Summary:

- Since my previous update, Devon Energy Corporation stock has significantly outperformed the S&P 500.

- The recent outperformance of the energy sector has bolstered Devon’s recovery as demand/supply dynamics have improved.

- Devon’s strong execution and enhanced capital allocation priorities have boosted investor confidence.

- I explain why Devon Energy’s recovery is still far from over, notwithstanding the recent outperformance.

- Supported by a fundamentally strong business model and robust price action, Devon Energy Corporation stock remains a Buy.

imaginima

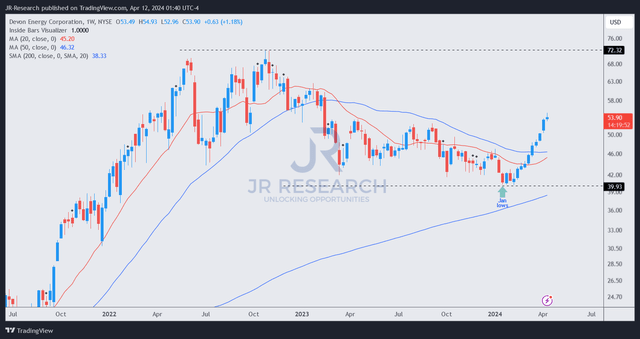

Devon Energy Corporation (NYSE:DVN) investors who ignored the market’s pessimism in early 2024 and bought more shares did well. I upgraded DVN in early February 2024, assessing a timely opportunity for DVN holders to add exposure. I postulated that DVN was close to a cycle bottom, even as it underperformed the energy sector (XLE) peers in 2023. With the reversal from its January lows, DVN has significantly outperformed the S&P 500 (SP500, SPX, SPY) since my previous update, up nearly 34%.

The recent outperformance of the energy sector has bolstered Devon’s recovery as demand/supply dynamics have turned increasingly constructive. With OPEC+ looking to hold its production cuts through June, we are back into a supply constrained market, as robust oil demand tailwinds underpinned the recent upside. While the natural gas market is caught in a downdraft, the strong performance of crude oil (CL1:COM, CO1:COM) has allayed investor fears, lifting leading E&P players like Devon.

Furthermore, Devon’s fourth-quarter earnings release in February underscored the company’s robust execution. Accordingly, Devon achieved a solid 8% production growth in 2023, which surpassed its guidance. Despite that, management assured investors that it would continue maintaining discipline in its production targets, achieving production growth of 5% annually. Therefore, I believe it lends credence to Devon’s capital allocation priorities, demonstrating its focus on attaining disciplined growth for investors.

In addition, Devon management boosted investor confidence by telegraphing a 10% reduction in capital spending to achieve its production level in 2024. Accordingly, Devon plans to shift a higher capital allocation to New Mexico, “concentrating roughly 70% of capital.” Devon has confidence that this will lead to an improvement in well productivity, focusing on extracting the highest value from its low-cost acreage.

Bolstered by a 10% increase in fixed dividends, Devon has done well to assure investors that the E&P leader can maintain its best-in-class profitability (“A” profitability grade). With DVN having staged a remarkable recovery in 2024, I believe the market will focus on execution moving ahead. Devon management acknowledged that the company faced “some challenges in allocating capital in 2023.” However, Devon highlighted that “significant improvements” have been undertaken. The company’s decision to focus increasingly on the Delaware Basis should strengthen the market’s confidence in Devon’s ability to “deliver improved capital efficiency in 2024.” Moreover, with a breakeven WTI price of $40 per barrel, the company should benefit significantly from the surge in oil prices recently.

Devon indicated a production level of about 650K boe per day for 2024, below Q4’s 662K boe per day. Therefore, I assessed DVN’s recent outperformance is likely predicated on the impressive recovery in oil prices. However, with nearly flat production growth in 2024, Devon investors need high oil prices to be sustained through 2025. The worsening geopolitical strife in the Middle East has lifted the oil bulls. However, assessing the impact and duration of these challenges is highly uncertain. In addition, there’s a possibility that OPEC+ might look to lower its production cuts to capitalize on higher prices. With natural gas not expected to play a vital role in lifting Devon’s profitability significantly in 2024, investors must closely monitor the oil market developments.

DVN price chart (weekly) (TradingView)

DVN is valued at a forward adjusted EBITDA multiple of 5.6x, below its 10Y average of 6.5x. DVN bulls could argue that the E&P leader seems relatively undervalued. As a result, I assessed that Devon’s fundamentally strong E&P business model and attractive valuation likely attracted buyers to add aggressively, leading to its relative outperformance.

While the surge in DVN could face selling pressure in the near term, DVN has likely shaken off its downtrend bias. As a result, I assessed that DVN seems likely to continue its uptrend recovery, which aligns with my bullish view of the energy market.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!