Summary:

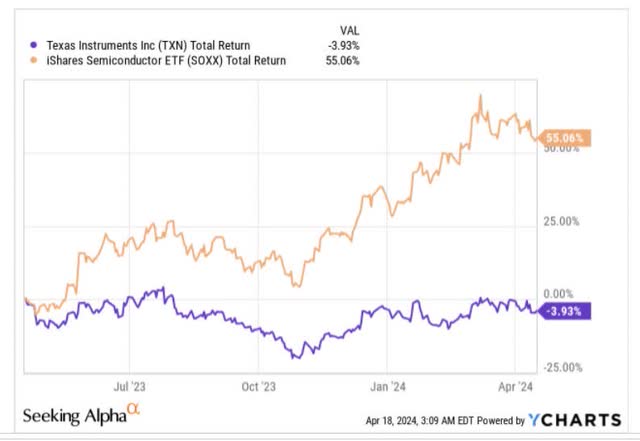

- TXN has lost 4% of its value and underperformed its semiconductor peers quite significantly over the past year.

- The company announces its Q1 results on the 23rd of April, and expectations are not particularly great.

- We explore various key metrics such as gross margins, the inventory position, CAPEX commitments, and cash flow.

- Even two years from now, TXN’s EPS could likely be 7% lower than the reported EPS of FY23, yet its forward P/E is roughly in line with its 5-year rolling average.

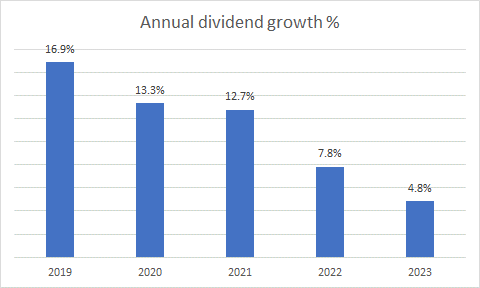

- TXN may offer a better-than-average yield at the moment, but do consider that the pace of dividend growth has consistently slowed in each of the past 5 years and is unlikely to get better, given FCF pressure.

kentoh

Introduction

The stock of Texas Instruments Incorporated (NASDAQ:TXN), the large-cap semiconductor entity that specializes in analog and embedded processing chips has experienced an underwhelming twelve months. Over the past year, when its domestic peers from the semiconductor universe have notched up impressive gains of 55%, TXN has lost pace by nearly -4%.

Could there now be an opportunity to put an end to this phase of underperformance and kickstart a new era, with the company close to announcing its Q1 results, on the 23rd of April? Well, we’re not necessarily convinced of that. Nonetheless, here are a few reasons why we’re not bullish on the stock.

Headline Expectations on Sales and EPS

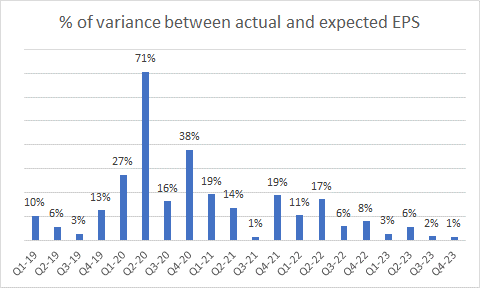

When it comes to beating bottom-line estimates, Texas Instruments appears to be one of the best in the business. Note that over the last 20 quarters, it has trumped sell-side EPS estimates on every single occasion with an average beat of 14% per quarter (although over the last 6 quarters, the degree of beat has dropped down to the single-digit threshold).

Seeking Alpha

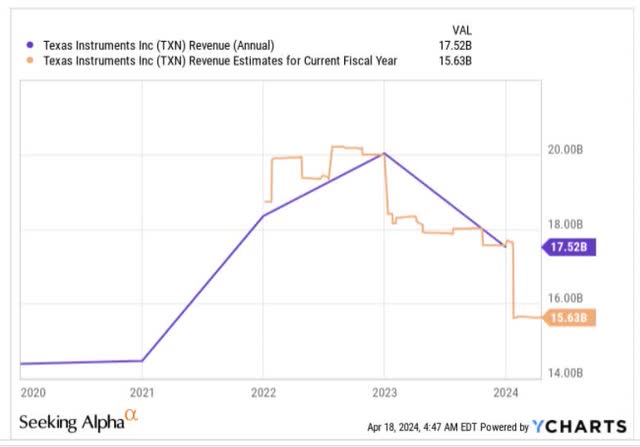

Now for the upcoming Q1, expectations are not particularly great. Firstly, note that traditionally, there has invariably been a seasonal dip between Q4 and Q1, particularly on the topline front. Now, consensus is currently budgeting for a figure of $3.61bn, which would represent not just an -11% sequential decline, but also a -17% YoY decline. There’s potential for this to be much worse (by around 4%) from the expected figure, as management’s expected, sales range for Q1 (provided during the Q4 earnings) had a lower-end figure of $3.45bn.

Note that YoY weakness is expected to linger for the first 3 quarters of the year, and will likely only turn positive by Q4, where topline growth of just 2% is expected. All in all, after already witnessing a -13% decline in the topline last year, we’re now likely staring at a -11% decline in FY24.

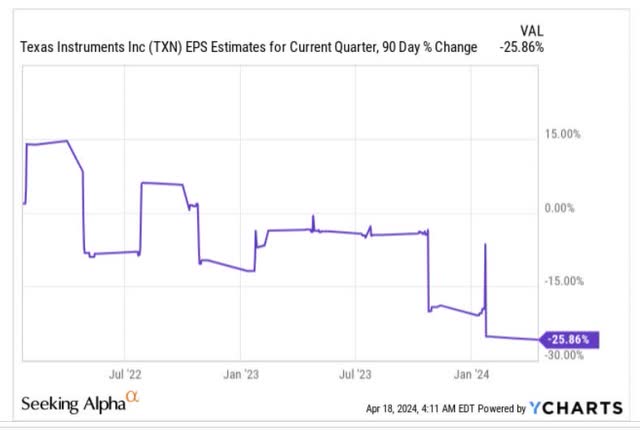

Coming back to the EPS, it’s fair to say that it would take something really egregious for TXN to fall short of street estimates ($1.08), as these numbers have already been adjusted downward quite significantly since Q4 results were last reported. Over the last 90 days, note that TXN’s Q1 EPS expectations have already been scaled down by over 25%, so even if it does end up beating those numbers, you’re looking at a fairly low bar.

Other Key Metrics

TXN’s dominant end-markets are industrial (which contributes 40% of group revenue), and automotive (34%), and it’s questionable if underlying conditions here will quickly reverse any time soon. For context, the industrial market weakness precipitated in Q4 witnessing mid-teens declines (from mid-single-digits in Q3), and weakness will likely linger in Q1 as well. Meanwhile, in the automotive market, it looks like the weakness is just getting started and could snowball from here, as it saw a sequential decline, of mid-single digits, after having grown by mid-single digits in Q3.

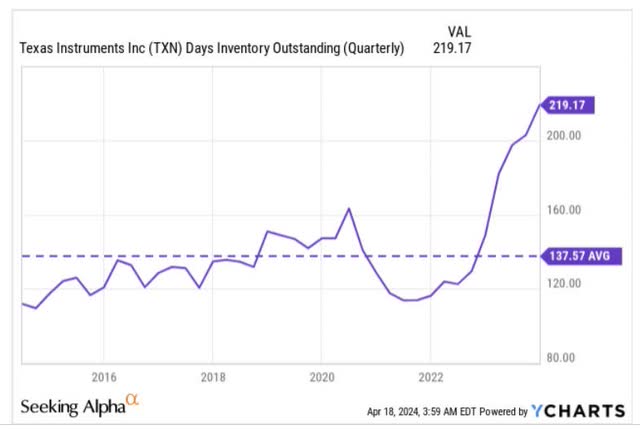

What’s key is that a lot of these customers still have ample inventory on their books, which they will look to draw down in the coming quarters. This would have been fine if TXN’s inventory position was at an acceptable level, but we have a worrying situation where TXN’s inventory days is already at 10-year highs of over 7 months!

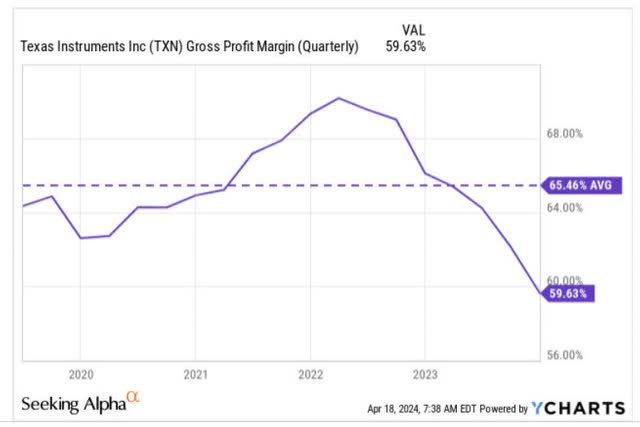

Those inventories may then be required to be unloaded at sub-par prices (at some stage), which could end up hurting the gross margin even further (GMs have also been seeing some pressure on account of underutilization of TXN’s capacity). What’s worrying to note is that gross margin levels are already at 5-year lows, yet management has spoken about expecting low single-digit price declines going forward, and a more pronounced impact on factory loadings in Q1. Put another way, expect another weak GM performance in the March quarter as well.

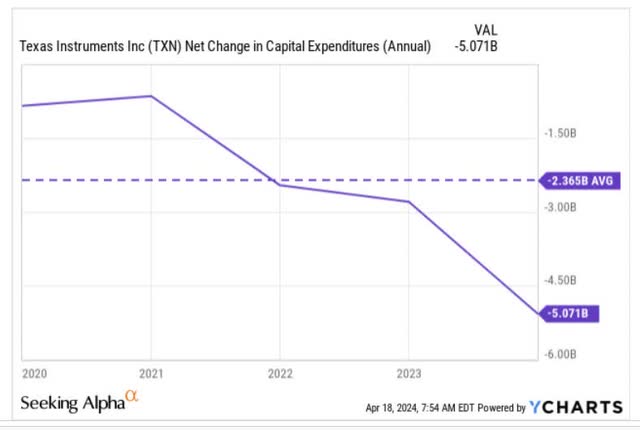

Texas Instruments is also in the process of ramping up its 300-millimeter wafer capacity (in the long run this could pay off as an unpackaged chip built on a 300mm wafer have a -40% cost differential relative to their 200mm counterparts) and this means CAPEX initiatives even this year could be above the $5bn threshold (in fact management expects this ballpark to linger all through FY26). For context, this is almost twice as much as what TXN has normally devoted towards CAPEX.

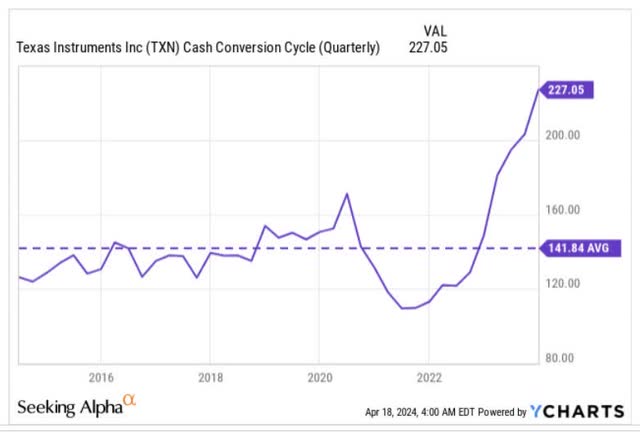

Given such high CAPEX commitments, it doesn’t reflect well on TXN if it isn’t also being more efficient with its working capital management, in its efforts to generate ample operating cash flow. The cash conversion cycle metric gives you a sense of the number of days cash is tied up with working capital, and already this is at decade highs.

At some stage, TXN will have to unload its inventories, but that’s unlikely to have happened in Q1 as management spoke about seeing upward biases on the inventory “probably for a couple of quarters at least”.

Why TXN Stock Isn’t A Good Buy

As suggested in the previous section, Q1 isn’t likely to be a stellar quarter, and even if it does beat street estimates, note that it wouldn’t be a steep hurdle to cross, as expectations, particularly on the EPS front, have already been dialed down quite significantly.

Looking ahead, we also don’t think the TXN stock offers a great deal of value, particularly when you consider the underwhelming earnings trajectory over the next 12- 18 months.

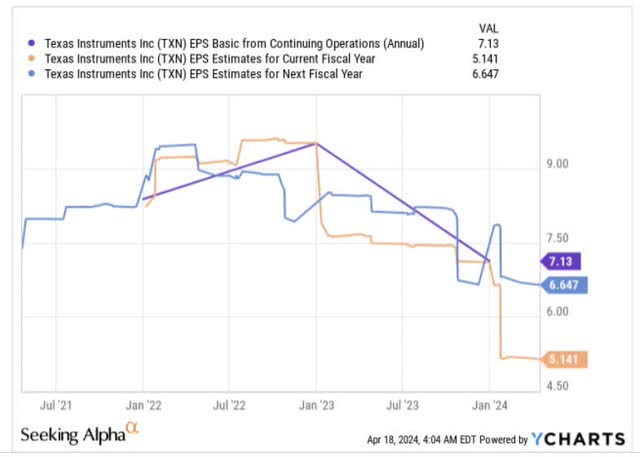

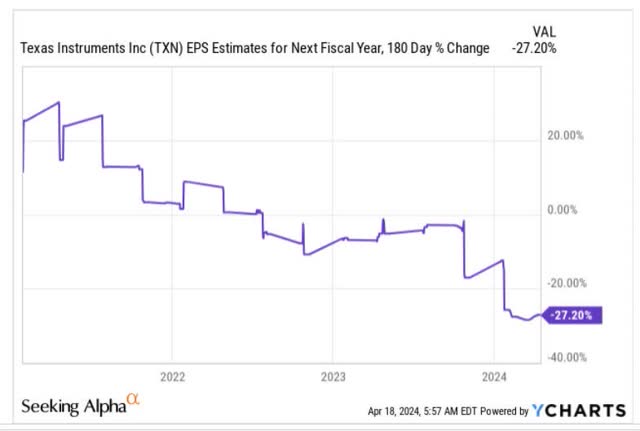

After having generated an EPS of $7.13 last year, consensus expects earnings to come off by 28% this year; the low base of the current year will give a decent fillip for earnings growth in FY25, but note that the figure will still be around 7% lower than what it was in FY23.

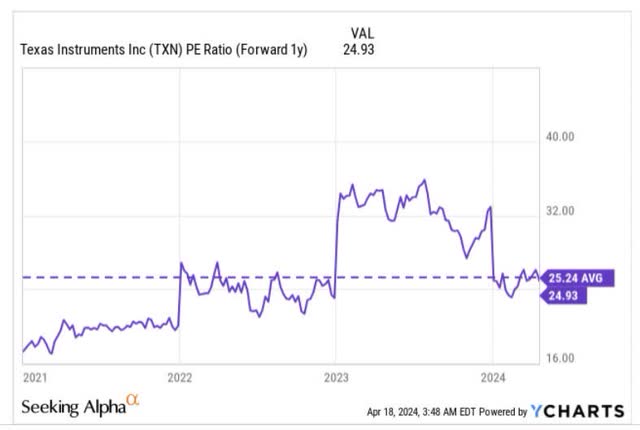

Given a contracting EPS landscape, we don’t think it’s fitting that the stock currently trades almost on par with its 5-year rolling forward P/E average of 25.2 (which is just a 1% discount); one would want to see a bigger discount before contemplating a position in this counter.

Note that the stock also trades roughly on par with its long-term average, even though the FY25 EPS estimates have already been cut by around 27% over the last 6 months. This suggests that they may be some disconnect between the underlying fundamentals and the price.

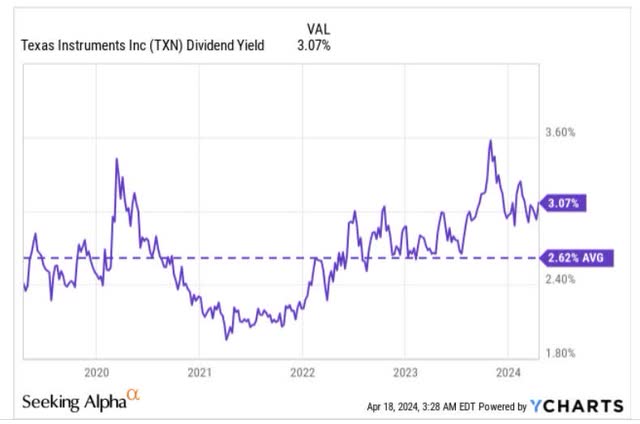

Admittedly, some investors may be diving into the TXN stock on account of its current 3%+yield, which is almost around 50bps better off than what you normally get (the 5-year average).

However, do consider that much of this is driven by the weakness of the share price, rather than an expanding pace of dividend growth. In fact, over each of the last 5 years, the dividend hike per year (in % terms) has been lower than the previous year. Given pressures on the FCF front, we wouldn’t expect this trend to reverse any time soon.

Seeking Alpha

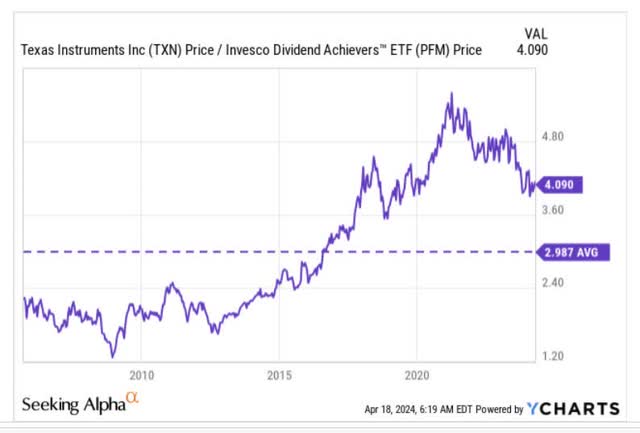

Separately, also consider that TXN still looks very overbought relative to other dividend achievers (companies that have increased their dividends for 10+ years). Its current relative strength ratio versus over 400 other dividend achievers is around 36% higher than its long-term average, dampening the prospects of rotational interest towards TXN.

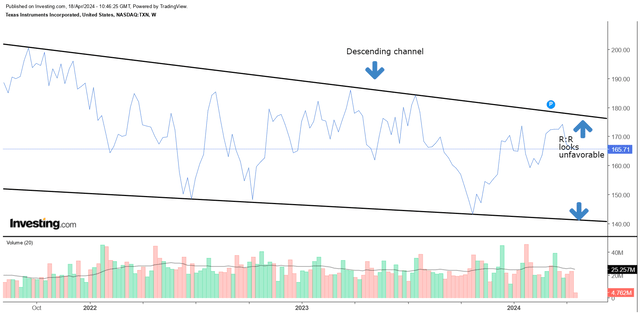

Finally, also note that TXN’s weekly price patterns over the last 30 months have taken place within a certain descending channel. History has shown that you ideally want to buy the stock when it is trading a lot closer to the lower boundary of this channel; not where it is based currently, where the implied risk-reward works out to less than 0.3x.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.