Summary:

- Texas Instruments has underperformed the semiconductor trend in recent years but is now poised for a comeback.

- Industrial growth expectations and inflation pressure are supporting TXN’s future growth.

- TXN is a key player in critical supply chains, with a broad product portfolio and strategic investments. It offers steady returns and a solid foundation for future growth.

PM Images

Introduction

Texas Instruments (NASDAQ:TXN) has become one of my favorite dividend growth stocks. While I haven’t added it to my portfolio due to aggressive investments in energy, other sectors, and a somewhat overwhelming tax bill (read: lack of cash), I consider it to be one of the best technology stocks to build long-term wealth with a highly favorable risk/reward.

What’s so interesting about TXN is that it embodies highly favorable shareholder value, which is one of the reasons why it has been treated as a “value” stock lately.

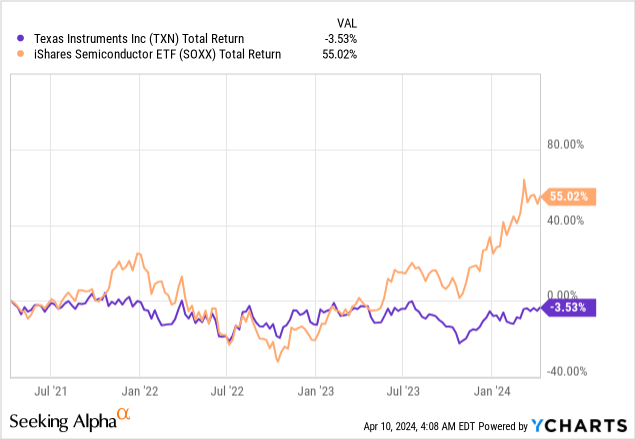

Investors who bought TXN in order to benefit from the semiconductor trend did not do so well.

Over the past three years, the iShares Semiconductor ETF (SOXX) has returned 55%. Texas Instruments has returned negative 4% during this period.

What’s interesting is that this divergence started to grow in the second half of last year when AI became mainstream.

Back then:

- ChatGPT and other programs were mass-adopted, which put AI on everyone’s radar.

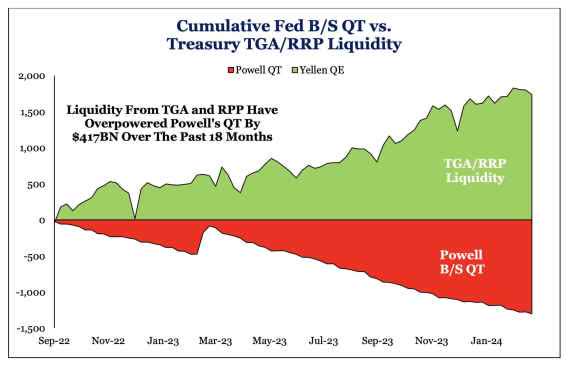

- Inflation was in a downtrend, which benefitted “growth” stocks over “value” stocks.

- The Treasury Department provided enough liquidity to offset the Federal Reserve’s quantitative tightening, which supported markets (and inflation).

X/Twitter (@ZeppLaRouche)

On top of that, it needs to be said that TXN has industrial clients, not “fancy” tech startups and hyperscalers like some of its Silicon Valley peers.

However, right now, we’re witnessing the comeback of TXN.

- Industrial growth expectations are improving.

- Inflation pressure is back (supporting value stocks).

- TXN is in a great spot to boost future growth, as it currently implements multi-billion investments.

My most recent article on TXN was written on January 3, when I went with the title “Texas Instruments May Not Look Cheap, But Its Future Looks Bright.”

Since then, shares are up 5% (including dividends), lagging the S&P 500 by roughly six points.

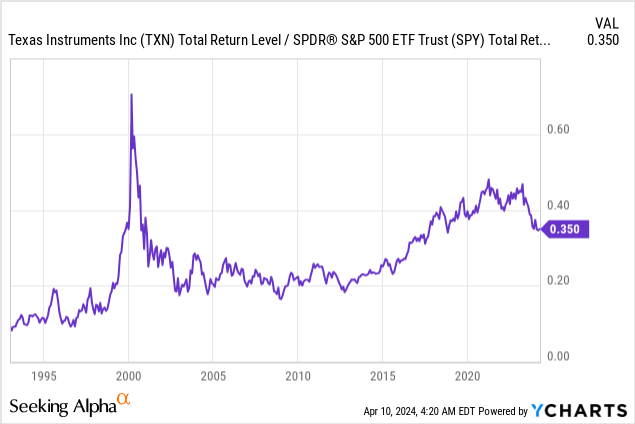

Now, I think it’s time for TXN to outperform, as I expect the TXN/S&P 500 ratio to bottom.

So, let’s dive into the details!

There’s So Much Value In TXN

I often say that I care about companies that play a major role in critical supply chains. That’s why I own oil and gas companies, railroads, and healthcare suppliers – just to name a few.

TXN is one of these companies.

To quote the firm (emphasis added):

We have a portfolio of approximately 80,000 products, which is more than our competitors’ portfolios. Just as importantly, we have leadership positions across the hundreds of product families that make up the analog and embedded processing markets. Our broad portfolio is about quantity and quality of our products.

Most customers’ applications use tens, if not hundreds, of analog and embedded processing chips in each system. Our breadth of product portfolio gives us access to more customers, which also means that we have the opportunity to sell more chips into each customer application.

[…] We sell our chips into six end markets that are grouped by their life cycles and market characteristics. The six end markets are industrial, automotive, personal electronics, communications equipment, enterprise systems and other.

In other words, it’s one of those companies that, if it suddenly were to vanish from the face of the earth, we would be in serious trouble – I like these wide-moat companies a lot.

That said, there’s one downside.

Especially in an environment where supply chains are being reconfigured (re-shoring, etc.), the company is investing billions into new facilities in the U.S.

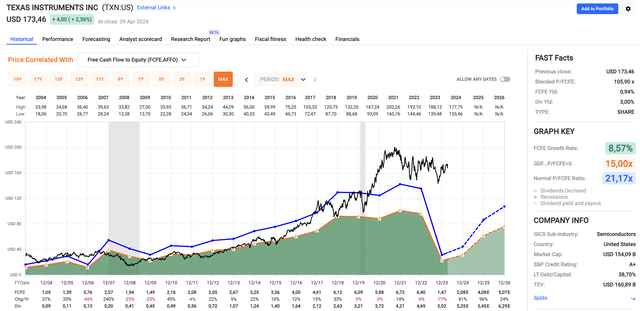

For example, the chart below shows TXN’s FCFE. That’s free cash flow to equity. FCFE shows how much cash can be distributed to shareholders by subtracting capital expenditures from operating cash flow (by incorporation of net debt flows).

As we can see below, FCFE has imploded. This kept a lid on the stock, as investors preferred to buy stocks with less capital spending growth.

FAST Graphs

The good news is that FCFE isn’t down because TXN is in trouble, but because it is preparing for a high-growth future.

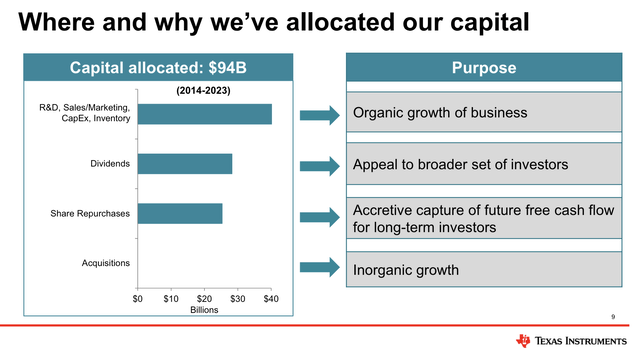

Between 2014 and 2023 alone, the company has spent $94 billion – most of it (roughly $40 billion) on research & development (R&D), sales/marketing, and capital expenditures.

Texas Instruments

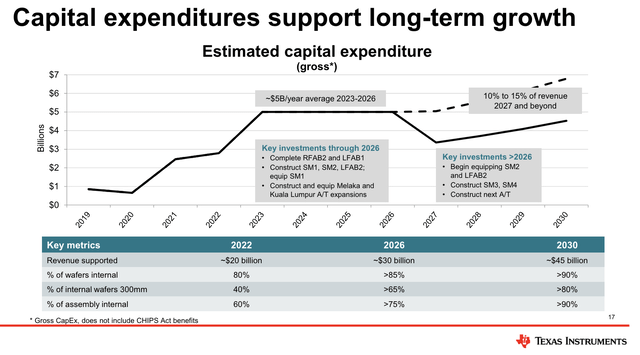

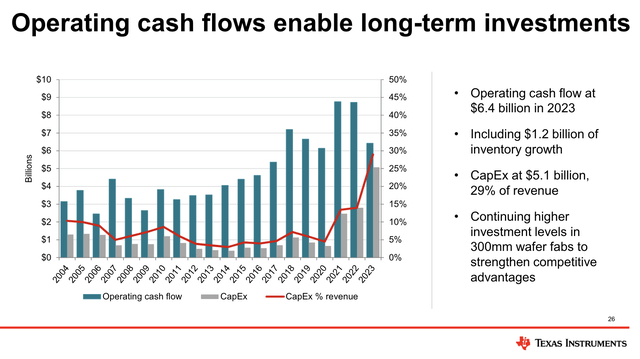

As we can see below, after the pandemic, the company massively accelerated CapEx, which explains why the FCFE chart above shows such a steep decline.

Texas Instruments

The chart below visualizes this even better, as it shows that CapEx reached 29% of total revenue last year.

Texas Instruments

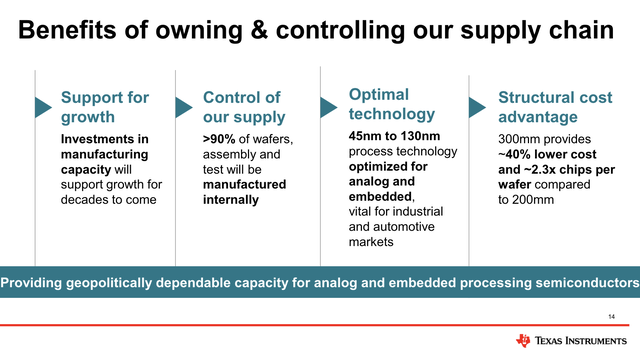

The good news, as I already briefly mentioned, is that these investments are building a better business model.

For example, by investing in manufacturing and technology, particularly in 300-millimeter wafer fab capacity, TI strengthens its cost advantage and provides greater control over its supply chain.

Especially in a world that suffers from deglobalization, it helps that the company will control more than 90% of wafers that are assembled internally.

Texas Instruments

This advantage becomes increasingly important in a world where geopolitical tensions impact supply chains and competitive dynamics.

Adding to that, the company sees both cost and pricing tailwinds.

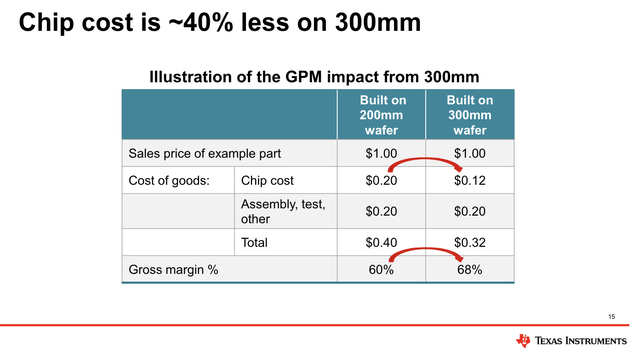

From a cost perspective, the company benefits from its investments in 300mm chips.

As diameters improve, they typically help to increase throughput and reduce costs. TI notes that output from 300 mm fab is 40% less expensive than chips produced using the 200 mm process, which is commonly used by its competitors. Moreover, according to the company, the returns on investment on 300 mm fab are likely to be higher for analog use cases, as it could be operated for as long as 20 to 30 years, something that the company noted would not be possible for digital chips. – Forbes

Texas Instruments

From a pricing point of view, the company used the Morgan Stanley Technology, Media & Telecom Conference to explain that, despite fluctuations in market conditions, it maintains a competitive pricing strategy aimed at capturing market share in various segments.

Although the company expects a shift from favorable pricing levels to low single-digit declines, it remains confident in its ability to compete effectively.

Essentially, by leveraging its strong product portfolio and cost-efficient manufacturing capabilities, it adjusts pricing dynamically to win contracts and secure profitable business opportunities.

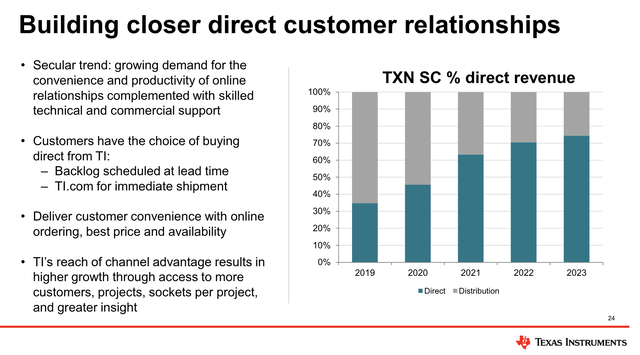

Speaking of customers, as we can see below, the company has been moving closer to its buyers, fueled by online sales and the benefits from improved backlog and faster shipments. This includes better pricing and availability.

Texas Instruments

The company also commented on the rise of self-sufficiency initiatives in China, which (technically) pose a threat to companies selling to China.

For example, we may face increased competition as a result of China actively promoting and reshaping its domestic semiconductor industry through policy changes and investment. These actions, in conjunction with trade tensions, may restrict us from participating in the China market or may prevent us from competing effectively. – TXN 2023 10-K

Last year, China accounted for 19% of its sales.

The good news is that TXN is very confident in its ability to compete, as it is closely monitoring the evolving competitive landscape and continuously improving its products to stay competitive.

It believes that the mix of advanced manufacturing processes, good customer relationships, and its competitive edge provide sustainable growth.

Tremendous Shareholder Value

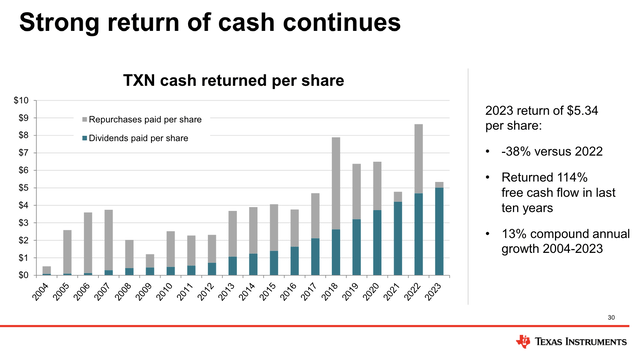

Not only is TXN one of the best “capital allocators” on the market, but it’s also a source of steady shareholder returns.

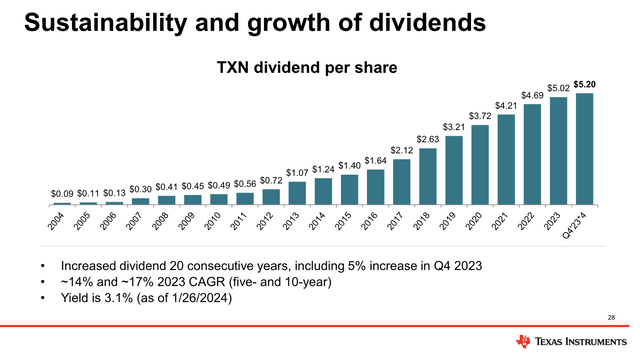

The company has increased its dividend for 20 consecutive years, including a 5% increase at the end of 2023. It currently yields 3.0%. The 10-year dividend CAGR is 17%.

Texas Instruments

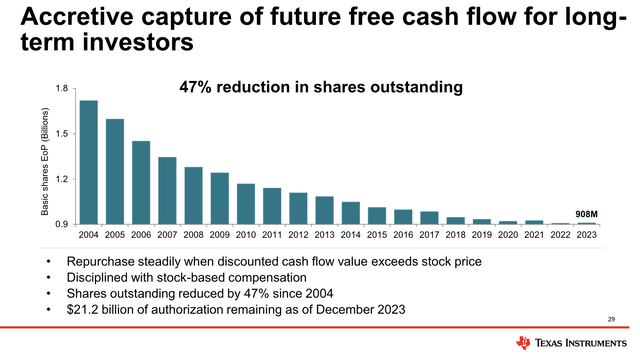

On top of that, the company has bought back almost half of its shares since 2004, which tremendously improved the per-share value of this business.

Texas Instruments

In fact, because the company maintained such a healthy balance sheet, it was able to return more than 100% of its free cash flow since 2004.

While dividend growth and buybacks have come down to support aggressive CapEx growth, I do not expect that future payout ratios will be much lower.

Texas Instruments

Speaking of debt, in 2021, the company had $2 billion in net cash (meaning more cash than gross debt). It is expected to end up with $6.4 billion in net debt in 2026. However, the net leverage ratio (net debt/EBITDA) is expected to peak at 0.8x EBITDA in 2024.

- 0.8x EBITDA is extremely low.

- These numbers show that aggressive CapEx is paying off, resulting in higher growth.

- The company maintains an A+ credit rating, one of the best ratings on the market.

This is what rating agency Fitch wrote in 2020 before the company ramped up CapEx:

Substantial Investment Intensity: Fitch expects continued high investment levels to support technology and cost leadership, despite the company raising long-term capex to 6% of revenues, from 4% previously, as it shifts focus to new from used 300mm equipment. Nonetheless, Fitch expects R&D intensity to remain in line with the analog industry and, combined with capital intensity, represent mid- to high-teens as a percentage of revenue through the longer term. – Fitch

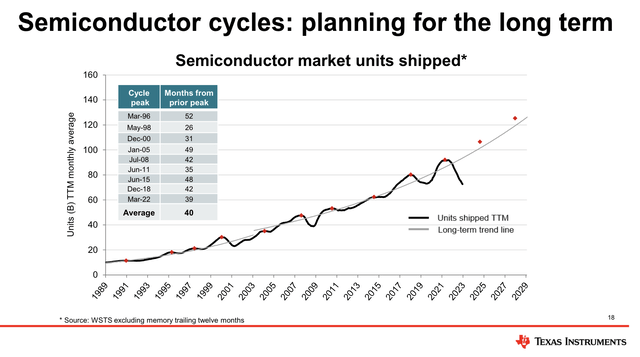

Adding to that, the company should soon benefit from a rebound in its semiconductor target market, which has followed a clear exponential trend since the 1980s.

Texas Instruments

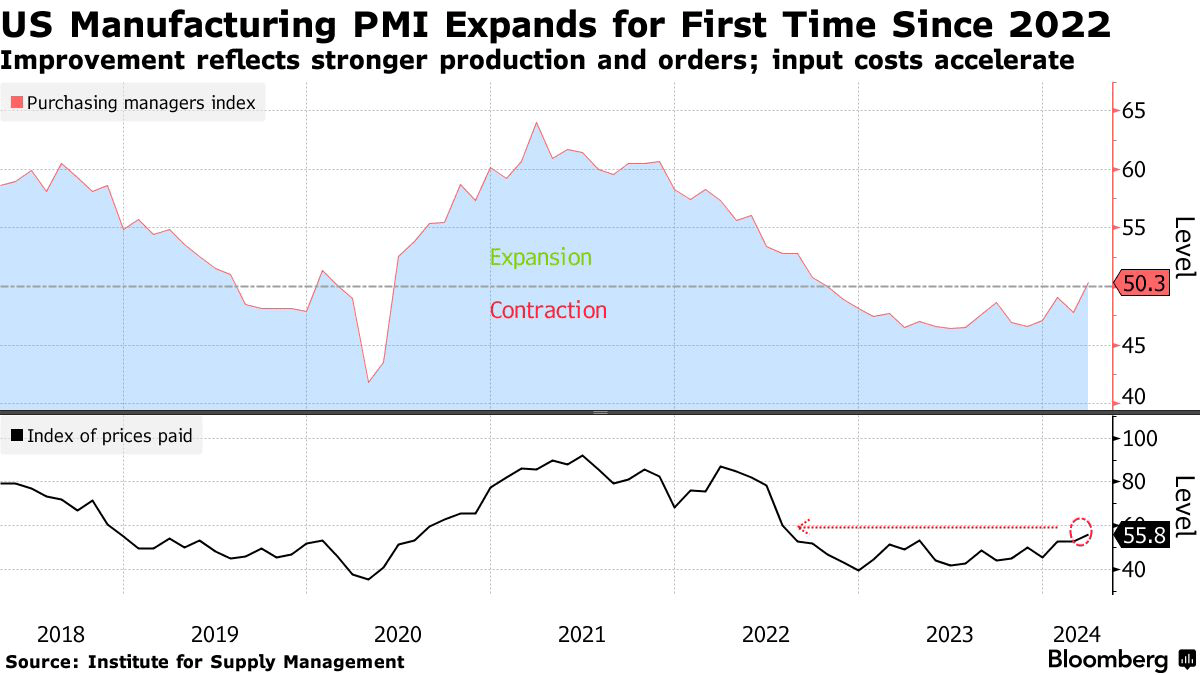

In this case, it may get support from a bottoming ISM Manufacturing Index, which just entered expansion territory, indicating a potential return to growth in cyclical manufacturing industries.

Bloomberg

So, what does this mean for its valuation?

Valuation

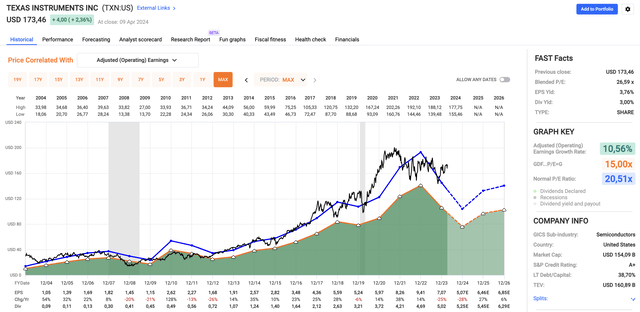

If you want to make a “quick buck,” TXN may not be the place to be. As we can see below (numbers at the bottom and the orange line), EPS expectations will be subdued through 2026, which comes with pressure on free cash flow due to elevated CapEx.

FAST Graphs

Using the data in the chart above, TXN currently trades at a blended P/E ratio of 26.6x, which is above its long-term normalized P/E ratio of 20.5x.

Essentially, this means that TXN trades at its fair value if we incorporate 27% EPS growth in 2025, potentially followed by 6% growth in 2026.

Analysts agree, as the consensus price target is $169, which is roughly $4 below the current price.

That said, I stick to a Buy rating.

While I expect that a potential market correction could offer a good buying opportunity, I expect that TXN remains in a great spot to maintain elevated long-term returns, especially as we get close to the end of aggressive CapEx growth and a pickup in earnings/free cash flow growth.

Depending on my financial situation, I am looking to make TXN a core holding of my portfolio.

Takeaway

Texas Instruments stands out as a beacon of shareholder value and resilience in the technology sector.

Despite recent challenges, its broad product portfolio and strategic investments position it as a key player in critical supply chains.

While aggressive capital expenditure has impacted short-term financial metrics, it underscores the company’s commitment to long-term growth and innovation – especially in an environment of elevated competition from China.

Moreover, with a track record of dividend increases and share buybacks, TXN offers steady returns and a solid foundation for future growth.

While its valuation may not appeal to short-term investors, those with a long-term perspective can find value in its potential for sustained profitability and market leadership.

Pros & Cons

Pros:

- Shareholder Value: TXN consistently delivers shareholder value through dividend growth and share buybacks.

- Strategic Investments: The company’s investments in manufacturing and technology position it for long-term success and cost advantages.

- Diverse End Markets: TXN serves a wide range of end markets, reducing dependency on any single sector.

- Strong Balance Sheet: With a healthy balance sheet and low debt levels, TXN is well-equipped to weather market fluctuations, including elevated interest rates.

Cons:

- Short-Term Performance: The recent performance has lagged behind due to market shifts and aggressive CapEx growth.

- Capital Spending: Elevated capital expenditures may pressure free cash flow in the short term.

- Market Valuation: The current valuation reflects future growth expectations, potentially limiting short-term upside.

- Geopolitical Risks: Geopolitical tensions and supply chain disruptions could impact TXN’s operations and growth trajectory.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.