Summary:

- McDonald’s investors experienced a roller coaster ride over the last six months.

- The Middle East conflict and the decline in comparable sales have impacted McDonald’s International Developmental Licensees segment.

- MCD has faced significant downside volatility recently as the market grapples with the impact.

- The recent minimum wage increases have compounded the challenges for McDonald’s.

- However, MCD doesn’t seem to be overvalued like before, presenting another excellent buy-the-dip opportunity.

M. Suhail

McDonald’s Corporation (NYSE:MCD) investors have experienced optimism and pessimism in the span of six months. I urged MCD investors to consider ignoring the doom and gloom in the market in October 2023 with a bullish MCD call, as MCD was attractively valued. That call panned out, as buyers returned aggressively, resoundingly helping MCD to bottom out. However, I assessed its previous surge reached euphoric levels, as I highlighted MCD FOMO in a January 2024 update, sounding a note of caution and downgrading MCD to a Hold. MCD topped out at the $300 level in late January, as it met stiff resistance at the same level it failed to break through in early 2023.

Therefore, it should be clear that sellers had already set the decline in motion even before McDonald’s fourth-quarter earnings release in early February 2024, which likely stunned the market. Observant investors should recall that the Middle East conflict led to a sharp decline in comparable sales for McDonald’s International Developmental Licensees or IDL segment. Furthermore, McDonald’s management guidance for 2024 suggests a normalized growth environment for global comps sales growth, within the historical 3% to 4% average for the US and the International Operated Markets or IOM segments. However, management dropped a caveat that the IDL segment will likely not see “significant improvement” until the Middle East conflict is resolved.

To make matters worse for McDonald’s, Iran attacked Israel over the weekend. While the attack resulted in minimal casualties and damages, it has escalated tensions in the Middle East. It could open up a new, more dangerous, direct theater of conflict between Iran and Israel. I believe McDonald’s is increasingly concerned with the uncertainties and impact driven by its IDL business in the Middle East. As a reminder, McDonald’s recently bought out its Israeli franchisee, Alonyal, after over 30 years of ownership and operations in Israel. While no specific reasons were provided in McDonald’s press release, it’s likely linked to the fracas last year when the Israeli franchisee “initiated discounts for soldiers in the Israeli Defense Forces, prompting backlash across the region against McDonald’s.” Therefore, I believe McDonald’s has decided to reinstate control over the Israeli franchisee operations to bring stability to other Middle Eastern operators and to demonstrate that the company is committed to the region’s prosperity. Despite that, I believe the adverse reactions in MCD stock likely suggest that the market remains unconvinced with the measures and has likely baked in higher execution risks on its 2024 guidance.

Furthermore, significant downside volatility in MCD was observed in March. CFO Ian Borden warned that first-quarter sales were “sluggish” in China and the Middle East, raising the specter of an extended impact. To compound matters, the recent inflation dynamics could worsen the traffic toward even top fast food leaders like McDonald’s as they grapple with weaker spending sentiment by lower-income households. Even as McDonald’s could emerge as a potential market share grower attributed to its value offerings and low-cost scale advantages, the market could be concerned with a more pronounced impact. Moreover, after two solid years of robust comps sales growth, 2024 could be a downcycle year.

As a result, I believe the market has likely de-rated McDonald’s performance in the first half, as the company could shift its growth recovery drivers toward the second half to meet its full-year comp sales growth outlook. In addition, the timing of the minimum wage increases in California couldn’t have come at a worse time, as fast food operators assess the impact on their costs. However, McDonald’s has a well-diversified and robust franchisee network in the US. If anything, McDonald’s and its operators look very well-positioned to emerge as market share leaders, as they potentially benefit from their ability to price attractively and squeeze higher-cost operators across various categories. With the upcoming partnership with Krispy Kreme (DNUT) rolling off in the US this year, McDonald’s could rejuvenate its push to bolster its breakfast category growth momentum as it looks to spruce up its menu offerings to its customers.

With a best-in-class “A+” profitability grade, McDonald’s is a very high-quality company. However, valuations matter, as MCD has underperformed the S&P 500 (SP500) since my downgrade in January. However, MCD’s forward adjusted EBITDA multiple has improved to 16.4x, slightly above its 10Y average of 16x. Therefore, MCD looks attractive again from the valuation perspective. The critical question is whether MCD’s price action suggests buyers have returned, or should we be prepared for more potential downside at the current levels?

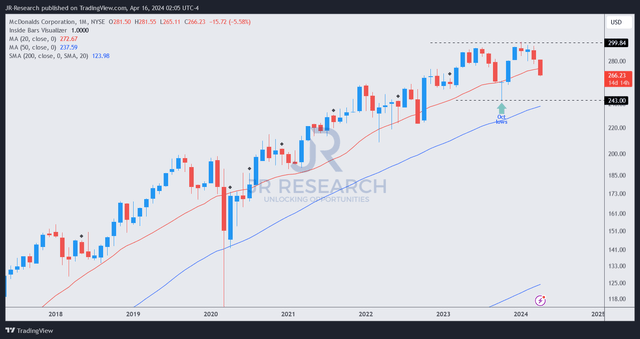

MCD price chart (monthly, long-term, adjusted for dividends) (TradingView)

MCD’s long-term uptrend remains intact, notwithstanding the recent pullback. I haven’t assessed a bullish reversal, suggesting dip-buyers have returned. In other words, we could even re-test the October lows at the low-$240s levels as the selling frenzy continues in earnest.

However, that would suggest the market taking MCD toward its 10Y valuation average even as the broad market remains bullish. That assumption seems less convincing to me as I expect a market pullback, but it won’t result in a bear market.

Therefore, I envisage MCD bottoming out ahead of its October lows, with the low-$260s level as a possible drop zone attracting more robust buying support.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!