Summary:

- Palantir stock is up 34% YTD and 174% YoY, and I’m seeing more investors who seem to be waiting for a dip to buy. I don’t think it’s worth waiting.

- Palantir’s revenue growth accelerated in the final quarter of 2023 against the backdrop of increasing margins – the AIP bootcamps opened up a new TAM opportunity.

- PLTR’s dependence on SBC, which was previously a pressing issue for the company, has decreased meaningfully.

- I expect that the EPS figures priced in today will most likely turn out to be too low, despite the implied EPS growth of over 17% CAGR for the next 10 years.

- I conclude that investors who are wary of buying Palantir at current highs could face a serious opportunity cost if the company beats current consensus forecasts for EPS and revenue in Q1 2024.

Jonathan Kitchen/DigitalVision via Getty Images

My Thesis

It has been 3 months since the publication of my first and previously only article on Palantir Technologies (NYSE:PLTR) and the stock has managed to grow significantly on the back of its strong report, the details of which I’m going to analyze today.

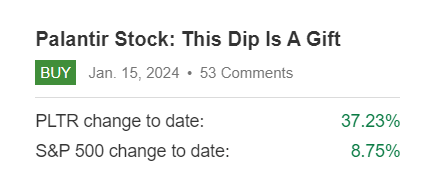

Seeking Alpha, Oakoff’s article on PLTR stock

PLTR is up 34% YTD and 174% YoY, and apparently, that’s why I’m finding more and more opinions from various people on the internet that if the stock corrects sharply, they’ll start buying the dip. In a conversation with these prospective investors, you can find out why they think so – I’ll talk about that below as well. However, I can form a fully-fledged thesis from the conclusion I come to today: No dip in Palantir is needed to justify buying the stock today to hold for the long term, even at the current seemingly elevated prices.

My Reasoning

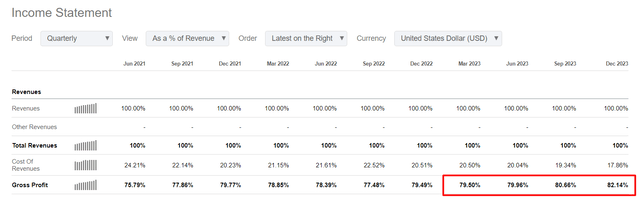

Palantir’s revenue growth accelerated in the final quarter of 2023, increasing by 20% YoY (in Q4) while for the full year 2023, it went up by 17%. It is worth noting that PLTR’s gross profit increased systematically over the course of the year, reaching an all-time high of over 82% at the end of the 4th quarter of 2023:

Seeking Alpha data, PLTR, Oakoff’s notes

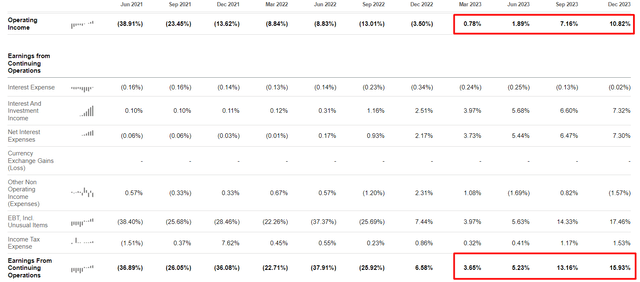

Looking at the segment data, we see that for the full year 2023, PLTR’s U.S. Commercial revenue experienced substantial growth, up 36% year-over-year to $457 million, while the Government revenue also went up, but not by as much: +14% YoY to $1.2 billion. Thanks to this substantial growth in gross profit and relatively modest expansion in operating costs, we could see a widespread margin expansion – below you can see the unadjusted data provided by Seeking Alpha:

Seeking Alpha data, PLTR, Oakoff’s notes

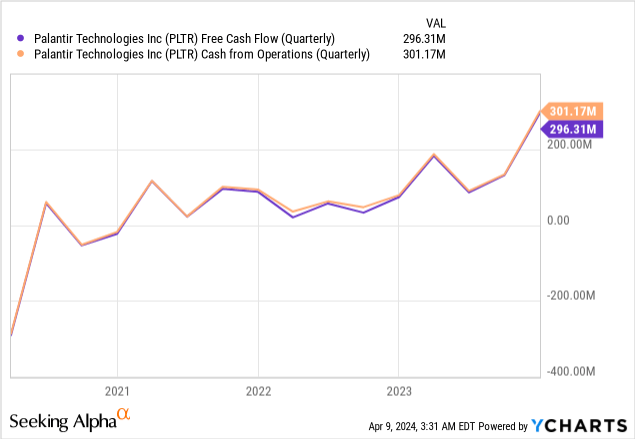

GAAP net income for 2023 as a whole amounted to ~$210 million, representing a 9% margin, with GAAP income from operations (EBIT) stood at $120 million (a 5% margin). As in the previous quarters, Palantir Technologies generated a positive cash flow from operating activities: the CFO reached $712 million, reflecting a 32% margin, while adjusted FCF stood at $731 million (a 33% margin). Based on quarterly data, Q4 2023 showed a peak in both metrics, according to YCharts:

In the past, many observers and also some investors have criticized PLTR for its massive use of a stock-based compensation (SBC) program as a way to save on direct costs at the expense of existing shareholders. Well, in 2023, SBC expenses decreased by 15.74% YoY and accounted for only 21.34% of total revenue, compared to 29.61% in 2022. It’s therefore absolutely no surprise to me that PLTR stock price responded with such rapid growth immediately after the publication of the Q4 earnings report: one of the main complaints against the company began to sound much softer.

The main positive aspects (business growth, margin growth, FCF, etc.) are primarily attributable to the success of the Adoption and Integration Program (AIP) and bootcamps. According to the latest earnings call commentary, Palantir has exceeded its target of conducting 500 AIP bootcamps within a year and has completed over 560 bootcamps in 465 companies (as of February 5, 2024).

In my opinion, Palantir has greatly expanded its total addressable market (TAM) thanks to the new global desire to integrate AI into operations. The real growth could be hidden from the eyes of the researcher who is looking for growth levers for Palantir’s business by looking for them in the growth of the overall artificial intelligence market, which is expected to grow at a CAGR of 15.83% over the next 6 years, according to Statista. In my opinion, investors need to look at this market more narrowly: When we talk about the commercial segment, Palantir’s offering is about helping companies launch AI in production, regardless of their sector and industry. And this is no longer 15-16%, but 3 times bigger than that:

The Global Artificial Intelligence In Manufacturing Market size is estimated to be valued USD 3.2 billion in 2023 and is anticipated to reach USD 20.8 billion by 2028, at a CAGR of 45.6% during the forecast period. The market growth is ascribed to emerging industrial IoT and automation technology.

Source: Market And Market data [January 2024]

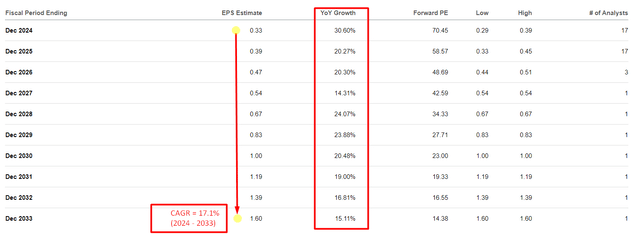

Therefore, I expect that a) the commercial segment will dominate the business structure, making comparisons between “old Palantir” and “new Palantir” completely untenable, and b) the EPS figures priced in today will most likely turn out to be too low, despite the implied EPS growth of over 17% (CAGR) for the next 10 years.

Seeking Alpha, PLTR’s EPS projections, Oakoff’s notes

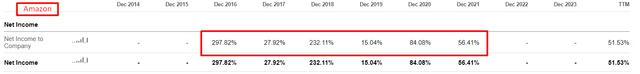

Many may think that Palantir’s EPS growth seems unattainable – over 30% in 2024 and over 20% in 2025 and 2026 are very generous assumptions for any company. But if we look at the historical indicators, we’ll see that the company has only just become profitable – PLTR has a very low base for growth. I don’t want to compare companies operationally by any means, but still – if we take the case of Amazon (AMZN) as an example, we can see what a low base leads to when the backdrop is a strong tailwind from TAM and margin expansion.

Seeking Alpha, AMZN’s income statement, Oakoff’s notes

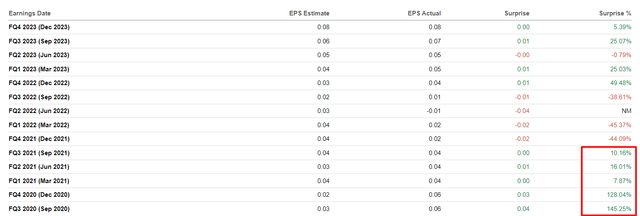

Therefore, the fact that Palantir stock is now near its local highs is no reason to shy away from buying it at current prices, in my opinion. Yes, corrections happen and are inevitable, but the constant anticipation of a steep correction can lead to a high opportunity cost – the stock can adjust much higher if the company’s results for Q1 2024 (expected on May 8, 2024) beat Wall Street expectations just as it did throughout 2021 (the heyday of the “old Palantir” business):

Seeking Alpha, PLTR, Oakoff’s notes

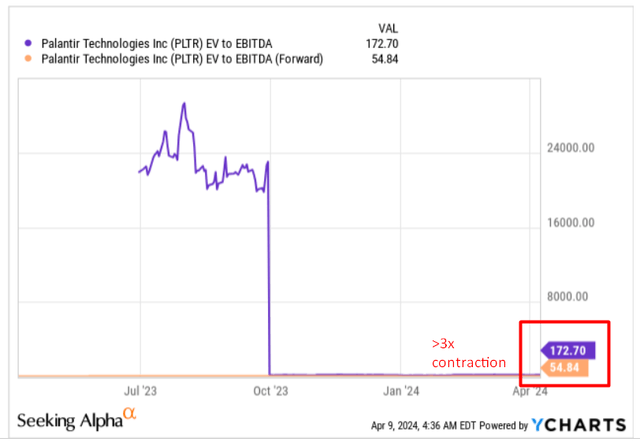

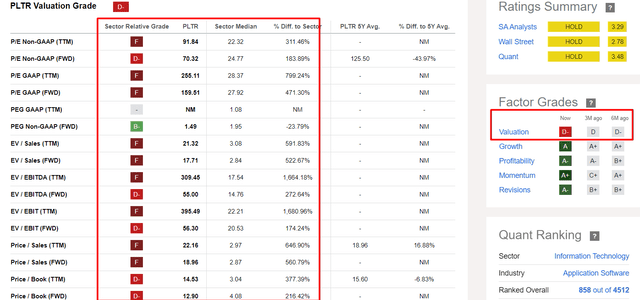

For the sake of fairness, it’s necessary to say a few words about the valuation of PLTR, which seems to be too expensive by many. From a price-to-earnings ratio perspective, I agree that Palantir appears overvalued. But if we look at the valuation of the company from an EV/EBITDA ratio perspective, we see that market prices in a multiple contraction of more than 3x for the forward figure. This suggests that PLTR, as I understand it, is actively growing out of its lofty valuation. So the stock’s YTD and YoY growth rates are well justified in my opinion.

Risk Factors To Consider

The elephant in the room among the risks surrounding PLTR stock today is the high valuation. In presenting my thesis today, I may be too biased in discussing this point. Even according to data from Seeking Alpha’s Quant System, Palantir’s valuation grade has only worsened in recent months:

Seeking Alpha, PLTR’s Valuation grades, Oakoff’s notes

If the market consensus correctly estimates Palantir’s EBITDA growth this year, the decline in the EV/EBITDA multiple from ~173x to ~55x would still make the company one of the most relatively expensive in its industry.

Another risk is that the technical analysis is not on PLTR’s side at the moment. As far as I can tell from the daily chart, PLTR is forming a classic “head and shoulders” price pattern that predicts further weakness and a possible correction to $17-16 per share given the weakening RSI indicator.

TrendSpider Software, Oakoff’s notes

Your Takeaway

Despite the risks surrounding Palantir today, I believe that the recent strength of the stock is fundamentally based. First, the company has proven the sustainability of its business model by systematically improving margins. Second, Palantir has significantly expanded its TAM, putting it in a position to deliver strong revenue and earnings growth for at least the next few years. Third, PLTR’s dependence on SBC, which was previously a pressing issue for the company, has decreased meaningfully. Based on these fundamental factors, I conclude that investors who are wary of buying Palantir at current highs could face a serious opportunity cost if the company beats current consensus forecasts for EPS and revenue in Q1 2024 (the base case scenario I see). No dip – no problems in Palantir’s case. Therefore, I reiterate my “Buy” rating.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.