Whenever you have this aggressive pricing from multiple perspective, the Company has to really showcase robust financials or clearly embody the characteristics, which send a message that the growth ahead will be material. Nevertheless, looking at the weakening drivers that contribute to Tesla’s growth story and seeing their negative effects already percolating through the Company’s books, the overall level of speculation (i.e., probability of Tesla actually matching or exceeding the expectations) has increased.

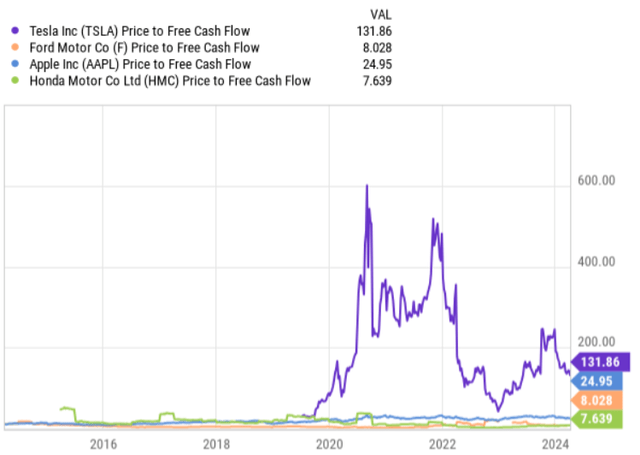

Based on a P/FCF, Tesla’s multiple exceeds most of its peers by a very huge margin. Even compared to Apple (NASDAQ:AAPL), which is widely associated with the embedded AI potential, but already generates a ton of cash, Tesla is way more expensive. I think that here, investors have to decide whether the current bets into AI by Tesla (e.g., full self-driving cars, robotaxis, and the Optimus autonomous robot together with its Dojo supercomputer) will, first, materialize, and, second, if they really succeed, whether there will be an underlying business in case. If both of these elements come to fruition, sure, Tesla will have all of the reasons to skyrocket. Yet, I am rather skeptical here due to the following reasons:

- Having FSD and robotaxis implemented at a large scale requires a myriad of regulatory acceptance, which is in itself a speculative process and clearly a time-consuming one.

- To extract juicy profits from these investments, you have to have a small competition place to penetrate the technology, while charging abnormal margins that would justify the long-duration investments. Given what we can see across the peer landscape and considering the pace of technology advancements by several Asian car manufacturers, I just do not think that we can take the market entry of the Tesla bets for granted.

- Finally, at the end of the day, it will boil down to cash generation for Tesla to justify the multiple and make sizeable returns from AI-related investments. Here we do not have any benchmark or directly comparable data points against which we could assess Tesla’s performance. However, considering the dynamics of its core business, where it was the front-runner before any other serious competition emerged, again, we cannot take solid profits for granted. So far, we have not seen Tesla capitalizing on its core EV business by delivering strong and growing free cash flows. Instead (as elaborated below) we can see a contraction in FCF taking place.

Plus, on an absolute basis, Tesla has a P/FCF that is just astronomical and its P/E is at ~ 60x, introducing a very tough basis to meet or exceed in order to capture alpha going forward.

In the chart below, we can nicely notice the valuation gap between Tesla and Apple as well as other selected car manufacturers. The key takeaway here is simple: take any more traditional car (including EV) manufacturer out there or even an AI-focused company like Apple, which has way more cash to direct towards AI potential, we will easily conclude that Tesla is priced to perfection. For example, a company like Ford (NYSE:F), which has sufficient capital to distribute dividends and direct capital into R&D activities trades more than 15x below Tesla’s P/FCF multiple even though Tesla currently also generates most of its cash from car production business (which is struggling now). This just speaks of how huge the “AI-related” premium is factored into Tesla’s stock.

However, after seeing the deterioration in financial performance, further weakening in deliveries, and taking the broader economic (including geopolitical) context in mind, the aforementioned multiples seem extremely stretched. Also, for me, it seems very unlikely that Tesla will manage to reach the EPS targets that the market has priced in.

Let’s remember that in 2023 Tesla registered negative adjusted EBITDA growth of ~13% (on a year-on-year basis) due to margin compression at gross profit and operating income level, while the total revenues ticked higher a bit. In other words, even with a sales increase that should at least theoretically provide benefit to the margins through economies of scale (as Tesla has a lot of fixed costs), the bottom line dropped. It was really a combination of both price per unit pressure and the general increase in cost input factors.

If we add the fact that during Q1, the deliveries were as weak as they were, it clearly sends a signal that on a top line there will not be much of a support for Tesla’s ability to convert the sales proceeds into tangible cash flows and earnings that really matter for investors.

Moreover, China, which constitutes circa 22% of Tesla’s sales, is increasingly becoming a tougher market for foreigners, where to play in.

Besides the recent recall of ~ 2 million cars in China after determining that parts of the autopilot features were overly confusing and too easy to misuse, there has been an increasing chatter about how the China government takes deliberate actions to support the domestic EV car manufacturers (from subsidies to outright entry restrictions at more government-affiliated venues).

As we already know, Tesla’s market share in China has also experienced unpleasant dynamics lately, where domestic firms such as BYD Company (OTCPK:BYDDF), Li Auto (LI), NIO (NIO), and XPeng (XPEV) have put the necessary efforts (my speculation, but most probably directly supported by the local Government in a meaningful and coordinated fashion) to render their models more attractive to locals via primarily price cuts. For example, BYD Company, which is the most significant rival to Tesla not only in China but also increasingly globally, embarked on multiple price cuts across most of its fleet (e.g., 12% price drop on its Yuan Plus crossover, a best-selling in the overseas market). There is also a firm expectation that the price cuts will continue in 2024 which will further put a downward pressure on Tesla’s ability to deliver growth in volumes (certainly to the extent that could justify the multiple).

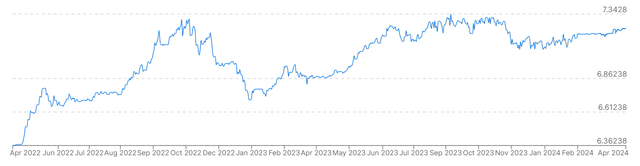

On top of all this, let’s not forget about the FX risk.

In the past two years, the USD has quite materially appreciated relative to CNY, and even on a YTD basis so far, the trajectory has remained unfavorable for exports like Tesla. While it is difficult to predict the path of this currency pair, it just introduces an additional risk into the equation, making the market’s EPS expectations a more challenging target.

Finally, it is worth underscoring the fact that the competition in the EV space really tightens up across the board as the historical CapEx commitments have started to bear meaningful fruit at a larger scale.

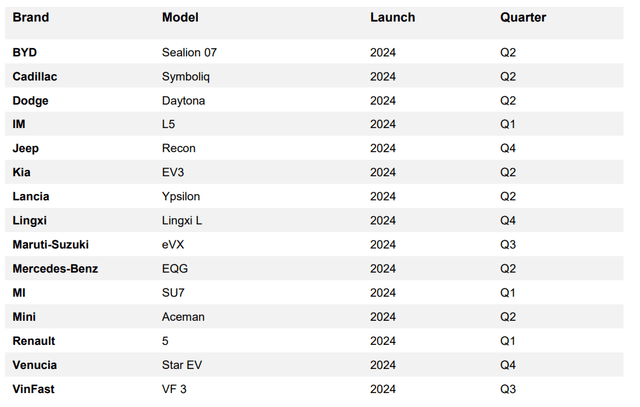

S&P Global Mobility Light Vehicle Production forecast, December 2023 Release

For example, the list of new EVs coming to market is really long (above is reflected in a non-exhaustive list of 2024 models) offering consumers a broader choice and making Tesla’s optionality less dominant.

The bottom line

In a nutshell, Tesla trades at too aggressive multiples that command strong underlying growth. We can also notice this by looking at the consensus EPS estimates for the foreseeable future that paint solid double-digit EPS growth going forward. Here, if Tesla fails to deliver on these metrics, the share price will inevitably fall, and, most probably, in a significant fashion as the valuations are very rich.

Based on Q1, 2024 production and delivery statistics and the emerging difficulties stemming from China market and the increased competition across the board, I just do not see how Tesla could register earnings in line with what the market has factored into the prevailing valuations.

For this reason, I still leave the rating at hold, without a recommendation to go long. In the meantime, it also would be too speculative for going short Tesla since as history has shown, the valuations and how they look like in the context of the underlying fundamentals oftentimes do not concern the market at all. An additional risk that could send the Stock higher from here could be driven by any positive news surrounding any of the AI-related bets (e.g., smooth uptake of robotaxis, fast and successful MVP of Optimus autonomous robot, or even a sudden reversal of momentum in China market). Yet, again, AI and investments in currently unexplored technology are inherently unpredictable, and the sales in China do not show any signs of recovery, but rather the opposite. For me and given rich excessive valuations, Tesla implies just too much of a speculation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.