Summary:

- Rising oil prices due to OPEC+ policies and geopolitical issues are benefiting companies in the oil and gas industry, including Halliburton.

- Halliburton has seen impressive stock performance, outpacing the S&P 500, but further upside is warranted.

- The company’s recent financial performance has been positive, with revenue, profits, and cash flow improving year over year, and analysts have slightly bullish expectations for its upcoming earnings release.

zhengzaishuru

Because of restrictive policies being implemented by OPEC+, as well as geopolitical issues like those involving Russia and Ukraine, on top of Israel and Gaza, oil prices have been on the rise. It also helps on that front that demand continues to grow. And absent something significantly negative happening, that trend will likely continue. While this may bode poorly for your wallet, it most certainly is positive for many companies out there, particularly those engaged in oil and gas producing activities.

One firm in this market that focuses on providing products and services to the energy industry and that is bound to continue benefiting from strength in this market is none other than Halliburton (NYSE:HAL). With a market capitalization of $34.07 billion as of this writing, Halliburton is a large enterprise. Its reach is global and, in recent years, financial performance has been quite positive. Shares are also attractively priced. This is in spite of the fact that, over the past few months, performance achieved by the stock has been very impressive. You see, when I last wrote about the business in January of this year, I ultimately rated it a ‘buy’ because of how robust results had been and how cheap shares were. But since then, the stock has risen by 13.7%, far outpacing the 4.4% rise seen by the S&P 500 over the same window of time.

Strong upside that significantly outpaces the market can’t happen forever. But it can happen for a while. Based on how things stand today, I would argue that additional upside is likely on the table for the company. However, that picture can always change. If it were to change, the most likely time would be after an earnings release. And it just so happens that management is expected to announce results for the first quarter of the company’s 2024 fiscal year before the market opens on April 23. Leading up to that point, analysts seem to be slightly bullish. So I don’t think we will see any negative developments in the near term. But there are certain things investors should be paying attention to as those earnings near.

A look at Halliburton’s recent performance

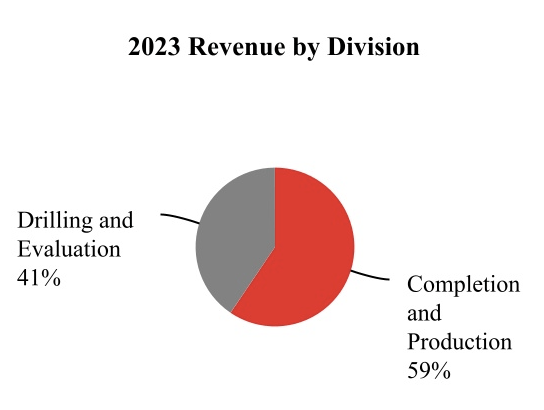

Operationally speaking, Halliburton is a large enterprise. It boasts over 48,000 employees spread across over 70 countries. While the company has many different facets, its operations can really be boiled down to two segments. The first of these is the Completion and Production segment, which helps to complete wells in the oil and gas space and get them producing. Activities here include cementing, providing completion tools like line hanger systems and sand control systems, providing chemicals and various services related to them, offering up pipeline and processing services, engaging in artificial lift services, and more. And the other segment is called Drilling and Evaluation. Its emphasis is on providing field and reservoir modeling, drilling, and other related services. It also provides certain fluids that make all of this possible. Some of its offerings even include software such as cloud based digital services and AI solutions, that theoretically should make the exploration and production market easier.

Halliburton

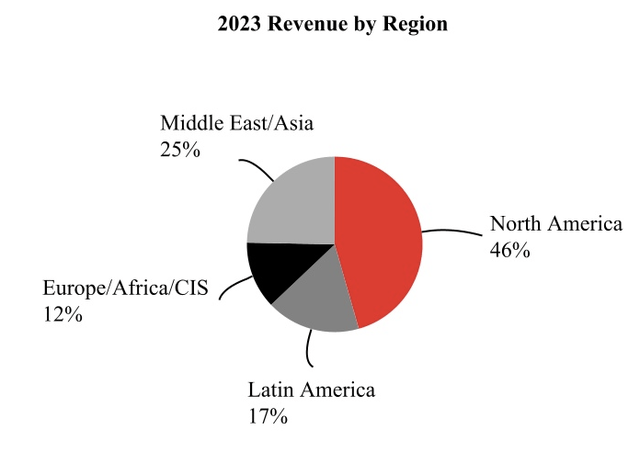

Using data from 2023, about 41% of the company’s revenue comes from its Drilling and Evaluation segment. The largest chunk, however, about 59% in all, comes from the Completion and Production segment. Geographically speaking, the firm is very much focused on the US market. North America as a whole accounts for about 46% of revenue. However, this is a global enterprise with a far reach. This has allowed it to build up an extensive list of clientele. As a result, about 25% of revenue comes from the Middle East while 17% comes from Latin America. The remaining 12% is split between places like Europe, Africa, and elsewhere.

Halliburton

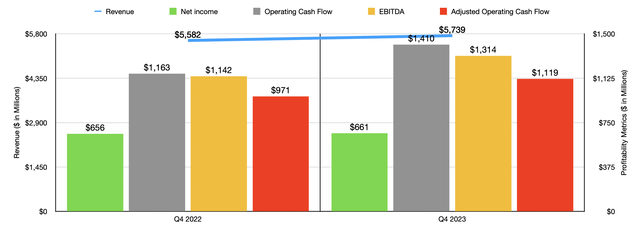

When I last wrote about the company, we had data covering through the third quarter of the 2023 fiscal year. Now that data extends through 4Q23. What that quarter showed was continued growth achieved by management. Revenue, for instance, totaled $5.74 billion. That’s up 2.8% compared to the $5.58 billion generated the same time of the 2022 fiscal year. This increase was in spite of the fact that Completion and Production revenue for the company dropped by about $170 million, or 5%, compared to what it was in the third quarter of the year.

Author – SEC EDGAR Data

Management attributed this weakness to reduced stimulation activity in the US land and Mexico markets, as well as lower artificial lift activity in the US land space. A decline in completion tool sales throughout Latin America also contributed to the pain. The real growth, then, came from the Drilling and Evaluation market. Revenue jumped by about $105 million, or 5%, compared to the prior quarter. Strong demand for software in the Middle East and Asia, as well as throughout Africa and Latin America, helped the company immensely. The company also benefited from higher fluid sales in various countries, including those in the western hemisphere and Africa. The picture would have been better had it not been for weather related reductions in drilling activity in Norway. But you can’t expect perfection everywhere.

Author – SEC EDGAR Data

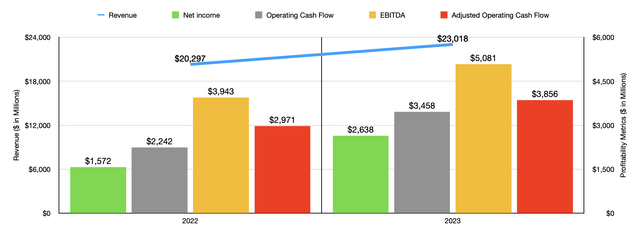

With revenue rising, profits followed suit. Net income inched up from $656 million to $661 million. Operating cash flow grew even more, jumping from $1.16 billion to $1.41 billion. If we adjust for changes in working capital, however, we do get a more modest increase from $971 million to $1.12 billion. And finally, EBITDA for the enterprise expanded from $1.14 billion to $1.31 billion. This robust quarter helped results for 2023 in its entirety. This much can be seen in the chart above. In it, you should notice that revenue, profits, and cash flow metrics, all improved for the company year over year.

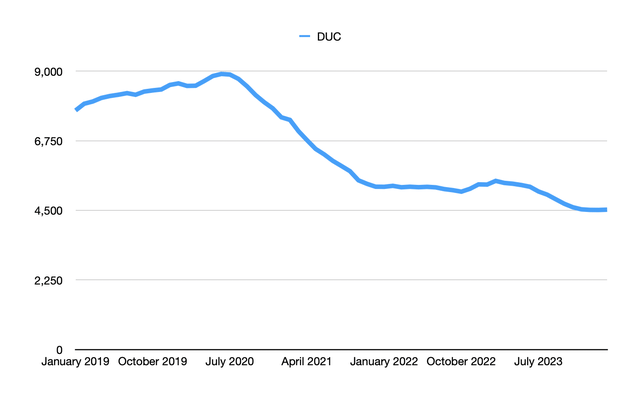

Author – EIA Data

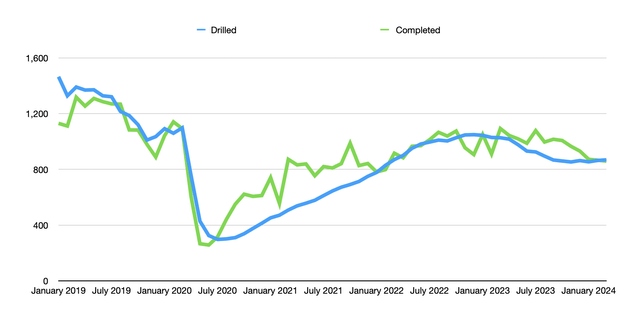

The fact of the matter is that Halliburton can and does benefit from increased oil and gas activities. As I covered in two articles recently, the first one here and the second one here, the bullish case for oil markets at least remains intact. It’s even possible that prices will rise from here. Most notably, we do seem to have a problem when it comes to DUC (drilled but uncompleted) wells. You see, the vast majority of the cost of establishing a productive well involves the drilling side of things. By comparison, completing the wells is fairly cheap. But ever since peaking back in 2020, the number of DUC wells has been on the decline. This has been because of an uptick in both drilling and completion activities. However, completion activities have outpaced drilling ones.

Author – EIA Data

At some point, this decline in DUC wells will have to result in additional drilling and completion. Obviously, the drilling has to come first. But regardless of that timeline, it’s clear that companies like Halliburton will benefit. Of course, after staging a strong recovery following the worst days of the COVID-19 pandemic, we did eventually see a decline in activity here at home. In March of this year, for instance, the number of drilled wells totaled 868. That’s down from the 1,027 reported one year earlier. And the number of completed wells managed to drop from 1,093 to 859 over the same window of time.

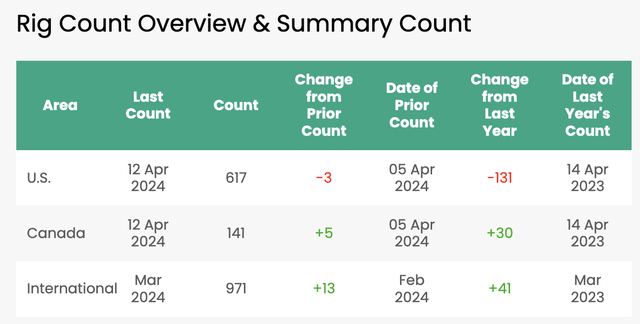

Baker Hughes

This weakness has also been reflected in the number of drilling rigs in operation. The most recent data provided by Baker Hughes (BKR) has the number, as of April 12th of this year, at 617. That’s down 131 from what was seen just one year earlier. But at some point, these numbers will increase. Meanwhile, in international markets, we are already seeing some nice increases when it comes to drilling rig activity. In the most recent data provided, the number of wells internationally hit 971. That’s up 13 from the prior month, and it’s up 41 from what it was one year earlier.

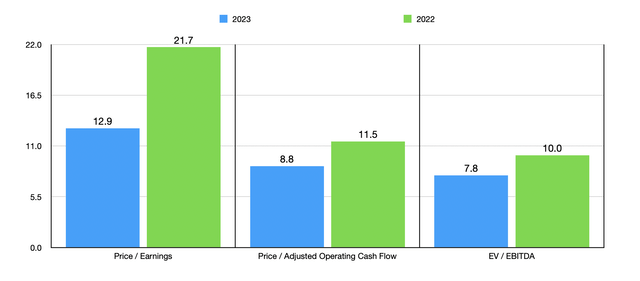

Author – SEC EDGAR Data

I would make the case that, even if activity does not pick up in this space, shares of Halliburton warrant upside. To see what I mean, we need only look at how shares are priced. In the chart above, you can see this using data from both 2022 and 2023. It’s wonderful to see a company trade in the mid to high single digits. I then compared Halliburton to five similar firms in the table below. On a price to earnings basis, two of the five were cheaper than it. But this number drops to one of the five when using the price to operating cash flow approach and the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Halliburton | 12.9 | 8.8 | 7.8 |

| Baker Hughes | 16.8 | 10.7 | 9.1 |

| Tenaris S.A. (TS) | 5.7 | 5.1 | 3.6 |

| NOV Inc. (NOV) | 7.5 | 52.3 | 8.5 |

| SLB Inc. (SLB) | 17.6 | 11.2 | 11.0 |

| ChampionX (CHX) | 23.3 | 13.6 | 10.3 |

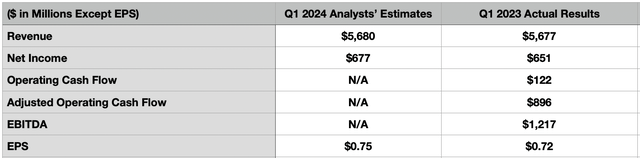

While shares are cheap at the moment, the picture can certainly evolve. And it just so happens that, before the market opens on April 23, management will be announcing financial results covering the first quarter of the 2024 fiscal year. Even though US drilling activity seems to be down year over year, analysts anticipate revenue coming in at about $5.68 billion. That’s virtually flat compared to what was seen the same time last year. Earnings per share, meanwhile, are expected to climb from $0.72 to $0.75. If this turns out to be correct, it would translate to an increase in net profits from $651 million to $676.5 million. In the table below, you can also see some other profitability metrics that investors should be paying attention to. If earnings do increase year over year, it wouldn’t be crazy to expect these to improve slightly as well.

Author – SEC EDGAR Data

Takeaway

Based on all the data provided, I continue to be amazed at how cheap shares of Halliburton remain. Yes, the stock has comfortably outperformed the broader market as of late. But the stock is still attractively priced, especially if we assume that current market conditions are reflective of what the next couple of years will look like. Shares are cheap on both an absolute basis and relative to similar firms. Analysts have slightly bullish expectations, though I wouldn’t be surprised if management exceeds these. Add all of this together, and I believe that the ‘buy’ rating I assigned the stock earlier this year is still appropriate.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!