Summary:

- Broadcom appears overvalued, plain and simple. The company’s expected growth rates, margins and business drivers don’t add up to the current stock price.

- We think Fair Value for the stock is closer to $680 – $830, representing significant downside & hampered capital appreciation for investors.

- Selling out now appears to be a solid move, on balance.

- We initiate coverage of AVGO with a ‘Sell’ rating.

Monty Rakusen

If you look at our track record on Seeking Alpha over the last few years, it’s one that we’re generally proud of. We’ve had a number of great calls that (we hope) have helped investors identify opportunities in the market and build wealth.

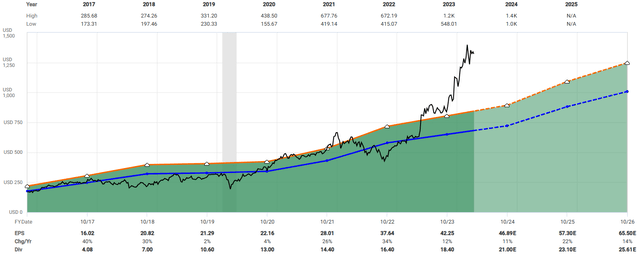

However, we’re not perfect, and every so often, we produce a dud that doesn’t age well. This happened last summer with an article titled “Nvidia: It’s Time To Trim“. As you can tell by the title, it was poorly timed. Looking back, the stock has basically doubled from the price at publication, and it’s probably our biggest public ‘miss’ since we began publishing here on SA:

The flaw with this article was that we didn’t correctly predict how much NVDA’s earnings were going to grow, despite being well aware of the trends upon which the stock was riding – chiefly, AI.

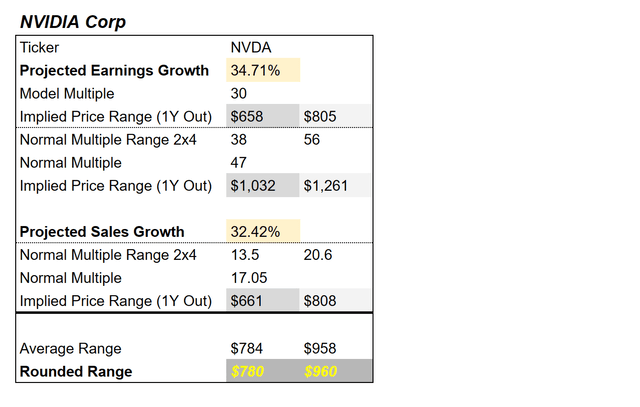

With better earnings visibility looking forward, we now think that the stock’s Fair Value is worth somewhere between $780 and $960 per share, based on the company’s premium historical valuation, and top and bottom-line growth rates, which both sit north of 30%:

Why mention this?

In short, because we’re about to do it again; make a negative call on a massively popular stock: Broadcom (NASDAQ:AVGO).

In our view, shares are overpriced relative to the company’s potential, and have significant downside room to our estimated Fair Value zone. We’re aware that this call may end up being another ‘cry wolf’ moment on a great company, should shares continue higher over the medium term. But to our eyes, Broadcom appears critically, dangerously, overvalued.

We believe this, even in light of the incredibly strong AI business driver.

Given the recent market-wide rally, it can be easy to forget that equity investing comes with a good deal of risk, but looking back to 2022, it’s clear that high-flying tech stocks can re-rate lower in short order.

Thus, today, we’ll take a look at AVGO’s financials and valuation picture, in order to explain why we think the stock is primed to plunge on the next market-wide selloff, and why you should consider dumping your stake at today’s frothy price point.

Sound good?

Let’s dive in.

Broadcom’s Financials

If there’s one thing that we like about AVGO, it’s the company’s financials. In short, they are pristine, and explain a good deal of the stock’s premium valuation.

In case you’re new to the company, AVGO is a global technology firm that supplies a number of semiconductor and infrastructure software solutions to a number of verticals within the tech industry; more broadly, including networking, wireless, and broadband.

Working off of a ‘sustainable franchise’ model, the company grows franchises related to specific use cases, like networking. Management isn’t looking for a hockey stick growth when they invest, they’re looking for markets where they can build or acquire, and then invest, in long term, durable segments.

Then, by adding these segments together, you get a highly durable overarching business, with its fingers in a LOT of pies.

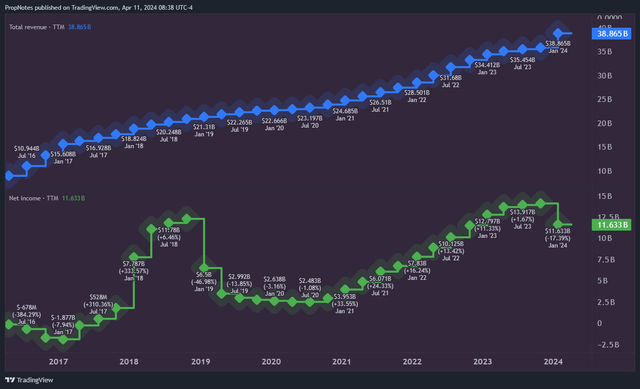

This approach has proven successful, and excluding unusual items, revenue and net income have grown like clockwork over the last number of years:

But what about AI?

Recently, much ado has been made over the GenAI technological breakthrough with ChatGPT, and Nvidia’s (NVDA) subsequent success.

Thus, the market is looking for the next big beneficiary of AI, and many think that AVGO is up next.

This seems to be partly true. On the recent earnings call, CEO Hock Tan mentioned the following:

Q1 networking revenue of $3.3 billion grew 46% year-on-year, representing 45% of our semiconductor revenue. This was largely driven by strong demand for our custom AI accelerators at our 2 hyperscale customers. This strength extends beyond AI accelerators.

Our latest generation Tomahawk 5 800G switches saw through Ethernet mix refinements, DSPs and optical components are experiencing strong demand at hyperscale customers as well as large-scale enterprises deploying AI data centers. For fiscal 2024, given continued strength of AI NAND working demand, we now expect networking revenue to grow over 35% year-on-year compared to our prior guidance for 30% annual growth…

We reiterate our guidance for Semiconductor Solutions revenue to be up mid- to high single-digit percentage year-on-year. I know we told you in December, our revenue from AI would be 25% of our full year semiconductor revenue. We now expect revenue from AI to be much stronger, representing some 35% of semiconductor revenue at over $10 billion.

This shows that there are a number of routes for AVGO to cash in on the AI trend, including networking and memory. As it turns out, you don’t need to make GPUs to cash in, off of AI.

Not mentioned in the quote above is the additional VMware impact, which has tailored AI on-prem solutions for businesses to deploy AI privately. This has also powered a chunk of AVGO’s software growth over the last year.

Thus, there’s no question that AI is having a positive impact on AVGO’s semiconductor & infrastructure software businesses.

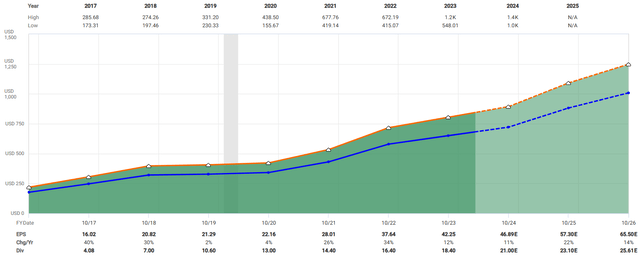

Analysts expect that these AI drivers should power EPS growth from $42 today to $65 in FY2026:

This represents growth of 50% over the next few years, which is highly impressive.

So, all in all, AVGO seems like an AI beneficiary, and the market / analysts are expecting strong growth over the next few years.

What Is Broadcom’s Stock Worth?

Why are we so bearish on the company, then?

Because, if you overlay AVGO’s stock price onto the above chart, it looks like this:

For a long time, AVGO’s modeled multiple and the stock’s price have largely mirrored one another, as the company’s EPS multiple has generally reflected the company’s potential growth rate.

However, now, in our eyes, the company is seriously overvalued, and, with current estimates, yesterday’s closing price bakes in a lot of growth that the company has not yet achieved. In short, the stock’s price appears highly speculative.

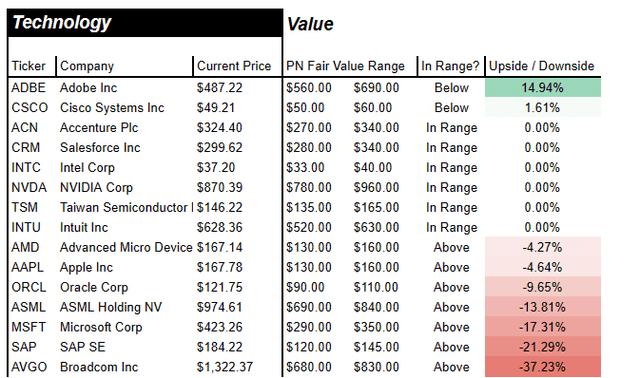

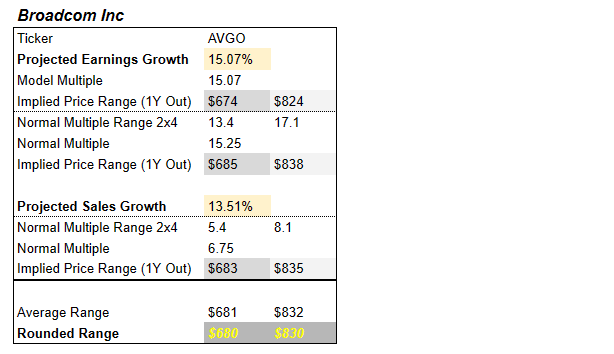

Viewed differently, we think that the stock is probably worth somewhere between $680 and $830 per share:

www.propnotes.co

We arrived at this zone based off of a model that is the average of three ranges: a 5-year historical blended AOEPS multiple, a 5-year historical blended sales multiple, and a model multiple based on AVGO’s expected growth rate.

Given that AVGO has much lower expected growth than Nvidia or other AI winners, it simply doesn’t appear as though the stock price is justified.

Zooming out, yesterday’s closing price was ~$1,320 per share, which makes AVGO appear to be the most overvalued large cap technology stock we cover – one which sports a potential downside to our Fair Value range of -37%:

In our view, this kind of expensive, premium-looking valuation doesn’t add up to a recipe for long term capital gains – the numbers simply don’t support a long position right now.

Risks

There are a few risks here with our Bearish thesis.

The key risk has to do with forecasting AVGO’s growth. If the company can improve or dramatically beat earnings and sales growth expectations over the next quarter or two, then we would see the stock’s current price as more justified, as the model multiple would expand, closing some of the gap at the same time that the company would also grow more quickly into its stock price.

You can see some evidence of this undercounting potentially happening when it comes to AVGO management predicting demand for AI networking semiconductor solutions, which was mentioned in the quote we referenced earlier:

I know we told you in December, our revenue from AI would be 25% of our full year semiconductor revenue. We now expect revenue from AI to be much stronger, representing some 35% of semiconductor revenue at over $10 billion.

If management, and therefore analysts, chronically undercount demand, then we see a path to where AVGO could be viewed as significantly less ‘overvalued’ vs. where things currently sit.

In other words, if AI semiconductor revenue in the short term jumps from 25%, to 35%, to 45%, to 55% of total share, and higher, that might begin to warrant the stock’s current price.

This is the mistake we made with NVDA, which is how the stock ‘looked’ expensive to us, but we had actually significantly underestimated demand for its chips. Therefore, by making this bearish call, we are open to this happening again.

Summary

That said, we think the impact of AI on AVGO will be much less significant than NVDA, and therefore the stock shouldn’t deserve the same speculative treatment. This is both due to product concentration, as well as AVGO’s margin profile, which appears more competitively priced.

Thus, while some see AVGO as the next big AI winner, to us, it only looks like a speculative, risky buy.

We’re not looking to make enemies with this post, so if you disagree with us, then we’re happy to hear from you in the comments!

That said, we’re still initiating coverage on AVGO with a ‘Sell’ rating.

Good luck out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.