Summary:

- Etsy’s stock price has reversed its recent rally and is now trading at a relatively low valuation compared to its historical norm and other growth stocks.

- The company’s supply trends remain strong, with an expected increase in sellers on the platform, while traditional retailers face negative headwinds.

- Etsy has a solid balance sheet and strong cash flow and is aggressively buying back its shares, improving shareholder value.

- Views that the firm will fail appear unsupported due to its healthy balance sheet and cash-flow margins.

- The ongoing decline in full-time jobs could benefit Etsy’s long-term growth as more people look to it for supplementary income.

grinvalds

I covered Etsy (NASDAQ:ETSY) six months ago with a neutral outlook. At that time, I believed the stock was likely oversold after tumbling 80%, having a far superior “P/E” valuation than in the past. I believe ETSY was trading in a clear bubble pattern from 2020 to 2022 as investors overestimated its growth rate based on the temporary impact of COVID lockdowns, encouraging more people to start businesses on the platform.

Therefore, my views regarding Etsy mirror those about Fiverr (FVRR). I see both as being fundamentally supply-driven companies. As more people look to become sellers on the platforms, more people will come to shop for those products and services. That is the classical economic theory of “Say’s law,” juxtaposing more common demand-driven views. Of course, regarding Etsy, I previously had a neutral view because I was uncertain of its demand outlook stemming from the relatively high cost of products on the platform, giving it some negative inflation exposure.

However, since October, we’ve seen ETSY’s stock rise higher in value and reverse those gains. It is now trading within a few points of when I covered it last. Further, I believe there is a clear improvement in Etsy’s fundamental demand and supply outlook. Consumer credit and retail spending trends certainly do not support a demand boom. However, Etsy’s supply trends are more critical and remain strong. The company is also showing a great degree of demand stability, with traditional “big box” retailers showing more negative headwinds on the consumer front.

Of course, Etsy’s valuation is also very low today compared to its historical norm and the typical range for growth stocks. Like Fiverr, I believe that stems from short-sighted expectations from most investors and a misunderstanding of how the COVID lockdown period changed the market. As Etsy is now back at an attractive price with some indication of technical support at its current level, I believe it is an opportune time to analyze the company to determine if it could be among the few discounted stocks today.

The Lockdown Era Accelerated Future Trends

Broadly, it seems fair to say that 2020 to 2022 saw a significant acceleration of existing trends. Work from home, supply-driven inflation (from a prolonged lack of US capital investment), and the shift toward e-commerce were all trends before 2020. However, the volatility of that period significantly accelerated those patterns, effectively pushing the future forward.

In virtually all stocks I’ve seen (besides the very stable ones), companies saw a pronounced rise or decline in sales and EPS from 2020 to 2022 and have not seen those changes reverse. However, the trends have stagnated, becoming perhaps less pronounced than before 2020 as the rest of the world catches up to those changes.

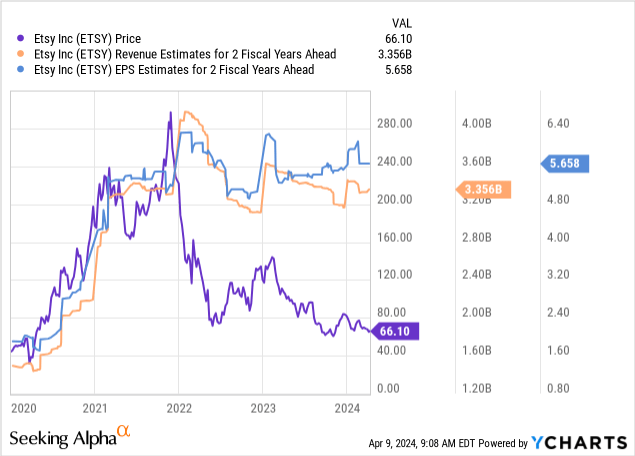

For example, Etsy had tremendous sales and income growth from 2020 to 2022, driven by an increase in the number of Etsy sellers. As people lost jobs or realized they preferred to work for themselves, they started Etsy businesses, causing the company’s sales to rise significantly. In 2019, the company had 2.7M sellers. By 2021, it had 7.5M, meaning it grew more sellers over that period than it ever had. That had a significant impact on its revenue and income expectations. See below:

Looking at Etsy’s stock price, investors may assume the company is on the verge of failing. Around 13% of its outstanding shares are sold short today, meaning many investors expect the company to fail. If those short-sellers are proven wrong, ETSY should rise significantly as they race to close their positions.

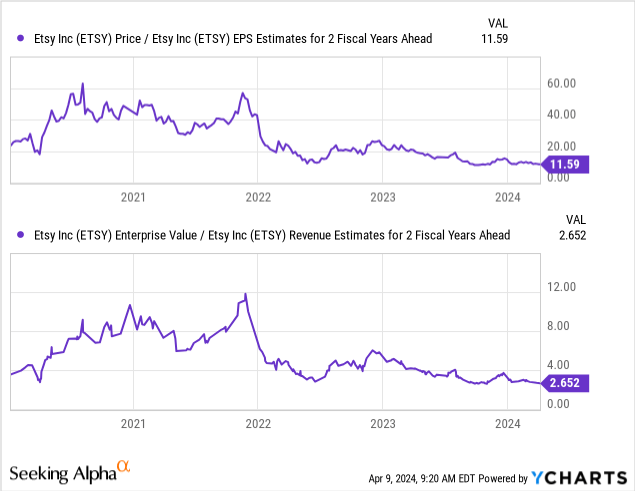

However, I believe Etsy’s issue today is not its fundamentals, but the short-sighted expectations of investors. In 2021, investors valued ETSY as if it would continue to grow at a tremendous pace. The same can be said for most smaller growth stocks, as likely detailed in perhaps one hundred or more of my articles from that period, given my historical focus on bearish picks. Today, as in Fiverr, I think the opposite issue is true; investors are pricing these stocks as if they will not grow ever again. See below:

Etsy’s forward “P/E” ratio based on a two-year EPS outlook is 11.6X today, which is extremely low for growth and retail stocks. Even Target (TGT) and Best Buy (BBY), failing to compete with e-commerce and having seen significant income declines recently, have materially higher valuations, TGT particularly at 18X. The massive decrease in Etsy’s “EV-to-sales” also indicates that investors are substantially lowering their growth outlook for the company.

In my view, it is unlikely we see tremendous growth from Etsy in 2024 or even 2025. Over this period, Etsy is still filling into the larger shoes it obtained in 2021. The company must adapt, which takes far more time than a rise in its sales or stock price, as it alters its focus on employees and operations. In other words, Etsy grew faster than it could manage from 2020 to 2022, so it must stagnate to adapt before it can continue to grow. Such is natural, but it does not imply that Etsy will not grow again or fail.

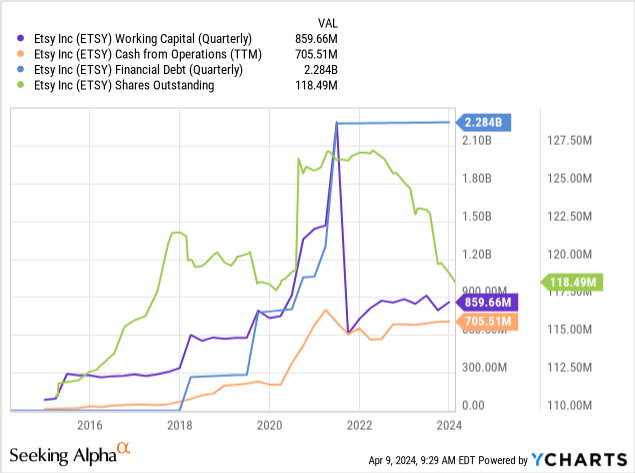

Etsy has a solid working capital base at ~$860M. It also has a positive CFO of $705M, with a low TTM “P/CFO” of around 11X. It had ~$2.3B in debt, all ultra-low rate convertible notes. The company is also buying back its shares aggressively today, improving shareholder value. See below:

Etsy’s debt is not necessarily high compared to its market capitalization and positive cash flow. Its debt will begin to mature in 2026 through 2028, but it can likely use its CFO to make those payments and could even refinance with traditional debt because its income is relatively high.

The trend in ETSY’s stock price and its relatively high short interest level may imply failure risk, but that is simply not supported by its fundamentals. The company has a very strong balance sheet, great margins, and strong cash flow. In many instances, I am weary of stocks that aggressively buy back their stocks. However, in Etsy’s case, its valuation is so low that it is a very logical choice and one that improves value for shareholders.

Lastly, Etsy also has ~$470M in R&D spending compared to a ~$670M two-year-ahead income outlook. Fundamentally, R&D spending is a value-add for a company, akin to capital expenditures. Companies can also reduce R&D if needed. Adding those together, we see over $1B in income potential. Of course, it will not earn that as it will not cut R&D, but that shows how profitable this company is and how low its valuation is compared to that potential.

The Bottom Line

The most significant risk facing Etsy is still a consumer-driven recession. In the past, that was the reason I was neutral on the stock. However, my view has changed recently. Based on a great deal of data, it remains clear that US households are in a weak position driven by low full-time salary growth, growing credit card debt, low savings, falling retail sales, etc. Therefore, any retail-focused company carries a great deal of risk today, as spending is fueled by credit card debt that will not persist.

Still, one of Etsy’s best years was recessionary (2020). Retail sales fell initially in 2020 but were strongly fueled by stimulus. That said, Etsy’s strong performance over that period stemmed mainly from a rise in the number of sellers on the platform, driven by a drive for secondary or primary self-employment.

As noted recently, the number of full-time jobs is falling fast today, while the number of full-time workers with second part-time jobs is rising. Platforms like Etsy benefit from that as some look to start a side business. As full-time jobs continue to decline, I expect more and more sellers will flock to the platform. Many people will have difficulty making money if supply grows faster than demand. However, people will always find new market niches that work, bringing new customers to the platform.

Thus, I believe Etsy has a recessionary hedge compared to many retailers. That has more to do with how a recession would improve supply on the platform, offsetting an inevitable decline in demand from a recession. Overall, a recession should temporarily harm Etsy’s platform but encourage its long-term growth, similar to the pattern in 2020-2022 when it initially crashed but quickly reversed those losses. Even if that occurs, Etsy has the benefit of not selling products, instead charging a royalty on sales and cutting R&D if needed, so I do not expect the company to be at risk of chronic negative cash flows. Of course, it also has more than enough working capital to manage that situation.

Overall, I am bullish on ETSY today and believe it is a tremendous growth-at-a-reasonable price stock today. In fact, I’d say it’s a “growth at an unreasonably low price” stock today, given its valuation is below retailers that are actually at risk of failing. Now that it’s back at its support level, I believe it is likely that ETSY will rebound. That said, caution is advised at Etsy, which could break below its support and temporarily continue lower as short-sellers pile against it. I would be even more bullish in that case, given its failure risk appears extremely low. Of course, if consumer demand crashes, ETSY may decline for some fundamental reason, such as a sales slip. Still, I believe that scenario would encourage long-term growth regardless as more people look to sell on the platform for side-income potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ETSY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.