Summary:

- AGNC Investment Corp.’s shares have declined significantly since its inception, but there may be an opportunity for appreciation and a sizable dividend.

- The trend of declining share value and reduced dividends poses risks for investing in AGNC.

- I turn bullish on AGNC due to the potential for rate cuts by the Fed, which could unlock the housing market and lead to increased earnings and book value.

PM Images

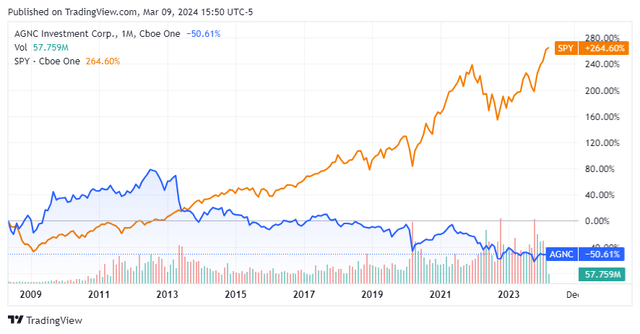

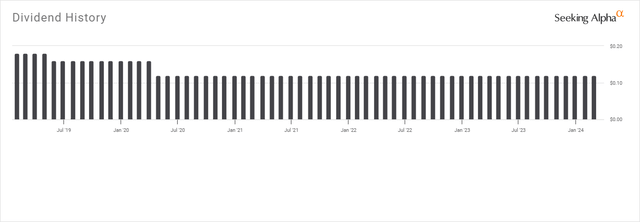

The trend hasn’t been AGNC Investment Corp.’s (NASDAQ:AGNC) friend, as shares have declined -51.33% since inception. AGNC went public during the financial crisis and became a dividend standout during the recovery. During 2010 and 2011, AGNC shares traded in the $28 – $31 range while throwing off a quarterly dividend of $1.40. Investors were getting around 4.8% returned through the dividend each quarter, as the annualized yield was roughly 19.3% at a share price of $29. Those days are certainly in the rearview mirror, as shares of AGNC have declined around -73.33% since reaching their all-time highs in 2012. On top of a drastic decline in share value, the dividend is a shell of itself after enduring several drastic reductions, which has reduced the annualized dividend to $1.44, which is -74.29% lower than the glory days when it was $5.60. I think there is an opportunity for shares of AGNC to appreciate after a downtrend that has existed for more than a decade while collecting a sizable dividend. I am getting bullish on AGNC going into a rate-cutting cycle.

Seeking Alpha

Following up on my previous article about AGNC

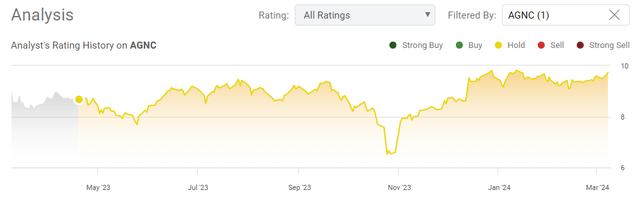

Almost a year ago, on April 19th 2023, I wrote my first article on AGNC (can be read here). I had discussed why the continued downward trend was concerning, the facts about its yield vs. share performance, and why I felt AGNC was a hold rather than a buy. Since that article, shares of AGNC have basically traded sideways as they are down -2.31% compared to the S&P 500 appreciated by 23.79%. After taking into consideration the monthly dividend, AGNC’s total return is 12.55%, which still trails the market. I wanted to follow up on that article as we have almost a year’s worth of data behind us and a Fed that looks like it will start its pivot to a rate-cutting environment within the next several months. I am bullish on AGNC as I feel its shares will continue to generate large yields, and I appreciate it as the MBS market opens up.

Seeking Alpha

Risks to investing in AGNC

The trend is not your friend in the case of AGNC. Shares can ultimately continue lower, and the dividend can be reduced further. AGNC has not established a strong track record in either category, and since they converted to a monthly dividend at the end of 2014, there have been 4 reductions, taking the monthly dividend from $0.22 to $0.12. AGNC has also continued to dilute shareholders by issuing shares, and the book value has continuously deteriorated over time. There is a 96% chance that the Fed will keep rates where they are at the next meeting, and if the Fed decides to reverse its decision about taking rates lower in 2024, it could increase the rates of defaults and bankruptcies in both the personal and corporate debt markets. This could strain AGNC’s shares further, as its business model revolves around investing in agency mortgage-backed securities. The reality is that the deterioration in AGNC’s share price has negatively impacted its principal objective to generate long-term returns on a risk-adjusted basis through its monthly dividends. Investing in AGNC comes with significant risks, and even if the Fed does lower rates, nobody has a crystal ball, and there is no telling how shares of AGNC will respond.

Why I am turning bullish on AGNC

Maybe it’s because we live in an environment where the access to information is at our fingertips, but I can’t remember a time when so many people were interested in each Fed meeting or testimony from a Fed official. I am ecstatic that more individuals are paying attention to macroeconomic events and what is going on with the Fed because it signals to me that more individuals are interested in finance and investing for their future. If you read through the transcripts from the Fed press conferences, Chair Powell has been turning a bit dovish, and recently, Chair Powell testified on the hill and indicated that the central bank wasn’t far from being in a position where rate cuts would be appropriate. President Biden has also predicted that the Fed would move to cut rates sooner rather than later.

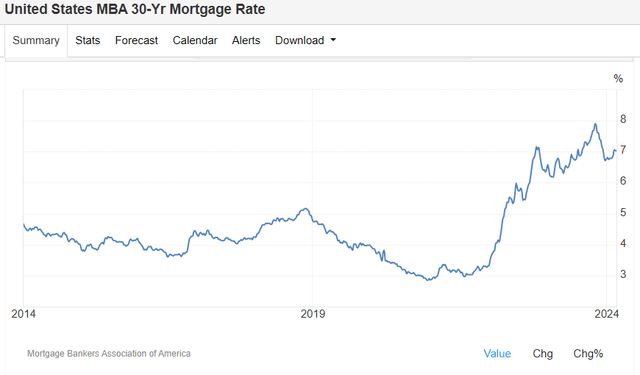

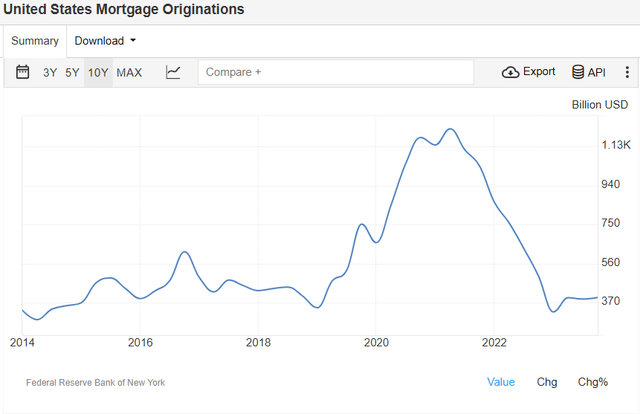

The FedWatch Tool from CME Group indicates that there is only an 8.5% chance that rates will remain where they are by the July FOMC meeting. The most likely scenario is that rates will be between 475 – 500 bps, as the likelihood that this occurs is 44.1%. There is also a 36.4% chance that the first-rate cut at 25 bps will have occurred. There is a direct correlation between the rising rate environment and the housing market being frozen. As interest rates increased, the number of mortgage originations declined. To put this into perspective, from Q3 of 2020 through Q4 of 2021, mortgage originations exceeded $1 trillion per quarter. The last time that mortgage originations exceeded $500 billion was in Q3 of 2022, and for the past 5 quarters, originations came in under $400 billion per quarter. The housing market has been frozen, as there is much less incentive for individuals or families to sell their homes and move or refinance them when they are locked into mortgages that are under 4%.

Trading Economics

Trading Economics

While a high-rate environment would mean that AGNC would generate additional interest earned on its investment assets after the associated borrowing and hedging costs are netted out, AGNC needs volume for this to play out. In a housing market that is frozen, the larger spread doesn’t benefit AGNC because there aren’t enough originations for AGNC to take advantage of the situation. AGNC’s business model revolves around investing in agency MBS and then utilizing leverage to increase their returns. These are mortgages that are backed by Fannie Mae and Freddie Mac, which in turn come with lower credit risk. It looks like the rising rate environment has come to an end, and the Fed is waiting as long as they can before claiming victory over inflation and starting the rate-cutting process. When this happens, I would expect the inverse between rates and mortgage originations to occur from what the past 2 years looked like. As rates start to decline and decline further in 2025, I believe originations will increase significantly, as there is probably a large segment of homeowners waiting for rates to become more reasonable so they can move. As this occurs, AGNC will be able to take advantage of a housing market that is becoming unlocked and full of activity. This could lead to increased earnings and book value, which could drive shares higher and lead to a long-awaited dividend increase.

If shares are bottoming, then locking in the 14.8% yield on cost could be a home run

The dividend has been the only saving grace for AGNC, as shares have been in a perpetual downturn while the market has appreciated. Since its inception, AGNC shares have declined by -50.61%, whereas if you had invested in the SPDR S&P 500 Trust (SPY), you would have been up 264.60% since the spring of 2008. AGNC was generating appreciation and large amounts of dividend income, but in 2013, things took a turn for the worse and never reversed course. Since its inception, AGNC has generated $47.44 of dividend income, which is 237.20% of its initial share value of $20. This also doesn’t include the impacts of compounding interest if the dividends were reinvested along the way.

Seeking Alpha

Despite drastically reducing the dividend over the years, AGNC has paid a monthly dividend of $0.12 since April of 2020. If my investment thesis becomes correct in the future and AGNC maintains its current dividend level, investors can lock in a yield on cost of 14.80%. There is currently $6.36 trillion sitting on the sidelines in money market accounts, while the risk-free rate of return is still around 5%. I think now is a great time to add shares of AGNC and lock in the 14.80% yield because once the Fed starts to cut rates, I believe that capital will flow into the market, and some of that will get allocated toward income-producing assets and push prices higher. It looks like shares of AGNC are in the process of bottoming out, and getting a 14.80% yield broken up into monthly dividends is a large cushion to mitigate risk at this point.

Seeking Alpha

Conclusion

As an income investor, I like the current setup for AGNC shares. Shares have rebounded from the market correction in the fall of 2023 and are trading where they were last spring. I think it’s a matter of when, not if, regarding rate cuts. The Fed isn’t in a position to keep rates higher for much longer, considering the amount of debt on the nation’s balance sheet, in addition to corporations and individuals. When rates are higher, the carrying cost on variable debt is increased, and debt that is maturing needs to be refinanced at higher rates. I don’t believe the Fed is going to run the risk of creating a credit crunch that could have been avoided. I think they will cut rates at the May or June meeting and start a multi-year rate-cutting cycle. If they do, this would be bullish for AGNC as the housing market would become unlocked. I plan on adding to my position in AGNC and locking in the current yield at a cost of 14.8% while I wait for my investment thesis to play out.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.