Summary:

- Riot is down 25% this year amid the anticipated reduction in Bitcoin rewards post-halving.

- Continued rise in Bitcoin price could help mining companies overcome the adverse impact on revenues.

- Riot recently acquired over 30,000 miners to boost mining capacity.

- The company expects to more than double its hash rate by the end of the year.

Daniel Balakov

Introduction

Since I wrote my last article on Bitcoin last month, the BTC/USD price has surged to new all-time highs, just as expected, albeit earlier than predicted. We are still a few weeks from the halving event, which is expected to have an impact on some stocks linked to Bitcoin.

From Bitcoin miners to Bitcoin treasuries and even exchange-traded funds (ETFs). The big question many will be asking themselves is whether Bitcoin can maintain the current rally post-halving, in which case, some stocks could benefit from it.

Although the halving event essentially reduces the earning potential of Bitcoin miners, it does not necessarily mean a reduction in revenues. That is why companies like Riot Platforms (NASDAQ:RIOT), which recently purchased more than 30,000 additional miners to boost its mining capacity present an interesting opportunity for those looking to ride the post-halving rally.

Riot Platforms

Riot Platforms is one of the leading Bitcoin mining companies with a market cap of just under $3 billion. The company also holds about 8,067 Bitcoins worth about $548 million as of this writing.

The value of bitcoins held has mostly been boosted by the rising price of the BTC-USD, over the past two months amid the SEC Spot Bitcoin ETF Approvals and the upcoming halving event.

Subsequently, the Riot Platforms price surged 68% in February following the announcement of its fourth-quarter results, benefitting from better-than-expected quarterly earnings and the rallying price of Bitcoin.

Riot’s adjusted earnings per share improved to $0.48 up from a loss per share of $0.07 in the same quarter a year ago.

However, despite the February rally, Riot shares have since pulled back to underperform the S&P 500. As of this writing the stock is down 25% year-to-date, which leaves a lot of room to catch up with the market.

Why it is not too late to buy RIOT

Although income from Bitcoin mining is expected to decline post-halving, there are circumstances that could still see some companies experience a significant increase in revenues after the event.

For instance, if the Bitcoin price continues to rise as expected, it could help companies level up against the reduction in blocks mined. The crypto industry highly expects a post-halving rally despite the significant rise in the price witnessed this year.

David Wigger, Managing Director at LIAN Group, a boutique investment firm specializing in direct investments and venture studios within the tech, blockchain, and crypto sectors expects the forces of supply and demand to favour the Bitcoin price post the halving event in April.

“The price of Bitcoin often increases after a halving event due to changes in supply and demand dynamics. As a matter of fact, the overall combination of reduced supply, historical precedent, perceived scarcity, market sentiment, and adoption trends often leads to price increases following Bitcoin halving events,” Wigger told me in an interview.

While the halving is expected to affect the number of new bitcoins being released to the market, the institutionalisation, of the world’s most popular cryptocurrency, which this year took a step in the right direction after the Spot ETF approvals is likely to boost the demand for Bitcoin.

“The institutionalization of Bitcoin is a considerable trigger that will reshape the crypto space, and bring better access and more transparency to the investors [and the sector overall],” Wigger added.

This will not only have an impact on the Bitcoin price but also on the amount paid to miners per block. Therefore, depending on how high the BTC-USD rises, Bitcoin mining companies like Riot Platforms could easily overcome the adverse effects of the reduction in Bitcoin rewards.

Mark Zalan, CEO GoMining, a Bitcoin mining company, thinks a higher bitcoin price is not the only way that miners could maintain a healthy bottom line post-halving. According to Zalan, although halving does cause “a shake-up for the mining industry, which can turn into a real shock for some players in the market, an improvement in the efficiency of miners, which includes hardware and access to cheaper resources like electricity could help companies maintain a reasonable profit margin by reducing the cost of mining.

From Riot Platform’s perspective, the halving comes timely following the company’s recent purchase of more than 30,000 additional miners from MicroBT. This acquisition increases Riot’s mining capacity.

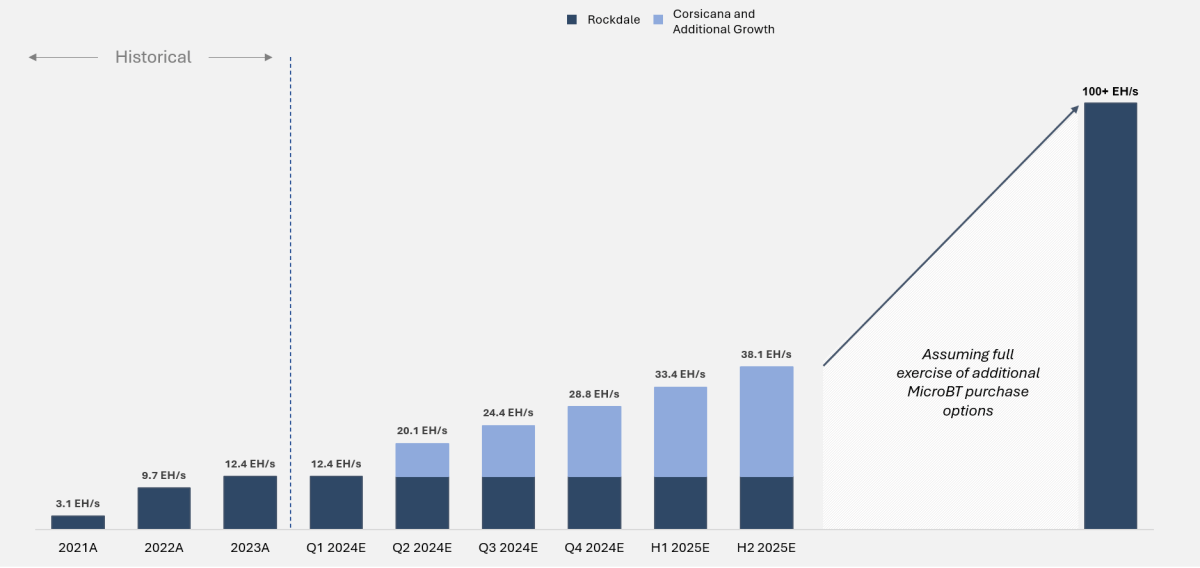

Hash Rate Projections (Riot Platforms Financials)

In 2023, Riot’s mining capacity increased by 28% to a hash rate of 12.4. The newly acquired 30,000 miners will play a crucial role in boating the company’s hash rate to 28.8 by the end of the year.

The company’s revenue also increased to a record $280 million last year. If Riot’s hash rate improves to more than 28 EH/s, that would be more than a 132% rise in mining capacity, which effectively compensates for the expected reduction in bitcoin rewards per block post-halving.

The halving is expected to cut the compensation per block to 3.125 bitcoins down from 6.25, Riot’s hash rate could be more than double by the end of the year, which subsequently implies a higher revenue potential assuming the Bitcoin price remains unchanged. A higher Bitcoin price will further boost Riot’s top line.

From a valuation perspective, Riot shares are currently trading at about 10.35 price-to-sales, after pulling back off yearly highs of $17.62.

Analysts currently have a high 2024 revenue estimate of $637 million and a low estimate of $329.5 million. Given the average projection of about $460 million for the year, the Riot stock could comfortably trade at about $18.77 per share whilst maintaining the same valuation multiple.

That price level also isn’t too much above its current 2024 highs, which makes it a feasible target.

Risks

Although Riot seems well prepared to boost its hash rate in the coming quarters, the Bitcoin halving will affect the amount rewarded per block. This has a direct impact on earning potential, which it has to overcome. Therefore, there is no guarantee the current revenue projection will be achieved within the stipulated time frame.

While improved efficiency in mining hardware and cheaper sources of energy lowers the cost of production, the price of bitcoin will be the ultimate determinant of Riot’s ability to maintain a healthy trajectory of revenue growth this year.

Recently, Standard Chartered Bank analysts led by Geoffrey Kendrick have revised their forecasted Bitcoin price in 2024 from 100,0000 to $150,000. However, the BTC-USD has demonstrated over the years that it is one of the most volatile assets to invest in, with its price falling from an all-time high of more than $65,000 in November 2021 to trade below $20,000 in 2022.

Bitcoin recently hit new all-time highs of more than $73,000 before retreating to the current level of $67,366 within days. This level of volatility makes it difficult to accurately predict the revenue potential of Bitcoin miners, not to mention the halving event on the horizon.

Investor take away

In summary, Bitcoin miners look poised to benefit from the current Bitcoin price rally. The halving event will certainly have an impact on rewards paid, but taking into consideration that happens in April, it won’t have an adverse impact on Riot Platform’s first-quarter results.

On the contrary, Riot’s first-quarter revenue should rise significantly given the Bitcoin price is up more than 50% this year.

Historically, Riot shares have demonstrated a higher correlation with the Bitcoin price than with the increase in hash rate capacity.

Therefore, it may yet come down to the price of the world’s most popular cryptocurrency, which at this time maintains a bullish outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.