Summary:

- Meta Platforms is expected to show a sharp jump in advertising revenue in its upcoming quarterly report, bringing total revenues likely to $36-37 billion.

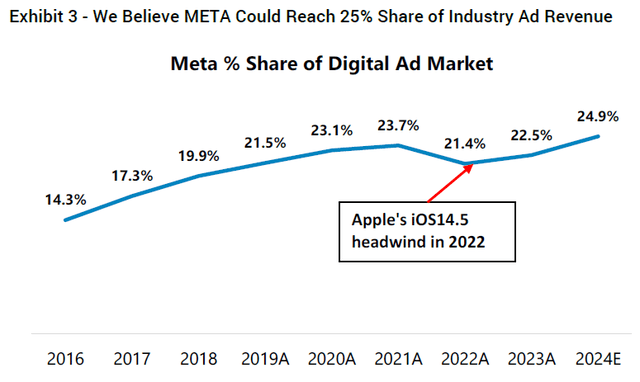

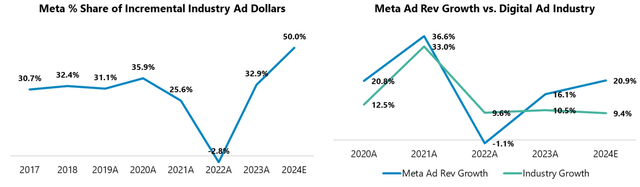

- The company is gaining market share in the digital ad market and is expected to capture 50% of the incremental digital ads revenue in 2024.

- On engagement, Meta is seeing solid user numbers and daily hours spent on the app.

- I expect Meta management to talk up the company’s GenAI ambitions, potentially boosting investor sentiment through the earnings call with analysts.

- On valuation, Meta is trading at a reasonable 19x (FWD) EV/EBIT, which is notably below the valuation levels seen in other AI juggernauts such as Microsoft and Nvidia.

Derick Hudson

Meta Platforms (NASDAQ:META) is set to open books for the company’s March quarter 2024 on April 24th, after the market closes, and I am bullish heading into earnings. In my view, Meta Platforms upcoming quarterly report is poised to show a sharp jump in advertising revenue, as various alternative data tracked by leading investment banks highlights both expanding advertising wallets, as well as market share gains for Meta within these wallet. At the same time, download trackers and survey suggest that Meta’s Instagram platform is seeing solid growth and engagement expansion. Lastly, I expect Meta management to talk up momentum in building and integrating GenAI capabilities across the social media empire, which may drive a fresh commercial growth cycle over the next few years. On the backdrop of a favorable risk/reward skew, paired with strong commercial momentum Q1 results, I am upgrading Meta shares to “Buy” and set a $600/ share target price (~25x EV/EBIT multiple, in line with valuation levels of other leading AI players such as Microsoft (28x EV/EBIT) and Nvidia (25x EV/EBIT).

For context: Meta stock has strongly outperformed the broader U.S. stock market, YTD. Since the start of the year, META shares are up approximately 36%, compared to a gain of about 4% for the S&P 500 (SP500).

Strong Advertising Momentum To Drive Topline Growth

I expect Meta’s Q1 2024 revenue to come in at the higher end of the company’s guidance of $34.5-37 billion, as strong advertising momentum appears to be exceptionally strong going into 2024. Having spoken to seven market participants with discretionary spending power over advertising budgets (mostly SME businesses), I estimate that YoY advertising spent on a macro level in Q1 2024 may be up 10-15%. And within this supportive backdrop, Meta is gaining share: According to a Jefferies research report, in 2024 Meta is expected to capture a 25% share of the digital ad market, and a breathtaking 50% share of incremental industry advertising dollars, significantly up from 33% in 2023. On that note, it is worth highlighting that Meta has demonstrated rapid recovery and growth following the initial impact of the iOS14.5 privacy changes, outgrowing its competitors for five consecutive quarters (Source: Jefferies research note dated April 4, 2024: Rising Above Ad Peers with a Mega Moat).

This market share growth should be driven by Meta’s leading advertising technology, driving ad effectiveness and customer ROI. On that note, Meta’s investments in 2023, amounting to approximately $27 billion in capital expenditures, and $36.5 billion of R&D expenses, have likely significantly strengthened the company’s technological prowess, particularly through the development of advanced AI-driven ad tools (e.g., Advantage+). As suggested by Q4 2023 commentary:

And then, of course, we’re investing a lot in AI-powered tools and products. So we’re really scaling our Advantage+ suites across all of the different offerings there, which really helped to automate the ads creation process for different types of advertisers. And we’re getting very strong feedback on all of those different features, Advantage+ Shopping, obviously, being the first, but Advantage+ Catalog, Advantage+ Creative, Advantage+ Audiences, et cetera. So we feel like these are all really important parts of what has continued to grow improvements in our Ads business and will continue to going forward.

Engagement Across Platforms Looks Strong

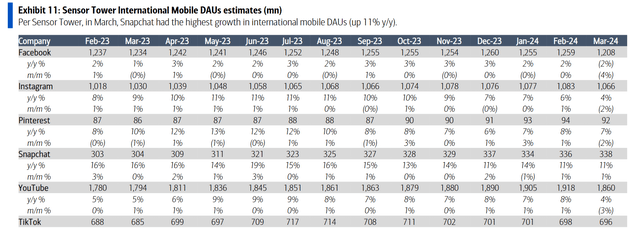

As a social media company, engagement metrics continue to be an important driver for Meta’s equity story. In that context, I am encouraged to note that download trackers and surveys suggest solid growth and increased engagement on Meta’s social media empire. According to fata collected by Bank of America, Instagram has likely seen a 6% YoY growth in users, to 1.1 billion DAU, while users for Facebook remained flattish at an elevated 1.25 billion DAU. (Source: BoFA research note dated 9th April: March Social Media Time Spent, User, Download and ARPU benchmarking).

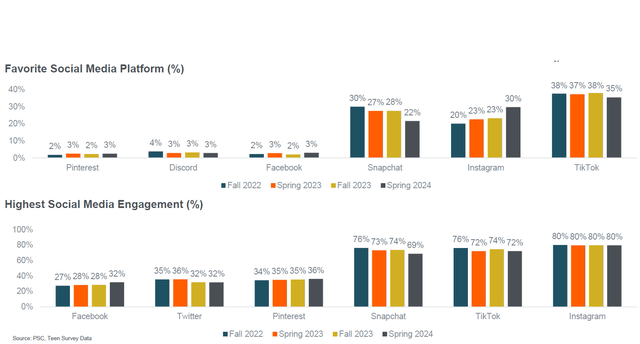

Moreover, Meta continues to see strong user engagement, likely to a considerable degree as a function of the AI recommendation engine and the introduction of Reels on Instagram. In the recent fall survey conducted by the Piper Sandler Research Team around 6,000 U.S. teens across 47 states were polled about their social media preferences. In that context, on a macro level, it is encouraging to learn that the average daily hours spent on social media rose slightly to approximately 4.7 hours, up about 0.3 hours from the 4.4 hours one year earlier. Within the social media landscape, Instagram has climbed to the second position as the favorite app among teens with approximately 30% of respondents voting for the app, up 700 basis point YoY (versus TikTok at 35% but down 300 basis points). Moreover, it is worth pointing out that Instagram has been highlighted as the most-used app with about 80% monthly usage, while competitor TikTok, although still in second place at 74%, saw a decline of about 200 basis points from the fall of 2023. Meanwhile, competitor BeReal’s usage has continued to decline from its peak in the fall of 2022 (Source: Piper Sandler research note dated April 9th: Teen Survey: Insta Big Jump, Snap to #3 Favorite, PINS / RBLX (+), TT Shops (+)).

Cavenagh Research Earnings Estimates

I have already pointed out that I expect Meta to report at the higher end of the company’s guidance of $34.5-37 billion. In my opinion, and anchored on my confidence in the strength of the digital advertising market, $36-37 billion should be reasonable, compared to $36.2 billion estimated by consensus. On costs, I expect Meta to remain disciplined, likely trending in line with Q4 expenses of approximately $23.5 billion. Accordingly, I estimate operating income to be around $12.5-13.5 billion, in line with consensus at around ($13.2 billion). Capital distributions to shareholders will be another key metric to watch in Q1; however, I don’t expect commentary around Meta’s distribution policy to be a key driver for the share price, especially following the Q4 announcement of a dividend. Still, it will be important for investors to learn how Mark Zuckerberg & Co. are balancing CAPEX requirements for GenAI development/ adoption with distributing cash to shareholders. Lastly, I expect lots of analyst discussion around Meta’s recent Llama 3 release, which has been termed by the company as the “most capable openly available LLM to date”. Given that the model is open-source and free, analysts and investors will be eager to learn how Meta is planning to leverage its AI capability for revenue generation or cost discipline.

Investor Takeaway

I am optimistic about Meta Platforms stock as we approach the company’s Q1 earnings report, believing that the market has not fully recognized the strength in advertising momentum and Instagram/ Facebook engagement. Moreover, I expect Meta management to talk up the company’s GenAI ambitions, potentially boosting investor sentiment through the earnings call with analysts. On valuation, Meta is trading at a reasonable 19x (FWD) EV/EBIT, which is comparable with multiples for Google (GOOG) and Apple (AAPL), but likely below fair Meta’s fair value. In my opinion, a ~25x EV/EBIT multiple, in line with valuation levels of other leading AI players such as Microsoft (28x EV/EBIT) and Nvidia (25x EV/EBIT) should be reasonable, suggesting a share price of >$600. Concluding, I expect Meta shares to pop on strong earnings; and as a short term options play in line with my thesis, I am considering building a position in META stock and acquiring time-sensitive call options as a tactical move. For investors looking to capitalize on similar expectations, I recommend exploring call spreads at 105/115% moneyness, expiring on May 3rd. These options could yield a 4:1 return if Meta’s stock reaches $550 by the expiration date.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.