Summary:

- Another of Andvari’s high-yielding security holdings is the stock of Altria Group.

- Altria’s profitability is extraordinary, and the business requires minimal capital expenditures.

- Andvari likes MO for its high margins, low capex requirements, and predictable revenues.

krblokhin

The following segment was excerpted from this fund letter.

Altria Group (NYSE:MO).

An example of a high-yielding security is the stock of Altria Group (MO). Before we get into the details of why we started a position in Altria, a brief history is in order.

The company was formerly known as Philip Morris (PM) before rebranding to Altria in 2003. Cynically, the rebranding was to minimize the negative attention from its tobacco business. However, the company also owned Kraft Foods and Miller Brewing, so it was logical to reflect its status as a conglomerate. Since rebranding, Altria has slowly “de-conglomerated”. It spun out Kraft in 2007. It spun out Philip Morris International in 2008. In 2021, it sold its Ste. Michelle Wine Estates business. Finally, last month, Altria announced it is selling part of its 10% ownership in Anheuser-Busch InBev (BUD).1

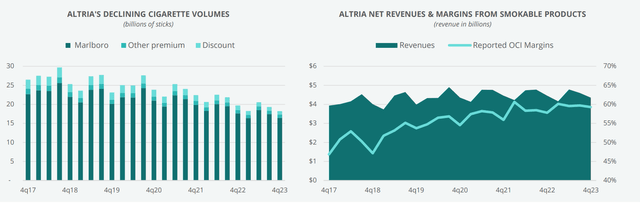

Andvari has followed Altria since we began our investment career. Profitability is extraordinary, and the business requires minimal capital expenditures. Despite the volume of cigarettes having steadily declined-a great thing for our population health-Altria has still managed to grow revenues and profits with regular price increases.

Also offsetting the decline in Altria’s cigarette business is the growth of its oral tobacco portfolio. Altria, and nearly all other tobacco companies, have developed or acquired multiple next generation products that deliver nicotine in a vastly safer way than cigarettes.2 These reduced risk products continue to grow rapidly. For example, Altria’s on! brand of nicotine pouches is growing volumes at an annual rate of >30%. Over a long period of time, the reduced risk products will make up most of the revenues and profits for Altria and other tobacco companies.

As to why Andvari started a position in Altria, it boils down to a combination of a business with excellent qualities and simple math. Andvari likes the business for its high margins, low capex requirements, and predictable revenues. The business also has extraordinary pricing power arising from its addictive products-a nice hedge against inflation.

Then there’s the welcome news of Altria raising cash from its BUD stake (roughly $2.1 billion if they obtain an average selling price of $60 per share for BUD) it will use to repurchase its shares. This is a rational choice because Andvari believes Altria shares are undervalued. Further, with fewer outstanding shares, Altria will have smaller total dividend payments to shareholders.

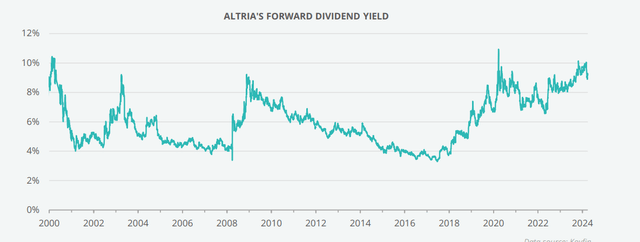

The math behind our purchase is simple. The dividend yield on Altria shares was at a level seen only two other times since the year 2000. Thus, Andvari purchased a security at a 9.7% dividend yield that can grow its dividend per share at an annual rate of 2%-3%. The odds are with us, this type of investment will provide good long-term returns.

|

Footnotes 1South African brewer SAB acquired Miller in 2002 to form SABMiller, with Philip Morris retaining a 36% ownership share. In 2015, Anheuser-Busch InBev acquired SABMiller. 2Nicotine itself is not the primary cause of smoking-related diseases. The smoke produced by the burning of a cigarette contains over 6,000 chemicals, of which 100 have been classified as causes or potential causes of smoking- related diseases such as lung cancer, cardiovascular disease, and emphysema. Thus, tobacco companies have created products that do not require the burning of tobacco to deliver nicotine. Altria has research showing the reduction of harm in their smokeless tobacco, heated tobacco, and e-vapor products. Disclosures & End Notes Andvari performance represents actual trading performance of all, actual clients beginning on 4/12/13, managed under the primary Andvari investment strategy. Performance from 12/31/12 to 4/12/13 is actual performance of proprietary accounts, namely the accounts of Andvari’s principal, Douglas Ott. Andvari believes, including Ott’s performance figures for the first 4 months and 12 days of 2013 is fair as he managed those accounts similarly to Andvari’s first clients. All performance, including the initial proprietary period, are net of management fees-assumed to be 1.25% per annum, paid quarterly, as currently advertised-net of brokerage commissions and expenses, time-weighted, and includes all cash and other securities. Performance includes realized and unrealized returns and excludes the effects of taxes on incurred gains or losses. Andvari does not certify the accuracy of these numbers. Performance data quoted represents past performance and does not guarantee future results. The exchange-traded funds (ETFs) are listed as benchmarks and are total return figures and assumes dividends are reinvested. The SPY ETF is based on the S&P 500 Index, which is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. The IWM ETF is based on the Russell 2000 Index, an index of 2,000 U.S. small-cap stocks. It is not possible to invest directly in an index. Because Andvariclient portfolios are non-diversified, the performance of each holding will have a greater impact on results and may make them more volatile than a more diversified index. Andvari also engages or may engage in strategies not employed by the S&P 500 or the Russell 2000 including, without limitation, the use of leverage. One may request a list of all securities mentioned or recommended for the preceding year as of the date of this letter. You may contact Andvari using the information below. Actual client results may differ from results depicted in this letter. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the loss of principal. Investment strategies managed by Andvari Associates LLC may have a position in the securities or assets discussed in this article. Securities mentioned may not be representative of the Andvari’s current or future investments. Andvari may re-evaluate its holdings in any mentioned securities and may buy, sell or cover certain positions without notice. The discussion of Andvari’s investments and investment strategy (including, but not limited to, current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) represents the views and opinions of Andvari’s portfolio managers and Andvari Associates LLC, the investment adviser, at the time of this report, and can change without notice. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein or of any of the affiliates of Andvari. The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. Any or all of Andvari’s forward-looking assumptions, expectations, projections, intentions or beliefs about future events may turn out to be wrong. These forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties, and other factors, most of which are beyond Andvari’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all securities, companies, and commodities discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.