Summary:

- Palantir’s Q4 earnings report showed 70% growth in its U.S. commercial business, and the company raised its 2024 forecast.

- The Palantir-Oracle partnership is expected to drive international commercial and government growth.

- Palantir’s Q1 earnings could exceed expectations, and the stock looks poised for further gains despite potential turbulence in the near term.

- I am keeping my year-end/early 2025 price target in the $35-$45 range, and Palantir’s stock could reach $100 by 2030.

Jonathan Kitchen

The last time I wrote about Palantir (NYSE:PLTR), this high-quality, unicorn tech company’s stock was in the $16-$17 range. This was right before Q4 earnings, and I was confident that Palantir would beat consensus estimates and guide higher. Please allow me to remind you what occurred.

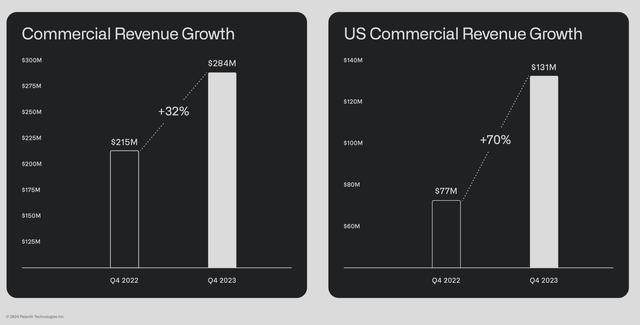

Palantir’s stock rose 24% in the following session (the day after the report). Here’s why: Palantir’s U.S. commercial business, now the company’s crown jewel (not the government segment anymore), grew by a staggering 70% in Q4. This was a sharp increase from the mid-20% growth we saw several quarters ago when the economy was going through a challenging phase and before the “AI revolution” shifted into high gear.

I’m not much of a soccer player (I prefer “American” football), but if Palantir is “the Lionel Messi of AI,” I’m going to own this stock for the long haul. And there is good reason to. Just look at what the company did last quarter.

In addition to beating Q4 sales expectations and illustrating stellar U.S. commercial growth, Palantir’s U.S. customer count grew by 55% YoY to 221 customers in Q4. Total commercial contract value rose 107% YoY to $343M during the period. Palantir also raised its 2024 full-year revenue forecast to $2.65-$2.66B, above the $2.64B consensus estimate.

Now, Palantir is getting set to report Q1 earnings early next month, and I think the company can beat its likely sandbagged forecast of $612-$616M in sales. Additionally, Palantir could raise its previous full-year guidance due to its recently announced lucrative Oracle (ORCL) partnership and other bullish developments likely to increase sales growth and improve profitability in future quarters.

Despite Palantir’s seemingly elevated valuation, it remains a top AI stock, often misunderstood and underrated by the market. Therefore, Palantir’s stock could appreciate considerably throughout 2024, potentially reaching my $35-$45 price target range by year-end or early 2025.

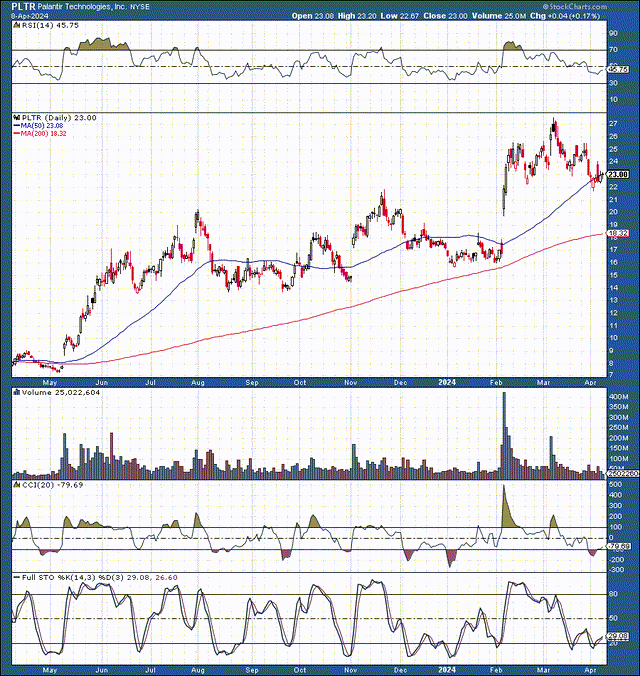

Technically – Still An Excellent Time To Buy Palantir

Technically, Palantir’s stock became overbought after its previous earnings announcement and subsequent run-up above $27. In early February, the stock’s RSI shot up to around 80 on massive volume. After a minor pullback, the stock advanced to the $27-$28 range on lover volume, putting in a “blowoff top” with an RSI peak below 70.

Since the near-term top, we saw an excellent 20% pullback to around $22, and now the stock looks poised to start moving higher again. The RSI, CCI, full stochastic, and other technical indicators suggest that technical momentum is improving, and it’s positive that the stock came back down to the 50-day MA.

In a “worst-case” scenario, and only likely if a broad market correction occurs, Palantir’s stock could close the gap around the $19-$20 level, resulting in a 25-30% pullback from its recent high. If this scenario occurs, it should lead to an excellent long-term buying opportunity despite the short-term pain.

Why The Palantir-Oracle Partnership Is A Big Deal

Palantir and Oracle recently announced a partnership that should benefit both companies, particularly Palantir. Palantir’s commercial business growth is already exploding because Palantir’s AIP provides highly coveted optimization solutions that any organization, domestic or foreign, government or private, can utilize to improve efficiency, increase efficacy, and expand profitability.

Palantir’s U.S. commercial revenue skyrocketed by 70% YoY last quarter, illustrating growing demand for its solutions among corporate clients. However, while U.S. commercial growth was 70%, its overall commercial segment expanded at 32%. This dynamic illustrates that Palantir can achieve much higher international growth in future years.

Commercial revenue (static.seekingalpha.com)

Oracle is the world’s most significant database company, with a massive global footprint. Therefore, Oracle’s distributed cloud and AI infrastructure can deliver Palantir’s leading AI and decision-acceleration platforms globally to commercial clients and governments. This dynamic should enable Palantir’s international commercial growth sales to increase considerably. Moreover, we could see Palantir’s government segment growth reaccelerate as we advance. Therefore, Palantir’s Q1 earnings and full-year results could be much better than expected, enabling its stock price to rise considerably as we advance.

Earnings Could Be Much Better Than Expected

Palantir is scheduled to report on May 8 after the market closes. Due to its continued positive advancements in AI, growing customer count, new partnerships, increasing contracts, and other favorable elements, Palantir could report better than anticipated sales and EPS and could provide better than expected Q2 and FY 2024 guidance.

AI monetization has likely hit its “next gear,” Wedbush Securities analyst Dan Ives wrote in an investor note. The highly respected tech analyst mentions that the “baton” has been handed from the semis to the software providers, and one of the top companies likely to benefit from the AI revolution is Palantir.

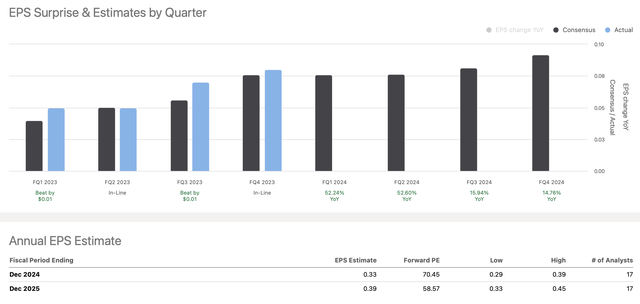

Earnings vs. estimates (seekingalpha.com )

While Palantir is still in a high growth phase and has an extremely long growth runway due to its monopolistic style position in a blue ocean atmosphere, it has reported $0.25 in EPS in its TTM. This dynamic represents a beat rate of about 9%, and my point is that even though Palantir doesn’t need to be profitable in this stage of its development cycle, it is more profitable than the market expects.

Therefore, Palantir can continue to provide better-than-anticipated profitability and could generate considerably higher EPS than the market expects. Consensus EPS estimates are relatively modest, just $0.33 this year and $0.39 in 2025. Applying a similar modest 9-10% beat rate implies Palantir could earn around $0.37 this year and around $0.44 in 2025.

EPS of $0.44 cents puts Palantir’s forward P/E ratio at about 50, which is relatively inexpensive for a stock in Palantir’s advantageous long-term position. Moreover, we could see substantial 20-30% (or higher) EPS growth for many years, and Palantir’s stock could continue much higher in the long run.

Positive Factors Continue For Palantir

Palantir recently disclosed a 6.5% stake in MSP Recovery (LIFW), a healthcare recovery and data analytics company. This dynamic illustrates that Palantir continues to increase its presence in the healthcare industry, one of the most lucrative areas for AI.

Palantir also continues to secure new defense contracts, and the Army recently confirmed its $178M TITAN contract. This dynamic illustrates that Palantir’s government segment revenues may reaccelerate in future quarters.

Wedbush bumped its Palantir price target to $35 following the AIPCon conference, the TITAN contract, and other positive factors. Kumich, a Palantir analyst, recently updated his price target to $48.

Not Everybody Is Bullish On Palantir

Recently, Monness downgraded the shares to sell from neutral, citing the company’s “rich valuation.” The firm has set a $20 price target on the stock, saying that “on the back of an unprecedented generative AI hype cycle, Palantir surged in 2023, and the stock’s upward trajectory has continued in 2024, leaving the company with what they view as an egregiously rich valuation.”

Considering Palantir’s enormous growth and profitability potential, I disagree that the stock has an egregiously rich valuation. Moreover, I disagree that the generative AI cycle is at an unprecedented hype stage, but everyone is entitled to their opinion. Instead, I believe we’re likely early in the AI ballgame, possibly around the bottom of the fourth inning, if I may use a baseball analogy. Therefore, Palantir could continue commanding a relatively high valuation of around 50-65 forward EPS estimates in the coming years.

Where Palantir’s stock could be in future years:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $2.87 | $3.64 | $4.6 | $5.7 | $7.1 | $8.8 | $10.7 |

| Revenue growth | 29% | 27% | 26% | 25% | 24% | 23% | 22% |

| EPS | $0.35 | $0.47 | $0.61 | $0.78 | $0.99 | $1.24 | $1.55 |

| EPS growth | 40% | 35% | 30% | 28% | 27% | 25% | 25% |

| Forward P/E | 65 | 64 | 62 | 60 | 58 | 55 | 52 |

| Stock price | $31 | $40 | $48 | $60 | $72 | $85 | $100 |

Source: The Financial Prophet

I’m using relatively modest sales and EPS growth figures to reach my projections. In a slightly more bullish scenario, we could see higher sales growth and more rapidly expanding EPS, leading to a higher stock price by 2030. However, despite my modest to base-case intermediate-term estimates, Palantir’s stock could achieve a $100 price tag in several years.

Risks to Palantir

Palantir faces several risks despite my bullish assessment. The first risk is a slower-than-expected economy and the possibility of “higher rates for longer” regime. A slow economy and high rates could impact business spending, hurting Palantir’s growth and profitability.

There is also the risk of worse-than-anticipated demand for Palantir’s services from the commerce segment. Additionally, government demand could be lower than anticipated if federal budgets get cut.

There is also the risk of increased competition. Other companies could attempt to cut into Palantir’s market share. Also, Palantir’s profitability could be worse than projected, and in a worst-case scenario, the share price may not appreciate as expected. Investors should examine these and other risks before investing in Palantir.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!