Summary:

- Bank of America is expected to report strong earnings and demonstrate financial stability in its upcoming earnings report.

- Concerns about lower interest rates and deposit flight are unfounded, as the bank has a strong deposit base and potential for higher-than-expected net interest income.

- The bank is undervalued and has the potential for approximately 20% upside in shares based on historical metrics and the upcoming earnings report.

ProArtWork

Investment Thesis

Heading into their earnings report pre-market on April 16th, I believe Bank of America Corporation (NYSE:BAC) is well positioned to report strong earnings and set an optimistic tone heading into the rest of 2024. The financial giant, one of the “too big to fail” banks, is known for its extensive retail branch network and diversified services. With a solid CET1 capital of $195 billion as of the Q4 presentation indicating strong financial stability, I believe the upcoming earnings will shed a favorable light on Bank of America’s ability to sustain strong NII revenue with interest rates at or near their peak, and better than what appears capital strength amidst some market concerns about the banks future with peaking rates.

While the company does have largely held to maturity losses, I think these are more than manageable given that the bank’s “too big to fail” attribute means that rapid deposit outflow is unlikely. Given this, I think BAC stock is a buy.

Earnings Preview & Q4 Context

Heading into the Q1 report, some Wall Street analysts have downgraded BofA on the concern that the current interest rate environment will result in the bank being in a lose-lose situation. What they mean by this is that the bank will either make less net interest income off of their deposit base, or if rates stay higher they risk deposit flight because of depositors’ concerns that their funds may not be safe.

I personally disagree with both concerns and will address them below. But as a preview for the quarter, the bank’s actual operating results look like they will be strong.

BofA is expected to earn $0.78/share this quarter on $25.37 billion in revenue. This will mark a 17.51% year-over-year earnings decline due to what looks to be higher deposit costs (a trend from last quarter) and the potential for more loan loss reserves being set aside.

While a decline may not seem like strength on its own, I think these results given the circumstances actually look good. These results should continue a trend from Q4 where the bank’s earnings per share declined as BofA took one-time charges related to the FDIC charges large banks had to pay because of the Silicon Valley Bank, Signature Bank, and First Republic Bank collapses in 2023 that resulted in the FDIC assuming these deposits.

While Q4 earnings were underwhelming due to the restructuring costs related to the FDIC settlement, Bank of America’s recorded strong performance in their investment banking division, with management noting that the Investment Banking team “exceeded what we thought in the quarter and seemed to perform better than industry. And actually we’re up a little bit year-over-year…” in commentary noted on the Q4 conference call. Management with this is implying that the bank is taking market share from competitors given that their revenue grew faster than the industry in Q4.

BofA’s CEO Brian Moynihan’s comments about having a “full pipeline” and expecting investment banking revenues to “move back to those levels” of $1-1.2 billion per quarter are also encouraging (Q4 Call). Investment banking has been a weaker area for many banks on Wall Street over the last few years as a result of higher interest rates hurting deal-making activity. The fact we are seeing outperformance here is encouraging.

Deposit Base Is Strong, HTM Concerns Are Mitigated

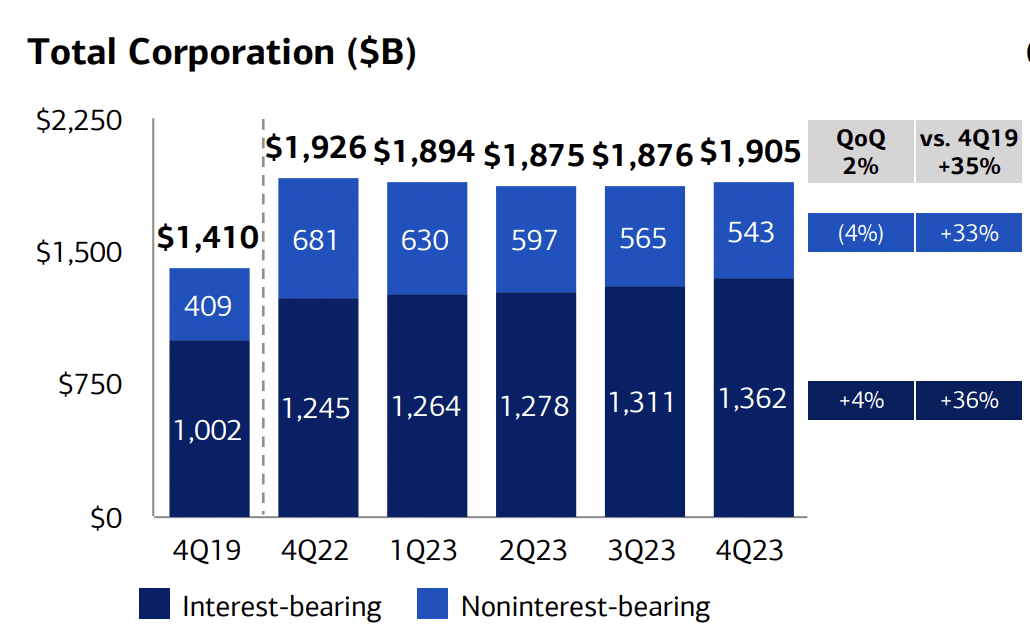

While analysts from UBS downgraded the bank because of the concerns I mentioned above, I think this is a misguided assumption. Bank of America’s deposit base and stability a positive sign for the company’s financial health. Despite concerns about deposit outflows, the company has maintained a robust deposit base that is 35% higher than pre-pandemic levels. This robust deposit base has allowed the bank to report stronger EPS since COVID (Q4 Earnings Presentation).

BofA Deposit Base (Q4 Earnings Presentation)

While UBS was concerned about lower interest rates in 2024, I think it’s key to note that the final expected federal funds rate for year-end 2024 has come up meaningfully since the end of 2023. For reference, one of BofA’s peers, JPMorgan Chase & Co. (JPM) noted in their Q4 earnings call that the bank expects 6 rate cuts this year. Since then the Federal Reserve has continued to indicate 3 rate cuts, not 6. I wrote about this being a positive variance for JPMs net interest income, and I expect it to be a catalyst for BofA’s net interest income too. I think UBS is not considering this.

For example, management at the beginning of Q1 2024, was assuming 6 rate cuts at BofA as well based on the Federal Funds rate futures curve. BofA’s CFO noted on the call:

With regard to the forward view I just provided, let me note a few other caveats. It would include an assumption that interest rates in the forward curve materialize. And the forward curve today has six cuts… – Q4 Earnings call.

As for the deposit base, while UBS is worried about deposit flight, the bank did not really see this much last year when there was a deposit flight on some of the regional banks. In fact, total deposits are relatively flat in Q4 2023 compared to Q4 2022. With this, I don’t expect a rapid drop-off in deposits. I hope management does a good job of conveying this in the Q1 earnings call.

Valuation

While some investors are worried about BofA’s loan portfolio, I actually believe the bank stands out as (compared to some regional banks) a beacon of financial strength. The bank’s forward Price-to-Earnings (P/E) ratio of 11.77 showcases a significant 13.41% premium over the sector median, signaling what I believe to be strong investor confidence in its future earnings trajectory.

Powering this on the profitability front, Bank of America excels with a Net Income Margin of 28.15% on a TTM basis is substantially surpassing the sector median of 23.47%, a 19.94% premium. I expect this to be strong going forward as well

With this, the bank’s TTM Price/Cash Flow (P/CF) ratio of 6.57 is actually a 17.74% discount from the sector median of 7.87, illustrating the company adeptly manages its assets and cash flows. I expect the bank to continue to produce strong cash flow this year as well.

With this, I think the bank is undervalued heading into earnings. Given this, I think we could see approx. 20% upside in shares if the bank converges on historical price to cash flow metrics seen by their sector median competitors, with the upcoming earnings report which should give us a strong indication of how 2024 will be for the financial giant, the metrics do look strong. I am optimistic.

Risks

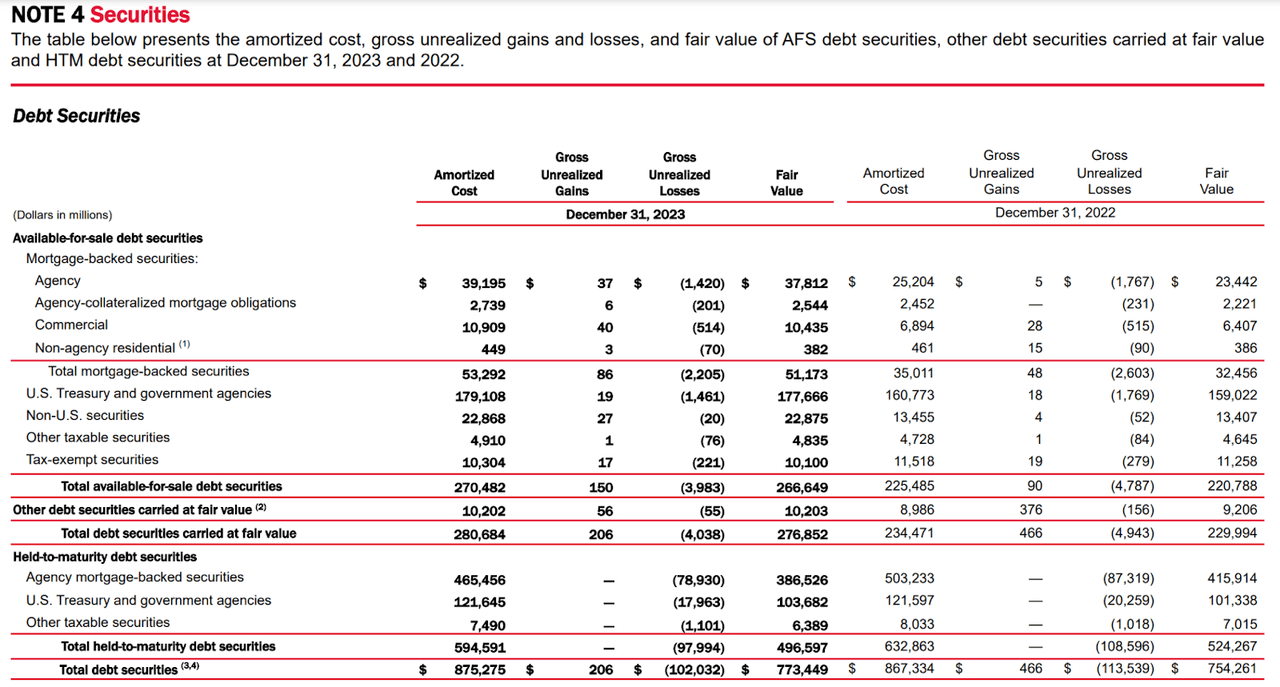

One of the major risks that people who are bearish on BofA point out is that the company could see over ½ of their CET1 capital wiped out if they have to sell their whole Held To Maturity securities portfolio in the event of a large deposit flight. The table below does a good job of showing how big that risk is.

HTM and AFS Portfolio Analysis (BofA 10K)

In essence, the bank had Gross unrealized losses of $98 billion at the end of Q4 (10K). While this would be 50.2% of their CET1 capital would be wiped out, I see this as fairly unlikely.

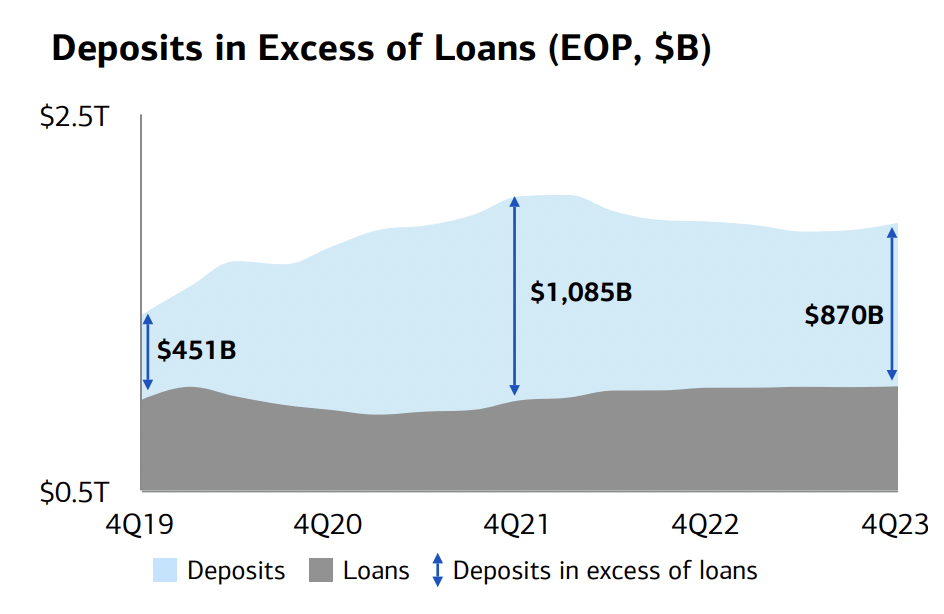

The bank has over $870 billion in excess deposits above loans (Q4 Presentation). This means the odds they would need to sell off any of their HTM securities in the event of a mass deposit flight is low. So these HTM securities will likely be held to maturity given their current deposit and loan mix.

Deposit Base Analysis (BofA Q4 Earnings Presentation)

Bottom Line

I believe Bank of America presents a compelling investment opportunity based on its solid financial performance and better than what meets the eye balance sheet condition heading into Q1 earnings. While some analysts believe that the company has to worry about lower net interest income margins or deposit flight, the previous reports from the bank quell these worries, in my opinion, and actually indicate there is room for upside on the net interest income front. In my opinion, Bank of America Corporation stock is a buy going into earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.