Summary:

- Netflix stock fell nearly 15% from recent highs, entering correction territory.

- Investors are perturbed about Netflix’s decision to stop reporting quarterly membership metrics.

- Netflix’s scale and dominance in streaming position it for continued growth against its legacy peers.

- My two previous bullish calls on NFLX have panned out spectacularly.

- While NFLX’s thesis deserves caution now, there’s no need to react adversely and turn bearish.

Giuliano Benzin

Late Netflix, Inc. (NASDAQ:NFLX) investors have been stunned into submission this week as the stock fell nearly 15% from its recent highs, entering well into correction territory. As a result, NFLX failed to conquer its 2021 highs at the $700 level before sellers sent it tumbling following Netflix’s robust first-quarter earnings release.

Netflix delivered a solid scorecard that surpassed analysts’ estimates. However, investors have thrown the towel in growth stocks, as seen with the weekly decline in the Nasdaq (QQQ) (NDX), which digested nearly three months of gains. Therefore, I assessed shorter-term momentum investors likely saw their stop-losses taken out in successive selling waves, worsening the downside volatility in growth stocks like NFLX.

Even though Netflix posted a solid report with robust paid net adds totaling 9.33M in the first quarter, investors are looking ahead. Make no mistake: The market is a forward-discounting mechanism as it reassesses Netflix’s decision to drop the ball on investor disclosure.

Observant investors should recall that Netflix management decided to stop reporting quarterly membership metrics from 2025 as Netflix believes that its business model has evolved beyond just membership reporting for accurate business forecasting. As a result, the company underscored its belief that attributing projections through “a direct correlation between the number of members and revenue is becoming increasingly inaccurate.” As a result, the company will transit to guiding revenue and key earnings metrics moving ahead, which is believed to align with its growth vectors in ad-supported streaming and multiple paid membership tiers.

Bearish investors would likely have you think that Netflix’s decision to stop reporting quarterly membership numbers represents a significant inflection in Netflix’s growth thesis. As a reminder, I’ve maintained my bullish stance on NFLX, first upgrading NFLX to a Buy in July 2022, when it first bottomed out. Notwithstanding the significant decline over the past two weeks, the rating has still been up more than 200% since then. I followed up with a timely update in July 2023, urging Netflix investors to maintain their faith in the streaming leader. NFLX has continued outperforming since then, notwithstanding the correction, beating the S&P 500 (SPX) (SPY) hands down.

While I believe the market better appreciates more investor disclosure than less disclosure, it doesn’t necessarily spell the end of Netflix’s growth potential. The market seems to have indicated its displeasure with the steep pullback, as some earlier dip-buyers likely capitalized on the opportunity to cash in on significant gains. As a result, I wouldn’t be unduly concerned with near-term volatility to assess the robustness of Netflix’s ability to drive operating leverage gains. In addition, the company’s ex-US growth potential is still in the early stages as Netflix continues to scale its content slate.

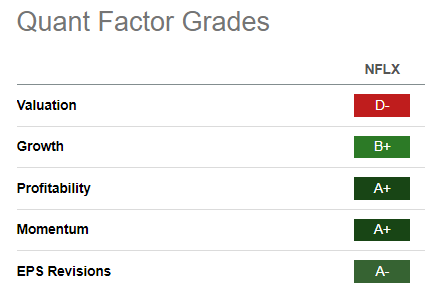

NFLX Quant Grades (Seeking Alpha)

NFLX boasts a best-in-class “A+” profitability grade relative to its communications sector peers. With a robust “B+” growth grade and excellent execution (“A-” earnings revisions grade), I believe NFLX has proved itself with its market outperformance over the past two years.

Netflix is still expected to scale its adjusted operating margins, reaching 28% in 2026 from just 20.6% last year. While Netflix management guided slower revenue growth of between 13% and 15% for the entire year, Netflix’s free cash flow is expected to remain robust and continue improving, in line with its margin expansion.

With a well-established global content slate and scale, Netflix’s leadership position in the streaming space has allowed it to generate solid FCF profitability that its legacy media peers struggle to replicate. As Netflix continues to reinvest its gains and scale its membership base, it should entrench its first-mover advantage further, as its legacy peers face daunting transition challenges from traditional networks. Furthermore, Netflix’s gains in ad-supported streaming have justified that it’s aggressively pursuing growth in a new growth vector, as the company reported a 65% QoQ growth in ads membership. Hence, I believe the bearish commentary on NFLX that its growth days are over is seemingly premature.

Despite that, I agree that justifying a premium valuation multiple (“D-” valuation grade) as it restructures its reporting framework could be challenging in the near term. NFLX is valued at a forward adjusted earnings multiple of nearly 30x, suggesting significant optimism. While it’s below its 5Y average of 47x, NFLX is no longer a high-growth stock that deserves a high-growth premium. Its “B+” growth grade supports my thesis, as investors move toward assessing NFLX as a profitable growth stock with more reasonable valuation multiples as growth is expected to slow. The company’s decision to move beyond reporting membership growth metrics suggest Netflix will likely focus more on its ability to generate operating leverage and FCF growth than membership growth.

However, investors should be careful when equating caution with a bearish thesis. While I assessed that Netflix investors must be cautious about adding more shares now, they can still consider holding on to NFLX as a core position.

Is NFLX Stock A Buy, Sell, Or Hold?

Netflix has demonstrated its execution ability, even as the media and entertainment industry struggles to transition from legacy networks to streaming. The lack of legacy baggage has provided the market with a more straightforward view of assessing Netflix’s valuation than trying to value declining traditional networks.

Netflix’s decision to stop reporting quarterly membership metrics has likely confused some investors, who require more disclosure. It could impact the market’s ability to forecast more accurately, potentially leading to higher execution risks. However, Netflix management has also committed to providing critical revenue and earnings outlook metrics to guide investor estimates and assure investors.

Netflix’s scale and dominance in streaming have proven itself over time. Its ability to continue investing while driving operating leverage is highly challenging to replicate. In a higher-for-longer environment, we could see increased reticence from legacy players to burn more money to justify competing with Netflix, providing a more constructive runway for Netflix to continue extending its leadership.

However, NFLX’s valuation suggests caution is necessary at the current levels. While I’ve confidence in its long-term thesis, the recent market correction has also provided opportunities to add exposure to other growth and tech stocks that have succumbed to the recent selloff. Netflix investors should consider holding a core position in NFLX while reallocating some gains to other opportunities.

My assessment suggests NFLX’s near-term volatility could bring it down further toward the $460 zone if the pullback continues in earnest. Buyers haven’t returned to support the $550 level, which suggests near-term volatility could persist. However, it’s still too early to determine whether a further move toward the $460 zone could actualize, and much will likely depend on how the price action pans out over the next two to four weeks as we reassess buying support at the current levels. Therefore, I determined a Hold rating as appropriate for now.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!