Summary:

- Intel Corporation stock has fallen by over 30% and is oversold. Moreover, its excellent fundamental backdrop makes Intel a solid long-term investment opportunity.

- Intel’s AI potential is underestimated, and the company is well-positioned to capitalize on the expanding AI boom.

- Intel remains a global leader in CPUs, GPUs, and other advanced chip technologies, with vast potential in the enterprise segment and AI.

J Studios

While I was intermediate and long-term bullish in my previous Intel Corporation (NASDAQ:INTC) article, I had already sold my shares. Intel appreciated too quickly due to premature artificial intelligence, or AI, optimism. Nonetheless, the dynamic was more Intel-specific, as I held and continue to own considerable Advanced Micro Devices (AMD) and Nvidia (NVDA) stakes (11% of portfolio holdings).

Back To Our Intel Article

Let’s focus on Intel because after a 30% drop, the stock appears much more attractive here. Unfortunately, Intel has an image problem, but that doesn’t mean it’s not an excellent stock to buy and own long-term, especially at these depressed levels. Intel stock has dropped considerably since peaking around late last year, it is now significantly oversold technically, and, perhaps most importantly, its problems are transitory.

Moreover, Intel’s AI potential is probably significantly underestimated here, as the company is in an advantageous position to capitalize on the expanding AI industry’s boom. Intel remains a global leader in CPUs, GPUs, and other advanced chip technologies. It also has a massive R&D budget and has invested heavily in AI, forging significant research partnerships lately.

Additionally, Intel’s AI enterprise segment potential is vast, and it could take some market share from current leaders. Intel’s earnings have improved dramatically recently, and the trend of higher-than-anticipated EPS and revenues could persist as the company advances.

Intel is cheap on a forward sales and earnings basis and could produce much better EPS and revenue results than expected. Perhaps more importantly, there is a high probability that Intel will increase guidance (in my view), and this constructive fundamental dynamic could lead to multiple expansion and a much higher stock price in future years.

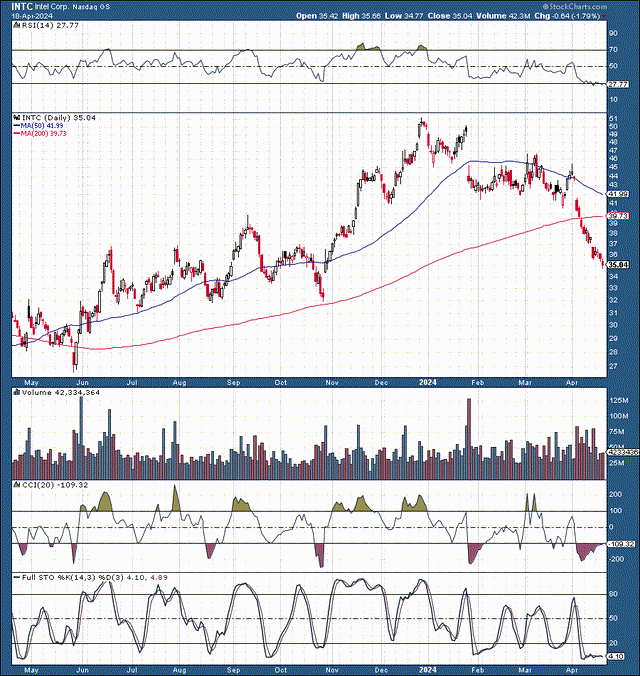

Technically – Intel Is A Strong Buy

Intel’s stock got ahead of itself late last year. There may have been too much near-term optimism regarding AI potential, not just in Intel but in AI-related stocks in general.

With its RSI below 30, Intel has become dramatically oversold. It’s also considerably below the 50 and 200-day moving averages, and the stock is back down to levels we saw nearly a year ago.

We see the CCI perking up, and the full stochastic could move above 20 soon, implying an improvement in Intel’s technical momentum. Also, Intel could go much higher due to its improving fundamental backdrop in the intermediate and long term.

Intel’s Greatly Underappreciated AI Potential

When we think of AI-related hardware, we often think of Nvidia, Advanced Micro Devices, and several other high-quality AI stocks. However, Intel usually gets left out of the conversation, and its stock price has suffered due to this unfortunate phenomenon.

Intel is a global chip juggernaut with an enormous R&D budget ($16B in 2023). In comparison, AMD spent around 1/3, $5.87B, on R&D last year. At the same time, Nvidia’s R&D was about $8.67B last year. In recent years, Intel has focused increasingly on designing, developing, expanding, and deploying its AI capabilities, and the fruits of the company’s labor could pay off soon.

One of Intel’s approaches is to amplify human potential through AI. Much of Intel’s AI emphasis is in healthcare, which could be the most lucrative area for tech companies and AI. Intel’s most crucial AI research areas include cognitive AI, graph neural networks, human-AI collaboration, natural language processing, probabilistic computing, responsible AI, and more.

Moreover, Intel is involved in various global research AI initiatives. Intel Labs collaborates with top academic institutions, government agencies, and industry leaders globally to advance AI research. This dynamic should also create considerable sales growth opportunities for Intel in future years.

There Is Room For Many Players In AI

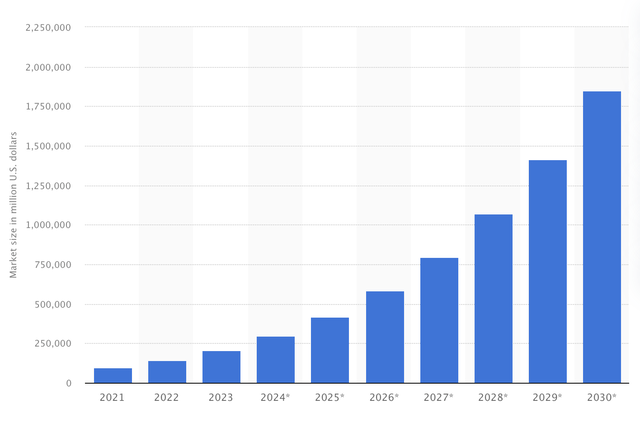

AI market projections (statista.com )

When discussing AI, we often hear about Nvidia, Broadcom (AVGO), AMD, and other chip, software, and services companies. However, Intel frequently gets overlooked. We should put things in perspective because we are still very early in the AI ballgame, and there is plenty of room for many market leaders to expand.

This year, AI-related revenues are expected to be about $300B. Yet, the AI market is expected to expand dramatically, with revenues estimated at $1.85 trillion by 2030. Intel has invested considerably in AI, has partnered with some of the most capable and brightest organizations globally, remains a global leader in GPU, CPU, and other technologies, and could capitalize substantially during the coming AI boom cycle.

Intel Remains The Global GPU Leader

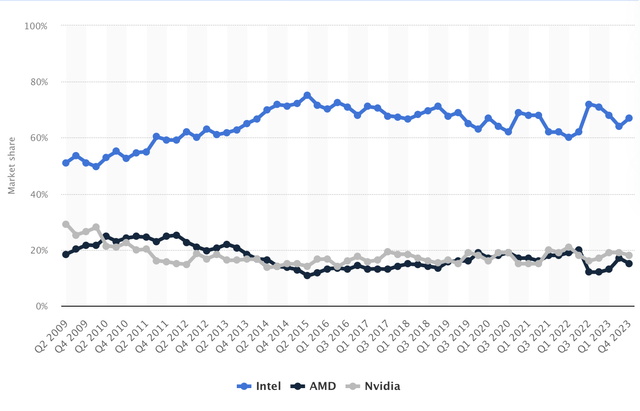

GPU share (Statista – The Statistics Portal )

Say what you want about AMD and Nvidia, but Intel is the global GPU leader, with about a 68% share of the worldwide PC market. Of course, Intel’s leading position is due to its dominance in the integrated GPU market, but Intel is also making a run at the lucrative discrete GPU market.

Intel entered the discrete GPU market in late 2022 and is attempting to disrupt the segment’s Nvidia/AMD duopoly. While Intel’s rollout has been bumpy, it’s established a foothold in the budget (lower-end market).

However, Intel’s “Battlemage” next-gen GPUs, which should come out later this year (H2), are aimed at the mid to higher-end GPU market. While Intel is only preparing to go head-to-head with the high-end performance GPUs from AMD and Nvidia, it’s moving in the right direction and also could capture more market share in the lower and mid-end discrete GPU space.

Unprecedented Long-Term GPU Potential

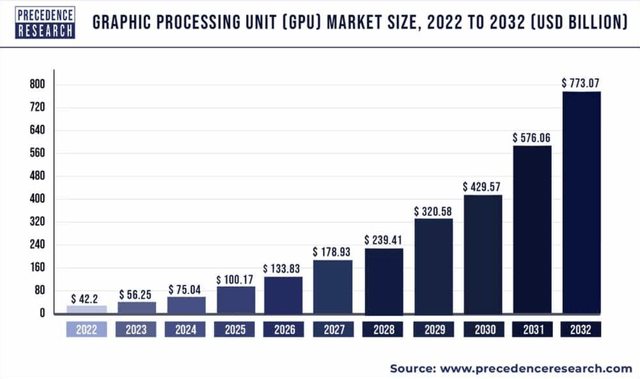

GPU growth projections (Precedence Research – Market Research Reports and Consulting Firm)

Due to continued advancements in AI, gaming, and other areas, GPU sales should skyrocket in future years. Sales are expected to surge from around $75B this year to over $770B in 2032. This dynamic illustrates the potential for a tenfold increase in the next ten years. The GPU market is massive, and its expansion should benefit Intel, not only Nvidia and AMD.

Intel – Still The CPU King

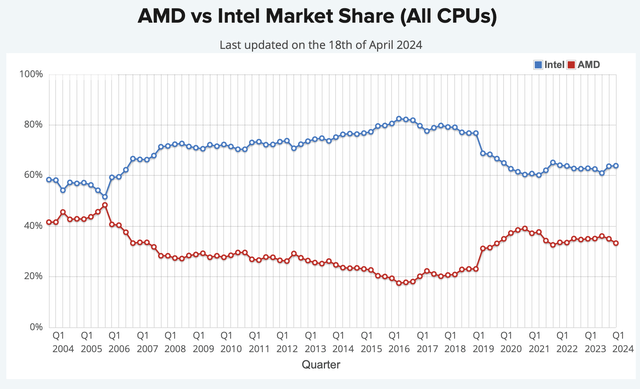

Intel vs. AMD (cpubenchmark.com)

The CPU market remains essentially a duopoly, and despite AMD’s advances, Intel remains the undisputed global leader in this space. While Intel’s market share is around 64% in the “all CPUs” market, it enjoys about a 74% market share in the lucrative laptop CPU space. Moreover, Intel’s server CPU lead is massive, trending at around 90%.

Intel Could Be Much Cheaper Than It Seems

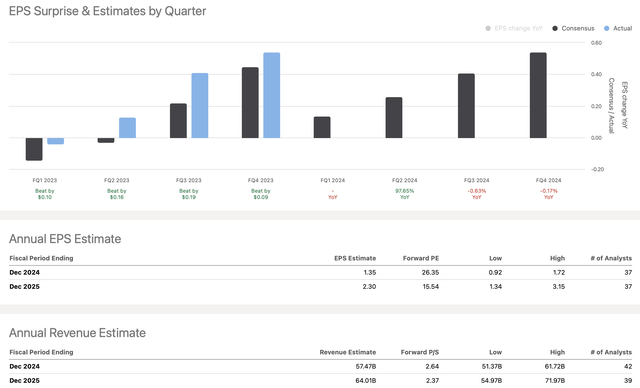

EPS beating estimates (Stock Market Analysis & Tools for Investors )

Intel has surpassed its recent EPS estimates by a wide margin, suggesting it is doing much better than analysts expect. Moreover, this positive earnings trend should continue, and Intel has a high probability of surpassing future EPS and sales expectations.

Consensus TTM EPS estimates were only $0.50. Instead, Intel beat in every one of its last four quarters, delivering $1.04 in EPS, a beat rate of over 100%. This year’s consensus EPS estimates are $1.35 and only $2.30 in 2025. These estimates appear highly depressed, and Intel could do much better.

If we apply a modest 25% beat rate this year, Intel could achieve an EPS of around $1.75. Also, consensus estimates imply a 70% EPS growth rate in 2025. If we apply a similar growth rate to our $1.75 2024 EPS estimate, Intel could earn about $3 next year instead of the consensus of $2.30. Additionally, higher-end estimates go above $3, to roughly $3.10-3.15 for 2025.

Intel is a $35 stock here. If it achieves an EPS of around $3 next year, its forward P/E ratio could be below 12. This valuation is very cheap for a company in Intel’s position, which will likely experience substantial revenue and EPS growth in the years ahead.

Even By Wall St.’s Standards, Intel Appears Undervalued

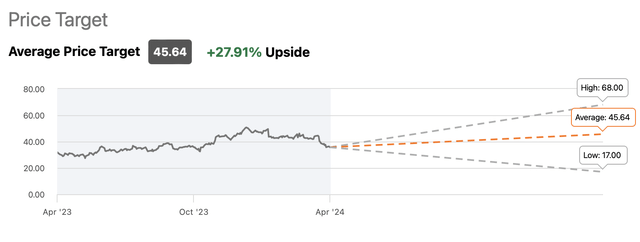

Price target (Stock Market Analysis & Tools for Investors )

The average price target on the street is only about $46, suggesting over 30% upside potential in the next year. Moreover, higher-end targets go up to nearly $70, implying the potential for a 100% upside in the next twelve months. While $70 may appear aggressive, there is a high probability that Intel could be around $55-65 by the end of 2024 (in my view).

Where Intel’s stock price could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $61 | $71 | $80 | $89 | $100 | $111 | $120 |

| Revenue growth | 13% | 16% | 13% | 12% | 11% | 10% | 9% |

| EPS | $1.75 | $3 | $3.80 | $4.65 | $5.56 | $6.56 | $7.74 |

| EPS growth | 66% | 70% | 27% | 22% | 20% | 18% | 16% |

| Forward P/E | 20 | 22 | 24 | 25 | 24 | 23 | 22 |

| Stock price | $60 | $84 | $112 | $140 | $158 | $178 | $200 |

Source: The Financial Prophet.

Intel’s stock price could go much higher due to modest revenue growth, minor improvements in efficiency and profitability, and modest multiple expansion. Like Microsoft (MSFT) and many other mature companies, Intel went through a challenging long-term stagnant phase. AI provides an ideal catalyst for Intel to increase revenues and improve profits, making it a top stock to hold over the next 5–10 years. This dynamic could drive Intel’s stock price to $200 by 2030 or sooner.

Note: I’ve upgraded longer-term price targets for Intel since my last projections.

Risks to Intel

Intel may be the most significant risk to Intel. Intel’s management has been “questionable” at times. Also, technology-wise, Intel has recently allowed AMD and Nvidia to pull ahead. Therefore, Intel faces the consistent threat of competition. Management could also prove challenging to deal with. Intel may grow sales slower than estimated, and its profitability could be less impressive than my projections predict. The company also needs to execute well and avoid future setbacks. Investors should consider these and other risks before investing in Intel.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio, and I plan to initiate a position in Intel in the coming days.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!