Summary:

- Apple’s stock has experienced weakness, down 9.6% while the S&P 500 is up 14.9%.

- The company is facing regulatory issues and weakness in certain markets, such as China.

- However, Apple’s long-term growth potential remains strong, with revenue growth in services and iPhone sales driving value.

ozgurdonmaz

The past few months have been a bit unpleasant for consumer technology giant Apple (NASDAQ:AAPL). At a time when the broader market has been roaring higher, led by a number of tech companies, shares of Apple have experienced some weakness. Consider, for instance, the time from when I last wrote about the business in late November of last year through the present day. Back then, citing mixed financial performance and shares that were a bit pricey, I ended up rating the business a ‘hold’ to reflect my view at the time that the stock should perform more or less along the lines of the broader market. But since then, shares have seen downside amounting to 9.6% at a time when the S&P 500 is up 14.9%.

In truth, there are plenty of issues that the company is contending with right now. Some of these are on the regulatory side, with an antitrust suit having recently been filed by the US Department of Justice in coordination with 16 States and the District of Columbia. That centers around messaging and other practices of the company that are considered anticompetitive. In Europe, the firm was recently fined nearly $2 billion over antitrust issues pertaining to music streaming apps, and it is undergoing other investigations there. Outside of the regulatory picture, the firm is facing weakness in certain markets. Rising threats in China, combined with product-specific weaknesses, are proving to be a problem for the company.

Naturally, this has investors a bit jittery. But when you step back and look at the long-term picture, it’s difficult to be all that pessimistic. My purpose in this article is not really to focus on the regulatory side of things. These could take years in order to sort out. And as other companies have shown over the years, with Microsoft (MSFT) being one great example, continued market dominance can persist even after facing intense scrutiny from governments. Instead, I will focus on the market potential for the firm, as well as giving a better understanding of some of the pain the company has seen recently on that front. My conclusion is that, while the company might not have rapid growth ahead for it these days, it should continue to have opportunities for revenue and cash flow expansion as time goes on.

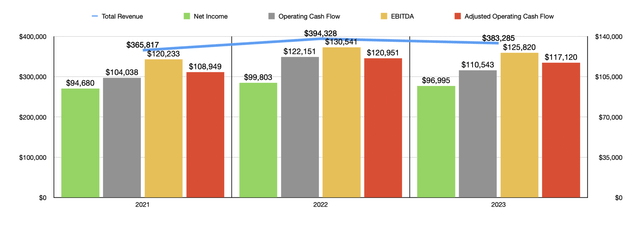

A look at recent weaknesses and opportunities

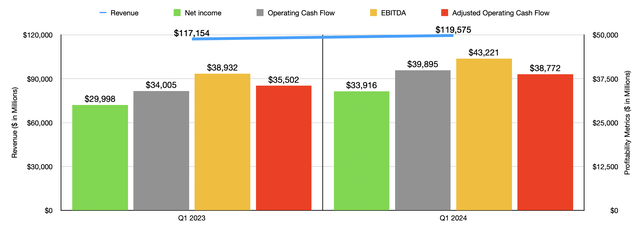

With a market capitalization of $2.66 trillion, Apple is currently the second largest publicly traded company on the planet. You would expect a business with this designation to post continued growth across the board from one year to the next. But that’s not exactly what has transpired. As I wrote about in my last article on the company late last year, revenue, profits, and cash flows, all weakened in 2023 compared to 2022. The graph that I used to illustrate that in the aforementioned article can be seen above as well. Fast forward to the present day, and we do have results covering the most recent quarter, which would be the first quarter of the 2024 fiscal year. This data can be seen in the chart below.

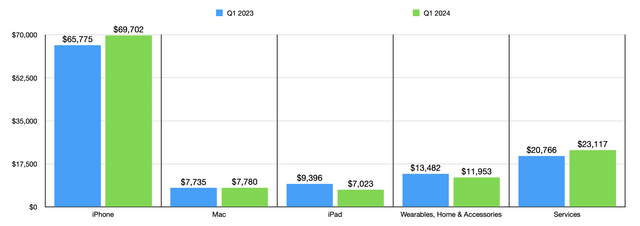

As you can see, the company does seem to be back on the growth path again. Revenue of $119.58 billion narrowly beat the $117.15 billion generated one year earlier. But this growth has not occurred across the board. When we look at the data on a product-by-product basis, we can see areas of strength and areas of weakness. The biggest pain for the company, for instance, came from its iPad, with revenue plummeting from just under $9.40 billion to $7.02 billion. This decline, approximately 25%, was due to weaker demand for the company’s iPad offerings. Another pain point, though not to the same extent, involved the Wearables, Home and Accessories products that the company sells. Revenue dropped by around 11% because of a reduction in demand as well. Unfortunately, management does not provide much in the way of additional details. But from my observations of the company over the years, these are all fairly marginal parts of the company that, in the long run, only have a slight impact on the business as a whole.

There are two parts to the company that I believe are the true drivers of growth and value in the long run. The less obvious of these would be the Services portion of the business. This includes revenue from advertising, video, cloud services, and more. Revenue actually rose by around 11% in the first quarter of 2024 compared to the same time last year, climbing from $20.77 billion to $23.12 billion. And then, even more significant, is revenue generated by the iPhone. In the first quarter of 2024 alone, this part of the company generated $69.70 billion in the form of sales. That’s 58.3% of the company’s overall revenue. That represents an increase of 6% over the $65.78 billion generated in the first quarter of 2023.

As I wrote about in my prior article, the iPhone has given the company unprecedented market power. Back in 2023, for instance, nearly 58% of the smartphone market in the US was controlled by Apple devices. And globally, that number was around 29%. Both had exhibited growth over the prior five-year window, though when it comes to the US market, the picture has more or less stabilized. But this brings us to one of the concerns for the company. And that involves potential weakness in China.

In terms of overall population, China is the second largest country on the planet. It boasts just under 1.41 billion people. Depending on which source and which definition you rely on when it comes to ‘middle-class’, it’s estimated that between 500 million people and over 700 million people in the country are middle class. It’s highly probable that this number will only continue to grow for the foreseeable future. Naturally, this makes the country the largest on the planet when it comes to smartphone sales. In 2023, an estimated 271.3 million smartphones were sold throughout the country. That’s nearly as many smartphones as there are people in the US.

The concern for shareholders of Apple is that, in addition to certain government agencies throughout the country banning the use of the phone for government workers, an old rival by the name of Huawei, appears to be on the rise again. Because of ties to the Chinese military, as well as other concerns, Huawei was severely hobbled a couple of years ago in a move that caused it to lose significant market share in the smartphone space. In a controversial move that is now being looked at by US officials out of concern that it might be violating US laws, Huawei did finally see a resurgence in the market, propelling it back into the top five spot in China.

We need to look at total revenue generated by Apple throughout China, there are also some concerns. After peaking at $74.20 billion in 2022, sales pulled back to $72.56 billion in 2023. But the real kicker was in the first quarter of 2024, when revenue of $20.82 billion came in 12.9% lower than the $23.91 billion generated in the country one year earlier. This signifies some meaningful weakness for the company in China. But honestly, this is not something that I am terribly worried about. This is because, although we don’t have data for the latest quarter, market share for the company in China hit 17.3% last year. That’s up from 16.8% reported for 2022. This bump-up in market share was driven in part by a 5% decline in total smartphone shipments in the country last year, which was far worse than the roughly 2% decline seen by Apple during the same window of time.

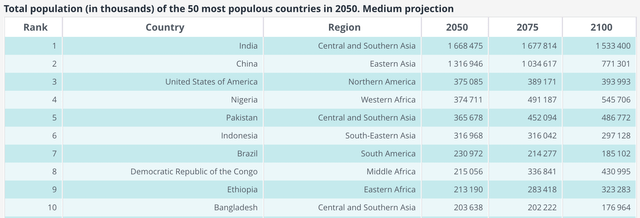

In the long run, I would argue that the picture in China might not be the best. The country is dealing with an aging population, and it’s projected to see its population peak before too long. In fact, by 2050, the country’s population is expected to dip to 1.32 billion. And by the end of the century, it should only be around 771.3 million. So what we should see is a nice spike over the next few years as the country’s middle class continues to grow. But ultimately, true growth for the company will come from other places.

At top of mind is India. In an article published back in 2015, Professor Dean Geoffrey Garrett at Wharton Pointed out a couple of advantages that India has for the long haul that China does not. The first of these is that, unlike China, India is unlikely to see its population decline anytime soon. Last year, the country had a population of 1.43 billion, marking the first time in recent history that its population surpassed the population of China. By 2050, this number should grow to around 1.67 billion. In fact, growth should continue until at least 2075 when it’s expected to hit around 1.68 billion.

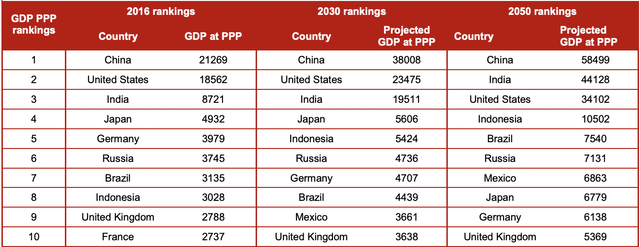

Unfortunately, Apple does not break down revenue when it comes to India on its own. In fact, instead of putting it in the Asia Pacific region, they lump it in with the European region that also includes the Middle East and Africa. We do know, however, from third-party estimates, that the company sells around 9 million iPhones throughout India each year. With 146 million units having been sold in 2023 alone, this comes out to a roughly 6.2% market share. At this time, India is substantially poorer than China is when it comes to the topic of GDP per capita. For China, that number is around $12,720. By comparison, for India, it is only $2,411. Even so, both countries are expected to see aggregate GDP expand over the next several years. By 2050, India is expected to become the second largest economy on the planet, with $44.13 trillion worth of GDP. While that will still fall short of the $58.50 trillion that China is expected to have, the gap in GDP per capita is expected to close quite a bit. By that time, in India, GDP per capita is expected to grow to around $26,449. That compares to the $40,948 forecasted for China.

We are already seeing some rapid growth in demand for high-priced products such as Apple devices. The premium market share phones that include some of the older iPhones amounted to just 3% of the country’s overall market share for smartphone sales last year. And yet, that market saw a 23% growth rate compared to what was seen in 2022. That comes at a time when overall smartphone shipments inched up only 1% year over year. And when it comes to the super-premium market that includes the newest and best iPhone models, growth in 2023 was an astounding 86%, taking the super-premium stake in the market up from 4% to 7%. This opens up the door to plenty of growth for Apple if current trends persist.

Because of what data we don’t have, it’s really impossible to know or the overall financial picture of the business would be from one year to the next, especially when talking about its performance in individual countries. But the point of this is to make the case that fixation on all of these threats on the market side is likely overblown. The global population is going to continue expanding, and the global middle class is going to grow. Places like China, not to mention Japan and South Korea, will see their populations decline. But in their place, other nations will thrive. By the end of the century, the population in the US is expected to rise to around 394 million. That’s up from around 336 million today. Other countries like Nigeria, Pakistan, and, as I mentioned already, India, will see their populations grow. There will always be demand for higher end offerings in the smartphone space. And management has demonstrated why the iPhone deserves to be a leader in that category.

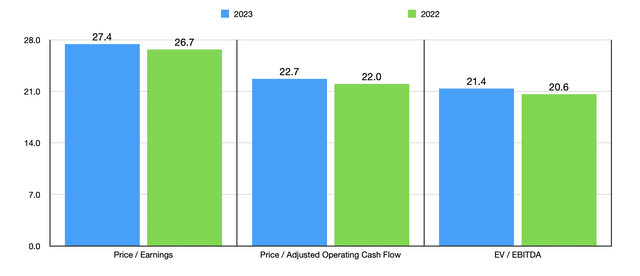

This doesn’t necessarily mean that investors should consider buying the stock today. As you can see in the chart above, shares are a bit pricey. This is especially true for a company that’s experiencing only marginal expansion from a revenue and profit perspective. But if we see shares drop much further from where they are now, or if fundamentals do start to pick up, a case could be made that the company is trading at a nice discount to its fair value. Until then, I don’t think that sitting on the sidelines is an awful idea. But for those who don’t mind the risk of underperformance, I can understand the decision to pick up units today.

Takeaway

All things considered, Apple appears to me to be a high quality company. It’s a massive business that has a global reach. But with massive scale comes massive problems. I already mentioned that I will refrain from opining much on the regulatory side. That is something that will take years to resolve. When it comes to competitive issues and market pressures, that is something the firm will have to work through. But when you look at growth opportunities, particularly in markets that the company does not generate a significant portion of its revenue from, but that also have significant upside potential, it’s difficult to be bearish. So long as the company can just maintain a major position in these markets, the outlook for investors should be positive. But this doesn’t mean that shares are attractive enough to buy yet. At this time, I consider them a bit pricey. But if they do decline much from here, a bullish stance would not be out of the question.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!