Summary:

- Nvidia’s revenue and profitability growth are expected to continue in the medium to long term, driven by data center dominance, parallel computing, and AI and ML applications.

- The company’s R&D spending is increasing, supporting its product pipeline and ensuring its competitiveness in the AI hardware space.

- Nvidia’s operational efficiency, pricing power, and valuable human capital contribute to its strong fundamentals and long-term growth potential.

Antonio Bordunovi

Any discussion on NVIDIA Corp. (NASDAQ:NVDA) is incomplete without discussing data center dominance, parallel computing, and, of course, AI and ML. However, rather than dwell on the obvious, I decided to look deep into the company’s fundamentals to see if the kind of stellar revenue and profitability growth currently driving its stock will hold up in the medium to long term. I’ll touch on some of the essentials, of course, but much of that has been discussed to death, and the market now seems a little more divided on the name. The question for now is, “Will NVDA resume its skyrocketing gains once Q1-25 results are out next month, and can this kind of growth be sustained in the long run?” The simple spoiler answer, in my opinion, is yes to both parts of this question. This article will hopefully demonstrate why I think that is.

The Stuff We Know, and My Thesis

Nvidia’s rise as one of the fastest-growing stocks on the market began in late 2022 when generative AI first became a buzzword. Without the launch of ChatGPT at the end of November 2022, and then a slew of other LLMs and gen AI products flooding the landscape, this story may not have played out the way it has. Sure, one could argue that it was Nvidia that first introduced the GPU in 1999 and the crucial CUDA model in 2006 that allowed parallel processing at levels needed by LLMs and AI applications, but I think the global tectonic shift to AI was incited by ChatGPT and OpenAI more than anything else. And, of course, data center revenue growth has undeniably been the primary driver for the stock since then, and nothing has changed on that front.

In many ways, the rise of NVDA as the leader of the Magnificent 7, as they are now known, is inextricably linked to the growth of data center footprints around the world. Indeed, analysts at Wells Fargo Equity Research have NVDA’s market share of data center GPUs at 98% at last count.

Aside from data center compute dominance, Nvidia is also an unstoppable force in high-performance networking, with a software stack that complements a robust offering of hardware components such as switches, data processing units or DPUs, etc.

Together, these offerings have driven revenue growth of over 200% in FY-24 for the segment and are directly responsible for where the stock trades at today.

That said, this is the side of Nvidia that most investors are well aware of – quarterly revenues growing from $6 billion in the final quarter of FY-23 to over $22 billion in Q4-24, gross margins rising from just over 63% to nearly 76%, ops margins tripling from 20% to +60%, and net income margins more than doubling from 23% to 55%, all over the same one-year period. It’s no wonder that the stock gained 200% in that time. This kind of growth excites the market to no end, but then fear takes over, and multiple factors collude to create a corrective phase for the stock. I think that’s what’s going on right now.

The main driver of my bullish thesis, however, is not that Nvidia will post consensus-beating numbers yet again come Q1-25, but that it is underpinned by some truly excellent fundamentals, even when compared to its other Mag 7 siblings. Well, Tesla (TSLA) and Apple (AAPL) aren’t in my sights at the moment, but in an overall comp showcase, this AI enabler has some of the most impressive metrics for a company that’s growing this fast.

What I Like About Nvidia Moving Forward (And Some Stuff Not Every Investor Tracks)

I can’t start with the launch of the H200 Tensor Core GPU in Q2, naturally. This is by far the most important catalyst for NVDA stock in the near term. The Hopper architecture-based GPU will be powered by Micron’s HBM3E modules and is expected to deliver 40% higher bandwidth for memory compared to the older H100 GPU. The modules will first ship alongside the H200, which is, as Nvidia claims, “the first GPU to offer 141 gigabytes (GB) of HBM3e memory at 4.8 terabytes per second (TB/s).”

Tech investors are understandably excited by the upcoming launch, and in my opinion, that’s the only thing holding back the stock right now; that, and, of course, a macro environment that’s not completely conducive to further expansion of the overall market. Much of the market’s momentum was NVDA-driven, understandably, which is why it’s also apparent why the market and NVDA are taking a bit of a breather before the next bull run. And there will definitely be one, in my opinion, and a lot of that burden actually falls on NVDA as the biggest mover over the past year.

Before I digress too much, let’s get into the nuts and bolts of why I think NVDA is a solid long-term investment if you’re looking to have your portfolio exploit the growth of AI applications and their supporting platforms, architectures, and other components.

#1: NVDA’s R&D Profile

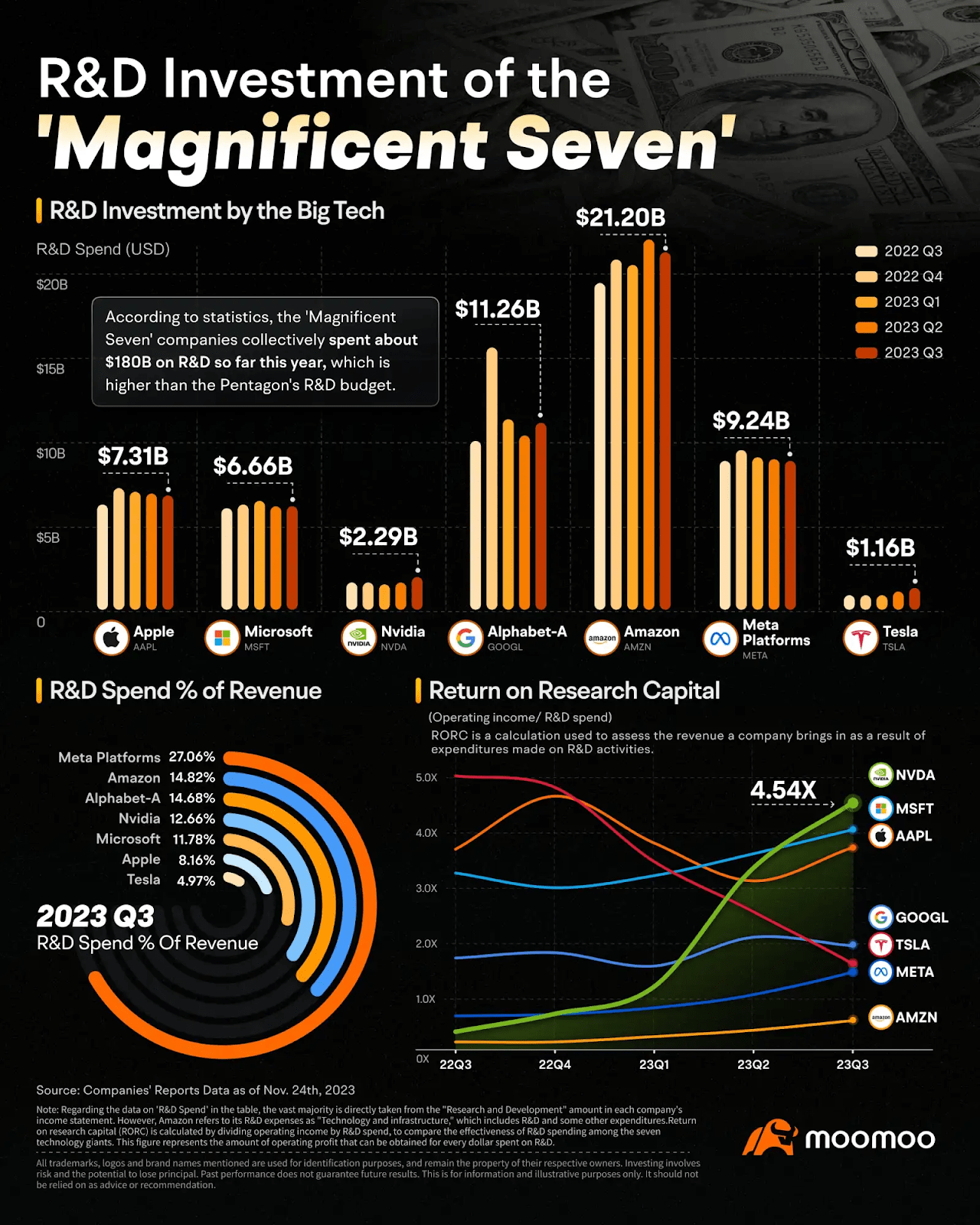

The first stop is how Nvidia deploys its R&D spend. On a comparative level, the company doesn’t spend as much as its higher-revenue Mag 7 peers. At this point, I’d like to share an infographic from Moomoo, a subsidiary of Hong Kong-based Futu Holdings (FUTU):

Moomoo

This is relatively old data from last year, but it makes my point. I’ll support that with fresher data from the latest quarterly reports from each of these companies, but I’d like to draw your attention to a few elements in that image.

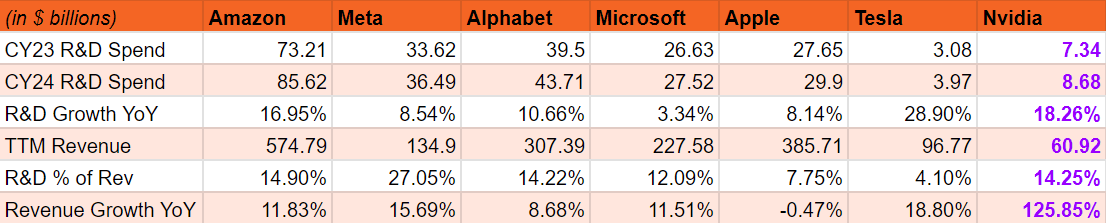

First, we see that Nvidia spends less than other Mag 7 companies on R&D (bar Tesla), but it is rapidly scaling up its expenditure on that front. On a YoY basis, Nvidia’s R&D line item in its income statement has gone from $1.95 billion in the January 2023 quarter to $2.47 billion in the January 2024 quarter. For comparison’s sake, I created the following table using TTM or CY figures to avoid the discrepancy in reporting fiscal years. This makes it more convenient to comp expenditure and revenues.

Data from SA; calculations by author

At +18%, Nvidia has the second-highest increase in R&D spend, but that’s not even the impressive part. What’s intriguing is the revenue growth it’s been able to achieve with that elevated spending on research and development. Nvidia needs to stay on top of the data center game, and with AMD and Intel on its heels (not hard on its heels, mind you), it needs that level of R&D spend to keep its product pipeline superior to those of its competitors.

Not yet impressed? Then how about the RORC as shown in the graph from Moomoo above? Look how that ramped up for Nvidia after Q1-23 (which is actually the first calendar quarter of 2022, well before ChatGPT was released) – it’s clearly showing the greatest return on R&D investments within this elite group. It’s not surprising, then, that R&D increases are driving revenue growth and, thereby, the stock’s price momentum over the past year.

As a side note, I wonder if it was a coincidence that NVDA began ramping up its R&D spend a full two quarters before generative AI became a global phenomenon. I suspect not because Nvidia would have had a fair idea of the direction that the use of its products was taking. In fact, as the inventor of the GPU and a key enabler of high-performance computing, Nvidia would, in my opinion, have known OpenAI’s timeline for ChatGPT’s release. Most developers in this space are likely to have known well in advance as well, but that’s just an assumption on my part, albeit a very calculated one. Still, I think it’s more than just a remarkable coincidence.

#2: NVDA’s Operational Efficiency and Pricing Power

Nvidia’s EBIT or operating income is another indicator of superior operational efficiencies, and it begins with core operating profits or gross profits. Nvidia’s gross margins are in the low 70s, better than MSFT’s high 60s and META’s 80%, while most of the other Mag 7 are in the 40s to 50s range. Tesla is the only one at the sub-20% level.

Now, a lot of this variance can be explained by the differences in their business model and the kind of products, services, and technologies they sell. For instance, the COGS component will be different for a primarily software company like Microsoft versus a primarily hardware player like Apple. Microsoft’s revenues mainly come from its Intelligent Cloud ($25.9 billion in Q2-24) and Productivity and Business Processes ($19.2 billion), while a smaller measure comes from More Personal Computing ($16.9 billion). The first two are relatively capital-light segments, with much of the hardware-based revenues coming from the last of these. As such, gross margins will naturally be higher than, for example, Apple, where revenues are product-heavy ($96.5 billion in Q1-24) rather than services-heavy ($23 billion.)

That’s why we’re looking at Microsoft with a 69% gross margin and Apple with 45%. It is also the reason why Nvidia’s gross margins are impressive. As a products-based company that gets its revenues primarily from hardware sales, the company’s 72% gross margin indicates tremendous pricing power. As the world scrambles to integrate AI into its commercial offerings, Nvidia the pick and shovel seller is still able to charge premium rates for its GPUs, CPUs, DPUs, cables, and other hardware products. The rest of the stack is capital-light, so when you look at Nvidia, it’s not a typical hardware-based company with tight gross margins. Tesla, on the other hand, is. We can see the negative impact of Tesla’s weak pricing power on its gross margins (around 18%.)

This pricing power is an important aspect for investors to be aware of because when Advanced Micro Devices (AMD) fully rolls out its MI300 series of GPUs and accelerators with the ROCm stack, which can now run the CUDA API, we could see some workloads shift in AMD’s favor:

Over the past two years AMD has quietly been funding an effort though to bring binary compatibility so that many NVIDIA CUDA applications could run atop the AMD ROCm stack at the library level — a drop-in replacement without the need to adapt source code. In practice for many real-world workloads, it’s a solution for end-users to run CUDA-enabled software without any developer intervention.

Of course, Nvidia’s data center dominance is not likely to see a large impact from this development, but it’s something to keep your eye on. Regardless, for the foreseeable future, with the highly anticipated launch of the H200 with HBM3E, AMD has its work cut out for it.

I don’t foresee Nvidia sacrificing its margins in the near term, but in the long run, it might need to adjust its pricing the way Tesla’s doing right now. As more competition enters any market, the leader is usually affected at the pricing level. Let’s see how that plays out, though. I’m not seeing a price drop as dramatic as what Tesla’s had to do with its EVs. For now, this is still a major bullish point for NVDA.

#3: NVDA’s Valuable Human Capital, and How It’s Incentivized

This isn’t something I’ve discussed extensively, so it’s worth a mention. At the end of FY-24, Nvidia had roughly 29,600 employees. In itself, that’s not impressive, even though it’s 5 times less than Apple and Tesla and 7x less than Microsoft. What should catch your eye, however, is this figure relative to the company’s bottom line. Tesla, for instance, makes about $107k of net income per employee; Microsoft is at around $374k and Apple is a much healthier $627k, but Nvidia blows them all out of the water with a net income per employee in excess of $1 million.

Where is most of this human capital deployed? You guessed it – R&D! According to the company, 22,200 of those 29,600 employees, or 75%, work in research and development roles, with only 1 in 4 employees in general administration, marketing, sales, and operations.

This type of human capital structure is very efficient, in my opinion because spending on what brings the bread and butter just makes good sense. Moreover, with the kind of return on research capital or RORC that Nvidia delivers, stock-based compensation under such a structure not only makes it ‘lean,’ but also much less cash-intensive. While that doesn’t necessarily help strengthen operating cash flows (as opposed to companies that have hefty SBC structures), it helps limit dilution.

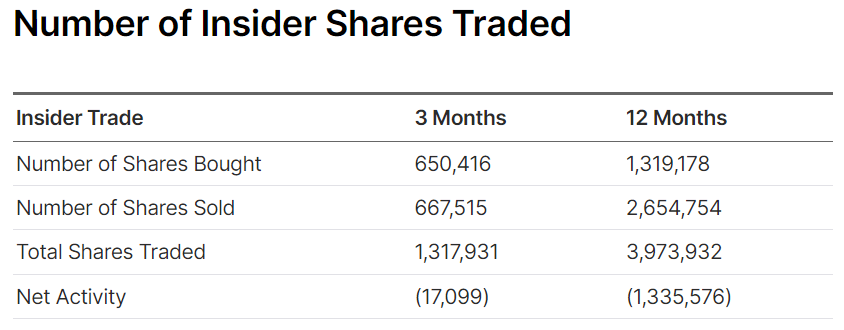

More importantly, it locks in employee loyalty, and not only at the top of the corporate structure. An interesting Business Insider report from late last year (as carried by Tom’s Hardware) claimed that “most middle managers make $1 million a year — or more.” Here’s a look at insider activity over the past year. Yes, some employees are taking profits off the table, but the volume of share purchases is the real kicker. Insiders sell stocks for all sorts of reasons, but they typically buy for just one – they’re that confident that the investment will do well in the future.

Nasdaq

Other Thoughts on NVDA as an Investment Now

The pullback over the past month affords investors an excellent chance to invest in this market leader. The real catalyst will be the launch of the new Hopper GPUs as well as the Grace Hopper superchip powering the GH200 platform in Q2. That’s going to be a game-changer because it’s likely to set the bar even higher for AMD and Intel, but I also believe that the kind of R&D spending the company is doing to ensure its dominance in the AI hardware space is not a flash in the pan. It’s a strategic plan that has a very long runway ahead of it.

Is NVDA expensive at its current price point of $762 (post-market, as of this writing)? Absolutely not, in my opinion. Admittedly, the market seems to think the stock’s valuation has gotten out of hand and represents a dangerous bubble that’s likely to burst, and so, out of fear, most likely, it’s hesitant to push the stock up even further until the next set of catalysts makes its appearance. That could be Q1 results coming out next month or the key product launches I discussed earlier. Nobody knows. The only thing we can say with near-absolute certainty is that this growth story is not over by any means.

If you’re worried about NVDA’s ‘apparently high’ valuation, consider these metrics:

-

NVDA’s ROE or return on equity stands at +90%, by far the highest among the Mag 7 except for Apple, which is an anomaly since common equity dropped sharply during the pandemic year and has been recovering slowly as net income kept growing.

-

ROA or return on assets stands at 55%, by far the highest within this peer group and far ahead of second-placed Apple at 30%.

-

ROCE or return on capital employed is at 47%, again the highest in this group, with Apple coming in at 42% but most other peers at 20% or under.

-

Tangible Book Value, Total Assets, and Levered Free Cash Flow for the past three years have grown at CAGRs of 55%, 32%, and 75%, respectively.

-

Forward (non-GAAP) PEG is currently at a ridiculously low 0.87, which is 50% below the sector median.

In addition, Nvidia now has greater revenue and demand visibility than it did in FY-24. As a result, they’ve aggressively signed on new vendors and pre-paid them for the additional capacity they’ll need, in addition to preparing their current suppliers beforehand for the demand to come. All of these things point to growth in the near term, but over the long haul, Nvidia’s number one job is to stay on top of the growing demand for AI products, whether that’s through its dominance in data center hardware, AI PCs, cloud products, or the more mundane stuff.

Downside Risks and Summary

Naturally, with such an attractive potential upside, there’s bound to be a downside. For instance, its elaborate network of vendors and suppliers is susceptible to macro developments such as the ongoing restrictions on importing to China, the high interest rate environment, and so on.

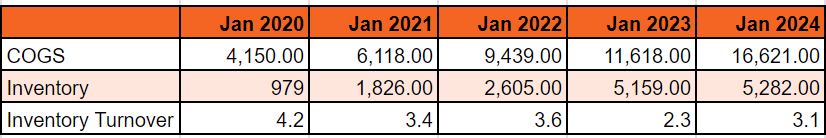

Another risk comes from oversupply. If Nvidia can’t time its inventories to line up with demand volumes, there could be a serious build-up on the books. That’s not happening now, but it could, in the future, if prepaid capacity doesn’t match up with demand. The risk here is relatively low because of demand visibility, but it remains a possibility. For now, Nvidia is turning over its inventory at least three times per fiscal year, which is a little higher than the prior year (3.1x vs 2.3x, as shown below)

Data from SA; calculations by author

I see execution and demand as the biggest risks right now. Execution has been superb thus far anyway you look at it, but if there’s a lull in demand due to the still-high and rising cost of capital for its customers, it could represent a major spanner in the works. The only thing that offsets this is that the bulk of demand is from large CSPs and OEMs, many of whom are cash-flow-and-cash-rich and aren’t currently concerned with the high cost of capital. Moreover, these companies are well aware that they need to address the demand for their own products, which is inextricably tied to Nvidia’s demand. I don’t see them curtailing their capital spending or growth spending in the immediate future, but with the economy acting in a very contrarian way to the Fed’s attempts at quantitative tightening, it could go either way.

I also think that the market’s hesitance to further reward NVDA stems from this uncertainty. Hopefully, the slew of earnings reports coming from the tech majors over the next week or more should dispel that hesitance and initiate the next bull run for the overall market. And guess who’s going to be leading it?

The last thought I’ll leave you with is this: if you think the company is too expensive, don’t buy it. Investor perception is what helps you sleep well at night, and if you’re not comfortable investing at these levels, then please do not. I’m pretty confident in my assessment, but if there’s something holding you back, then listen to that inner voice. Is it really worth putting your money into something that won’t put your mind at ease? And for that reason, even though I’m very bullish on the name, I can only recommend a Hold at this time. Take some profits off the table if it’ll put your mind at rest, but staying in the game could reward you handsomely, the way Nvidia’s own employees have been rewarded.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.