Summary:

- Since my last article, the company’s share price has fallen about 10% despite its quarterly revenue growth and achieving significant success in developing experimental drugs.

- In addition to growing sales of next-generation drugs such as Ngenla, Bosulif, Padcev, Oxbryta, and Abrysvo, the company’s dividend yield exceeds 6.5%.

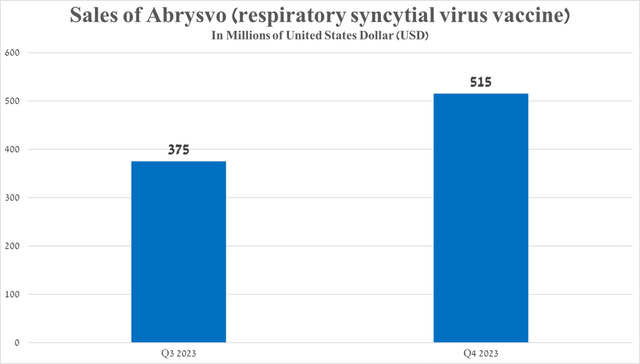

- So, sales of Abrysvo amounted to $515 million in the fourth quarter of 2023, an increase of 37.3% compared to the previous quarter.

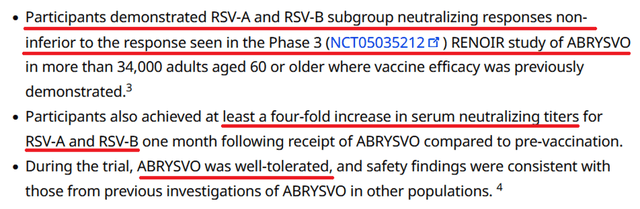

- On April 9, 2024, Pfizer announced positive results from a pivotal clinical trial evaluating Abrysvo’s efficacy against respiratory syncytial virus.

- Consequently, I am upgrading Pfizer’s rating from ‘Buy’ to ‘Strong Buy’.

PeopleImages

Pfizer (NYSE:PFE) is one of the largest pharmaceutical companies, dominating the global oncology and neurological disorder drugs markets.

Investment thesis

Since the publication of my last article on December 28, 2023, the company’s share price has declined by about 10% despite making significant progress in the development of its pipeline of experimental drugs, including the publication of positive results from phase 3 clinical trials.

So, on March 12, 2024, Pfizer announced that the Adcetris combination, being developed for the treatment of patients with relapsed/refractory diffuse large B-cell lymphoma, demonstrated a favorable safety profile and a statistically significant improvement in overall survival. Additionally, positive results were achieved across other endpoints, including overall response rate and progression-free survival, thereby increasing the likelihood of approval of the company’s product for the treatment of patients with high unmet needs.

In my assessment, the key contributors to Pfizer’s free cash flow growth will be innovative drug products such as Ngenla, Nurtec ODT/Vydura, Bosulif, Padcev, Oxbryta, and Abrysvo.

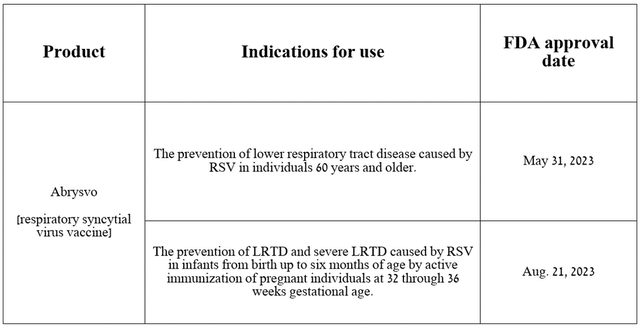

So, Abrysvo (respiratory syncytial virus vaccine) is a vaccine that received the first FDA approval on May 31, 2023, for the prevention of LRTD caused by respiratory syncytial virus. Just three months later, it was authorized to prevent lower respiratory tract disease in infants through active immunization of pregnant women.

Since Pfizer’s product consists of 2 recombinant stabilized RSV prefusion F proteins, its mechanism of action is complex. It is based on several aspects, the key of which is the stimulation of the production of neutralizing antibodies, as well as its ability to specifically target the pre-F form of the fusion protein (F protein), which ultimately leads to a significant reduction in the ability of the respiratory syncytial virus to penetrate cells, as well as reduces the risk of re-infection.

Source: table was made by Author on Pfizer press releases

Its total sales were $515 million in the fourth quarter of 2023, up 37.3% from the prior quarter, primarily due to its geographic expansion, increasing demand in the US even as competition from GSK’s Arexvy (GSK) increased.

Source: graph was made by Author based on 10-Q and 10-K

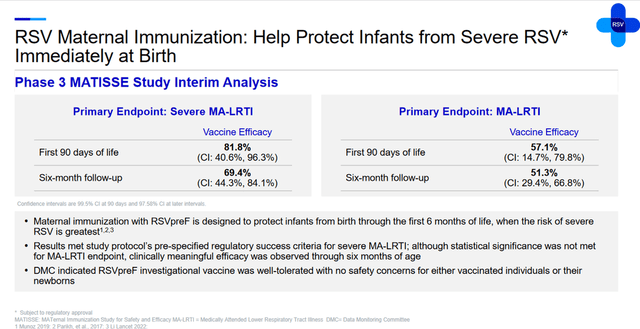

An additional factor that will continue to have a positive impact on Abrysvo sales in the long term is its favorable safety profile, as well as data from the Phase 3 clinical trial MATISSE, which demonstrated the vaccine’s high efficacy in protecting infants from severe lower respiratory tract infection.

Furthermore, the Phase 3 clinical trial RENOIR, which assessed the efficacy of Abrysvo against RSV among people aged 60 and older, also met its primary endpoints, demonstrating a statistically significant reduction in the risk of lower respiratory tract infections (LRTI) caused by respiratory syncytial virus. Also, vaccination with Pfizer’s product reduced the risk of RSV-LRTI requiring medical intervention.

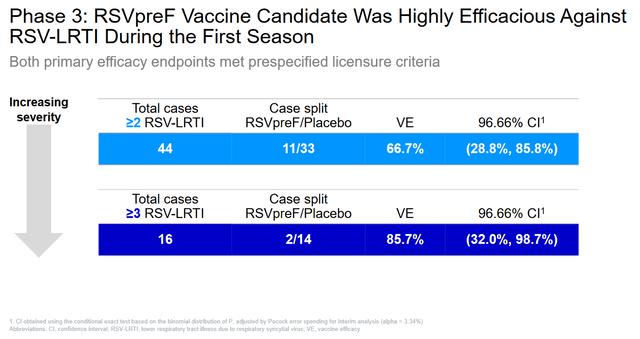

Additionally, on April 9, 2024, Pfizer announced results from an ongoing Phase 3 clinical trial evaluating the effectiveness of Abrysvo versus placebo in people aged 18 to 59 years at risk of developing RSV-associated lower respiratory tract infection. There are currently no FDA-approved vaccines to prevent RSV in people in this age group.

Given that this study met its primary endpoints and confirmed the favorable safety profile and the need for effective protection against this deadly virus, I believe there is a high likelihood that regulatory authorities will expand Abrysvo’s label as early as 2025.

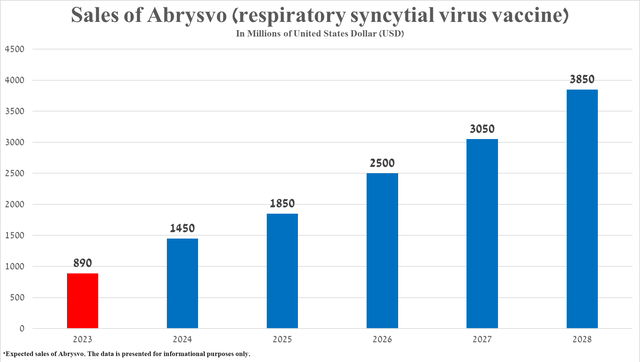

Based on Abrysvo’s historical sales growth rate, its expected geographic expansion, and recently published encouraging results confirming its competitive advantage in the fight against respiratory syncytial virus, I estimate that its total sales will reach $3.85 billion in 2028.

Source: graph was made by Author based on 10-K

Consequently, I am upgrading Pfizer’s rating from ‘Buy’ to ‘Strong Buy’.

Prospects for Pfizer’s business development in 2024

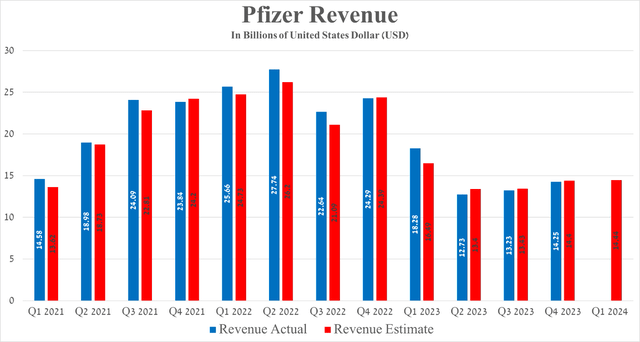

Pfizer’s revenue for the three months ended December 31, 2023, was $14.25 billion, continuing its positive trend since the second quarter of 2023 despite poor sales of its COVID-19 products, such as Paxlovid, which is approved to treat coronavirus disease, and Comirnaty, a vaccine developed jointly with BioNTech (BNTX).

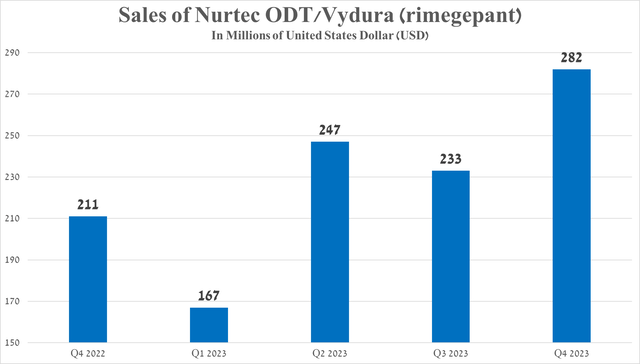

In addition to Abrysvo, Nurtec ODT (rimegepant), developed by Biohaven Pharmaceuticals and acquired by Pfizer in 2022, also continues to make a significant contribution to minimizing the financial risks associated with the loss of exclusivity of Inlyta and Xeljanz in 2025.

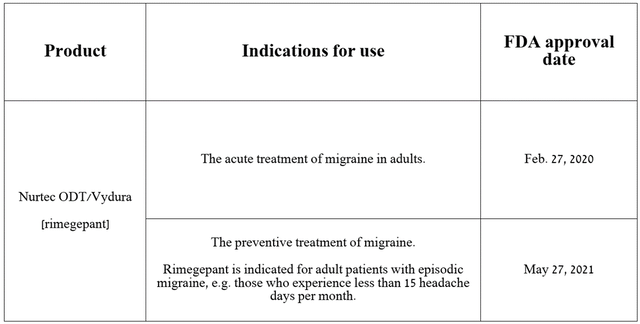

So, Nurtec ODT is a calcitonin gene-related peptide receptor antagonist that received FDA approval in late February 2020 for the treatment of migraine in adults.

Source: table was made by Author on Pfizer press releases

Its sales were $282 million in the fourth quarter of 2023, up 33.6% year over year, driven by continued strong demand in the U.S. and European Union and its competitive advantage relative to AbbVie’s Ubrelvy (ABBV) and Teva Pharmaceutical’s Ajovy (TEVA).

Source: graph was made by Author based on 10-Qs and 10-Ks

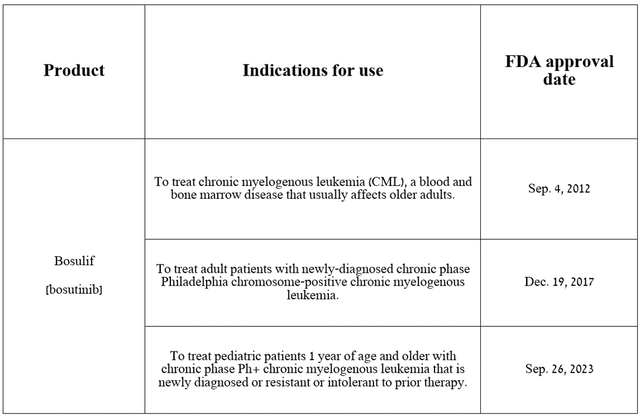

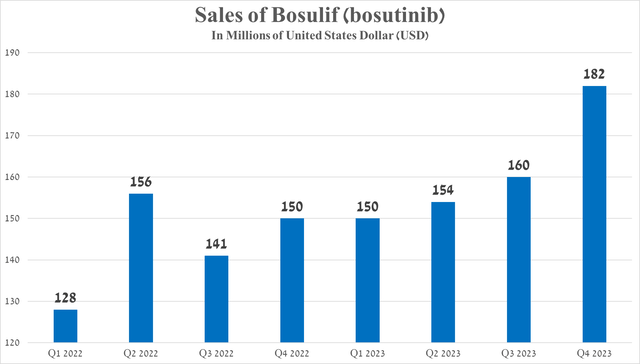

Also, I want to note that despite the prevalence of skepticism among institutional and retail investors regarding the company’s business prospects, one of the key contributors to the growth of its revenue and cash flow in the long term will be Bosulif (bosutinib), a tyrosine kinase inhibitor. It has been approved by regulatory authorities for the treatment of patients with chronic myelogenous leukemia.

Source: table was made by Author on Pfizer press releases

Its sales were $182 million for the three months ended December 31, 2023, up 21.3% year over year, primarily due to its FDA approval in late September of the previous year for the treatment of pediatric patients with chronic myelogenous leukemia. Chronic myelogenous leukemia (CML) is a type of blood cancer characterized by excessive production of white blood cells by the bone marrow.

Source: graph was made by Author based on 10-Qs and 10-Ks

Taking into account Seeking Alpha’s data, the company’s revenue for the first quarter of 2024 is projected to range from $12.8 billion to $16.46 billion, which is about 0.9% less than the previous quarter.

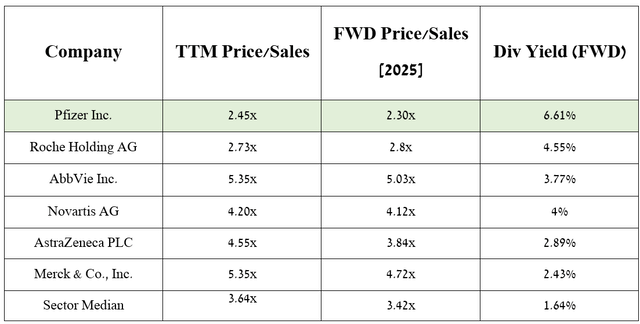

However, I want to note that on a larger scale, this financial metric is expected to continue to grow to around $62.58 billion in 2025, representing a P/S ratio of 2.3x. As a result, this suggests that Pfizer is trading at a discount to its key competitors in the global cancer therapeutics market, including Novartis (NVS), Merck (MRK), and AbbVie.

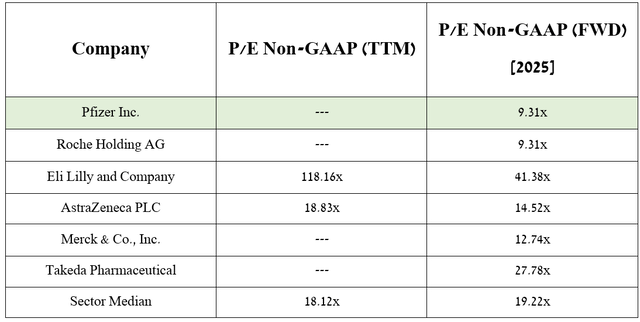

Source: table was made by Author based on Seeking Alpha

In addition to increasing sales of FDA-approved medications, I believe that aggressive development of next-generation product candidates will be a key factor that will not only improve the company’s financial position, but also contribute to the recovery of its stock price in the short term.

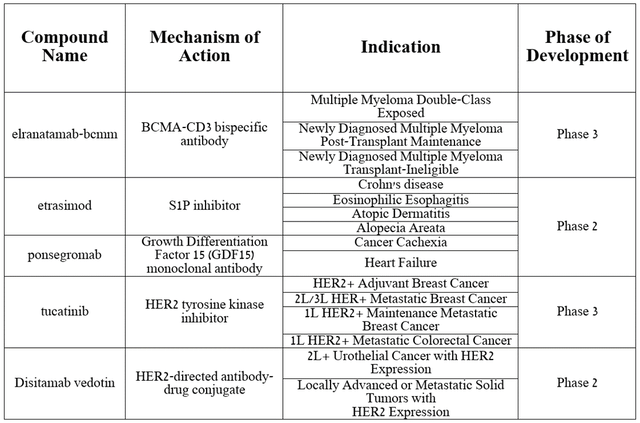

Among the rich portfolio of drugs, I highlight etrasimod, ponsegromab, elranatamab-bcmm, tucatinib, and disitamab vedotin, which demonstrate extremely high efficacy in the treatment of various types of cancer and inflammatory disorders.

Source: table was made by Author on Pfizer presentation

Risks

Before moving on to the conclusion, I would like to note the following financial risks that may affect the price of Pfizer shares in the medium term. These risks include the launch of generic versions of Xeljanz and Inlyta in 2025, whose sales accounted for about 4.9% of the company’s total revenue, continued weak sales of COVID-19 products through 2024, continued elevated consumer inflation in the United States, and increased geopolitical tensions in the Middle East.

Takeaway

Despite the pessimism prevailing on Wall Street regarding Pfizer, its management continues to make significant progress in minimizing the above-described risks to the company’s financial position. This progress includes the publication of encouraging results from numerous phase 2/3 clinical trials, as well as the FDA and EMA approval of its medications, many of which will significantly contribute to improving the company’s operating margin.

Source: table was made by Author based on Seeking Alpha

As a result, the company’s P/E Non-GAAP is expected to reach 9.31x in 2025, which, combined with its price-to-sales (P/S) ratio, indicates that Pfizer is an attractive asset for conservative investors looking for undervalued assets with extremely high dividend yields.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.