Summary:

- AGNC Investment Corp. investors await more clarity on the timing and extent of the Fed’s interest rate cuts.

- AGNC boasts a 15% dividend yield that should provide a substantial buffer to mitigate near-term uncertainties.

- AGNC’s valuation remains below its long-term average, indicating that the market has not fully reflected a recovery in the leading mREIT.

- I explain why AGNC’s buying sentiments have remained remarkably resilient.

- AGNC buyers should consider capitalizing on its improved buying momentum to add exposure before other investors realize it.

Iryna Drozd

AGNC Investment Corp. (NASDAQ:AGNC) investors who have stayed on the sidelines since my last AGNC update in late January 2024 have avoided its stagnating momentum. Accordingly, I urged investors to consider letting AGNC take a break after its Q4 surge since bottoming out in October 2023. As a result, AGNC has underperformed the S&P 500 (SPX) (SPY) since my previous article, even when adjusted for its high dividend yield.

Accordingly, AGNC delivered a total return of 9.3% over the past year. With a forward dividend yield of nearly 15% at the current levels, it could be attractive enough to attract more income investors who aren’t perturbed by the volatility in its price action, impacting AGNC’s total return.

As a reminder, AGNC is a leading mREIT with a market cap of $6.7. As a result, AGNC has significant scale in the market, bolstered by its lowered leverage of 7x and robust liquidity “exceeding $5 billion, representing 66% of equity.” Therefore, I am confident it should allow the mREIT to capitalize on growth opportunities moving ahead, as the Fed looks increasingly likely to lower interest rates this year.

Fed Chair Jerome Powell didn’t rock the boat in his recent commentary, even as current inflation rates are still well above the Fed’s long-term target. Despite that, it indicates the effectiveness of the Fed’s policy construct, even as we navigate the timing and extent of the Fed’s rate cuts. Notwithstanding the near-term uncertainties, the S&P 500 has powered to a new high, accentuating the bullish sentiments underpinning the market’s advance. Therefore, I assessed that the improved market environment should bolster a further recovery in AGNC, as its valuation remains well below its long-term average.

AGNC is valued at a forward-adjusted P/E of 4.4x, well below its 10-year average of 7x. Its forward dividend yield of 15% is markedly above its 10-year average of 11.8%. Consequently, I gleaned that the market has yet to reflect a recovery in the mREIT market, likely baking in execution risks regarding the timing, extent, and Fed’s withdrawal of liquidity from mortgage-backed securities.

AGNC management articulated its confidence that the worst headwinds emanating from the Fed’s rate hikes are likely over. I had anticipated such challenges in my previous update, awaiting a steeper pullback. While AGNC has underperformed the SPX, buying sentiments have remained remarkably resilient.

In other words, it’s possible that income investors could have started their rotation from Treasuries toward appealing and seemingly undervalued opportunities like AGNC to partake in the ongoing recovery. With the most significant risks affecting the Agency MBS market to have peaked, I believe it’s reasonable to assume investors could continue reallocating to mREIT leaders like AGNC moving forward.

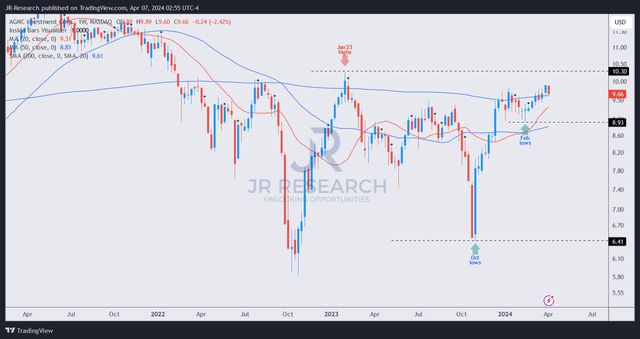

AGNC price chart (weekly, medium-term, adjusted for dividends) (TradingView)

AGNC has shaken off its downward bias since its recent bottom in February 2024 at the $9.2 level. When adjusted for dividends, it’s clear that dividend investors have appreciated AGNC’s relatively undervalued appeal, as they returned to defend against further downside volatility in February.

As a result, AGNC’s price action has demonstrated tremendous resilience, moving past the substantial volatility over the past two years. Management’s confidence in a more stable spread and interest rate environment has been corroborated by the robust buying sentiments in AGNC over the past few months.

Consequently, the ongoing recovery looks ready to continue as income investors potentially continue their reallocation as the timing of the Fed’s rate cuts becomes clearer.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!