Summary:

- Boeing’s current CEO and other high-level executives are stepping down amid a series of quality issues and management changes.

- Potential candidates for the new CEO position include former executive Patrick Shanahan and current GE CEO Larry Culp, both highly accomplished professional executives.

- However, I view the root problem at Boeing as an engineering issue, not a management issue.

- As such, I have reservations about the likelihood for these candidates to successfully restore its engineering rigor.

ICHIRO/DigitalVision via Getty Images

Thesis

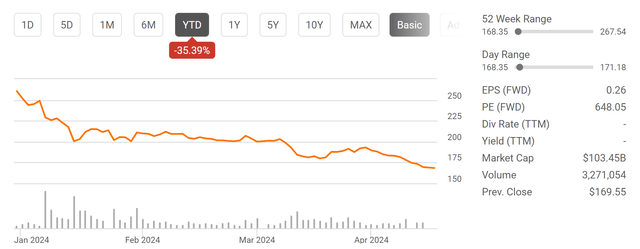

The goal of this article is to argue for a hold thesis on Boeing Company (NYSE:NYSE:BA). The key consideration for this thesis is the mixed outlook I’m seeing. As such, I anticipate the stock price to move sideways without a definitive direction. For existing investors, this means that I do not see too much room for the stock to fall in a downward direction anymore. The large corrections so far (the stock lost more than 35% year-to-date alone as shown below) already have priced in most of the negatives.

For potential investors, I don’t see too much upside potential either. Most of the bullish thesis on BA that I’ve read so far essentially is betting on successful and speedy turnaround. I’m skeptical of this expectation. I will argue that A) BA’s issues are not a management issue but a deep-routed engineering issue, and B) fix this issue will only take the right CEO but also time and resources to restore its engineering vigor.

Seeking Alpha

Boeing’s Next CEO

If you’re reading this article, I assume you’re aware of the recent accidents and management changes surrounding BA. So here I will just skip the background and directly get to the part of the story that’s of the most relevance to my thesis.

Following a series of quality issues, Boeing’s current President and CEO Dave Calhoun announced that he will step down by the end of 2024. At the same time, Boeing Commercial Airplanes President Stan Deal announced his retirement, while Boeing Chairman Lawrence W. Kellner also announced that he will not seek re-election at the upcoming shareholder meeting. The gist is that BA has to replace multiple high-level executives quickly amid a crisis.

Boeing is currently in the process of selecting a new CEO, and there are a few potential candidates. You can see a more complete list and a more thorough discussion of the candidates here. Based on these analyses, the most likely candidates in my mind seem to include its former executive and Deputy Secretary of Defense Patrick Shanahan, current General Electric CEO Larry Culp, and Chief Operating Officer Stephanie Pope. Judging by their resumes, they should also be favored by Wall Street as professional executives.

However, can they truly address Boeing’s pressing issues? I have to say that I’m not totally sure. I’m not questioning their capability – these candidates are some of the most accomplished individuals. All candidates mentioned above have MBA as their terminal degrees (and to make it crystal clear, I have nothing against MBAs). It’s just that I view BA’s root problem as an engineering problem, not a business (or even a management problem). I think BA needs a transformational leader whose roots are in engineering (someone like Jack Welch, PhD, in chemical engineering).

In the remainder of this article, I will elaborate this argument further.

Boeing: Historical Perspective

Boeing’s current issue goes back to its merger with McDonnell Douglas, in my view. That was among Boeing’s biggest moments. This merger, the largest aviation merger in U.S. history, made Boeing the world’s largest aircraft manufacturer and the undisputed leader in the civil aviation market. After the merger, Boeing’s goal has changed from “building the best aircraft” to “maximizing shareholder returns.” This change of goal has gradually eroded Boeing’s once-proud engineering culture.

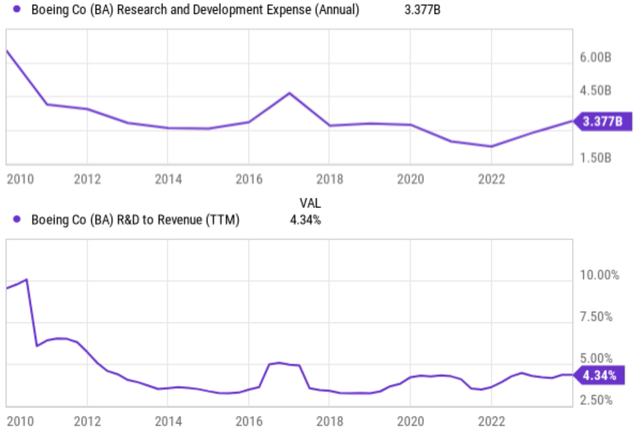

You can get a vivid view of this change in the chart below. The next chart shows BA’s research and development expenses (“R&D”) since 2010, a few years after the merger. The top panel shows the annual R&D expenses in dollar amount and the bottom panel shows the R&D expenses as a percentage of total revenue. As seen, in terms of actual spending, BA’s R&D expenses have been in an overall decreasing trend since then. It started at more than $6 billion in 2010 and declined to a bottom of ~$3.00 billion, roughly halved despite the tremendous growth of sales and profit during this period. That’s why, as a percentage of total revenue, R&D spending has declined even more dramatically since 2010. In 2010, it was close to 10% of total revenue and it fell to a bottom of around 3% only in 2022.

Seeking Alpha

Headwinds Ahead

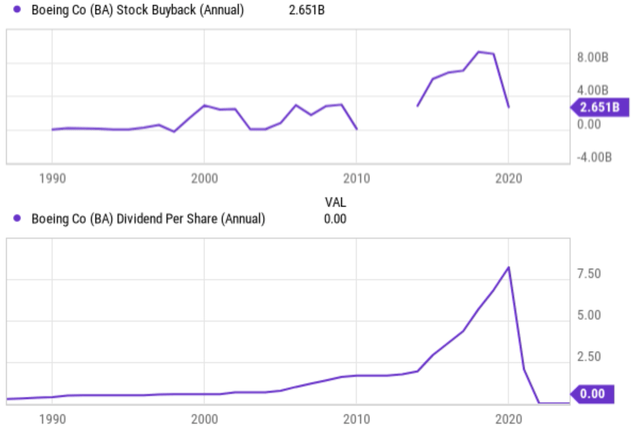

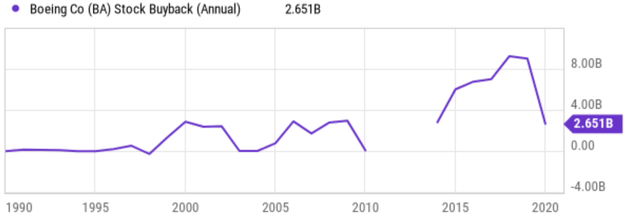

Then where did the money go? A large part of it went to shareholders as dividends and share repurchases (see the next chart below). BA has been spending large sums on buybacks and generously increasing its dividends in the past until 2020 when COVID-19 broke out. Between 2015 and 2019, my analyses show that BA has cumulatively allocated more than $34 billion for stock buybacks and more than $15 billion on dividends. To better contextualize things, these amounts are more than the entire development cost of the Boeing 787 Dreamliner. The development cost of Airbus’ new aircraft model the Airbus A350 is around €11 billion cost. Thus, these funds spent on near-term shareholder returns would have been sufficient to develop two entirely new aircraft models. Now thanks to the capital allocation priorities, I do not think Boeing has any meaningful plan for the development of a new aircraft model before 2030 – even if the next CEO successfully navigates it out of the current crisis.

Seeking Alpha

Such focus on shareholder returns has led to several structural shifts in BA’s current management culture. These shifts, when put in a positive light (and in popular management jargon) involve cost reduction and operations streamlining.

However, when put in a more negative light, these shifts have caused a reduction in investment in research and development as mentioned above. This decline in R&D is really trading BA’s long-term future (with new competitive aircraft models) for short-term returns. In the meantime, outsourcing has dramatically increased as a way to cut costs. Many manufacturing and engineering tasks at BA are outsourced these days. While outsourcing can offer cost advantages, it can also introduce risks related to quality control. For example, this following report pointed out that:

The recent emergency landing incident, attributed to missing bolts, has cast a harsh light on Boeing’s oversight and quality control, particularly with suppliers like Spirit AeroSystems.

Overall, as also pointed out by the same report,

The outsourcing approach, which saw over 70% of the 787’s design and manufacturing handed off to over 50 key suppliers, has been linked to a range of problems, from production delays to fatal crashes.

Seeking Alpha

Other risks and final thoughts

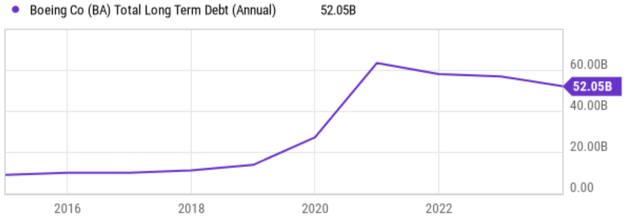

To recap, beyond the damaged reputation and declining orders, I see the key issue at BA as an engineering issue accumulated over many years. I’m not entirely sure if a new CEO out of the current potential list of candidates can solve these problems in the next few years. To solve its quality issues and safety concerns, the fundamental solution is to restore its engineering rigor, reinvigorate its R&D program, and restructure manufacturing operations. All of these become increasingly difficult due to the capital allocation decisions that focus on the near term in recent years. Its earnings are projected to be barely breaking even in FY 2024 (with an EPS projection of around $0.26 only) and its debt is quite high (see the next chart below).

Seeking Alpha

On the upside, I do not think the stock has too much downside risk. The recent correction (from the 52-week peak of $267 in early 2024 to the current level of $170) has largely priced in the risks analyzed above. Civilian aviation is of course a key segment for BA, but it also has substantial defense segments, which are of importance for national security. Actually, one could also argue that its civilian aviation is of national security importance too considering BA’s dominating role in this space.

Weighing these mixed factors, I rate BA stock as a hold under current conditions. The company faces a variety of strong headwinds in the next few years, including management changes, quality control issues, reputation damages, and potential profit issues. But in my mind, the root cause is an engineering problem. Restoring its engineering rigor will take time and resources and I don’t expect a speedy turnaround.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.