Summary:

- Google’s stock has slightly outperformed the market, but the gap between Google and its rivals in the generative AI race is widening.

- AWS and Azure each have their unique strategic strengths in generative AI, and Google’s Cloud looks like a big laggard here.

- Google’s valuation suggests the stock is slightly overvalued.

Matteo Colombo

Investment thesis

My previous bullish thesis about Google (NASDAQ:GOOG) aged well as the stock slightly outperformed the broader market over the last quarter with almost a 12% rally. The stock now looks slightly overvalued and recent developments suggest that the gap between Google and its rivals in the generative AI race is widening. Since generative AI capabilities are disrupting most high-tech industries and niches, the lag in the AI race is a big threat to Google’s prospects in the cloud business. Moreover, it appears to me that Google’s management could be underestimating the effect of recent potential Gemini reputational damage on the company’s long-term prospects in the generative AI domain. Based on my valuation analysis, the stock looks slightly overvalued, which seems to be unfair given the abovementioned strategic threats. All in all, I downgrade Google to “Sell”.

Recent developments

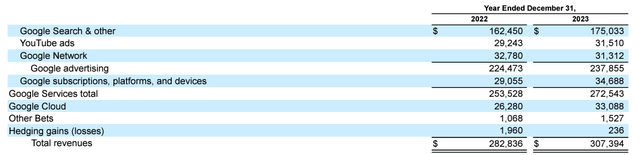

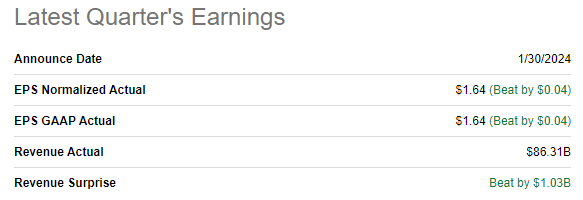

Google delivered strong quarterly earnings on January 30, confidently surpassing consensus estimates. Revenue grew by 13.5% on a YoY basis and the adjusted EPS expanded significantly, from $1.05 to $1.64.

Seeking Alpha

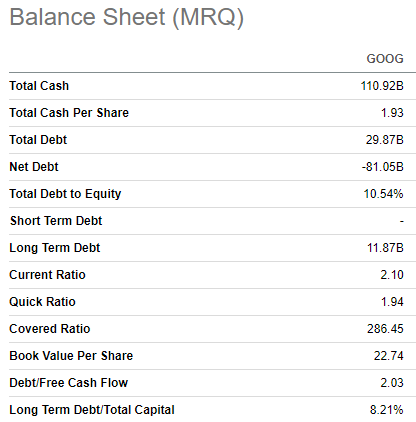

The strength in EPS was ensured by the improved operating margin, from 23.9% to 28.9%. The substantial EPS improvement was also achieved due to the decreased number of outstanding shares, from 12.85 billion to 12.46 billion, according to Seeking Alpha. Google’s balance sheet is still a fortress, with almost no leverage (in relative terms) and a massive $110 billion cash pile.

Seeking Alpha

I do not want to spend readers’ time on deep analysis of the previous earnings report, but I want to emphasize that, for the full fiscal year, revenue grew by 8.6%, or $24 billion. Out of this increase in absolute terms, digital advertising added $14 billion, being by far the largest growth contributor.

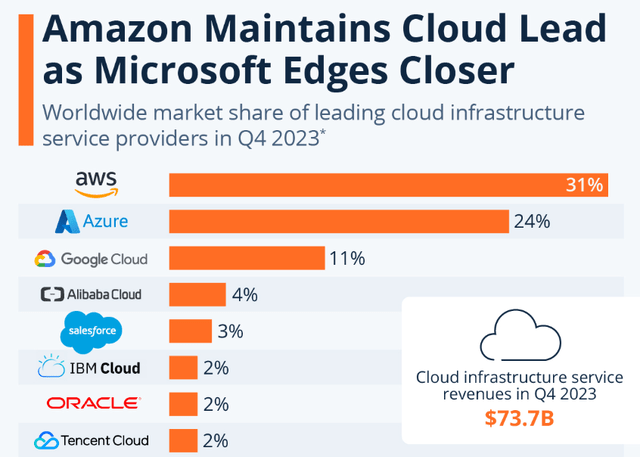

The second-largest contributor was Google Cloud, which delivered a 25% YoY growth. This might look like an impressive growth, but I must add context here. According to crn.com, Google Cloud generated almost three times less than Amazon’s (AMZN) and Microsoft’s (MSFT) cloud businesses, which is a massive gap. I would like to explain why I believe Google is very unlikely to close the gap with its rivals.

Artificial intelligence (AI) capabilities, and especially generative AI, are disrupting various industries, and cloud infrastructure industry is apparently one of them. I believe that the infrastructure cloud market share matters a lot in generative AI, because machine learning algorithms for gen AI are not making up the information from nowhere. Instead, the quality of the generative AI to a large extent develops on the number of different training scenarios and iterations the machine learning algorithm is facing. That said, when AWS holds almost three times larger market share than Google Cloud, it means that Amazon’s machine learning algorithms have access to almost three times larger dataset. The same with comparisons with Microsoft’s Azure, with its market share two times higher than Google Cloud’s. And all this information and sophisticated training scenarios for machine learning algorithms is not something that Google is able to acquire.

I believe that this technological gap is already apparent. OpenAI’s ChatGPT (backed by Microsoft) is an apparent generative AI superstar and by far the most used chatbot. What is important here is that now it works like a snowball effect: The more users with different topics iterate with the chatbot, the deeper its algorithms are trained and the better the quality of the chatbot’s answers becomes over time. It is akin to the 10 thousand hours rule for someone mastering a skill, and OpenAI appears to be the most hard-working student in the class. There are rumors that the new GPT-5 version of the chatbot might be released in the next few months, which means that new sophisticated features are likely to be introduced. All these positive developments with ChatGPT improve the technological potential for all Microsoft’s offerings, and especially cloud solutions. As an early investor in OpenAI, Microsoft has exclusive access to GPT’s code and is able to integrate chatbot’s capabilities with its services.

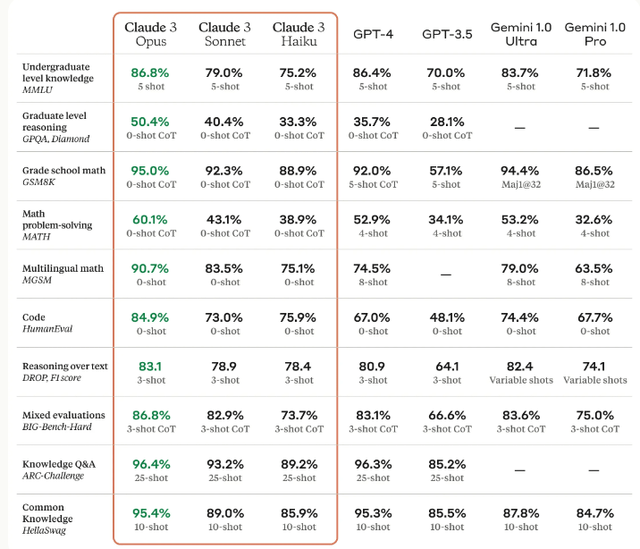

AWS does not have such a superstar chatbot as a strategic partner, but it has by far the largest market share in cloud. Moreover, Amazon is by far the largest e-commerce platform in the world (excluding China) with hundreds of millions of users and merchants connected. This means that Amazon’s business-specific dataset is likely to be unmatched, which gives it strong opportunities to develop high-quality generative AI solutions, whether in-house or partnering with a promising startup Anthropic. Moreover, about a month ago, Anthropic released its Claude 3 model family, which looks very competitive to ChatGPT from a technological perspective. I also want to pay attention that, according to the below table, Google’s Gemini is notably behind both ChatGPT and Claude across most of the technological metrics.

Apart from the technological perspective and the potential to develop generative AI capabilities depending on the cloud business scale, it seems to me that Google underestimates that “chatbot’s reputation” is crucial in the generative AI business. What I mean here is that it looks like the management did not learn from the failure of its Bard chatbot in early 2023 in my opinion, which was clearly not ready for public release, but the company proceeded with a “raw” version. Despite such a failure last year, I believe history repeated itself in February 2024 when the image generator Gemini also had issues with its controversial responses. That said, the technological gap in generative AI between Google and its big rivals is also multiplied by the arguably flawed reputation as a serious chatbot player. I think that these two adverse factors substantially limit Google’s potential to close the gap in generative AI with its rivals, which will ultimately weigh on Google Cloud’s ability to compete with AWS and Azure over the long term.

Valuation update

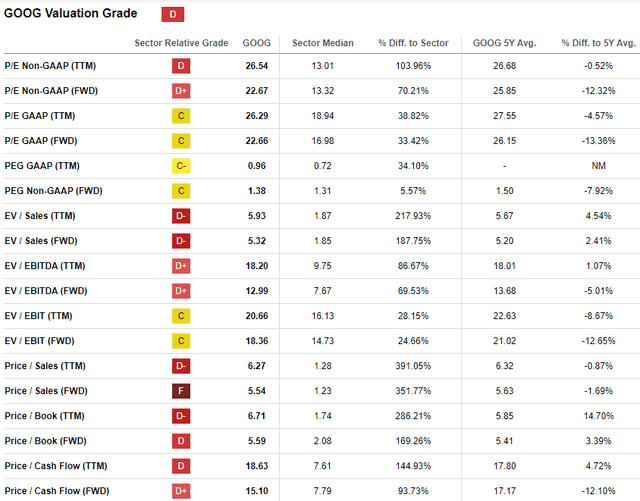

Google rallied by 47% over the last twelve months and is having a solid 2024 with a 9% YTD rally. Current valuation ratios are mostly in line with the company’s historical metrics, meaning the stock is approximately fairly valued from the multiples perspective. For hyper scalers like Google, I ignore comparisons with the sector median because the footprint of big tech companies is unmatched.

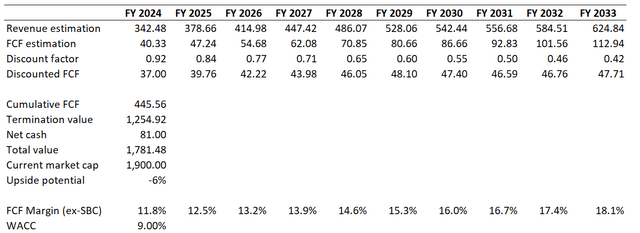

Valuation ratios analysis is never enough for me, and I proceed with the discounted cash flow (DCF) simulation. I use a 9% WACC, slightly lower than in my previous GOOG valuation, but it is still in line with the recommended range from valueinvesting.io. I use long-term revenue consensus estimates projecting a 7% revenue CAGR for the next decade, which appears conservative enough to me. I use a TTM 11.8% FCF ex-SBC margin and expect the metric to expand by 70 basis points yearly, which correlates with a projected 7% topline CAGR.

According to my DCF simulation, the business’s fair value is slightly below $1.8 trillion. This indicates that the stock is slightly, about 6%, overvalued. I think that this is fair given all the secular risks Google faces amid the AI revolution.

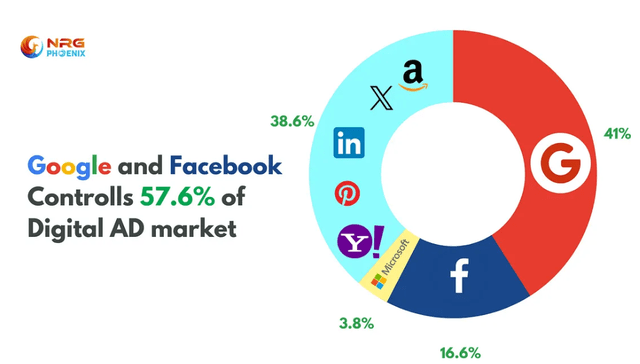

Risks to my bearish thesis

Despite lagging in the AI race and facing the risk of being disrupted, Google still dominates the global digital advertising space with a staggering 41% market share. This enables Google to generate substantial free cash flows, $59 billion in FY 2023. The company’s balance sheet is clean, meaning that the company has massive resources to continue investing in innovation. Therefore, despite having a substantial gap in the cloud market and generative AI advancements, there is a slight probability that Google might make a comeback. Given all Google’s weaknesses in the AI race I have mentioned above, I consider odds for such a scenario to be low, however.

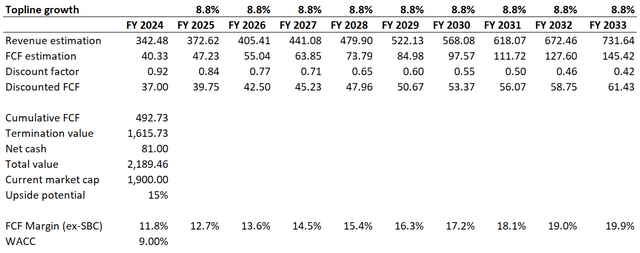

As we have seen in the valuation section, the company’s current market cap is close to the fair value of the business. My DCF incorporates consensus forecasts, which represent a relatively conservative 7% long-term revenue CAGR. This is behind an 8.8% projected digital advertising market growth by 2028. I think that such cautious GOOG revenue projections assume that the market can be disrupted by the ongoing AI revolution, and I agree that the probability of the industry being disrupted is indeed high. However, it is difficult to forecast the timing of these disruptions and how rapidly they could potentially decelerate Google’s revenue growth. If I incorporate an 8.8% revenue growth pace and a 90 basis points FCF margin expansion, Google’s valuation becomes more attractive with a 15% upside potential. While a 15% upside potential looks insufficient to me given the risks of being disrupted, I think that the market will likely positively react in case of consensus upgrade of Google’s revenue growth.

Bottom line

To conclude, I consider Google’s stock a “Sell” now. The technological lag behind Microsoft and Amazon in the AI race looks apparent to me, but Google is still a digital advertising king with vast resources. Therefore, I will look at how technological developments will unfold. I might change my view to more positive in case Google’s market share in cloud expands at the expense of competitors, but in the current reality, I consider odds to be low.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.