Summary:

- Energy Transfer LP has a market capitalization of over $50 billion and offers a dividend of just over 8%.

- The company reported strong financial results in 2023, with net income up 15% YoY and adjusted EBITDA of $3.6 billion.

- Energy Transfer has made several acquisitions, building up a massive asset portfolio and presenting growth opportunities.

primeimages

Energy Transfer LP (NYSE:ET) is among the largest midstream companies, with a market capitalization just over $50 billion. The company has a dividend just a hair over 8%, and its share price remains near 52-week highs. The company has continued to invest in its growth and income generation, making it a valuable long-term investment.

Energy Transfer Updates

The company has managed to drive strong results in 2023, with a strong start in 2024.

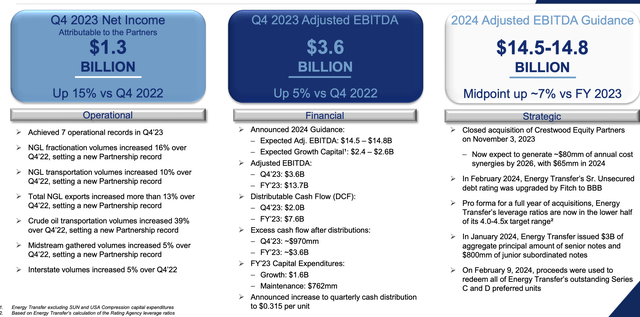

Energy Transfer Investor Presentation

The company earned $1.3 billion in last quarter net income up 15% YoY. Volumes increased dramatically, enabling the company to continue achieving operational records. Adjusted EBITDA for the company was $3.6 billion, annualized at just over $14 billion. FY ’23 discounted cash flow, or DCF, was $7.6 billion, with a massive $2 billion for the last quarter.

The company’s 2024 guidance is $14.65 billion in adjusted EBITDA, supported by the closed Crestwood Equity Partners acquisition. The company is at the target end of its leverage ratio and has utilized more debt to redeem all of its outstanding Series C/D preferred units, helping to clean up the capital stack. The company’s 7% EBITDA increase guidance is impressive.

The company is expected to ramp up growth capital to ~$2.5 billion. We expect more than $8 billion in DCF for the year, or $5.5 billion post growth capital, and $1.5 billion post dividends. That’s incredibly strong DCF for a company that’s both growing and driving strong returns.

Energy Transfer Footprint

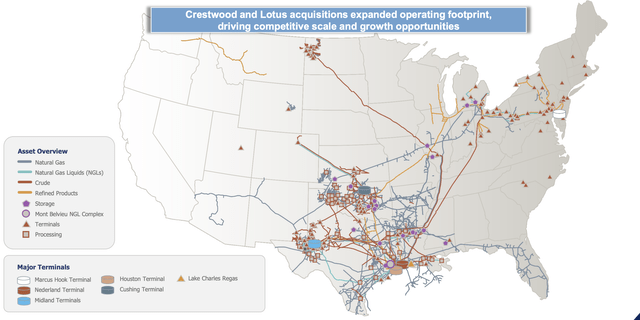

The company is continuing to build up a massive footprint, with the benefits of large acquisitions.

Energy Transfer Investor Presentation

The company’s Crestwood and Lotus acquisitions in 2023 show $9 billion worth of additional acquisitions and the company’s continued growth through bolt-on acquisitions. The company now has a massive footprint with a substantial amount of integrated scale and assets. That enables the company to operate as a consistent toll road operator for oil and natural gas.

The company’s massive asset portfolio also presents numerous growth and acquisition opportunities as the company can continue to build incremental capacity.

Energy Transfer Consolidation

The below chart shows an idea of how quickly the company has focused on consolidating its portfolio.

Energy Transfer Investor Presentation

The last several years have seen very minimal acquisitions and consolidation in the midstream space. Energy Transfer, with 4 acquisitions in 3 years, has spent more than $16 billion to acquire 4 companies. Each acquisition was small, but in totality, they make up more than 30% of the company’s market capitalization today.

The company has a unique ability to find strong bolt-on acquisitions, and we’re excited to see it keep doing so without stretching its financial position.

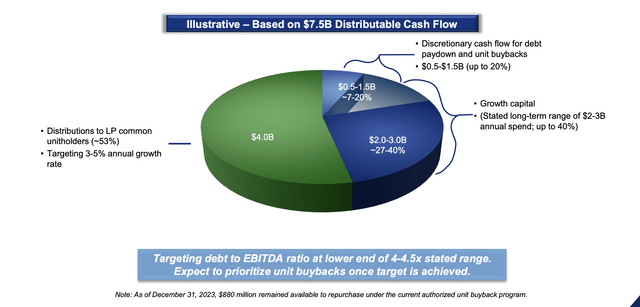

Energy Transfer Long-Term Returns

The company’s long-term return potential is strong, and that’s not counting the fact that we expect the company’s DCF to come in above the $7.5 billion target. For reference, the company earned $7.6 billion in 2023, and its current midpoint EBITDA guidance is up 7%. The company has also continued to manage its debt load, although rising interest rates do pose a risk.

Energy Transfer Investor Presentation

The company expects ~$4 billion in distributions, or its current yield of just over 8%. The company is targeting a 4% growth rate for this distribution, and we don’t expect that to change, it’s a level that the company can comfortably afford and one that’s sustainable for the long run. The company then plans to spend $2-3 billion in growth capital.

The company expects to spend up to 40% of its DCF on growth capital, which would imply $3 billion to a $7.5 billion range. However, as its DCF grows, this could mean more growth capital. After all this, the company has $0.5-1.5 billion it can use for debt pay down or unit paybacks. At an 8% yield, we’d prefer to see unit buybacks, but regardless, we expect returns.

Our View

For those looking to invest, we discuss a short-term risk and recommend two investment strategies to invest now.

The first is the short-term risk. U.S. “super-core” inflation remains high, and there’s now talk of at least slower rate cuts if not rate increases. As a hefty dividend payer, Energy Transfer’s yield is tied to the yield of safe investments such as treasuries, hence its current yield of over 8%. An interest rate increase could hurt its share price.

However, if interest rates do come down as expected (the FED continues to forecast 3 2024 cuts), that will result in a similar decrease in Energy Transfer’s yield, providing a short-term boost in share price. That helps make now a good time to invest. For those looking to keep things simple, we recommend just buying the common stock of a great company with the catalyst of lower rates.

Alternatively, we recommend taking a look at PUT options on the company. The June 2025 $12 PUT is currently trading at $0.42 / share or ~3.5% yield on cash for just over a year. Most brokerages let you purchase a naked PUT where you don’t need to put the cash upfront (although keep in mind you might be obligated to purchase and need the cash suddenly).

The upside is you just keep the cash. The downside is the share price drops, and you’re forced to purchase at a net cost of $11.6, a great price for the company given its long-term prospects and cash flow discussed above. Regardless of which strategy you pick to invest, we see Energy Transfer as a long-term core portfolio holding.

Thesis Risk

The largest risk to our thesis is the company’s continued massive investments in oil and natural gas infrastructure as the global market and demand continues to change. That changing demand could substantially hurt the company’s ability to continue driving shareholder returns over longer timeframes, should volume and demand for its assets decline.

Conclusion

Energy Transfer has an impressive portfolio of assets, as the company has continued to make bolt-on acquisitions to consolidate the midstream oil industry. The company generates massive cash flow with a strong finish to the year, and we expect its cash flow to continue growing into 2024. The company does face the risk of higher interest rates, but it’s manageable.

The company should continue to pay out its 8% dividend that it can comfortably afford, while optimally working to increase it. Additionally, the company has extra cash it can use for share buybacks or other returns. Regardless of how the company spends this money, it’s a valuable long-term investment we recommend taking advantage of.

Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.