Summary:

- Google’s data advantage in the generative AI space could help them overcome recent teething problems and maintain search leadership.

- The company has a number of avenues to drive growth, including YouTube ads, their subscription business, as well Google Cloud, which has an edge in machine learning, a market that is on the cusp of rapid growth.

- Google Shopping ads are Alphabet’s effort to carve out a niche in the burgeoning eCommerce ad space and prospects are promising as their strategy leverages Google’s USP and rides on an ongoing D2C trend.

- Their valuation looks slightly stretched based on conservative figures but not demanding considering tremendous long-term opportunities.

georgeclerk/iStock Unreleased via Getty Images

Alphabet (NASDAQ:GOOGL) (GOOG) has been going through a rough patch lately; however, the company still has a number of growth avenues. Their valuation is a bit stretched based on conservative assumptions but doesn’t look very demanding considering enormous long-term opportunities in Cloud and Google Shopping.

Google has a major advantage in the generative AI space to remain as search market leader

Search ads are Google’s bread and butter business, accounting for over half of revenues alone. There have been concerns over the long-term prospects of this business due to Generative AI; however, Alphabet appears positioned to profitably maintain search leadership.

Search is not likely to disappear, however the interfaces consumers use to perform search is evolving from Google’s search bar to generative AI chatbots. First mover ChatGPT is currently ahead of Gemini across a few metrics like users (ChatGPT has 180 million users compared with 142 million for Gemini) and app downloads (ChatGPT registered over 3.2 million app downloads in February this year compared with around 630,000 for Google Gemini which was released in February and is currently available in the U.S. only).

Gemini has been hampered by some early teething problems; however, it has a major advantage to help them counter ChatGPT and maintain their dominance in search; unlike ChatGPT, Google’s Gemini has access to data from its vast ecosystem of apps including YouTube, Maps, Google Books, Google Scholar and needless to say Google Search (which has hundreds of billions of web pages in their index, which makes its closest rival Bing a relative minnow with an estimated 8-14 billion webpages).

A larger pool of training data could be a significant competitive advantage for Gemini over ChatGPT, which could translate into a better search experience. Despite Microsoft (MSFT) integrating AI-features into search engine Bing in the hopes of eating into Google’s market share, so far, that has had limited impact; Google’s share of search is over 90% while Bing’s has increased marginally from 3% to 3.4% over the past year. Apple’s (AAPL) decision to integrate Google Gemini into iOS is further indicative of Gemini’s capabilities.

Alphabet has a number of options to monetize Gemini. One option is placing ads, which follows a playbook they have used across many other Google products including Google Search, YouTube, and Play Store. A second option is rolling out an independent subscription (Gemini is currently bundled as a productivity tool along with other cloud subscription products). A third option is licensing the tool to enterprises (like with Apple, as mentioned earlier).

With search expected to remain an important aspect of a customer’s purchase journey, search ad spend is forecast to grow at a CAGR in the high single digits over the coming years and market leader Google is likely to remain a beneficiary.

Google Shopping, a potentially massive long-term opportunity

Traditional search has been losing share of global digital ad spend to retail media platforms such as Amazon (AMZN) and Walmart (WMT). Alphabet, however, is fighting back with Google Shopping ads, which have been around for years but only recently has been getting some attention from Alphabet. Google Shopping at this stage does not have Amazon’s advantage of direct connections with consumers and their purchase habits, but Google Shopping has its own USP, i.e., a wider, global audience beyond Amazon’s platform (whose audience is largely limited to Amazon customers), and a relatively convenient platform for customers to compare product options and prices across multiple retailers be giants like Amazon or smaller, niche D2C players (more below). In fact, Amazon was reportedly an avid advertiser on Google Shopping for Prime Day.

Beyond appealing to bigger retailers like Amazon, however, Alphabet’s strategy leverages on the growing D2C trend whereby merchants increasingly bypass intermediaries and sell direct to consumers instead, for a variety of reasons including better customer service, better margins, better control overlook and feel, and direct connections with customers. Google Shopping may not dislodge retail media bigwigs like Amazon and Walmart for the foreseeable future, however, with proper execution, it may be possible to draw customers back to Google as part of their shopping journey, and thereby give Alphabet a share of the growing eCommerce ad pie. Most D2C ad spend is currently directed at Google and Facebook according to eMarketer and Google has been gaining share at Facebook’s expense.

The long-term opportunities are enormous with a successful Google Shopping business, for instance, Google Gemini could help customers sift through thousands of retailers to search for products. Alphabet could then offer merchants the ability to accept payment using Google Pay, allowing customers a seamless option to shop across thousands of retailers worldwide. Retailers may be encouraged to maintain a ‘social feed’ combining text and YouTube video Updates and product demonstrations as part of marketing efforts, and given Google’s audience advantage, products, and retailers may draw considerably more customer reviews than independent marketplace platforms, in turn solidifying Google’s importance in a customer’s search journey.

Other business segments could contribute to growth

Alphabet’s non-search business accounts for just under half of revenues, and they could contribute meaningfully to medium term growth, offsetting Network revenue declines which is likely to continue its downward trajectory for various reasons, including the deprecation of third-party cookies, and ad budgets shifting to competitor ad channels.

YouTube ads:

YouTube ad revenues currently amount to around $31 billion. With a monthly active user base of around 2.5 billion, the platform’s ARPU equates to around $12.5, ranking at the lower end compared to rivals like Netflix, considerably lower than streaming peers like Netflix ($131), Hulu ($213), and Spotify ($23) suggesting room for further increases.

Subscriptions (YouTube Premium, YouTube Music, YouTube TV, Google One):

Google’s subscription revenues amounted to around $35 billion of which nearly half, or $15 billion, were generated from YouTube Premium and Music alone (YouTube Music and YouTube Premium have around 100 million subscribers roughly paying an average price of around $12/month or roughly $144/year). There is room for further monetization, considering Netflix’s subscribers (at around 260 million) are double that of YouTube. YouTube is the most watched streaming platform in the U.S. according to Nielsen (ahead of Netflix by a small margin but ahead nevertheless), so it is plausible for YouTube to narrow the subscriber gap with Netflix.

Google Cloud:

At $33 billion, or nearly 10% of total revenues, Google Cloud is a relatively small business but offers tremendous growth prospects. The cloud market is still at early stages, with cloud spend accounting for just around 11% of total IT spend worldwide. Gartner expects worldwide cloud spend to grow from $679 billion in 2024 to over $1 trillion by 2028.

Google Cloud is a relatively small player with a market share of around 11% (compared with over). However GCP’s edge in machine learning and data analytics innovations makes them a preferred choice for data-driven businesses, which positions them well to capitalize on growing demand for AI applications which is still very much at early stages.

Valuation

The following assumptions suggest Alphabet is worth around $1.3 trillion, lower than their $1.9 trillion market cap currently. However, the assumptions do not take into account potential ad revenue gains from Google Shopping and its related long-term opportunities, which at this point is premature to reasonably assess. With successful execution, Google Shopping could give a significant boost to Alphabet’s financials and valuation. The assumptions also conservatively assume Google Cloud to grow roughly in line with historical growth rates, which may be conservative considering public cloud’s long growth runway and GCP’s edge in machine learning and AI, a market that is still at embryonic stages and on the cusp of rapid growth. Margin growth assumptions may also be conservative; looking at AWS, whose cloud division is its profitability driver, Alphabet may deliver better than anticipated margin improvements as their cloud business scales. Google Shopping ads is likely to be a high margin business as well and is likely very margin accretive if successful.

|

Revenue growth YoY % |

Approximately 10% annually on average over the medium term, i.e., four years (this is largely driven by their core search ads business which is assumed to grow at 8% keeping pace with industry growth projections, supported by cloud revenue growth projected in the mid-20s which is in line with historical averages, 8% annual growth in YouTube ad revenues, and subscription growth at nearly 20% gradually dropping to the mid single digits after four years. Network revenues are assumed to decline 1% annually on average) |

|

Terminal growth rate % |

2% |

|

Net margin % |

Assumed to increase slightly from 24% to around 25% driven by growing cloud profitability with scale and profit contribution as cloud’s share of overall revenues increase, the gradual phasing out of lower margin network revenues, and potential tax benefits from CAPEX investments |

|

Depreciation % |

4% of revenues (roughly on par with historical average) |

|

CAPEX % |

12% of revenues in 2024, dropping to 11% and then 10% over the next three years (management mentioned plans to step up CAPEX investments to support growing AI needs which require considerably more computing resources) |

|

Discount rate % |

9% (based on cost of equity, but this depends on the individual investor) |

Their valuation looks a bit stretched on a conservative scenario but is potentially undervalued on a best-case scenario which could be as follows; Alphabet generated around $30 billion in Network ads in 2023, note that this is Google’s share after paying roughly over 60% in commissions to publishers. If Alphabet manages to shift around half of those customers and their ad spend towards Google Shopping, which will generate considerably higher revenues as the takings do not have to be split with content creators, Alphabet in a best-case scenario could generate an additional $30 billion in ad revenues (after factoring the loss of half of their Network ads business). Search ads and Shopping ads are likely to carry higher margins than Network ads as the former offers more value to advertisers in the form of better targeting as well as reaching an audience with buying intent, which means more competitive bidding, and hence is likely to be very margin accretive to Alphabet. If we take the same conservative assumptions above but tweak it to include an additional $30 billion in revenues from Google Shopping ads plus a slight bump up in net margins to 28% suggests Alphabet could generate over $130 billion in net profit. At this stage, Alphabet has only converted half of their network ad clients, and the company still offers tremendous growth potential from payments and other services related to being a growing force in the retail search ads space mentioned earlier and would likely deserve a higher earnings multiple. Applying a multiple of 30 (Microsoft currently trades at a forward P/E of 35) translates into a market value of $4 trillion.

Risks

Execution risks

Execution missteps around Gemini’s development could have a significantly negative impact on the company’s ability to adapt to changing search habits. While Gemini has a data advantage thanks to Alphabet’s ecosystem of products and services, ultimately much depends on what type of training data is fed into the platform, which can be heavily influenced by the biases and inclinations of the individuals responsible for training the chatbot.

Alphabet may also fail to deliver on Google Shopping’s potential, either due to management inefficiency or due to a range of stumbling blocks, such as legal obstacles.

Conclusion

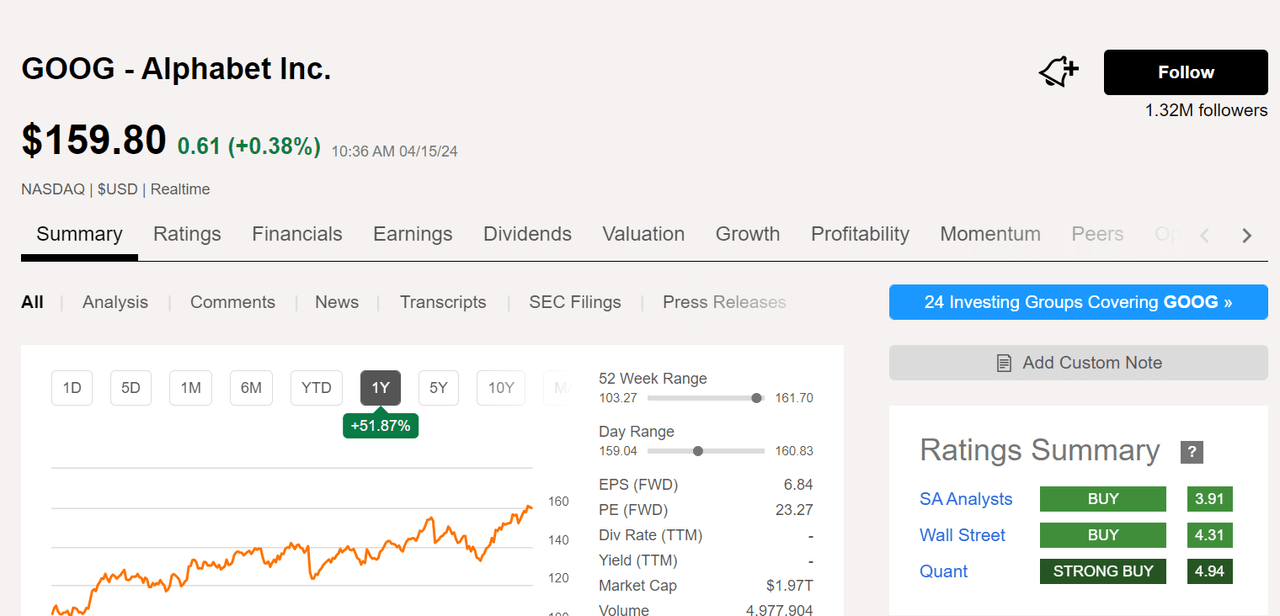

Alphabet has a buy analyst consensus rating.

Alphabet’s valuation looks a bit stretched based on conservative assumptions however Alphabet could deliver materially better returns with Google Shopping helped by a growing D2C trend worldwide, and Google Cloud driven by machine learning and AI, areas GCP is recognized to be the more competitive player compared to AWS and Azure, and whose growth potential is yet to fully materialize with the industry still at very early stages. Alphabet may be viewed as a buy for investors willing to tolerate the risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not a recommendation to buy or sell any stock mentioned. Please consult with a professional investment advisor prior to making any decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.