Summary:

- Wells Fargo’s offers investors a variety of choices when it comes to their preferred stock offerings, though one was just redeemed.

- Wells Fargo’s lowest coupon preferred stock, Pfd DD, offers the best combination of yield and call protection among its preferred stocks.

- Wells Fargo’s preferred stocks have comparable yields to Bank of America and JPMorgan Chase, but Citigroup offers higher yields.

Justin Sullivan

Introduction

Writing about bank-issued preferred stock generates high read counts, indicating their interest to the Seeking Alpha community. Having reviewed preferred stocks from other large US banks, this time I chose the two lowest coupon issues available from Wells Fargo & Company (NYSE:WFC), currently the third-largest bank in the US as measured by Total Assets.

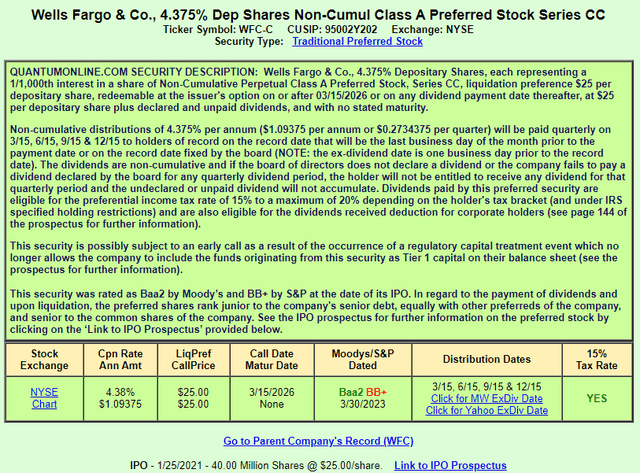

- Wells Fargo & Company 4.37 DP A PFD CC (NYSE:WFC.PR.C)

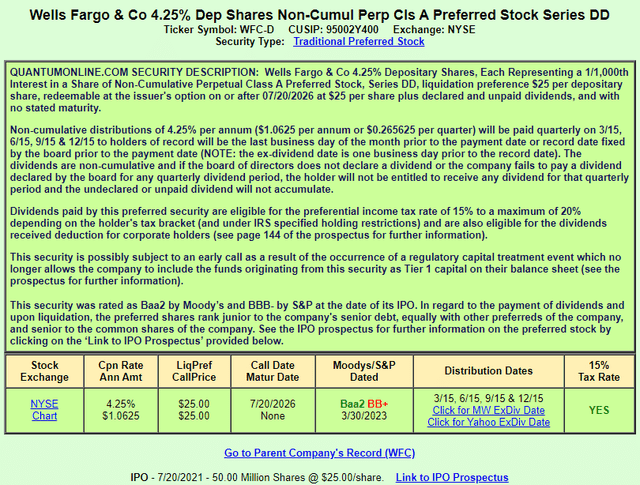

- Wells Fargo & Company DEP CL A PFD DD (NYSE:WFC.PR.D)

After comparing the yields of all five similar preferred stocks, the Pfd DD issued offers the best combination of yield and call protection. That said, another major bank I see having like risk levels, has preferred stocks with much higher yields. That bank is listed later.

Understanding Wells Fargo & Company

Seeking Alpha provides this description of the bank (condensed):

Wells Fargo & Company, a financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally. The company operates through four segments: The Consumer Banking and Lending segment offers diversified financial products and services for consumers and small businesses. The Commercial Banking segment provides financial solutions to private, family owned, and certain public companies. The Corporate and Investment Banking segment offers a suite of capital markets, banking, and financial products and services, such as corporate banking and investment banking. The Wealth and Investment Management segment provides personalized wealth management. The company was founded in 1852 and is headquartered in San Francisco, California.

Source: seekingalpha.com WFC

In the most recent SEC 10-K report, Wells Fargo described their business as such:

Wells Fargo & Company is a corporation organized under the laws of Delaware and a financial holding company and a bank holding company registered under the Bank Holding Company Act of 1956, as amended (BHC Act). Its principal business is to act as a holding company for its subsidiaries. References in this report to “the Parent” mean the holding company. References to “we,” “our,” “us” or “the Company” mean the holding company and its subsidiaries that are consolidated for financial reporting purposes.

At December 31, 2023, we had assets of approximately $1.9 trillion, loans of $936.7 billion, deposits of $1.4 trillion and stockholders’ equity of $185.7 billion. Based on assets, we were the fourth largest bank holding company in the United States. At December 31, 2023, Wells Fargo Bank, N.A. was the Company’s principal subsidiary with assets of $1.7 trillion, or 90% of the Company’s assets.

Source: Wells Fargo 10-K

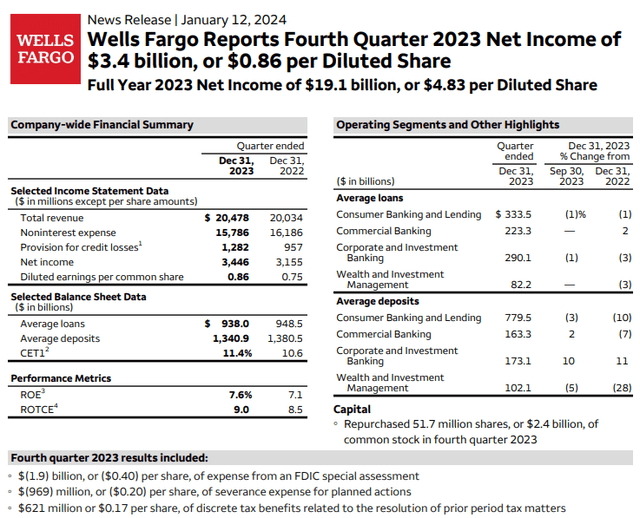

The following is from the Wells Fargo 4th quarter report.

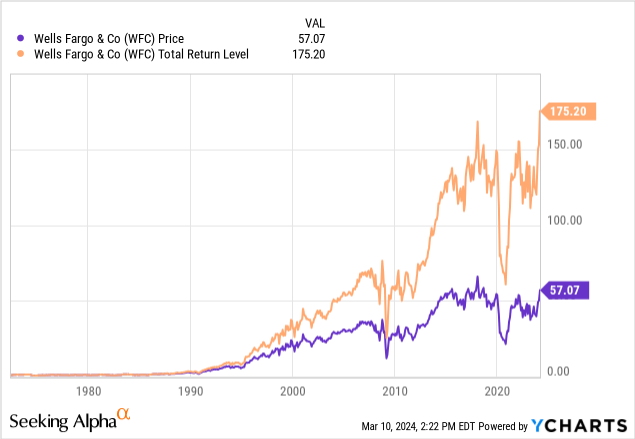

EPS improved to the point that only 2021 shows better results over the past decade, while Revenue Per Share was at record levels. Income seekers are still experiencing dividend levels far below what they reached before COVID, though both 2022 and 2023 saw the amount climb.

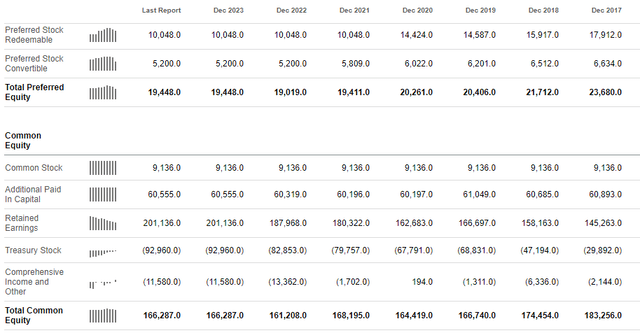

Results for the quarter showed improvements over the same time in 2022 for both EPS and ROE. The Wealth Management division though showed disappointing results. Right or wrong, my main ratio for preferred stockholders is how much common equity is there to cover all the outstanding preferred stock shares. For that, we turn to the Balance sheet.

seekingalpha.com Balance sheet

Here we see that Total Common Equity has been unchanged since 2019, down from a peak the prior year. Offsetting that is WFC redeemed about 30% of the preferred stock outstanding during 2021, the results being a higher coverage ratio, which now stands at 8.6x, a very solid multiple! When you look at the current yields available, I see the market pricing in no chance of a missed payment, which stop the common stock dividend, and certain repayment if called. In line with that, the bank is redeeming one issue valued at $840m, improving the coverage ratio to 9.

Preferred stock review

As have most fixed income assets, prices started rising last fall with the hope that the FOMC would start cutting rates in early 2024. Compared to their floating-rate cousins, lower rates would benefit these fixed-rate preferreds more.

As you will see with the other preferred too, S&P rates both as non-investment-grade by one notch. That matches other US global banks where I think the best rating might have only been BBB-. This makes the holding ineligible for investment-grade funds and apparently “fallen angel” funds too as the VanEck Fallen Angel High Yield Bond ETF (ANGL) doesn’t own any Wells Fargo issues. That said, it would not take much to be upgraded to investment-grade class.

Unlike the other preferred, WFC-D started life as investment-grade only months after WFC-C, making it eligible for the “fallen angel” funds but neither of the two major ETFs hold it. Holders will get a clue on the odds of being Called as WFC-C is eligible first and has a coupon only .125% higher than this one.

Important comparisons for these two preferred stocks include:

- Both are non-cumulative with payouts eligible for the 15% tax rate. Keep in mind that those rates expire after 2025.

- Both are fixed-rate preferreds, and have the lowest coupons issued by the bank. While there are two other preferreds with similar coupons that become callable in 2025, investors should keep an eye on what WFC does with its Wells Fargo & Company NON CUM PFD Y (WFC.PR.Y) issue which has 5.625% coupon and can be Called now. All three provide call protection for these two.

- While both are callable starting in 2026, they can be called early if their Tier 1 capital eligibility ends, but as I stated above, others will be called first.

- While the Moody’s rating has stayed the same for both (Baa2), S&P lowered theirs for the Pfd D one notch from BBB- to BB+. That effect was discussed above.

Portfolio strategy

Wells Fargo has a great summary webpage that lists five $25 preferred stocks, five $1000 preferred stocks, one convertible preferred, and two Trust preferreds. The key comparison points of the $25 non-convertible options are listed below. An 11th issue, the 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Class A Preferred Stock, Series R (WFC.PR.R) was redeemed on 3/15/24. It would otherwise have carried a 10.315% coupon until its next reset date.

| Ticker | Coupon | Price | Yield | Callable | YTC |

| WFC.PR.A | 4.70% | $21.45 | 5.48% | 12/15/25 | 13.9% |

| WFC.PR.C | 4.375% | $20.04 | 5.46% | 3/15/26 | 16.1% |

| WFC.PR.D | 4.25% | $19.55 | 5.43% | 9/15/26 | 14.8% |

| WFC.PR.Y | 5.625% | $24.85 | 5.65% | 6/15/22 | NA |

| WFC.PR.Z | 4.75% | $21.53 | 5.52% | 3/15/25 | 20.2% |

Before any of these are called, there are several of the $1000 preferreds that become callable soon that will have yields over 9%, whom will be definitely called first as was the Series R recently. There are two others with floating rates that would be over 8% today who would be next to be called. Based on all of that, since the yields are close, that makes the DD Series the best choice amongst the Wells Fargo preferreds.

Final thoughts

As I mentioned, I have reviewed preferred stocks from most of the major banks and several regional ones too. The Wells Fargo yield are compatible with those of Bank of America (BAC) and JPMorgan Chase (JPM) but trail by a large margin those available from Citigroup (C). I see the risks each has being the same, so investors should consider the higher-yield Citigroup issue (C.PR.N) first.

Evaluating preferred stocks boils down to a few key questions to ask:

- Do I believe in the issuer enough to not fear missing a dividend payout or its redemption value?

- If currently or soon-to-be callable, will it? If they think so, then does the YTC measure up well against other preferred I could hold instead?

- If the coupon floats, where do I see rates going if I am not a long-term holder where it is of less concern?

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Alex Pettee is President and Director of Research and ETFs at Hoya Capital. Hoya manages institutional and individual portfolios of publicly traded real estate securities. Alex leads the investing group known as the Hoya Capital Income Builder, which uses the investment knowledge of several Seeking Alpha analysts provide members with insightful articles covering mostly individual stocks or funds. Occasionally an article cover will cover an investing strategy or other topic that investors need to be aware of, such as law changes that might effect their long-term strategy.

For more information about this Investors Group, click on this link: